Current Report Filing (8-k)

22 November 2022 - 8:12AM

Edgar (US Regulatory)

0001158114

false

0001158114

2022-11-16

2022-11-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 16, 2022

Applied

Optoelectronics, Inc.

(Exact name of Registrant as specified in its

charter)

| Delaware |

001-36083 |

76-0533927 |

| (State of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

13139 Jess Pirtle Blvd.

Sugar Land, TX 77478

(address of principal executive offices and zip

code)

(281) 295-1800

(Registrant’s telephone number, including

area code)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common

Stock, Par value $0.001 |

AAOI |

NASDAQ Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01 |

Entry into a Material Definitive Agreement. |

On November 16, 2022, Applied

Optoelectronics, Inc. (the “Company”) entered into a Loan Security and Guarantee Agreement (the “Credit Facility”)

with CIT Northbridge Credit, LLC, as agent for secured parties. The Credit Facility provides the Company with a three-year, $27.78 million

revolving line of credit. Borrowings under the Credit Facility will be used to repay senior debt with Truist Bank and for working capital

needs, capital expenditures, and other corporate purposes.

The Company's obligations

under the Credit Facility will be secured by substantially all of the Company's domestic tangible and intangible property, including but

not limited to the Company's inventory, accounts receivable, instruments, equipment, intellectual property, and all business assets with

the exception of real estate and all foreign assets. Borrowings under the Credit Facility will bear interest at a rate equal to the Secured

Overnight Financing Rate (SOFR) plus 3.75%, while monthly average usage is less than 50% of the Credit Facility, otherwise SOFR plus 4.75%.

The Credit Facility requires

the Company to maintain certain financial covenants and contains representations and warranties, and events of default applicable to the

Company that are customary for agreements of this type.

The foregoing description

of the Credit Facility does not purport to be a complete statement of the parties’ rights and obligations under the Credit Facility

and is qualified in its entirety by reference to the full text of the Loan Security and Guarantee Agreement, dated November 16, 2022,

copies of which are attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

| Item 1.02 |

Termination of a Material Definitive Agreement. |

On November 16, 2022, the

Company repaid the outstanding balance and terminated its $20 million revolving line of credit with Truist Bank, originally entered into

on September 28, 2017 with subsequent amendments, and maturing on April 15, 2023 (the “Truist Credit Line”). Upon repayment

of the outstanding balance and termination of the Truist Credit Line the Company has no further obligations with Truist Bank. There were

no penalties associated with the early repayment and termination.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information contained in Item 1.01 of this

Current Report on Form 8-K with respect to the Credit Facility is incorporated by reference herein and made a part hereof.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 21, 2022 |

Applied Optoelectronics, Inc. |

| |

|

|

| |

|

|

| |

By: |

/s/ David C. Kuo |

| |

Name: |

David C. Kuo

|

| |

Title: |

General Counsel and Secretary |

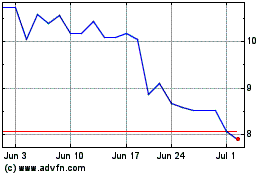

Applied Optoelectronics (NASDAQ:AAOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Applied Optoelectronics (NASDAQ:AAOI)

Historical Stock Chart

From Apr 2023 to Apr 2024