U.S. Dollar Climbs As Mid-term Elections In Focus

08 November 2022 - 2:52PM

RTTF2

The U.S. dollar advanced against its major counterparts on

Tuesday, as investors awaited the outcome of the mid-term elections

in the country.

The mid-term elections to the House of Representatives and the

Senate are due today.

The Republican party is expected to get a majority in both

Houses, paving the way for a political deadlock.

The benchmark yield on the 10-year treasury note rose to 4.224

percent. Yields move inversely to bond prices.

U.S. consumer inflation data, due on Thursday, could shed more

clues on the Fed's monetary policy tightening stance.

The greenback edged up to 0.9923 against the franc and 0.9987

against the euro, from its prior lows of 0.9875 and 1.0031,

respectively. The greenback is likely to challenge resistance

around 1.02 against the franc and 0.96 against the euro.

The greenback reversed from its early lows of 1.1537 against the

pound and 146.31 against the yen, rising to 1.1460 and 146.94,

respectively. If the greenback rises further, 1.11 and 151.00 are

likely seen as its next resistance levels against the pound and the

yen, respectively.

The greenback rebounded to 0.5899 against the kiwi, from a

1-1/2-month low of 0.5952 seen at 7:30 pm ET. On the upside, 0.56

is possibly seen as the next resistance level.

The greenback climbed to 0.6444 against the aussie and 1.3527

against the loonie, following its previous lows of 0.6491 and

1.3475, respectively. The greenback is seen finding resistance

around 0.60 against the aussie and 1.37 against the loonie.

Looking ahead, at 5:00 am ET, Eurostat publishes euro area

retail sales figures for September.

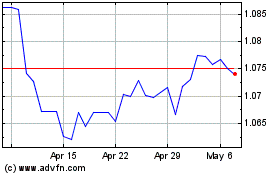

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

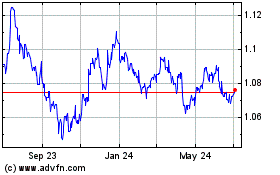

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024