U.S. Dollar Lower On Hopes For Slower Fed Rate Hikes

11 November 2022 - 7:26PM

RTTF2

The U.S. dollar lost ground against its major counterparts in

the European session on Friday, as indications that inflation has

peaked in October supported the case for a slowdown in the pace of

rate hikes in the coming months.

Dallas Fed President Lorie Logan and San Francisco Fed President

Mary Daly suggested that the central bank may ease the pace of its

hikes in the future.

Traders are assigning an 85.4 percent probability of a 50

basis-point rate hike at the December meeting.

The dollar index that tracks the greenback against a basket of

other currencies touched near a 3-month low of 107.10.

U.S. stock futures are higher, as soft inflation data supported

odds for smaller rate hikes by the Fed.

The greenback depreciated to near a 2-month low of 0.9568

against the franc and near a 3-month low of 1.0297 against the

euro, from its early highs of 0.9682 and 1.0163, respectively. The

currency may challenge support around 0.93 against the franc and

1.05 against the euro.

The greenback touched a 2-1/2-month low of 1.1774 against the

pound and more than a 2-month low of 138.75 against the yen, after

climbing to 1.1647 and 142.48, respectively in early deals. The

currency is seen finding support around 1.22 against the pound and

134.00 against the yen.

The greenback fell to 0.6060 against the kiwi and 0.6679 against

the aussie, its lowest levels in nearly two months. The greenback

is likely to challenge support around 0.62 against the kiwi and

0.69 against the aussie.

The greenback touched 1.3284 against the loonie for the first

time since September 20. Next key support for the currency is seen

around the 1.30 level.

The University of Michigan's preliminary U.S. consumer sentiment

index for November is set for release in the New York session.

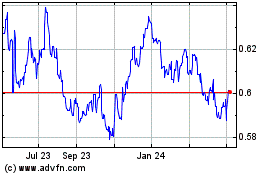

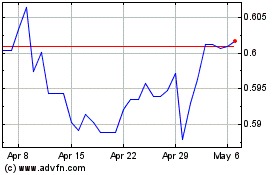

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024