Canadian Dollar Rallies As Oil Prices Surge

26 July 2022 - 1:49PM

RTTF2

The Canadian dollar spiked up against its major counterparts in

the Asian session on Tuesday, as Gazprom's move to reduce gas flows

through a major pipeline lifted oil prices.

Crude for October delivery rose $1.71 to $101.90 per barrel.

Russia's Gazprom said that it will reduce gas supply through

Nord Stream 1 to 33 million cubic metres per day from July 27,

which will be just 20 percent of normal capacity.

Investors also focus on the two-day policy setting meeting of

the Federal Reserve, at which it is expected to raise rates by 75

basis points.

That would take the Fed's benchmark rate to a range of 2.25

percent to 2.5 percent.

The loonie strengthened to 4-day highs of 1.2822 against the

greenback and 106.61 against the yen, following its prior lows of

1.2854 and 106.07, respectively. The next possible resistance for

the loonie is seen around 1.26 against the greenback and 108.00

against the yen.

Against the euro, the loonie was up at a 4-day high of 1.3101.

On the upside, 1.28 is possibly seen as its next resistance

level.

The loonie edged up to 0.8923 against the aussie, after falling

to 0.8959 at 9:30 pm ET, which was its lowest level since June 27.

If the loonie extends rise, 0.88 is possibly seen as its next

resistance level.

Looking ahead, Canada wholesale sales for June are scheduled for

release at 8:30 am ET.

U.S. consumer confidence index for July, new home sales for June

and FHFA's house price index and S&P/Case-Shiller home price

index for May will be published in the New York session.

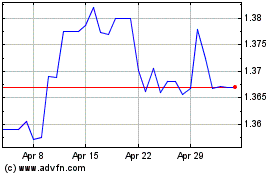

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

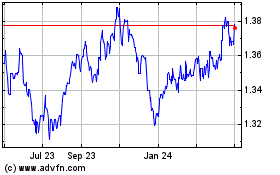

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024