AAON, INC. (NASDAQ-AAON), a leader in innovation and production of

premium quality, highly energy efficient HVAC products for

nonresidential buildings, today announced its results for the

fourth quarter of 2021.

AAON reported record fourth quarter revenue of

$136.3 million, up 16.8% from the prior-year quarter. Price

increases contributed approximately 10.0% to revenue growth in the

quarter. However, gross profit declined 21.7% to $26.5 million, or

19.5% of sales. Gross profit was impacted by supply chain issues,

which constrained production, led to operational inefficiencies and

unabsorbed fixed costs, and exacerbated the adverse effects of

inflation by slowing the turnover of our lower priced backlog and

delaying the throughput of orders placed after recent price

increases. This resulted in net income of $6.2 million and earnings

per diluted share of $0.11, down year over year 68.6%, compared to

$0.35 in the prior-year quarter.

Excluding one-time items, including

acquisition-related transaction fees of $4.4 million in the fourth

quarter of 2021 and $6.4 million of gain on insurance recoveries in

the fourth quarter of 2020, non-GAAP adjusted earnings per share

was $0.181, down year over year 35.7%, compared to $0.281 in the

prior-year quarter.

| Financial

Highlights: |

Three Months Ended December

31, |

|

% |

|

|

|

Years Ending December

31, |

|

% |

| |

2021 |

|

2020 |

|

Change |

|

|

|

2021 |

|

2020 |

|

Change |

| |

(in thousands, except share and per share data) |

|

|

|

(in thousands, except share and per share data) |

| GAAP

Measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

$ |

136,282 |

|

|

$ |

116,700 |

|

|

16.8 |

% |

|

|

|

$ |

534,517 |

|

|

$ |

514,551 |

|

|

3.9 |

% |

| Gross profit |

$ |

26,547 |

|

|

|

33,923 |

|

|

(21.7 |

)% |

|

|

|

|

137,830 |

|

|

|

155,849 |

|

|

(11.6 |

)% |

|

Gross profit margin |

|

19.5 |

% |

|

|

29.1 |

% |

|

|

|

|

|

|

25.8 |

% |

|

|

30.3 |

% |

|

|

| Operating income |

$ |

5,443 |

|

|

|

25,718 |

|

|

(78.8 |

)% |

|

|

|

|

69,253 |

|

|

|

101,836 |

|

|

(32.0 |

)% |

|

Operating margin |

|

4.0 |

% |

|

|

22.0 |

% |

|

|

|

|

|

|

13.0 |

% |

|

|

19.8 |

% |

|

|

| Net income |

$ |

6,186 |

|

|

$ |

18,892 |

|

|

(67.3 |

)% |

|

|

|

$ |

58,758 |

|

|

$ |

79,009 |

|

|

(25.6 |

)% |

|

Earnings per diluted share |

$ |

0.11 |

|

|

$ |

0.35 |

|

|

(68.6 |

)% |

|

|

|

$ |

1.09 |

|

|

$ |

1.49 |

|

|

(26.8 |

)% |

| Diluted average shares |

|

53,948,763 |

|

|

|

53,469,759 |

|

|

0.9 |

% |

|

|

|

|

53,728,989 |

|

|

|

53,061,169 |

|

|

1.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

Measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjusted net

income1 |

$ |

9,523 |

|

|

$ |

14,771 |

|

|

(35.5 |

)% |

|

|

|

$ |

62,095 |

|

|

$ |

74,888 |

|

|

(17.1 |

)% |

|

Non-GAAP earnings per diluted share1 |

$ |

0.18 |

|

|

$ |

0.28 |

|

|

(35.7 |

)% |

|

|

|

$ |

1.16 |

|

|

$ |

1.41 |

|

|

(17.7 |

)% |

| Adjusted EBITDA1 |

$ |

17,208 |

|

|

$ |

26,637 |

|

|

(35.4 |

)% |

|

|

|

$ |

103,587 |

|

|

$ |

121,746 |

|

|

(14.9 |

)% |

|

Adjusted EBITDA margin1 |

|

12.6 |

% |

|

|

22.8 |

% |

|

|

|

|

|

|

19.4 |

% |

|

|

23.7 |

% |

|

|

| 1These are non-GAAP

measures. See "Use of Non-GAAP Financial Measures" below for

reconciliation to GAAP measures. |

The Company finished the fourth quarter of 2021

with a backlog of $260.2 million, up 249.6% from $74.4 million a

year ago, and up 43.1% from $181.8 million at the end of the third

quarter of 2021. Excluding BasX's backlog, organic backlog was up

200.7% from the prior year quarter.

| Backlog |

|

|

|

|

|

|

|

|

|

| |

December 31, 2021 |

|

September 31, 2021 |

|

June 30, 2021 |

|

March 31, 2021 |

|

December 31, 2020 |

|

Backlog |

$ |

260,164 |

|

|

$ |

181,813 |

|

|

$ |

138,131 |

|

|

$ |

96,733 |

|

|

$ |

74,417 |

|

| Year over year change |

|

249.6 |

% |

|

|

114.2 |

% |

|

|

33.4 |

% |

|

|

(19.1 |

)% |

|

|

(47.9 |

)% |

On December 10, 2021, AAON completed the

acquisition of BasX, LLC (doing business as BasX Solutions,

"BasX"), which included an upfront cash payment of $107.8 million,

including acquisition-related transaction fees, net of cash

acquired. As of December 31, 2021, the Company had liquidity of

$61.1 million compared to liquidity of $107.2 million at December

31, 2020. We believe the Company's senior credit facility provides

adequate capacity to fund working capital needs and continue our

investment in long-term growth.

Rebecca Thompson, CFO, commented, “We are very

comfortable with our financial position at the end of 2021. Our

balance sheet remains in a very strong position and we will

continue to invest in our long-term growth plans. Capital

expenditures in 2021 were $55.4 million, compared to $67.8 million

in 2020. We anticipate a capital expenditure budget of $100.4

million for 2022.”

Gary Fields, President and CEO, stated, “I am

extremely pleased with the growth we have seen in our backlog and

new bookings. Backlog is up year over year 249.6% and new bookings

have maintained the strong levels we saw in the second and third

quarter. Moreover, strong demand trends continued into early 2022.

The growth reflects several factors, including solid end-market

demand, market share gains, competitive lead times, the

strengthening of our independent sales channel and the compelling

value proposition AAON equipment offers.”

Mr. Fields continued, "While we are pleased with

demand and the market share gains, sales and earnings results were

disappointing. The primary factors that contributed to the lower

than anticipated profits were supply chain constraints and material

inflation. Supply chain constraints escalated for us in October and

November, which led to lower production and less cost absorption.

Meanwhile, our cost structure has been rising as we have been

increasing headcount due to our rising backlog and in anticipation

of the robust growth we foresee in 2022. Furthermore, production

constraints magnify the price/cost inflation effect. Lower

production means we were not churning through the lower priced

backlog fast enough, delaying the recovery in gross profit. In

addition to all of this, supply chain constraints created many

operational inefficiencies. All in, this led to the underwhelming

gross profit and earnings.”

Mr. Fields continued, “On a positive note, we

believe the worst of the supply chain constraints are behind us.

December was a solid month as far as production and gross profit,

and we have seen month-to-month improvement in January and

February. Furthermore, the margin profile of our backlog is the

highest it has been in about nine months. With less supply chain

constraints, higher production capacity, and a large backlog with

an improving margin profile, we anticipate production and margins

to improve significantly through the first half of 2022."

Mr. Fields concluded, "The challenges we, as

well as much of the manufacturing sector, faced in 2021 were truly

unprecedented, at least in respect to the last 30 years. In my

view, we have navigated the headwinds extremely well and I am very

proud of our team. I also believe we are emerging from these

challenges as a much stronger Company, which will help us better

execute and absorb the robust growth we are anticipating. Despite

the recently disappointing results, we remain extremely optimistic

on the fundamentals of the business. Our legacy business and the

recently acquired BasX both have robust backlogs with paths for

significant margin improvement in 2022 and beyond. We continue to

believe the Company is best positioned to benefit from an increased

focus on decarbonization, electrification, energy efficiency,

indoor air quality and cloud-based infrastructure, and we are

investing to take advantage of the robust growth we foresee."

Conference Call and Webcast

The Company will host a conference call and

webcast to discuss its financial results and outlook on February

28, 2022 at 5:15 P.M. ET. The conference call will be accessible

via a dial-in for those who wish to participate in Q&A as well

as a listen-only webcast. To access either mode, register at

https://connect.beacon360.com/ses/JmYFFym2dtuULrRqTsWTlg~~. After

registering, participants will receive an email with instructions

on how to access the dial-in and webcast. On the next business day

following the call, a replay of the call will be available on the

Company’s website at https://aaon.com/Investors.

About AAON

AAON, Inc. engaged in the engineering,

manufacturing, marketing, and sale of premium air conditioning and

heating equipment consisting of standard, semi-custom, and custom

rooftop units, data center cooling solutions, cleanroom systems,

chillers, packaged outdoor mechanical rooms, air handling units,

makeup air units, energy recovery units, condensing units,

geothermal/water-source heat pumps, coils, and controls. Since the

founding of AAON in 1988, AAON has maintained a commitment to

design, develop, manufacture and deliver heating and cooling

products to perform beyond all expectations and demonstrate the

value of AAON to our customers. For more information, please visit

www.AAON.com.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Words such as “expects”, “anticipates”,

“intends”, “plans”, “believes”, “seeks”, “estimates”, “should”,

“will”, and variations of such words and similar expressions are

intended to identify such forward-looking statements. These

statements are not guarantees of future performance and involve

certain risks, uncertainties and assumptions, which are difficult

to predict. Therefore, actual outcomes and results may differ

materially from what is expressed or forecasted in such

forward-looking statements. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date on which they are made. We undertake no

obligations to update publicly any forward-looking statements,

whether as a result of new information, future events or otherwise.

Important factors that could cause results to differ materially

from those in the forward-looking statements include (1) the timing

and extent of changes in raw material and component prices, (2) the

effects of fluctuations in the commercial/industrial new

construction market, (3) the timing and extent of changes in

interest rates, as well as other competitive factors during the

year, and (4) general economic, market or business conditions.

Contact InformationJoseph

MondilloDirector of Investor RelationsPhone: (617) 877-6346Email:

joseph.mondillo@aaon.com

|

AAON, Inc. and Subsidiaries |

|

Consolidated Statements of Income |

|

(Unaudited) |

| |

Three Months Ended December

31, |

|

Years Ending December

31, |

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| |

(in thousands, except share and per share data) |

|

Net sales |

$ |

136,282 |

|

|

$ |

116,700 |

|

|

$ |

534,517 |

|

|

$ |

514,551 |

|

| Cost of sales |

|

109,735 |

|

|

|

82,777 |

|

|

|

396,687 |

|

|

|

358,702 |

|

| Gross profit |

|

26,547 |

|

|

|

33,923 |

|

|

|

137,830 |

|

|

|

155,849 |

|

| Selling, general and

administrative expenses |

|

21,110 |

|

|

|

14,622 |

|

|

|

68,598 |

|

|

|

60,491 |

|

| Gain on disposal of assets and

insurance recoveries |

|

(6 |

) |

|

|

(6,417 |

) |

|

|

(21 |

) |

|

|

(6,478 |

) |

| Income from operations |

|

5,443 |

|

|

|

25,718 |

|

|

|

69,253 |

|

|

|

101,836 |

|

| Interest (expense) income,

net |

|

(121 |

) |

|

|

(2 |

) |

|

|

(132 |

) |

|

|

88 |

|

| Other income, net |

|

24 |

|

|

|

31 |

|

|

|

61 |

|

|

|

51 |

|

| Income before taxes |

|

5,346 |

|

|

|

25,747 |

|

|

|

69,182 |

|

|

|

101,975 |

|

| Income tax (benefit)

provision |

|

(840 |

) |

|

|

6,855 |

|

|

|

10,424 |

|

|

|

22,966 |

|

| Net income |

$ |

6,186 |

|

|

$ |

18,892 |

|

|

$ |

58,758 |

|

|

$ |

79,009 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.12 |

|

|

$ |

0.36 |

|

|

$ |

1.12 |

|

|

$ |

1.51 |

|

|

Diluted |

$ |

0.11 |

|

|

$ |

0.35 |

|

|

$ |

1.09 |

|

|

$ |

1.49 |

|

| Cash dividends declared per

common share: |

$ |

0.19 |

|

|

$ |

0.19 |

|

|

$ |

0.38 |

|

|

$ |

0.38 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

52,467,696 |

|

|

|

52,240,829 |

|

|

|

52,404,199 |

|

|

|

52,168,679 |

|

|

Diluted |

|

53,948,763 |

|

|

|

53,469,759 |

|

|

|

53,728,989 |

|

|

|

53,061,169 |

|

|

|

|

AAON, Inc. and Subsidiaries |

|

Consolidated Balance Sheets |

|

(Unaudited) |

| |

December 31, 2021 |

|

December 31, 2020 |

| Assets |

(in thousands, except share and per share data) |

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

2,859 |

|

$ |

79,025 |

|

Restricted cash |

|

628 |

|

|

3,263 |

|

Accounts receivable, net of allowance for credit losses of $549 and

$506, respectively |

|

70,780 |

|

|

47,387 |

|

Income tax receivable |

|

5,723 |

|

|

4,587 |

|

Inventories, net |

|

130,270 |

|

|

82,219 |

|

Contract assets |

|

5,749 |

|

|

— |

|

Prepaid expenses and other |

|

2,071 |

|

|

3,770 |

| Total current assets |

|

218,080 |

|

|

220,251 |

| Property, plant and

equipment: |

|

|

|

|

Land |

|

5,016 |

|

|

4,072 |

|

Buildings |

|

135,861 |

|

|

122,171 |

|

Machinery and equipment |

|

318,259 |

|

|

281,266 |

|

Furniture and fixtures |

|

23,072 |

|

|

18,956 |

|

Total property, plant and equipment |

|

482,208 |

|

|

426,465 |

|

Less: Accumulated depreciation |

|

224,146 |

|

|

203,125 |

| Property, plant and equipment,

net |

|

258,062 |

|

|

223,340 |

| Intangible assets, net |

|

70,121 |

|

|

38 |

| Goodwill |

|

85,727 |

|

|

3,229 |

| Right of use assets |

|

16,974 |

|

|

1,571 |

| Other long-term assets |

|

1,216 |

|

|

579 |

| Total assets |

$ |

650,180 |

|

$ |

449,008 |

| |

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

|

29,020 |

|

|

12,447 |

|

Accrued liabilities |

|

50,206 |

|

|

46,586 |

|

Contract liabilities |

|

7,542 |

|

|

— |

| Total current liabilities |

|

86,768 |

|

|

59,033 |

| Revolving credit facility,

long-term |

|

40,000 |

|

|

— |

| Deferred tax liabilities |

|

31,993 |

|

|

28,324 |

| Other long-term

liabilities |

|

18,843 |

|

|

4,423 |

| New market tax credit

obligation |

|

6,406 |

|

|

6,363 |

| Commitments and

contingencies |

|

|

|

| Stockholders' equity: |

|

|

|

|

Preferred stock, $.001 par value, 5,000,000 shares authorized, no

shares issued |

|

— |

|

|

— |

|

Common stock, $.004 par value, 100,000,000 shares authorized,

52,527,985 and 52,224,767 issued and outstanding at

December 31, 2021 and December 31, 2020,

respectively |

|

210 |

|

|

209 |

|

Additional paid-in capital |

|

81,654 |

|

|

5,161 |

|

Retained earnings |

|

384,306 |

|

|

345,495 |

| Total stockholders'

equity |

|

466,170 |

|

|

350,865 |

| Total liabilities and

stockholders' equity |

$ |

650,180 |

|

$ |

449,008 |

|

|

|

AAON, Inc. and Subsidiaries |

|

Consolidated Statements of Cash Flows |

|

(Unaudited) |

| |

Years Ending December

31, |

| |

2021 |

|

2020 |

| Operating

Activities |

(in thousands) |

|

Net income |

$ |

58,758 |

|

|

$ |

79,009 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

|

30,343 |

|

|

|

25,634 |

|

|

Amortization of debt issuance cost |

|

43 |

|

|

|

43 |

|

|

Amortization of right of use assets |

|

73 |

|

|

|

— |

|

|

Provision for credit losses on accounts receivable, net of

adjustments |

|

43 |

|

|

|

153 |

|

|

Provision for excess and obsolete inventories |

|

629 |

|

|

|

1,108 |

|

|

Share-based compensation |

|

11,812 |

|

|

|

11,342 |

|

|

Gain on disposition of assets and insurance recoveries |

|

(21 |

) |

|

|

(6,478 |

) |

|

Foreign currency transaction gain |

|

(1 |

) |

|

|

(12 |

) |

|

Interest income on note receivable |

|

(24 |

) |

|

|

(24 |

) |

|

Deferred income taxes |

|

3,669 |

|

|

|

13,027 |

|

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(9,737 |

) |

|

|

19,859 |

|

|

Income tax receivable |

|

(1,136 |

) |

|

|

(3,815 |

) |

|

Inventories |

|

(45,955 |

) |

|

|

(9,726 |

) |

|

Contract assets |

|

1,886 |

|

|

|

— |

|

|

Prepaid expenses and other |

|

1,374 |

|

|

|

(2,364 |

) |

|

Accounts payable |

|

10,899 |

|

|

|

(2,155 |

) |

|

Contract liabilities |

|

(229 |

) |

|

|

— |

|

|

Deferred revenue |

|

447 |

|

|

|

1,010 |

|

|

Accrued liabilities and donations |

|

(1,690 |

) |

|

|

2,203 |

|

|

Net cash provided by operating activities |

|

61,183 |

|

|

|

128,814 |

|

| Investing

Activities |

|

|

|

|

Capital expenditures |

|

(55,362 |

) |

|

|

(67,802 |

) |

|

Cash paid in business combination, net of cash acquired |

|

(103,430 |

) |

|

|

— |

|

|

Proceeds from sale of property, plant and equipment |

|

19 |

|

|

|

60 |

|

|

Insurance proceeds |

|

— |

|

|

|

6,417 |

|

|

Principal payments from note receivable |

|

54 |

|

|

|

52 |

|

|

Net cash used in investing activities |

|

(158,719 |

) |

|

|

(61,273 |

) |

| Financing

Activities |

|

|

|

|

Borrowings under revolving credit facility |

|

40,000 |

|

|

|

— |

|

|

Stock options exercised |

|

21,148 |

|

|

|

21,418 |

|

|

Repurchase of stock |

|

(20,876 |

) |

|

|

(30,060 |

) |

|

Employee taxes paid by withholding shares |

|

(1,590 |

) |

|

|

(1,169 |

) |

|

Dividends paid to stockholders |

|

(19,947 |

) |

|

|

(19,815 |

) |

|

Net cash provided by (used in) financing activities |

|

18,735 |

|

|

|

(29,626 |

) |

| Net (decrease)

increase in cash, cash equivalents and restricted

cash |

|

(78,801 |

) |

|

|

37,915 |

|

| Cash, cash equivalents

and restricted cash, beginning of period |

|

82,288 |

|

|

|

44,373 |

|

| Cash, cash equivalents

and restricted cash, end of period |

$ |

3,487 |

|

|

$ |

82,288 |

|

Use of Non-GAAP Financial

Measures

To supplement the Company’s consolidated

financial statements presented in accordance with generally

accepted accounting principles (“GAAP”), additional non-GAAP

financial measures are provided and reconciled in the following

tables. The Company believes that these non-GAAP financial

measures, when considered together with the GAAP financial

measures, provide information that is useful to investors in

understanding period-over-period operating results. The Company

believes that this non-GAAP financial measure enhances the ability

of investors to analyze the Company’s business trends and operating

performance as they are used by management to better understand

operating performance. Since adjusted net income, adjusted net

income per diluted share, EBITDA, adjusted EBITDA, and adjusted

EBITDA margin are non-GAAP measures and are susceptible to varying

calculations, adjusted net income, adjusted net income per diluted

share, EBITDA, adjusted EBITDA, and adjusted EBITDA margin, as

presented, may not be directly comparable with other similarly

titled measures used by other companies.

Non-GAAP Adjusted Net

Income

The Company defines non-GAAP adjusted net income

as net income adjusted for any one-time events, such as acquisition

related costs or insurance proceeds received, net of profit sharing

and tax effect, in the periods presented

The following table provides a reconciliation of

net income (GAAP) to non-GAAP adjusted net income for the periods

indicated:

| |

|

Three Months Ended December

31, |

|

Years Ending December

31, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| |

|

(in thousands) |

|

Net income, a GAAP disclosure |

|

$ |

6,186 |

|

|

$ |

18,892 |

|

|

$ |

58,758 |

|

|

$ |

79,009 |

|

|

Acquisition-related fees |

|

|

4,367 |

|

|

|

— |

|

|

|

4,367 |

|

|

|

— |

|

|

Insurance recoveries |

|

|

— |

|

|

|

(6,417 |

) |

|

|

— |

|

|

|

(6,417 |

) |

|

Profit sharing effect |

|

|

(437 |

) |

|

|

642 |

|

|

|

(437 |

) |

|

|

642 |

|

|

Tax effect |

|

|

(593 |

) |

|

|

1,654 |

|

|

|

(593 |

) |

|

|

1,654 |

|

| Non-GAAP adjusted net

income |

|

$ |

9,523 |

|

|

$ |

14,771 |

|

|

$ |

62,095 |

|

|

$ |

74,888 |

|

| Non-GAAP adjusted earnings per

diluted share |

|

$ |

0.18 |

|

|

$ |

0.28 |

|

|

$ |

1.16 |

|

|

$ |

1.41 |

|

EBITDA and Adjusted EBITDA

EBITDA (as defined below) is presented herein

and reconciled from the GAAP measure of net income because of its

wide acceptance by the investment community as a financial

indicator of a company's ability to internally fund operations. The

Company defines EBITDA as net income, plus (1) depreciation and

amortization, (2) interest expense (income), net and (3) income tax

expense. EBITDA is not a measure of net income or cash flows as

determined by GAAP.

The Company’s EBITDA measure provides additional

information which may be used to better understand the Company’s

operations. EBITDA is one of several metrics that the Company uses

as a supplemental financial measurement in the evaluation of its

business and should not be considered as an alternative to, or more

meaningful than, net income, as an indicator of operating

performance. Certain items excluded from EBITDA are significant

components in understanding and assessing a company's financial

performance. EBITDA, as used by the Company, may not be comparable

to similarly titled measures reported by other companies. The

Company believes that EBITDA is a widely followed measure of

operating performance and is one of many metrics used by the

Company’s management team and by other users of the Company’s

consolidated financial statements.

Adjusted EBITDA is calculated as EBITDA adjusted

by items in non-GAAP adjusted net income, above, except for taxes,

as taxes are already excluded from EBITDA.

The following table provides a reconciliation of

net income (GAAP) to EBITDA (non-GAAP) and Adjusted EBITDA

(non-GAAP) for the periods indicated:

| |

|

Three Months Ended December

31, |

|

Years Ending December

31, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| |

|

(in thousands) |

|

Net income, a GAAP measure |

|

$ |

6,186 |

|

|

$ |

18,892 |

|

|

$ |

58,758 |

|

|

$ |

79,009 |

|

|

Depreciation and amortization |

|

|

7,811 |

|

|

|

6,663 |

|

|

|

30,343 |

|

|

|

25,634 |

|

|

Interest expense (income), net |

|

|

121 |

|

|

|

2 |

|

|

|

132 |

|

|

|

(88 |

) |

|

Income tax expense |

|

|

(840 |

) |

|

|

6,855 |

|

|

|

10,424 |

|

|

|

22,966 |

|

| EBITDA, a non-GAAP

measure |

|

|

13,278 |

|

|

|

32,412 |

|

|

|

99,657 |

|

|

|

127,521 |

|

|

Acquisition-related fees |

|

|

4,367 |

|

|

|

— |

|

|

|

4,367 |

|

|

|

— |

|

|

Insurance recoveries |

|

|

— |

|

|

|

(6,417 |

) |

|

|

— |

|

|

|

(6,417 |

) |

|

Profit sharing effect1 |

|

|

(437 |

) |

|

|

642 |

|

|

|

(437 |

) |

|

|

642 |

|

| Adjusted EBITDA, a non-GAAP

measure |

|

$ |

17,208 |

|

|

$ |

26,637 |

|

|

$ |

103,587 |

|

|

$ |

121,746 |

|

| Adjusted EBITDA margin |

|

|

12.6 |

% |

|

|

22.8 |

% |

|

|

19.4 |

% |

|

|

23.7 |

% |

| 1Profit sharing

effect of acquisition-related fees and insurance recoveries in the

respective period. |

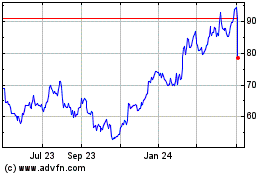

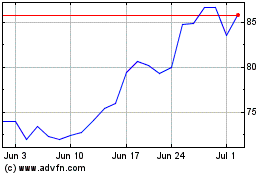

AAON (NASDAQ:AAON)

Historical Stock Chart

From Mar 2024 to Apr 2024

AAON (NASDAQ:AAON)

Historical Stock Chart

From Apr 2023 to Apr 2024