Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258018

PROSPECTUS SUPPLEMENT NO. 3

To Prospectus dated July 30, 2021

PLAYSTUDIOS, Inc.

Up to 107,495,199 Shares of Class A Common Stock

Up to 10,996,631 Shares of Class A Common Stock Issuable Upon Exercise of Warrants

Up to 3,821,667 Warrants

This prospectus supplement no. 3 is being filed to update and supplement the information contained in the prospectus dated July 30, 2021 (as may be supplemented or amended from time to time, the “Prospectus”), which forms part of our registration statement on Form S-1 (No. 333-258018) with the information contained in our Current Report on Form 8-K which was filed with the Securities and Exchange Commission on November 29, 2021 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of up to an aggregate of 10,996,631 shares of our Class A common stock, $0.0001 par value per share (the “Class A common stock”), which consists of (i) up to 7,174,964 shares of our Class A common stock that are issuable upon the exercise of 7,174,964 warrants (the “Public Warrants”) by the holders thereof and (ii) up to 3,821,667 shares of Class A common stock that are issuable upon the exercise of 3,821,667 warrants (the “Private Placement Warrants,” and together with the Public Warrants, the “Warrants”).

The Prospectus and this prospectus supplement also relate to the resale from time to time by the selling securityholders named in the Prospectus (the “Selling Securityholders”) of (i) up to 107,495,199 shares of Class A common stock, including up to 10,693,624 shares of Class A common stock issuable as Earnout Shares (as defined in the Prospectus) and 1,444,962 shares of Class A common stock issuable upon the exercise of 1,444,962 options to purchase shares of Class A common stock (the “Class A Option Shares”) and (ii) 3,821,667 Private Placement Warrants. The shares of Class A common stock registered include 21,348,205 shares issuable upon conversion of: (i) 16,130,300 shares of our Class B common stock, par value $0.0001 per share (the “Class B common stock” and, together with the Class A common stock, our “common stock”), issued to Andrew S. Pascal, our Chairman of the Board and Chief Executive Officer, (ii) 3,026,112 shares of Class B common stock issuable as Earnout Shares and (iii) 2,191,793 shares of Class B common stock issuable upon the exercise of 2,191,793 options to purchase shares of Class B common stock (the “Class B Option Shares”, and together with the Class A Option Shares, the “Option Shares”). We will not receive any proceeds from the sale of shares of common stock or Private Placement Warrants by the Selling Securityholders pursuant to the Prospectus, except with respect to amounts received by us upon exercise of the Options Shares or Warrants.

The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to twenty votes per share and is convertible into one share of Class A common stock. Outstanding shares of Class B common stock, all of which are held by Mr. Pascal and certain of his affiliates, represent approximately 74.6% of the voting power of our outstanding capital stock as of November 26, 2021.

We registered the securities for resale pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling Securityholders. Our registration of the securities covered by the Prospectus does not mean that the Selling Securityholders will offer or sell any of the shares of Class A common stock or Private Placement Warrants. The Selling Securityholders may offer, sell or distribute all or a portion of their shares of Class A common stock or Private Placement Warrants publicly or through private transactions at prevailing market prices or at negotiated prices. We provide more information about how the Selling Securityholders may sell the shares of Class A common stock or Private Placement Warrants in the section titled “Plan of Distribution” in the Prospectus.

This prospectus supplement incorporates into the Prospectus the information contained in our attached Current Report on Form 8-K, which was filed with the Securities and Exchange Commission on November 29, 2021.

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and are subject to reduced public company reporting requirements. This prospectus supplement complies with the requirements that apply to an issuer that is an emerging growth company.

You should read this prospectus supplement in conjunction with the Prospectus. This prospectus supplement is qualified by reference to the Prospectus except to the extent that the information in this prospectus supplement supersedes the information contained in the Prospectus. This prospectus supplement is not complete without, and may not be delivered or utilized except in connection with, the Prospectus. If there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement. Terms used in this prospectus supplement but not defined herein shall have the meanings given to such terms in the Prospectus.

Our Class A common stock is currently listed on The Nasdaq Global Market (“Nasdaq”) under the symbol “MYPS”, and our Public Warrants are currently listed on The Nasdaq Global Market under the symbol “MYPSW”. On November 26, 2021, the closing price of our Class A common stock was $4.43 and the closing price for our Public Warrants was $0.735.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of the Prospectus and in the other documents that are incorporated by reference in the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November 29, 2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

November 22, 2021

Date of Report (date of earliest event reported)

PLAYSTUDIOS, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-39652

|

|

98-1606155

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

10150 Covington Cross Drive, Las Vegas, Nevada

|

|

89144

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (725) 877-7000

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A common stock

|

|

MYPS

|

|

The Nasdaq Stock Market LLC

|

|

Redeemable warrants, each whole warrant exercisable for one Class A common stock at an exercise price of $11.50

|

|

MYPSW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On November 22, 2021, PLAYSTUDIOS, Inc. (the “Company”), entered into agreements with N3TWORK Inc. and The Tetris Company, LLC pursuant to which the Company acquired the rights to develop and operate Tetris®-branded mobile games for an initial term through August of 2024. The Company paid N3TWORK Inc. $13 million at closing and agreed to pay up to an additional $34 million subject to satisfaction of certain conditions. In addition, the Company will pay royalties to The Tetris Company, LLC, the licensor of the rights.

On November 29, 2021, the Company issued a press release, furnished as Exhibit 99.1, announcing its expansion into the popular puzzle game genre as the exclusive developer and publisher of the iconic Tetris® game franchise for mobile devices.

The information contained in Exhibit 99.1 attached hereto is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(a)None

(b)None

(c)None

(d)Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

99.1*

|

|

Press release dated November 29, 2021, announcing the acquisition of the exclusive rights to the Tetris® game franchise for mobile devices.

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 29, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLAYSTUDIOS, Inc.

|

|

|

|

|

|

|

|

By:

|

/s/ Scott Peterson

|

|

|

|

Name:

|

Scott Peterson

|

|

|

|

Title:

|

Vice President, Chief Financial Officer

|

Exhibit 99.1

PLAYSTUDIOS SECURES EXCLUSIVE RIGHTS TO TETRIS® FRANCHISE FOR MOBILE DEVICES

Accelerates expansion into the casual puzzle genre

Affords the opportunity to enhance the Tetris® franchise with the playAWARDS loyalty program

LAS VEGAS – PLAYSTUDIOS (Nasdaq: MYPS), the developer of the playAWARDS loyalty platform and a suite of free-to-play mobile and social games, today announced it is expanding into the popular puzzle game genre as the exclusive developer and publisher of the iconic Tetris® game franchise for mobile devices. Through a strategic partnership with The Tetris Company and N3TWORK, PLAYSTUDIOS has assumed the exclusive global, multi-title mobile rights (excluding China) for the Tetris game. PLAYSTUDIOS will continue to operate and advance the current Tetris mobile products, while reimagining and eventually launching a new and improved version of the game that incorporates the company’s unique playAWARDS loyalty platform. The design of the new game will draw inspiration from leading casual game formats and embody new features and mechanics that will usher in a new era for Tetris on mobile.

The current Tetris mobile app, which was introduced in early 2020 by N3TWORK, has generated approximately 30 million downloads to date, and has retained millions of active players who will now become part of the PLAYSTUDIOS’ audience network.

“For nearly forty years, Tetris has appealed to a broad, multi-generational audience,” says PLAYSTUDIOS Founder, Chairman, and Chief Executive Officer Andrew Pascal. “Breaking into the puzzle genre with a storied brand like Tetris fits our strategy perfectly. It affords us the opportunity to integrate an iconic game into our playAWARDS loyalty program and drive meaningful growth.”

“Securing the exclusive license fully aligns with our strategic priorities and positions us to accelerate our growth, diversify our portfolio, grow our network of players, and scale our unique playAWARDS platform,” adds PLAYSTUDIOS Executive Vice President, Head of Corporate and Business Development Jason Hahn.

“PLAYSTUDIOS’ expertise in developing and operating compelling and beautifully executed games on top of their unique loyalty marketing platform make them an ideal partner to create a richer, more engaging experience for our loyal Tetris fans, old and new,” says Maya Rogers, President and CEO of Tetris. “We’re confident that PLAYSTUDIOS will be a wonderful steward of our brand.”

Conceived by software engineer Alexey Pajitnov in 1984, Tetris maintains a loyal following of players and is consistently ranked among the best games of all time. More recently it has become a popular game in Apple Arcade. Adding Tetris games to the PLAYSTUDIOS portfolio will introduce millions of its players worldwide to playAWARDS, allowing engaged fans to earn loyalty currency during free gameplay that they can exchange for real-world rewards from more than 275 celebrated entertainment, travel, leisure, and lifestyle brands. In addition, through its relationship with The Tetris Company, PLAYSTUDIOS can tap into the rich collection of Tetris game mechanics and experiences, while having the opportunity to add new features, innovations, and game adaptations to the Tetris ecosystem.

About PLAYSTUDIOS

PLAYSTUDIOS (Nasdaq: MYPS) is the developer and operator of award-winning free-to-play casual games for mobile and social platforms. The company’s collection of original and published titles is powered by its groundbreaking playAWARDS loyalty marketing platform, which enables players to earn real-world rewards from a portfolio of global entertainment, retail, technology, travel, leisure, and gaming brands across 17 countries and four continents. Founded by a team of veteran gaming, hospitality, and technology entrepreneurs, PLAYSTUDIOS brings together beautifully designed mobile gaming content with an innovative loyalty platform in order to provide its players with an unequaled entertainment experience and its partners with actionable business insights. To learn more about PLAYSTUDIOS, visit playstudios.com.

About playAWARDS

Created by award-winning game developer PLAYSTUDIOS, playAWARDS is an innovative, scalable, and cost-efficient loyalty marketing program that connects the world’s leading entertainment, retail, technology, travel, leisure, and gaming companies with a valuable, highly engaged audience of mobile and social gamers. By integrating branded content and promotional offerings into PLAYSTUDIOS’ portfolio of casual, free-to-play mobile apps, playAWARDS keeps its rewards partners top-of-mind while converting entertaining digital impressions into real-world brand engagement. The playAWARDS platform also provides partners with a powerful suite of management and analytics tools that offer deep, actionable insights into audience engagement and program performance.

About The Tetris® Brand

The Tetris® brand is one of the leading and most distinctive video game brands and franchises in the world. Now after more than 35 years, the brand continues to be loved globally by people of all ages and all cultures. Billions of Tetris games are played online every year, and over 590 million Tetris mobile games have been downloaded to date. The Tetris brand’s global licensee network includes major video game publishers, including Nintendo and Sega, as well as many partners in electronics, toys, apparel, lifestyle goods, entertainment and more. Tetris Holding, LLC, is the owner of Tetris rights worldwide, and The Tetris Company, Inc. is its exclusive licensee. For the latest information about the Tetris brand and Tetris products, please visit www.tetris.com. For the latest information about the Tetris brand and Tetris products, please visit www.tetris.com. Become a fan of Tetris on Facebook (www.facebook.com/Tetris) and follow Tetris on Twitter (@Tetris_Official) and Instagram (@Tetris_Official).

|

|

|

|

|

PLAYSTUDIOS CONTACTS

|

|

|

|

Investor Relations

|

|

IR@playstudios.com

|

|

|

|

Media Relations

|

|

Amy Rosetti

|

|

media@playstudios.com

|

SOURCE: PLAYSTUDIOS

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding the company’s exercise of rights to develop and operate Tetris® games, maintaining the current player base, introducing those players to playAWARDS and acquiring new players. The company’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the company’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the ability to recognize the anticipated benefits of the licensed rights to the Tetris® games, (2) costs related to the acquisition of the license rights and the integration of the Tetris® games into the company’s portfolio of games and playAWARDS; (3) the company’s ability to operate the Tetris® games and maintain its players; (4) changes in applicable laws or regulations; (5) general economic, business, and/or competitive factors; and (6) other risks and uncertainties included from time to time in the company’s other filings with the U.S. Securities and Exchange Commission (the “SEC”). Additional information will be made available in other filings that the company makes from time to time with the SEC. In addition, any forward-looking statements contained in this press release are based on assumptions that the company believes to be reasonable as of this date. The company

undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law.

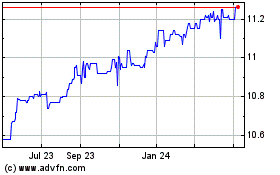

Acri Capital (NASDAQ:ACAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

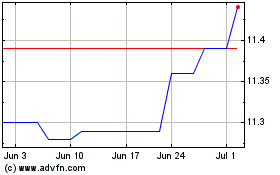

Acri Capital (NASDAQ:ACAC)

Historical Stock Chart

From Apr 2023 to Apr 2024