U.S. Dollar Appreciates On Growth Worries

30 June 2022 - 7:59PM

RTTF2

The U.S. dollar climbed against its most major counterparts in

the European session on Thursday, as European stocks fell on

growing concerns about an economic downturn as central bank chiefs

across the world emphasized their commitment to control inflation

despite the risks to the economy.

At the European Central Bank's forum in Sintra, Portugal,

central bank governors said that bringing down high inflation is

their main goal, raising concerns over a global economic downturn

due to the tightening of monetary policy.

Federal Reserve Chair Jerome Powell said that the central bank

is prepared to proceed with tightening until it is confident that

inflation is under control.

Data from the Commerce Department showed that U.S. personal

income increased in line with economist estimates in May.

The report showed personal spending rose by 0.5 percent in May,

matching the revised increase seen in April as well as

expectations.

Meanwhile, the Commerce Department said personal spending edged

up by 0.2 percent in May after climbing by a downwardly revised 0.6

percent in April.

Economists had expected personal spending to increase by 0.5

percent compared to the 0.9 percent advance originally reported for

the previous month.

The greenback touched 2-week highs of 1.0382 against the euro

and 1.2092 against the pound, following its early lows of 1.0469

and 1.2166, respectively. The greenback is seen facing resistance

near 1.02 against the euro and 1.19 against the pound.

The greenback moved up to a 3-day high of 0.9606 against the

franc, from a low of 0.9530 hit at 2 am ET. The greenback is likely

to face resistance around the 0.98 region, if it gains again.

Against the loonie, the greenback was up at a 6-day high of

1.2933. The currency may challenge resistance around the 1.32

level.

In contrast, the greenback was trading at 0.6901 against the

aussie and 0.6238 against the kiwi, retreating from its previous

session's more than 2-week highs of 0.6854 and 0.6198,

respectively. The greenback is poised to target support around 0.72

against the aussie and 0.64 against the kiwi.

The greenback fell to 135.79 against the yen, off its Asian

session's high of 136.81. On the downside, 124.00 is possibly seen

as the next support level for the greenback.

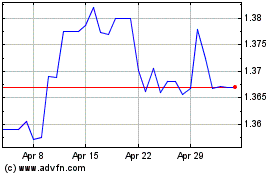

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

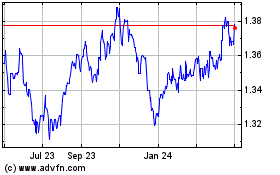

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024