Current Report Filing (8-k)

28 April 2022 - 10:34PM

Edgar (US Regulatory)

0001823878FALSE00018238782022-04-282022-04-280001823878us-gaap:CommonClassAMember2022-04-282022-04-280001823878us-gaap:WarrantMember2022-04-282022-04-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

April 28, 2022

Date of Report (date of earliest event reported)

PLAYSTUDIOS, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

Delaware | | 001-39652 | | 88-1802794 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | |

10150 Covington Cross Drive, Las Vegas, Nevada | | 89144 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant's telephone number, including area code: (725) 877-7000

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock | | MYPS | | The Nasdaq Stock Market LLC |

| Redeemable warrants, each whole warrant exercisable for one Class A common stock at an exercise price of $11.50 | | MYPSW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events

On April 28, 2022, PLAYSTUDIOS, Inc. (the “Company”) issued a press release, furnished as Exhibit 99.1, announcing an extension of the expiration date of the offer by the Company to purchase for cash up to 10,996,361 of its outstanding warrants to purchase Class A common stock, par value $0.0001 (the “Warrants”), at a price of $1.00 per warrant, without interest (the “Offer Purchase Price”), on the terms and conditions set forth in the Amended and Restated Offer to Purchase and Consent Solicitation and the Amended and Restated Letter of Transmittal and Consent filed by the Company as exhibits to Amendment No. 2 to the Tender Offer Statement on Schedule TO on April 28, 2022. The Amended and Restated Offer to Purchase and Consent Solicitation and the Amended and Restated Letter of Transmittal and Consent, together with any amendments or supplements thereto, collectively constitute the “Offer”. If a holder elects to tender Warrants in the Offer, such holder will approve an amendment to the Warrant Agreement, dated as of October 22, 2020, by and between the Company (formerly Acies Acquisition Corp.) and Continental Stock Transfer & Trust Company, which governs all of the Warrants, permitting the Company to redeem each outstanding Warrant for $0.90 in cash, without interest, which is 10% less than the Offer Purchase Price. The Offer was previously scheduled to expire at 12:00 midnight, Eastern Time, at the end of the day on April 29, 2022. The expiration date of the Offer has been extended until 12:00 midnight, Eastern Time, at the end of the day on May 13, 2022, unless further extended or terminated. Broadridge Corporate Issuer Solutions, Inc., the depositary for the Offer, has indicated that as of 5:00 p.m. Eastern Time on April 27, 2022, (i) 33,606 Public Warrants had been validly tendered and not validly withdrawn from the Offer, representing approximately 0.5% of the outstanding Public Warrants and (ii) none of the outstanding Private Placement Warrants had been validly tendered and not validly withdrawn from the Offer. A copy of the press release is filed as Exhibit 99.1 hereto and is incorporated herein by reference.

The information contained in Exhibit 99.1 attached hereto is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(a)None

(b)None

(c)None

(d)Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1* | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: April 28, 2022

| | | | | | | | | | | |

| PLAYSTUDIOS, Inc. |

| | | |

| By: | /s/ Scott Peterson |

| | Name: | Scott Peterson |

| | Title: | Chief Financial Officer |

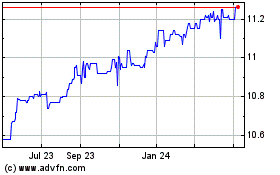

Acri Capital (NASDAQ:ACAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

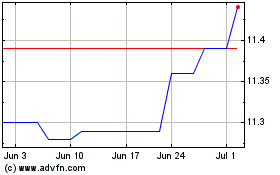

Acri Capital (NASDAQ:ACAC)

Historical Stock Chart

From Apr 2023 to Apr 2024