Australian Dollar Drops On Fed Rate Hike Worries

29 August 2022 - 2:39PM

RTTF2

The Australian dollar fell against its major counterparts in the

Asian session on Monday, as Asian markets followed Wall street

lower, as comments from Federal Reserve Chair Jerome Powell sparked

concerns about the possibility of more aggressive rate hikes to

tame inflation.

In his speech at the Jackson Hole symposium on Friday, Powell

said that the central bank is likely to keep rates at higher levels

to restore price stability.

Powell acknowledged the central bank's efforts to combat

inflation will cause "some pain" but argued a failure to restore

price stability would mean "far greater pain."

Powell reiterated the Fed's resolve to bring inflation back to

its 2 percent target, declaring that the "economy does not work for

anyone" without price stability. He added that the central bank

would use its tools "forcefully" to bring demand and supply into

better balance.

Preliminary data from the Australian Bureau of Statistics showed

that Australia's retail sales grew at the fastest pace in four

months in July.

Retail sales gained by more-than-expected 1.3 percent

month-on-month in July, faster than the 0.2 percent rise in

June.

The aussie was lower against the euro and the loonie, touching

1-week lows of 1.4512 and 0.8942, respectively. The aussie is seen

finding support around 1.47 against the euro and 0.87 against the

loonie.

The aussie touched 0.6841 against the greenback, its lowest

level in nearly six weeks. Next key support for the aussie is seen

around the 0.66 level.

The aussie reached as low as 1.1206 against the kiwi. If the

aussie drops further, 1.10 is possibly seen as its next support

level.

In contrast, the aussie was higher against the yen, with the

pair trading at 95.06. Immediate resistance for the currency is

seen around the 98.00 level.

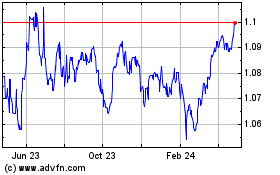

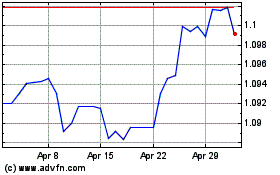

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024