New Zealand Dollar Climbs Amid Risk Appetite

18 November 2022 - 4:10PM

RTTF2

The New Zealand dollar advanced against its major opponents in

the European session on Friday, as European shares rose, with

investors monitoring the Fed policy outlook.

Market participants digested hawkish comments from Fed officials

indicating the possibility of a 'higher for longer' rate

outlook.

Oil prices rose as a surge in virus cases in China fuelled

concerns about demand outlook.

A pullback in the dollar also underpinned oil prices, as a

weaker currency makes oil attractive for purchases in other

currencies.

The kiwi appreciated to a 2-day high of 0.6177 against the

greenback and a 3-day high of 1.6776 against the euro, from its

early lows of 0.6114 and 1.6925, respectively. The kiwi is seen

finding resistance around 0.64 against the greenback and 1.65

against the euro.

The kiwi touched 86.54 against the yen, its strongest level

since November 9. Next immediate resistance for the kiwi is seen

around the 88.00 level.

Against the aussie, the kiwi reached nearly a 7-month high of

1.0861. The currency is likely to find resistance around the 1.06

level.

Looking ahead, Canada industrial product price index and U.S.

existing home sales for October are set for release in the New York

session.

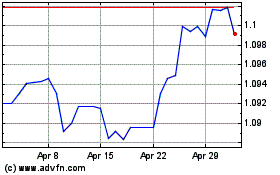

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

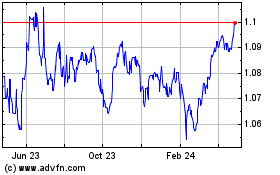

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024