NZ Dollar Falls Amid Tepid China Data, U.S. Midterm Election Results

09 November 2022 - 2:29PM

RTTF2

The NZ dollar dropped against its major counterparts in the

Asian session on Wednesday, as China's consumer inflation slowed

more than expected in October and investors digested the likelihood

of Republicans attaining a majority in the U.S. House of

Representatives in midterm elections.

Data from the National Bureau of Statistics showed that consumer

prices grew 2.1 percent in October from the same period last

year.

This was slower than the 2.8 percent increase posted in

September and also economists' forecast of 2.4 percent.

Early results suggested the chance of Republicans winning in the

House of Representatives, which will pose challenges to the Biden

administration.

Republicans are leading in the tightly contested race to the

Senate.

The kiwi was down at 0.5927 against the greenback. On the

downside, 0.55 is likely seen as the next support for the kiwi.

The kiwi touched 1.6968 against the euro, its lowest level in

six days. The currency is seen finding support around the 1.72

level.

The kiwi declined to a 2-day low of 86.41 against the yen and a

5-day low of 1.0946 against the aussie, off its early highs of

86.76 and 1.0897, respectively. The kiwi is poised to challenge

support around 83.00 against the yen and 1.13 against the

aussie.

Looking ahead, U.S. wholesale inventories for September are due

in the New York session.

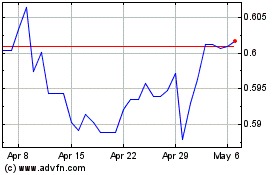

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

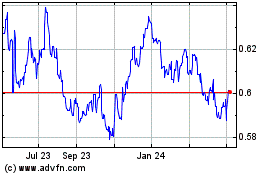

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024