Additional Proxy Soliciting Materials (definitive) (defa14a)

23 March 2023 - 8:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

Atlantic Coastal Acquisition Corp. II

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11. |

ATLANTIC COASTAL ACQUISITION CORP. II

6 St Johns Lane, Floor 5

New York, NY 10013

SUPPLEMENT TO PROXY STATEMENT FOR

THE SPECIAL MEETING OF STOCKHOLDERS

To Be Held April 12, 2023

Explanatory Note

On March 20, 2023, Atlantic Coastal Acquisition Corp. II, which we refer to as “we,” “us,” “our,”

“ACAB” or the “Company,” filed a definitive proxy statement, which we refer to as the “Proxy Statement,” for a special meeting, which we refer to as the “Special Meeting,” of stockholders of the Company to be

held at 12:00 p.m. Eastern Time on April 12, 2023. This supplement, which we refer to as this “Supplement,” to the Proxy Statement supplements the Proxy Statement as filed and should be read in conjunction with the Proxy Statement.

The purpose of this Supplement is to correct a typographical error with respect to the anticipated

per-share price at which public shares may be redeemed from cash held in the SPAC trust account, which we refer to as the “Trust Account,” at the time of the Special Meeting. The anticipated per-share price at which public shares may be redeemed is $10.40.

THIS SUPPLEMENT SHOULD BE READ IN

CONJUNCTION WITH THE PROXY STATEMENT.

EXCEPT AS SPECIFICALLY SUPPLEMENTED BY THE INFORMATION CONTAINED HEREIN, THIS SUPPLEMENT DOES NOT

MODIFY ANY OTHER INFORMATION SET FORTH IN THE PROXY STATEMENT.

This Supplement supplements and updates the disclosures in the Proxy

Statement as follows:

| |

• |

|

On the third page of the section entitled “NOTICE OF SPECIAL MEETING OF STOCKHOLDERS To Be Held

April 12, 2023,” the paragraph that begins with “Based upon the current amount” is deleted in its entirety and replaced with the following: |

Based upon the current amount in the Trust Account, the Company anticipates that the

per-share price at which public shares will be redeemed from cash held in the Trust Account will be approximately $10.40 at the time of the Special Meeting. The closing price of the Company’s Series A

common stock on March 17, 2023 was $10.36. The Company cannot assure stockholders that they will be able to sell their shares of the Company’s Series A common stock in the open market, even if the market price per share is higher than the

redemption price stated above, as there may not be sufficient liquidity in its securities when such stockholders wish to sell their shares.

2

| |

• |

|

On the third page of the section entitled “NOTICE OF SPECIAL MEETING OF STOCKHOLDERS TO BE HELD

APRIL 12, 2023 PROXY STATEMENT,” the paragraph that begins with “Based upon the current amount” is deleted in its entirety and replaced with the following: |

Based upon the current amount in the Trust Account, the Company anticipates that the

per-share price at which public shares will be redeemed from cash held in the Trust Account will be approximately $10.40 at the time of the Special Meeting. The closing price of the Company’s Series A

common stock on March 17, 2023, the most recent practicable date prior to the date of this proxy statement, was $10.36. The Company cannot assure stockholders that they will be able to sell their shares of the Company’s Series A common stock in

the open market, even if the market price per share is higher than the redemption price stated above, as there may not be sufficient liquidity in its securities when such stockholders wish to sell their shares.

| |

• |

|

In the section entitled “THE CHARTER AMENDMENT PROPOSAL,” in the subsection entitled “Redemption

Rights,” the paragraph that begins with “If properly demanded, the Company” is deleted in its entirety and replaced with the following: |

If properly demanded, the Company will redeem each public share for a per-share price,

payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest (which interest shall be net of taxes payable), divided by the number of then outstanding public shares. Based upon the current amount in the

Trust Account, the Company anticipates that the per-share price at which public shares will be redeemed from cash held in the Trust Account will be approximately $10.40 at the time of the Special Meeting. The

closing price of the Company’s Series A common stock on March 17, 2023, the most recent practicable date prior to the date of this proxy statement, was $10.36.

Other than the changes described in this Supplement, the terms in the Proxy Statement remain as described.

Important Information

There are no

changes to the proposals to be acted upon at the Special Meeting, which are described in the Proxy Statement, or the proxy card you previously received. Except as amended or supplemented by the information contained in this Supplement, all

information set forth in the Proxy Statement continues to apply and should be considered in voting your shares.

This Supplement and the

Proxy Statement are available on the SEC’s website at www.sec.gov.

Whether or not you intend to be present at the Special Meeting of

Stockholders, we urge you to vote or submit your proxy promptly.

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: March 22, 2023 |

|

|

|

|

|

By Order of the Board of Directors |

|

|

|

|

|

|

|

|

|

|

/s/ Shahraab Ahmad |

|

|

|

|

|

|

Shahraab Ahmad |

|

|

|

|

|

|

Chairman and Chief Executive Officer |

4

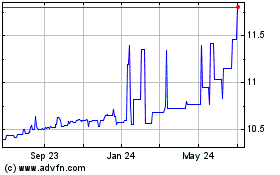

Atlantic Coastal Acquisi... (NASDAQ:ACAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atlantic Coastal Acquisi... (NASDAQ:ACAB)

Historical Stock Chart

From Apr 2023 to Apr 2024