U.S. Dollar Higher With Inflation Data In Focus

11 July 2022 - 8:06PM

RTTF2

The U.S. dollar advanced against its major counterparts in the

European session on Monday, as investors awaited U.S. inflation

data due this week, after strong jobs data supported expectations

for the aggressive policy tightening path by the Federal

Reserve.

The consumer price index is expected to rise to 8.8 percent

year-on-year in June from 8.6 percent in May.

A strong reading is likely to boost bets for super-sized hikes

from the Fed to tame it.

The currency was further supported by a drop in European shares

amid fresh COVID-19 curbs in China and the energy crunch in

Europe.

Virus worries intensified after Shanghai detected its first case

of the latest highly contagious variant of Covid-19, BA.5

omicron.

Russia stopped gas exports through the Nord Stream gas pipeline,

heightening the energy crisis in Europe.

The greenback reached as high as 1.0066 against the euro, its

highest level since December 2, 2002. The greenback is seen

challenging resistance around the 0.97 level.

The greenback touched near a 4-week high of 0.9824 against the

franc and a 5-day high of 1.1907 against the pound, off its

previous lows of 0.9758 and 1.2037, respectively. The greenback may

face resistance around 1.00 against the franc and 1.14 against the

pound.

Against the loonie, the greenback was higher at 1.3027. Next

likely resistance for the greenback is seen around the 1.32

level.

The greenback approached more than 2-year highs of 0.6738

against the aussie and 0.6110 against the kiwi, following its early

lows of 0.6855 and 0.6193, respectively. Immediate resistance for

the greenback is likely seen around 0.64 against the aussie and

0.585 against the kiwi.

The greenback resumed its rally against the yen, hitting near a

24-year high of 137.75. If the greenback rises further, 139.00 is

seen as its next resistance level.

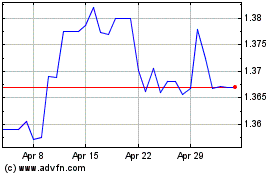

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

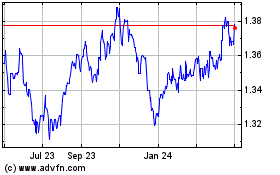

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024