Euro Weakens In Cautious Trade

30 December 2021 - 5:43PM

RTTF2

The euro dropped against its major counterparts in the European

session on Thursday, as a rapid spread of the Omicron variant of

Covid-19 clouded global economic outlook.

Data from Johns Hopkins University showed that global infections

exceeded 284 million, while the deaths surpassed 5.44 million.

France and the U.K. reported a record rise in daily infections

on Wednesday. The seven-day average of new cases rose above 277,000

in the U.S.

European Central Bank governing council member Ignazio Visco

said that inflation forecasts of below 2 percent in 2023-2024 could

be exposed to the downside and upside risks.

Inflation in the Eurozone could remain above the central bank's

goal of 2 percent after 2022, ECB policymaker Klaas Knot said.

Trading volumes were thin as the year-end holidays

approached.

The euro declined to 1.1300 against the greenback, 1.4471

against the loonie and 130.12 against the yen, after rising to

1.1360 and 1.4522 and 1-1/2-month high of 130.59, respectively in

prior deals. The next possible support for the euro is seen around

1.10 against the greenback, 1.42 against the loonie and 127.5

against the yen.

The euro dipped to a fresh 5-week low of 0.8392 against the

pound, from a high of 0.8417 seen at 6:45 pm ET. Next key support

for the currency is seen around the 0.82 region.

The European currency touched a 6-day low of 1.6553 against the

kiwi and near a 5-week low of 1.5569 against the aussie, down from

its early highs of 1.6619 and 1.5661, respectively. The euro may

locate support around 1.62 against the kiwi and 1.53 against the

aussie.

The euro slipped to 1.0366 against the franc, after a 2-day rise

to 1.0384 at 9:15 pm ET. On the downside, 1.01 is possibly seen as

its next support level.

Looking ahead, U.S. weekly jobless claims for the week ended

December 24 will be out in the New York session.

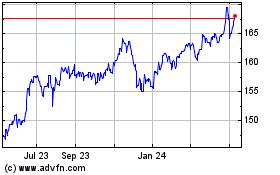

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

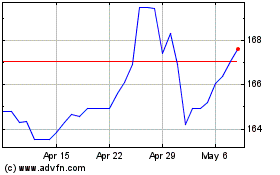

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024