Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258018

PROSPECTUS SUPPLEMENT NO. 3

To Prospectus dated March 23, 2022

PLAYSTUDIOS, Inc.

Up to 97,184,288 Shares of Class A Common Stock

Up to 10,996,631 Shares of Class A Common Stock Issuable Upon Exercise of Warrants

Up to 3,821,667 Warrants

This prospectus supplement no. 3 is being filed to update and supplement the information contained in the prospectus dated March 23, 2022 (as may be supplemented or amended from time to time, the “Prospectus”), which forms part of our registration statement on Form S-1 (No. 333-258018) with the information contained in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, filed with the Securities and Exchange Commission on May 5, 2022 (the “Quarterly Report”). Accordingly, we have attached the Quarterly Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of up to an aggregate of 10,996,631 shares of our Class A common stock, $0.0001 par value per share (the “Class A common stock”), which consists of (i) up to 7,174,964 shares of our Class A common stock that are issuable upon the exercise of 7,174,964 warrants (the “Public Warrants”) by the holders thereof and (ii) up to 3,821,667 shares of Class A common stock that are issuable upon the exercise of 3,821,667 warrants (the “Private Placement Warrants,” and together with the Public Warrants, the “Warrants”).

The Prospectus and this prospectus supplement also relate to the resale from time to time by the selling securityholders named in the Prospectus (the “Selling Securityholders”) of (i) up to 97,184,288 shares of Class A common stock, including up to 10,693,624 shares of Class A common stock issuable as Earnout Shares (as defined in the Prospectus) and 1,444,962 shares of Class A common stock issuable upon the exercise of 1,444,962 options to purchase shares of Class A common stock (the “Class A Option Shares”) and (ii) 3,821,667 Private Placement Warrants. The shares of Class A common stock registered include 21,348,205 shares issuable upon conversion of: (i) 16,130,300 shares of our Class B common stock, par value $0.0001 per share (the “Class B common stock” and, together with the Class A common stock, our “common stock”), issued to Andrew S. Pascal, our Chairman of the Board and Chief Executive Officer, (ii) 3,026,112 shares of Class B common stock issuable as Earnout Shares and (iii) 2,191,793 shares of Class B common stock issuable upon the exercise of 2,191,793 options to purchase shares of Class B common stock (the “Class B Option Shares”, and together with the Class A Option Shares, the “Option Shares”). We will not receive any proceeds from the sale of shares of common stock or Private Placement Warrants by the Selling Securityholders pursuant to the Prospectus, except with respect to amounts received by us upon exercise of the Options Shares or Warrants.

The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to twenty votes per share and is convertible into one share of Class A common stock. Outstanding shares of Class B common stock, all of which are held by Mr. Pascal and certain of his affiliates, together with the shares of Class A common stock held by Mr. Pascal and certain of his affiliates, represent approximately 74.7% of the voting power of our outstanding capital stock as of May 4, 2022.

We registered the securities for resale pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling Securityholders. Our registration of the securities covered by the Prospectus does not mean that the Selling Securityholders will offer or sell any of the shares of Class A common stock or Private Placement Warrants. The Selling Securityholders may offer, sell or distribute all or a portion of their shares of Class A common stock or Private Placement Warrants publicly or through private transactions at prevailing market prices or at negotiated prices. We

provide more information about how the Selling Securityholders may sell the shares of Class A common stock or Private Placement Warrants in the section titled “Plan of Distribution” in the Prospectus.

This prospectus supplement incorporates into the Prospectus the information contained in our attached Quarterly Report on Form 10-Q, which was filed with the Securities and Exchange Commission on May 5, 2022.

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and are subject to reduced public company reporting requirements. This prospectus supplement complies with the requirements that apply to an issuer that is an emerging growth company.

You should read this prospectus supplement in conjunction with the Prospectus. This prospectus supplement is qualified by reference to the Prospectus except to the extent that the information in this prospectus supplement supersedes the information contained in the Prospectus. This prospectus supplement is not complete without, and may not be delivered or utilized except in connection with, the Prospectus. If there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement. Terms used in this prospectus supplement but not defined herein shall have the meanings given to such terms in the Prospectus.

Our Class A common stock is currently listed on The Nasdaq Global Market (“Nasdaq”) under the symbol “MYPS”, and our Public Warrants are currently listed on The Nasdaq Global Market under the symbol “MYPSW”. On May 4, 2022, the closing price of our Class A common stock was $5.75 and the closing price for our Public Warrants was $1.00.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of the Prospectus and in the other documents that are incorporated by reference in the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is May 5, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For transition period from to

Commission File Number 001-39652

PLAYSTUDIOS, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 88-1802794 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

10150 Covington Cross Drive

Las Vegas, NV 89144

(725) 877-7000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class A common stock | | MYPS | | The Nasdaq Stock Market LLC |

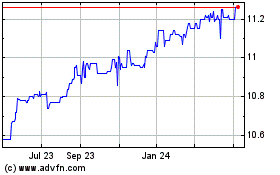

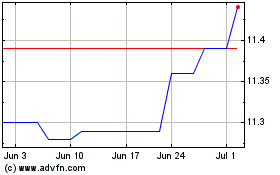

| Redeemable warrants exercisable for one Class A common stock at an exercise price of $11.50 | | MYPSW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

As of April 29, 2022, there were 110,339,318 shares of Class A common stock, $0.0001 par value per share, and 16,130,300 shares of Class B common stock, $0.0001 par value per share, issued and outstanding.

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We have based these forward-looking statements on our current expectations and projections about future events. All statements, other than statements of present or historical fact included in this Quarterly Report, about our future financial performance, strategy, expansion plans, future operations, future operating results, estimated revenues, losses, projected costs, prospects, plans and objectives of management are forward-looking statements. Any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “continue,” “goal,” “project” or the negative of such terms or other similar expressions.

Forward-looking statements contained in this Quarterly Report on Form 10-Q include, but are not limited to, statements about:

•our business strategy and market opportunity;

•our future financial performance, including our expectations regarding our revenue, cost of revenue, gross profit, or gross margin, operating expenses (including changes in sales and marketing, research and development, and general and administrative expenses), and profitability;

•market acceptance of our games;

•our ability to raise financing in the future and the global credit and financial markets;

•factors relating to our business, operations, financial performance, and our subsidiaries, including:

◦changes in the competitive and regulated industries in which we operate, variations in operating performance across competitors, and changes in laws and regulations affecting our business;

◦our ability to implement business plans, forecasts, and other expectations, and identify and realize additional opportunities; and

◦the impact of the COVID-19 pandemic (including existing and possible future variants as well as vaccinations).

•our ability to maintain relationships with our platforms, such as the Apple App Store, Google Play Store, Amazon Appstore, and Facebook;

•the accounting for our outstanding warrants to purchase shares of Class A common stock;

•our ability to develop, maintain, and improve our internal control over financial reporting;

•our ability to maintain, protect, and enhance our intellectual property rights;

•our ability to successfully defend litigation brought against us;

•our ability to successfully close and integrate acquisitions to contribute to our growth objectives; and

•our success in retaining or recruiting, or changes required in, our officers, key employees or directors.

These forward-looking statements are based on our current plans, estimates and projections in light of information currently available to us, and are subject to known and unknown risks, uncertainties and assumptions about us, including those described under the heading “Risk Factors” in this Quarterly Report on Form 10-Q, and in other filings that we make with the Securities and Exchange Commission (the “SEC”) from time to time, that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. In addition, the risks described under the heading “Risk Factors” are not exhaustive. New risk factors emerge from time to time, and it is not possible to predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any risk factor or combination of risk factors may cause actual results to differ materially from those contained in any forward-looking statements. Forward-looking statements are also not guarantees of performance. You should not put undue reliance on any

forward-looking statements, which speak only as of the date hereof. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Quarterly Report on Form 10-Q whether as a result of new information, future events or otherwise.

We intend to announce material information to the public through our Investor Relations website, ir.playstudios.com, SEC filings, press releases, public conference calls and public webcasts. We use these channels, as well as social media, to communicate with our investors, customers, and the public about our company, our offerings, and other issues. It is possible that the information we post on our website or social media could be deemed to be material information. As such, we encourage investors, the media, and others to follow the channels listed above, including our website and the social media channels listed on our Investor Relations website, and to review the information disclosed through such channels. Any updates to the list of disclosure channels through which we will announce information will be posted on the investor relations page on our website.

PART I. Financial Information

Item 1. Financial Statements

PLAYSTUDIOS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited, in thousands, except par value amounts)

| | | | | | | | | | | |

| March 31,

2022 | | December 31,

2021 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 219,965 | | | $ | 213,502 | |

| Receivables | 20,982 | | | 20,693 | |

| Prepaid expenses | 3,456 | | | 5,059 | |

| Income tax receivable | 1,827 | | | 2,117 | |

| Other current assets | 1,188 | | | 413 | |

| Total current assets | 247,418 | | | 241,784 | |

| Property and equipment, net | 7,115 | | | 5,289 | |

| Internal-use software, net | 35,622 | | | 43,267 | |

| Goodwill | 5,059 | | | 5,059 | |

| Intangibles, net | 17,068 | | | 18,755 | |

| Deferred income taxes | 3,803 | | | 6,282 | |

| Other long-term assets | 12,481 | | | 14,408 | |

| Total non-current assets | 81,148 | | | 93,060 | |

| Total assets | $ | 328,566 | | | $ | 334,844 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | 8,759 | | | 7,793 | |

| Warrant liabilities | 9,237 | | | 6,521 | |

| Accrued liabilities | 16,769 | | | 15,599 | |

| Total current liabilities | 34,765 | | | 29,913 | |

| | | |

| Deferred income taxes | 5,218 | | | — | |

| Other long-term liabilities | 2,235 | | | 1,464 | |

| Total non-current liabilities | 7,453 | | | 1,464 | |

| Total liabilities | $ | 42,218 | | | $ | 31,377 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

Preferred stock, $0.0001 par value (100,000 shares authorized, no shares issued and outstanding as of March 31, 2022 and December 31, 2021) | — | | | — | |

| | | |

Class A common stock, $0.0001 par value (2,000,000 shares authorized, 110,339 and 110,066 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively) | 11 | | | 11 | |

Class B common stock, $0.0001 par value (25,000 shares authorized, 16,130 and 16,130 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively). | 2 | | | 2 | |

| Additional paid-in capital | 276,621 | | | 268,522 | |

| Retained earnings | 9,327 | | | 34,539 | |

| Accumulated other comprehensive income | 387 | | | 393 | |

| Total stockholders’ equity | 286,348 | | | 303,467 | |

| Total liabilities and stockholders’ equity | $ | 328,566 | | | $ | 334,844 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLAYSTUDIOS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited, in thousands, except per share data)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2022 | | 2021 | | | | |

| Net revenues | $ | 70,451 | | | $ | 74,097 | | | | | |

| Operating expenses: | | | | | | | |

Cost of revenue(1) | 21,033 | | | 24,488 | | | | | |

| Selling and marketing | 20,540 | | | 17,000 | | | | | |

| Research and development | 16,981 | | | 14,746 | | | | | |

| General and administrative | 9,691 | | | 4,223 | | | | | |

| Depreciation and amortization | 8,394 | | | 6,034 | | | | | |

| Restructuring and related | 8,655 | | | 56 | | | | | |

| Total operating costs and expenses | 85,294 | | | 66,547 | | | | | |

| (Loss) income from operations | (14,843) | | | 7,550 | | | | | |

| Other (expense) income, net: | | | | | | | |

| Change in fair value of warrant liabilities | (2,716) | | | — | | | | | |

| Interest expense, net | (5) | | | (42) | | | | | |

| Other income (expense), net | 187 | | | (242) | | | | | |

| Total other expense, net | (2,534) | | | (284) | | | | | |

| (Loss) income before income taxes | (17,377) | | | 7,266 | | | | | |

| Income tax benefit (expense) | (7,835) | | | (1,348) | | | | | |

| Net (loss) income | $ | (25,212) | | | $ | 5,918 | | | | | |

| Net (loss) income per share attributable to Class A and Class B common stockholders: | | | | | | | |

| Basic | $ | (0.20) | | | $ | 0.06 | | | | | |

| Diluted | $ | (0.20) | | | $ | 0.05 | | | | | |

Weighted average shares of common stock outstanding: | | | | | | | |

| Basic | 126,337 | | | 93,809 | | | | | |

| Diluted | 126,337 | | | 109,951 | | | | | |

(1)Amounts exclude depreciation and amortization.

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLAYSTUDIOS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

(unaudited, in thousands)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2022 | | 2021 | | | | |

| Net (loss) income | $ | (25,212) | | | $ | 5,918 | | | | | |

| Other comprehensive (loss) income: | | | | | | | |

Change in foreign currency translation adjustment(1) | (6) | | | (296) | | | | | |

| Total other comprehensive (loss) income | (6) | | | (296) | | | | | |

| Comprehensive (loss) income | $ | (25,218) | | | $ | 5,622 | | | | | |

(1)These amounts are presented gross of the effect of income taxes. The total change in foreign currency translation adjustment and the corresponding effect of income taxes are immaterial.

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLAYSTUDIOS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | | Common Stock | | Class A Common Stock | | Class B Common Stock | | Additional

Paid-In

Capital | | Accumulated Other Comprehensive Income | | | | Total

Stockholders'

Equity |

| Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | | Retained

Earnings | |

| Balance as of December 31, 2020 | 162,596 | | | $ | 8 | | | 238,186 | | | $ | 12 | | | — | | | $ | — | | | — | | | $ | — | | | $ | 71,776 | | | $ | 481 | | | $ | 23,802 | | | $ | 96,079 | |

| Retroactive application of reverse recapitalization | (162,596) | | | (8) | | | (238,186) | | | (12) | | | 74,421 | | | 8 | | | 18,977 | | | 2 | | | 10 | | | — | | | — | | | — | |

| Adjusted balance as of December 31, 2020 | — | | | $ | — | | | — | | | $ | — | | | 74,421 | | | $ | 8 | | | 18,977 | | | $ | 2 | | | $ | 71,786 | | | $ | 481 | | | $ | 23,802 | | | 96,079 | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 5,918 | | | 5,918 | |

| Exercise of stock options | — | | | — | | | — | | | — | | | 737 | | | — | | | — | | | — | | | 808 | | | — | | | — | | | 808 | |

| Stock-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,109 | | | — | | | — | | | 1,109 | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (296) | | | — | | | (296) | |

| Balance as of March 31, 2021 | — | | | $ | — | | | — | | | $ | — | | | 75,158 | | | $ | 8 | | | 18,977 | | | $ | 2 | | | $ | 73,703 | | | $ | 185 | | | $ | 29,720 | | | $ | 103,618 | |

PLAYSTUDIOS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | | Common Stock | | Class A Common Stock | | Class B Common Stock | | Additional

Paid-In

Capital | | Accumulated Other Comprehensive Income | | | | Total

Stockholders'

Equity |

| Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | | Retained

Earnings | |

| Balance as of December 31, 2021 | — | | | $ | — | | | — | | | $ | — | | | 110,066 | | | $ | 11 | | | 16,130 | | | $ | 2 | | | $ | 268,522 | | | $ | 393 | | | $ | 34,539 | | | 303,467 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (25,212) | | | (25,212) | |

| Exercise of stock options | — | | | — | | | — | | | — | | | 113 | | | — | | | — | | | — | | | 130 | | | — | | | — | | | 130 | |

| Issuance of vested restricted stock units | — | | | — | | | — | | | — | | | 160 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Stock-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 7,969 | | | — | | | — | | | 7,969 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (6) | | | — | | | (6) | |

| Balance as of March 31, 2022 | — | | | $ | — | | | — | | | $ | — | | | 110,339 | | | $ | 11 | | | 16,130 | | | $ | 2 | | | $ | 276,621 | | | $ | 387 | | | $ | 9,327 | | | $ | 286,348 | |

PLAYSTUDIOS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

| | | | | | | | | | | |

| Three Months Ended

March 31, |

| 2022 | | 2021 |

| Cash flows from operating activities: | | | |

| Net (loss) income | $ | (25,212) | | | $ | 5,918 | |

| Adjustments: | | | |

| Depreciation and amortization | 8,394 | | | 6,034 | |

| Amortization of loan costs | 34 | | | 20 | |

| Stock-based compensation expense | 6,868 | | | 900 | |

| Change in fair value of warrant liabilities | 2,716 | | | — | |

| Asset impairments | 8,353 | | | — | |

| Deferred income tax expense | 7,945 | | | (110) | |

| Other | (203) | | | 242 | |

| Changes in operating assets and liabilities | | | |

| Receivables | (203) | | | (10,311) | |

| Prepaid expenses and other current assets | 871 | | | (164) | |

| Income tax receivable | 366 | | | 1,021 | |

| Accounts payable & accrued liabilities | 1,926 | | | 1,220 | |

| Other | (270) | | | 28 | |

| Net cash provided by operating activities | 11,585 | | | 4,798 | |

| Cash flows from investing activities: | | | |

| Purchase of property and equipment | (1,936) | | | (197) | |

| Additions to internal-use software | (5,519) | | | (6,710) | |

| Additions to notes receivable and other investments | — | | | (5,034) | |

| Receipts of notes receivable | 2,348 | | | — | |

| Net cash used in investing activities | (5,107) | | | (11,941) | |

| Cash flows from financing activities: | | | |

| Proceeds from stock option exercises | 130 | | | 808 | |

| | | |

| Payments for capitalized offering costs | — | | | (2,968) | |

| | | |

| | | |

| Net cash provided by (used in) financing activities | 130 | | | (2,160) | |

| Foreign currency translation | (145) | | | (149) | |

| Net change in cash and cash equivalents | 6,463 | | | (9,452) | |

| Cash and cash equivalents at beginning of period | 213,502 | | | 48,927 | |

| Cash and cash equivalents at end of period | $ | 219,965 | | | $ | 39,475 | |

| Supplemental cash flow disclosures: | | | |

| Interest paid | $ | 35 | | | $ | 27 | |

| Income taxes paid, net of refunds | 244 | | | 487 | |

| Non-cash investing and financing activities: | | | |

| Capitalization of stock-based compensation | $ | 1,101 | | | $ | 209 | |

| Increase in property and equipment included in accounts payable and other long-term liabilities | 656 | | | — | |

| Capitalization of deferred transaction costs included in accrued liabilities and accounts payable | — | | | 263 | |

| Addition to note receivable included in accrued liabilities | — | | | 2,500 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, in thousands, unless otherwise noted)

NOTE 1—BACKGROUND AND BASIS OF PRESENTATION

Organization and Description of Business

On June 21, 2021 (the “Closing Date”), Acies Acquisition Corp., a Cayman Islands exempted company (prior to the Closing Date, “Acies”), consummated the previously announced business combination (“Business Combination”) with PlayStudios, Inc., a Delaware corporation (“Old PLAYSTUDIOS”) pursuant to the Agreement and Plan of Merger, dated as of February 1, 2021 (the “Merger Agreement”), by and among Acies, Catalyst Merger Sub I, Inc., a Delaware corporation and a direct wholly owned subsidiary of Acies (“First Merger Sub”), Catalyst Merger Sub II, LLC, a Delaware limited liability company and a direct wholly owned subsidiary of Acies (“Second Merger Sub”), and Old PLAYSTUDIOS. The Business Combination was accounted for as a reverse recapitalization and Acies was treated as the “acquired” company for accounting purposes. The Business Combination was accounted as the equivalent of Old PLAYSTUDIOS issuing stock for the net assets of Acies, accompanied by a recapitalization.

PLAYSTUDIOS, Inc., formerly known as Acies Acquisition Corp. (the "Company” or "PLAYSTUDIOS"), was incorporated on August 14, 2020 as a Cayman Islands exempted company, and domesticated into a Delaware corporation on June 21, 2021 (the "Domestication"). The Company's legal name became PLAYSTUDIOS, Inc. following the closing of the Business Combination. The prior period financial information represents the financial results and conditions of Old PLAYSTUDIOS.

The Company develops and operates online and mobile social gaming applications (“games” or “game”) each of which incorporate a unique loyalty program offering “real world” rewards provided by a collection of rewards partners. The Company’s games are free-to-play and available via the Apple App Store, Google Play Store, Amazon Appstore, and Facebook (collectively, “platforms” or “platform operators”). The Company creates games based on its own original content as well as third-party licensed brands. The Company generates revenue through the in-game sale of virtual currency and through advertising.

Unless the context indicates otherwise, all references herein to “PLAYSTUDIOS,” the “Company,” “we,” “us,” and “our” are used to refer collectively to PLAYSTUDIOS, Inc. and its subsidiaries.

Basis of Presentation and Consolidation

The accompanying condensed consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) and pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). The consolidated financial statements include the accounts of PLAYSTUDIOS, Inc. and its consolidated subsidiaries. All intercompany balances and transactions have been eliminated upon consolidation. Certain reclassifications in these financial statements have been made to comply with US GAAP applicable to public companies and SEC Regulation S-X.

The significant accounting policies referenced in the annual consolidated financial statements of the Company as of December 31, 2021 have been applied consistently in these unaudited interim consolidated financial statements. In the opinion of the Company, the accompanying unaudited financial statements contain all adjustments, consisting of only normal recurring adjustments, necessary for a fair presentation of its financial position as of March 31, 2022, and its results of operations for the three months ended March 31, 2022, and 2021, and cash flows for the three months ended March 31, 2022, and 2021. The Consolidated Balance Sheet as of December 31, 2021 was derived from the audited annual financial statements but does not contain all of the footnote disclosures from the annual financial statements. The Company made certain reclassifications to the comparative balances in the condensed consolidated financial statements to conform with current year presentation.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with US GAAP requires us to make estimates and assumptions that affect the reported amounts in the consolidated financial statements and notes thereto. Significant estimates and assumptions reflected in the Company’s condensed consolidated financial statements include the estimated consumption rate of virtual goods that is used in the determination of revenue recognition, useful lives of property and equipment and definite-lived intangible assets, the expensing and capitalization of research and development costs for internal-use software, assumptions used in accounting for income taxes, stock-based compensation and the evaluation of

goodwill and long-lived assets for impairment. The Company believes the accounting estimates are appropriate and reasonably determined. Due to the inherent uncertainties in making these estimates, actual amounts could differ materially.

Segments

Operating segments are defined as components of an entity for which discrete financial information is available, and that is regularly reviewed by the Chief Operating Decision Maker (“CODM”) in deciding how to allocate resources to an individual segment and in assessing performance. The CODM, the Company’s Chief Executive Officer, reviews financial information on a consolidated basis for purposes of evaluating performance and allocating resources. As such, the Company has one operating and reportable segment.

Emerging Growth Company

At March 31, 2022, the Company qualified as an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and the Company has taken and may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies are required to comply with the new or revised standards. The JOBS Act provides that an emerging growth company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. The Company has opted to take advantage of such extended transition period available to emerging growth companies which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company can adopt the new or revised standard at the time private companies adopt the new or revised standard. The Company did not lose its emerging growth company status on December 31, 2021. As a result, the Company does not expect to adopt any accounting pronouncements currently deferred based on private company standards until a year subsequent to 2022. The Company will reevaluate its eligibility to retain emerging growth company status at the end of its second quarter of 2022, and otherwise as required.

NOTE 2—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

For a discussion of our significant accounting policies and estimates, please refer to our 2021 Annual Report on Form 10-K filed on March 3, 2022.

Share-Based Compensation

The Company has a stock-based compensation program which provides for equity awards including time-based stock options and restricted stock units (“RSUs”). Stock-based compensation expense is measured at the grant date, based on the estimated fair value of the award, and is recognized as expense over the requisite service period for the award. The Company records forfeitures as a reduction of stock-based compensation expense as those forfeitures occur.

The Company uses the Black-Scholes-Merton option-pricing model to determine the fair value for option awards. In valuing our option awards, the Company makes assumptions about risk-free interest rates, dividend yields, volatility and weighted-average expected lives. The Company accounts for forfeitures as they occur. Risk-free interest rates are derived from United States Treasury securities as of the option award grant date. Expected dividend yield is based on our historical cash dividend payments, which have been zero to date. The expected volatility for shares of the Company's Class A common stock is estimated using our historical volatility. The weighted-average expected life of the option awards is estimated based on our historical exercise data.

The Company's dual class structure was created upon the Domestication (as defined in Note 1—Background and Basis of Presentation). The Class B common stock including Class B common stock underlying vested stock options, held by Mr. Andrew Pascal, the Company's Chairman and Chief Executive Officer, or his affiliates (the "Founder Group") carry a super vote premium. As the Founder Group did not have control of Old PLAYSTUDIOS prior to the Business Combination, and Mr. Pascal is an employee of the Company, the incremental value resulting from the super vote premium is accounted for as incremental compensation costs.

The Company utilized the market approach by observing other market participants with (i) dual class structures, (ii) super vote premiums for a single class and (iii) both classes trading on a national exchange. Based on the observed data, management selected a premium for the Class B common stock and the stock options held by members of the Founder Group.

The Company uses the estimated fair value of equity and associated per-share value at the time of grant to determine the compensation cost to be recognized associated with RSUs granted.

Recently Issued Accounting Pronouncements Not Yet Adopted

In February 2016, the Financial Accounting Standards Board ("FASB") issued ASU 2016-02, Leases (Topic 842). The amended guidance is intended to increase transparency and comparability among organizations by recognizing lease assets and liabilities in the Consolidated Balance Sheets and disclosing key information about leasing arrangements. The adoption of this guidance is expected to result in a significant portion of the Company’s operating leases, where the Company is the lessee, to be recognized in the Company’s Consolidated Balance Sheets. The guidance requires lessees and lessors to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. This guidance is effective for the Company for fiscal years beginning after December 15, 2021, and interim periods within fiscal years beginning after December 15, 2022, with earlier adoption permitted. The Company intends to first present the application of this guidance in its Annual Report on Form 10-K for the year ending December 31, 2022 with an effective date of January 1, 2022. The Company is currently evaluating the impact of adopting this guidance.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326). The new guidance replaces the incurred loss impairment methodology in current guidance with a current expected credit loss model (“CECL”) that incorporates a broader range of reasonable and supportable information including the forward-looking information. This guidance is effective for the Company for fiscal years beginning after December 15, 2022, including interim periods within that annual reporting period, with early adoption permitted. Application of the amendments is through a cumulative-effect adjustment to retained earnings as of the effective date. The Company is currently evaluating the impact of adopting this guidance.

Recently Adopted Accounting Pronouncements

In December 2019, the FASB issued ASU 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. The new guidance removes certain exceptions for recognizing deferred taxes for investments, performing intraperiod allocation and calculating income taxes in interim periods. It also adds guidance to reduce complexity in certain areas, including recognizing deferred taxes for tax goodwill and allocating taxes to members of a consolidated group. The Company adopted this guidance prospectively on January 1, 2022. The adoption resulted in the Company not utilizing the prior exception under ASC 740-270-30-28 to the general methodology of calculating interim income taxes for the period ended March 31, 2022, but did not have a material impact on the Company’s condensed consolidated financial statements.

NOTE 3—RELATED-PARTY TRANSACTIONS

The following table is a summary of balance sheet assets and liabilities from related parties:

| | | | | | | | | | | | | | | | | |

| March 31,

2022 | | December 31,

2021 | | Financial Statement Line Item |

| Marketing Agreement | $ | 1,000 | | | $ | 1,000 | | | Intangibles, net |

| | | | | |

The Company did not have any revenues recognized from related parties during the three months ended March 31, 2022 and 2021.

The Company’s expenses recognized from related parties were immaterial during the three months ended March 31, 2022 and 2021.

MGM Resorts International (“MGM”)

MGM is a stockholder and MGM's Chief Commercial Officer also serves on the Company’s Board of Directors. MGM owned approximately 16.6 million and 16.6 million shares of the Company's outstanding Class A common stock as of March 31, 2022 and December 31, 2021, respectively.

Marketing Agreement

In April 2011, the Company entered into a joint marketing agreement with MGM (as amended, the “Marketing Agreement”) in exchange for assistance with marketing campaigns and the exclusive right to utilize MGM’s licensed marks and licensed copyrights for the development of certain of the Company’s social casino games. The initial term was for one year from the go-live date of the first such game in July 2012, with an automatic renewal provision for successive two-year terms based on the games meeting certain performance criteria. If the games do not achieve the specified performance criteria, the term will be automatically renewed for a one-year period and the right to utilize MGM’s licensed marks and copyrights will become non-exclusive. The non-exclusive term will be automatically renewed for successive one-year periods so long as the games meet certain other performance criteria. As consideration for the use of MGM’s intellectual property, the Company issued 19.2 million shares of its common stock representing 10% of its then-outstanding common stock; and in lieu of royalty payments, the Company agreed to pay MGM a profit share of: (i) during the exclusive term, a mid- to high-single digit percentage of cumulative net operating income, as defined in the Marketing Agreement, and (ii) during the non-exclusive term, a low- to mid-single digit percentage of cumulative net operating income. As further described in Note 8—Goodwill and Intangible Assets, the Marketing Agreement was recorded as an indefinite-lived intangible asset.

On October 30, 2020, the Company and MGM agreed to amend the Marketing Agreement (the “MGM Amendment”), under which the Company and MGM agreed to terminate the profit share provision. In exchange, the Company agreed to remit to MGM a one-time payment of $20.0 million, payable on the earliest to occur of (i) the PIPE Investment, (ii) the date that the Company waives MGM’s commitment to participate in the PIPE Investment, or (iii) two years from the date of the MGM Amendment. In addition, MGM agreed to reinvest in the Company at a minimum amount of $20.0 million by participating in the PIPE Investment or a private placement of equity offering to third party investors for minimum gross proceeds to the Company of $50.0 million. As a result of the termination, the Company is no longer obligated to make profit share payments, but the other rights and obligations under the Marketing Agreement continue in full force and effect.

On June 21, 2021, the Company consummated the Business Combination and MGM participated in the PIPE Investment. In connection with the PIPE Investment, the Company recorded an equity contribution from MGM as a settlement of the $20.0 million liability. As of March 31, 2022, the $20.0 million liability was settled in full and no amount remained outstanding.

NOTE 4—RECEIVABLES

Receivables consist of the following:

| | | | | | | | | | | |

| March 31,

2022 | | December 31,

2021 |

| Trade receivables | $ | 20,731 | | | $ | 20,540 | |

| Other receivables | 251 | | | 153 | |

| Total receivables | $ | 20,982 | | | $ | 20,693 | |

Trade receivables generally represent amounts due to the Company from social and mobile platform operators, including Apple, Google, Amazon and Facebook. Trade receivables are recorded when the right to consideration becomes unconditional. No allowance for doubtful accounts was considered necessary as of March 31, 2022 and December 31, 2021.

Concentration of Credit Risk

As of March 31, 2022, Apple, Inc. and Google, Inc. accounted for 41.3% and 33.0% of the Company’s total receivables, respectively, while as of December 31, 2021, Apple, Inc. and Google, Inc. accounted for 43.0% and 34.6% of the Company’s total receivables, respectively. As of March 31, 2022 and December 31, 2021, the Company did not have any additional counterparties that exceeded 10% of the Company’s net accounts receivable.

During the year ended December 31, 2021, the Company entered into agreements pursuant to which the Company acquired the rights to develop and operate Tetris®-branded mobile games. As contemplated in the agreements, the Company agreed to an $8.0 million Advance Payment (as defined in Note 14—Commitments and Contingencies). If the Company and the counterparty fail to perform according to the terms of the agreements, the maximum amount of loss which the Company may incur is approximately $9.3 million, of which $8.0 million related to the Advance Payment is reported within the Other long-term assets line item on the Consolidated Balance Sheets.

NOTE 5—FAIR VALUE MEASUREMENT

The carrying values of the Company’s cash and cash equivalents, trade receivables and accounts payable approximate fair value due to their short maturities.

The following tables present the financial assets not measured at fair value on a recurring basis as of March 31, 2022 and December 31, 2021:

| | | | | | | | | | | | | | | | | | | | |

| March 31, 2022 | |

| Carrying Value | | Estimated Fair Value | | Fair Value Hierarchy | Financial Statement Line Item |

| Financial assets: | | | | | | |

| Notes receivable - current | $ | 72 | | | $ | 72 | | | Level 3 | Receivables |

| Notes receivable - non-current | 1,250 | | | 1,250 | | | Level 3 | Other long-term assets |

| Prepaid expenses - non-current | 8,000 | | | 8,000 | | | Level 3 | Other long-term assets |

| Total financial assets | $ | 9,322 | | | $ | 9,322 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2021 | | |

| Carrying Value | | Estimated Fair Value | | Fair Value Hierarchy | | Financial Statement Line Item |

| Financial assets: | | | | | | | |

| Notes receivable - current | $ | 8 | | | $ | 8 | | | Level 3 | | Receivables |

| Notes receivable - non-current | $ | 3,391 | | | $ | 3,391 | | | Level 3 | | Other long-term assets |

| Prepaid expenses - non-current | $ | 8,000 | | | $ | 8,000 | | | Level 3 | | Other long-term assets |

| Total financial assets | $ | 11,399 | | | $ | 11,399 | | | | | |

The notes receivable are fixed-rate investments, are not traded and do not have observable market inputs, therefore, the fair value is estimated to be equal to the carrying value. The advance payment is not a traded asset and does not have observable market inputs, therefore, the fair value is estimated to be equal to the carrying value.

The following tables present the liabilities measured at fair value on a recurring basis, by input level, in the Consolidated Balance Sheets at March 31, 2022 and December 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2022 |

| Level 1 | | Level 2 | | Level 3 | | Total |

| Financial liabilities: | | | | | | | |

| Public Warrants | $ | 6,027 | | | — | | | — | | | 6,027 | |

| Private Warrants | — | | | 3,210 | | | — | | | 3,210 | |

| Total financial liabilities | $ | 6,027 | | | $ | 3,210 | | | $ | — | | | $ | 9,237 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2021 |

| Level 1 | | Level 2 | | Level 3 | | Total |

| Financial liabilities: | | | | | | | |

| Public Warrants | $ | 4,255 | | | — | | | — | | | 4,255 | |

| Private Warrants | — | | | 2,266 | | | — | | | 2,266 | |

| Total financial liabilities | $ | 4,255 | | | $ | 2,266 | | | $ | — | | | $ | 6,521 | |

NOTE 6—PROPERTY AND EQUIPMENT, NET

Property and equipment, net consists of the following:

| | | | | | | | | | | |

| March 31,

2022 | | December 31,

2021 |

| Computer equipment | $ | 8,943 | | | 8,819 | |

| Leasehold improvements | 6,496 | | | 6,310 | |

| Purchased software | 2,352 | | | 542 | |

| Furniture and fixtures | $ | 2,300 | | | $ | 2,125 | |

| Construction in progress | 911 | | | 721 | |

| Total property and equipment | 21,002 | | | 18,517 | |

| Less: accumulated depreciation | (13,887) | | | (13,228) | |

| Total property and equipment, net | $ | 7,115 | | | $ | 5,289 | |

The aggregate depreciation expense for property and equipment, net is reflected in “Depreciation and amortization” in the Consolidated Statements of Operations. During the three months ended March 31, 2022 and 2021, depreciation expense was $0.8 million and $0.7 million, respectively. No impairment charges or material write-offs were recorded for the three months ended March 31, 2022 and 2021.

Property and equipment, net by region consists of the following:

| | | | | | | | | | | |

| March 31,

2022 | | December 31,

2021 |

| United States | $ | 3,281 | | | $ | 1,672 | |

EMEA(1) | 2,916 | | | 2,813 | |

| All other countries | 918 | | | 804 | |

| Total property and equipment, net | $ | 7,115 | | | $ | 5,289 | |

(1)Europe, Middle East, and Africa (“EMEA”). Amounts primarily represent leasehold improvements of local office space and computer equipment.

NOTE 7—INTERNAL-USE SOFTWARE, NET

Internal-use software, net consists of the following:

| | | | | | | | | | | |

| March 31,

2022 | | December 31,

2021 |

| Internal-use software | $ | 128,487 | | | $ | 130,942 | |

| Less: accumulated amortization | (92,865) | | | (87,675) | |

| Total internal-use software, net | $ | 35,622 | | | $ | 43,267 | |

The aggregate amortization expense for internal-use software, net is reflected in "Depreciation and amortization" in the Consolidated Statements of Operations. During the three months ended March 31, 2022 and 2021, the Company capitalized internal-use software development costs of $6.6 million and $6.9 million. Total amortization expense associated with its capitalized internal-use software development costs for the three months ended March 31, 2022 and 2021 was $5.9 million and $5.2 million.

During the three months ended March 31, 2022, the Company adopted a plan to suspend the further development of Kingdom Boss, resulting in a change in the useful life of the assets associated with Kingdom Boss. The Company recorded a $8.4 million non-cash impairment charge during the first quarter of 2022 within "Restructuring and related" in the Consolidated Statement of Operations. There were no write-offs or impairment charges recorded for the three months ended March 31, 2021.

NOTE 8—GOODWILL AND INTANGIBLE ASSETS

Goodwill

The Company had $5.1 million in goodwill as of March 31, 2022 and December 31, 2021. There were no business combinations during the three months ended March 31, 2022 and 2021. There were no indicators of impairment as of March 31, 2022 and December 31, 2021.

Intangible Assets

The following table provides the gross carrying value and accumulated amortization for each major class of intangible asset other than goodwill:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2022 | | December 31, 2021 |

| Gross

Carrying

Amount | | Accumulated

Amortization | | Net

Carrying

Amount | | Gross

Carrying

Amount | | Accumulated

Amortization | | Net

Carrying

Amount |

| Amortizable intangible assets: | | | | | | | | | | | |

| Licenses | $ | 19,000 | | | $ | (2,932) | | | $ | 16,068 | | | $ | 19,000 | | | $ | (1,245) | | | $ | 17,755 | |

| Trade names | 1,240 | | | (1,240) | | | — | | | 1,240 | | | (1,240) | | | — | |

| 20,240 | | | (4,172) | | | 16,068 | | | 20,240 | | | (2,485) | | | 17,755 | |

| Nonamortizable intangible assets: | | | | | | | | | | | |

| Marketing Agreement with a related party | 1,000 | | | — | | | 1,000 | | | 1,000 | | | — | | | 1,000 | |

| Total intangible assets | $ | 21,240 | | | $ | (4,172) | | | $ | 17,068 | | | $ | 21,240 | | | $ | (2,485) | | | $ | 18,755 | |

Intangible assets consist of trade names and long-term license agreements with various third parties. In 2021, the Company entered into agreements with N3TWORK Inc. and The Tetris Company, LLC pursuant to which the Company acquired the rights to develop and operate Tetris®-branded mobile games for an initial term through August 2024. The Company paid N3TWORK Inc. $13.0 million at closing and agreed to pay up to an additional $34.0 million subject to satisfaction of certain conditions, of which $8.0 million was an Advance Payment (as defined in Note 14—Commitments and Contingencies). In addition, the Company will pay royalties to The Tetris Company, LLC, the licensor of the rights.

The aggregate amortization expense for amortizable intangible assets is reflected in “Depreciation and amortization” in the Consolidated Statements of Operations. During the three months ended March 31, 2022 and 2021, amortization was $1.7 million and $0.1 million, respectively. There were no impairment charges for intangible assets for the three months ended March 31, 2022 and 2021.

As of March 31, 2022, the estimated annual amortization expense for the years ending December 31, 2022 through 2026 is as follows:

| | | | | | | | |

| Year Ending December 31, | | Projected Amortization

Expense |

Remaining 2022 | | $ | 5,059 | |

| 2023 | | 6,645 | |

| 2024 | | 4,364 | |

| 2025 | | — | |

| 2026 | | — | |

| Total | | $ | 16,068 | |

NOTE 9—WARRANT LIABILITIES

Public Warrants and Private Warrants

Upon the closing of the Business Combination, there were approximately 7.2 million publicly-traded redeemable warrants to purchase shares of Class A common stock (the "Public Warrants") and 3.8 million redeemable warrants to purchase shares of Class A common stock initially issued to the Sponsor in a private placement (the "Private Warrants") were issued by Acies prior to the Business Combination. Each whole Public Warrant entitles the registered holder to purchase one whole share of the Company’s Class A common stock at a price of $11.50 in cash per share, subject to adjustment as discussed below, as of October 27, 2021. Pursuant to the Warrant Agreement, a holder of Public Warrants may exercise the Public Warrants only for a whole number of shares of Class A common stock. The Public Warrants will expire 5 years after the completion of the Business Combination, or earlier upon redemption or liquidation. The Private Warrants are identical to the Public Warrants, except that the Private Warrants and the shares of Class A common stock issuable upon exercise of the Private Warrants were not transferable until after the completion of the Business Combination, subject to certain limited exceptions. Additionally, the Private Warrants are non-redeemable so long as they are held by the initial holder or any of its permitted transferees. If the Private Warrants are held by someone other than the initial holder or its permitted transferees, the Private Warrants will be redeemable by the Company and exercisable by such holders on the same basis as the Public Warrants. The Private Warrants may be exercised on a cashless basis so long as held by the Sponsor or certain permitted transferees.

The Company may redeem the outstanding Public Warrants in whole, but not in part, at a price of $0.01 per Public Warrant upon a minimum of 30 days’ prior written notice of redemption, if and only if the last sale price of the Company’s common stock equals or exceeds $18.00 per share for any 20-trading days within a 30-trading day period ending three business days before the Company sends the notice of redemption to the Warrant Holders. If the Company calls the Public Warrants for redemption, management will have the option to require all holders that wish to exercise the Public Warrants to do so on a cashless basis. In no event will the Company be required to net cash settle the exercise of Public Warrants.

At March 31, 2022, there were approximately 7.2 million Public Warrants and 3.8 million Private Warrants outstanding. Refer to Note 5—Fair Value Measurements for further information.

On April 1, 2022, the Company commenced (i) an offer to each holder of its outstanding Public Warrants and Private Warrants (collectively, the “Warrants”), each to purchase shares of its Class A common stock, par value $0.0001 per share, the opportunity to receive $1.00 in cash, without interest, for each outstanding Warrant tendered by the holder pursuant to the offer (the “Offer to Purchase”), and (ii) the solicitation of consents (the “Consent Solicitation”) from holders of the outstanding Warrants to amend the Warrant Agreement, dated as of October 22, 2020, by and between the Company (formerly Acies Acquisition Corp.) and Continental Stock Transfer & Trust Company, which governs all of the Warrants (the “Warrant Amendment”) (collectively the "Tender Offer"). If approved, the Warrant Amendment would permit the Company to redeem each outstanding Warrant for $0.90 in cash, without interest, which is 10% less than the purchase price applicable to the Offer to Purchase. The total amount of cash required to complete the Offer to Purchase, including the payment of any fees, expenses and other related amounts incurred in connection with the Offer to Purchase, will be approximately $11.9 million, all of which the Company will fund from its existing and available cash reserve, with no alternative plans to finance the purchase of the tendered Warrants.

NOTE 10—ACCRUED LIABILITIES

Accrued liabilities consist of the following:

| | | | | | | | | | | |

| March 31,

2022 | | December 31,

2021 |

| Accrued payroll and vacation | 5,626 | | | 5,696 | |

| Minimum guarantee liability | 5,200 | | | 5,200 | |

| Other accruals | 5,943 | | | 4,703 | |

| Total accrued liabilities | $ | 16,769 | | | $ | 15,599 | |

NOTE 11—REVENUE FROM CONTRACTS WITH CUSTOMERS

Disaggregation of Revenue

The following table summarizes the Company’s revenue disaggregated by type, and by over time or point in time recognition:

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | |

| 2022 | | 2021 | | | | |

Virtual currency (over time)(1) | $ | 65,935 | | | $ | 73,226 | | | | | |

| Advertising (point in time) | 4,075 | | | 871 | | | | | |

| Other revenue (point in time) | 441 | | | — | | | | | |

| Total net revenue | $ | 70,451 | | | $ | 74,097 | | | | | |

(1)Virtual currency is recognized over the estimated consumption period.

The following table summarizes the Company’s revenue disaggregated by geography:

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | |

| 2022 | | 2021 | | | | |

| United States | $ | 62,103 | | | $ | 64,074 | | | | | |

| All other countries | 8,348 | | | 10,023 | | | | | |

| Total net revenue | $ | 70,451 | | | $ | 74,097 | | | | | |

Contract Balances

Contract assets represent the Company’s ability to bill customers for performance obligations completed under a contract. As of March 31, 2022 and December 31, 2021, there were no contract assets recorded in the Company’s consolidated balance sheet. The deferred revenue balance related to the purchase of virtual currency was immaterial as of March 31, 2022 and December 31, 2021. The opening and closing balance of trade receivables is further described in Note 4—Receivables.

NOTE 12—LONG-TERM DEBT

Credit Agreement

On June 24, 2021, in connection with the Closing, the Company terminated and replaced the Revolver (as defined below). The Company, a subsidiary of the Company, JPMorgan Chase Bank, N.A., as administrative agent and JPMorgan Chase Bank, N.A., Silicon Valley Bank and Wells Fargo Securities, LLC, as joint bookrunners and joint lead arrangers entered into a credit agreement (the “Credit Agreement”) which provides for a five-year revolving credit facility in an aggregate principal amount of $75.0 million. Borrowings under the Credit Agreement may be borrowed, repaid and re-borrowed by the Company, and are available for working capital, general corporate purposes and permitted acquisitions.

Commitment fees and interest rates are determined on the basis of either a Eurodollar rate or an Alternate Base Rate plus an applicable margin. The applicable margins are initially 2.50%, in the case of Eurodollar loans, and 1.50%, in the case of Alternate Base Rate loans. The applicable margin is subject to adjustment based upon the Company's Total Net Leverage Ratio (as defined in the Credit Agreement). Eurodollar rates and the Alternate Base Rate are subject to floors of 0.00% and 1.00%, respectively. The Credit Agreement contains various affirmative and negative financial and operational covenants applicable to the Company and its subsidiaries.

The Credit Agreement includes customary reporting requirements, conditions precedent to borrowing and affirmative, negative and financial covenants. Specific financial covenants include the following, commencing with the quarter ended September 30, 2021:

•Maximum Net Leverage Ratio of 3.50:1.00 (subject to increase to 4.00:1.00 following consummation of certain material acquisitions)

•Minimum Fixed Charge Coverage Ratio of 1.25:1.00.

At issuance, the Company capitalized $0.7 million in debt issuance costs. As of March 31, 2022, the Company has not made any drawdowns on the Credit Agreement.

Private Venture Growth Capital Loans

On March 27, 2020, the Company entered into an agreement for a revolving credit facility (the “Revolver”) with Silicon Valley Bank. The Revolver was secured by the assets including intellectual property of the Company and matures on September 27, 2022. Borrowings under the Revolver may be borrowed, repaid and re-borrowed by the Company, and are available for working capital, general corporate purposes and permitted acquisitions. Up to $3.0 million of the Revolver may be used for letters of credit. On June 24, 2021, in connection with the Closing, the Company terminated and replaced the Revolver as described above.

NOTE 13—INCOME TAXES

The Company recorded an income tax expense of $7.8 million and $1.3 million for the three months ended March 31, 2022 and 2021, respectively. Our effective tax rate was (45.1)% for the three months ended March 31, 2022 compared to 18.5% for the three months ended March 31, 2021. The effective rate of (45.1)% differs from the federal statutory rate of 21% primarily due to the jurisdictional mix of earnings at differing tax rates, research and development tax credits, non-deductible stock compensation, and the effect of a valuation allowance on certain federal deferred tax assets.

NOTE 14—COMMITMENTS AND CONTINGENCIES

Minimum Guarantee Liability

The following are the Company’s total minimum guaranteed obligations as of:

| | | | | | | | | | | |

| March 31,

2022 | | December 31,

2021 |

| | | |

| Minimum guarantee liability - current | 5,200 | | | 5,200 | |

| Total minimum guarantee obligations | $ | 5,200 | | | $ | 5,200 | |

| Weighted-average remaining contractual term (in years) | 2.4 | | 2.6 |

The following are the Company’s remaining expected future payments of minimum guarantee obligations as of March 31, 2022:

| | | | | | | | |

| Year Ending December 31, | | Minimum Guarantee

Obligations |

Remainder of 2022 | | $ | 5,200 | |

| 2023 | | — | |

| 2024 | | — | |

| 2025 | | — | |

| 2026 | | — | |

| Total | | $ | 5,200 | |

Leases

The Company leases both office space and office equipment and classifies these leases as either operating or capital leases for accounting purposes based upon the terms and conditions of the individual lease agreements. As of March 31, 2022, all leases were classified as operating leases and expire at various dates through 2027, with certain leases containing renewal option periods of two to five years at the end of the current lease terms.

The Company’s future minimum rental commitments as of March 31, 2022, are as follows:

| | | | | | | | |

| Year Ending December 31, | | Minimum Rental

Commitments |

Remaining 2022 | | $ | 3,042 | |

| 2023 | | 4,415 | |

| 2024 | | 4,349 | |

| 2025 | | 2,598 | |

| 2026 and thereafter | | 3,485 | |

| Total | | $ | 17,889 | |

Certain lease agreements have rent escalation provisions over the lives of the leases. The Company recognizes rental expense based on a straight-line basis over the term of the leases. Rental expense was $1.1 million and $1.2 million for the three months ended March 31, 2022 and 2021, respectively, which is included within “General and administrative” expenses in the Consolidated Statements of Operations.

N3TWORK, Inc.

On November 22, 2021, the Company entered into agreements with N3TWORK Inc. and The Tetris Company, LLC pursuant to which the Company acquired the rights to develop and operate Tetris®-branded mobile games for an initial term through August 2024. The Company paid N3TWORK Inc. $13.0 million at closing and agreed to pay up to an additional $34.0 million subject to satisfaction of certain conditions (the "Contingent Payments"). As of March 31, 2022, the Company advanced $8.0 million of the Contingent Payments (the "Advance Payment"). None of the Advance Payment was considered earned as of March 31, 2022, which is included within "Other long-term assets" within the Consolidated Balance Sheets.

Other

The Company is party to ordinary and routine litigation incidental to its business. On a case-by-case basis, the Company engages inside and outside counsel to assess the probability of potential liability resulting from such litigation. After making such assessments, the Company makes an accrual for the estimated loss only when the loss is reasonably probable and an amount can be reasonably estimated. The Company does not expect the outcome of any pending litigation to have a material effect on the Company’s Consolidated Balance Sheets, Consolidated Statements of Operations, or Consolidated Statements of Cash Flows.

In May 2021, the Company became party to a litigation matter brought by TeamSava d.o.o. Beograd (“TeamSava”) and other related parties. The plaintiffs filed a Statement of Claim in May 2021 in Tel Aviv District Court in Israel, alleging claims, among other things, that the Company breached the terms of a commercial contract relating to services provided by TeamSava and related parties in connection with the sourcing and administrative management of personnel in Serbia who provided game development services exclusively for the Company. The pending litigation seeks damages of 27.3 million New Israeli Shekels ("NIS"). The Company believes that the claims are without merit and the Company intends to vigorously defend against them; however, there can be no assurance that the Company will be successful in the defense of this litigation. The Company’s range of possible loss could be up to 27.3 million NIS based on the claim amount of the litigation, but the Company is not able to reasonably estimate the probability or amount of loss and therefore has not made any accruals.

On April 6, 2022, a class action lawsuit was filed in the United Stated District Court, Northern District of California, by a purported Company shareholder in connection with alleged federal securities violations: Christian A. Felipe et. al. v. PLAYSTUDIOS, Inc. (the “Felipe Complaint”). The Felipe Complaint names the Company and Andrew Pascal, the Company’s Chairman and CEO as defendants. The Felipe Complaint alleges misrepresentations and omissions regarding the state of the Company’s development of the Kingdom Boss game and its financial projections and future prospects in the S-4 Registration Statement filed by Acies that was declared effective on May 25, 2021, the Proxy Statement filed by Acies on May 25, 2021, and other public statements that touted Old PLAYSTUDIOS’ and the Company’s financial performance and operations, including statements made on earnings calls and the Amended S-1 Registration Statement filed by the Company that was declared effective on July 30, 2021. The Felipe Complaint alleges that the misrepresentations and omissions resulted in stock price drops of 13% on August 12, 2021, and 5% on February 25, 2022, following (i) the Company’s release of financial results for the second quarter of 2021, ended on June 30, 2021, and (ii) the filing of the Company’s annual report for 2021 and issuance of a press release summarizing financial results for the fourth quarter and year ended December 31, 2021, respectively. The Felipe Complaint seeks an award of damages for an unspecified amount. The Company believes that the claims are without merit and the Company intends to vigorously defend against them; however, there can be no assurance

that the Company will be successful in the defense of this litigation. The Company is not able to reasonably estimate the probability or amount of loss and therefore has not made any accruals.

NOTE 15—STOCKHOLDERS’ EQUITY

The condensed consolidated statements of stockholders’ equity reflect the reverse recapitalization as discussed in Note 1—Background and Basis of Presentation as of June 21, 2021. As Old PLAYSTUDIOS was deemed the accounting acquirer in the reverse recapitalization with Acies, all periods prior to the consummation date reflect the balances and activity of Old PLAYSTUDIOS. The consolidated balances and the audited consolidated financial statements of Old PLAYSTUDIOS, as of December 31, 2020, and the share activity and per share amounts in these condensed consolidated statements of equity were retroactively adjusted, where applicable, using the recapitalization exchange ratio of approximately 0.233 for Old PLAYSTUDIOS common stock. Old PLAYSTUDIOS Series A Preferred Stock, Old PLAYSTUDIOS Series B Preferred Stock, Old PLAYSTUDIOS Series C-1 Preferred Stock, and Old PLAYSTUDIOS Series C Preferred Stock were deemed converted into shares of Old PLAYSTUDIOS common stock at a share conversion factor of 1.0 as a result of the reverse recapitalization. Old PLAYSTUDIOS warrants to purchase preferred stock were deemed exercised and the underlying shares converted based on the respective preferred stock conversion ratio.

Common Stock

As of March 31, 2022, the Company was authorized to issue 2.0 billion and 25.0 million shares of Class A and Class B common stock, respectively. The Company had 110.3 million and 110.1 million shares of Class A common stock and 16.1 million and 16.1 million shares of Class B common stock issued and outstanding as of March 31, 2022 and December 31, 2021, respectively.

Subject to the prior rights of the holders of any preferred stock, the holders of common stock are entitled to receive dividends out of the funds legally available at the times and in the amounts determined by the Company's Board of Directors. Each holder of Class A common stock is entitled to one vote for each share of Class A common stock held and each holder of Class B common stock is entitled to twenty votes for each share of Class B common stock held. After the full preferential amounts due to preferred stockholders have been paid or set aside, the remaining assets of the Company available for distribution to its stockholders, if any, are distributed to the holders of common stock ratably in proportion to the number of shares of common stock then held by each such holder. None of the Company’s common stock is entitled to preemptive rights and neither is subject to redemption. The Company’s common stock is not convertible into any other shares of the Company’s capital stock.

The shares of Class B common stock are subject to a “sunset” provision if any member of the Founder Group transfers shares of Class B common stock outside the Founder Group (except for certain permitted transfers). In the event of such non-permitted transfers, any share transferred will automatically convert into shares of Class A common stock. In addition, the outstanding shares of Class B common stock will be subject to a “sunset” provision by which all outstanding shares of Class B common stock will automatically convert into shares of Class A common stock (i) if holders representing a majority of the Class B common stock vote to convert the Class B common stock into Class A common stock, (ii) if the Founder Group and its permitted transferees collectively no longer beneficially own at least 20% of the number of shares of Class B common stock collectively held by the Founder Group as of the Effective Time, or (iii) on the nine-month anniversary of the Founder’s death or disability, unless such date is extended by a majority of independent directors.

Accumulated Other Comprehensive Income

The following tables shows a summary of changes in accumulated other comprehensive income:

| | | | | | | | | | | |

| Currency

Translation

Adjustment | | Total Accumulated

Other Comprehensive

Income |

| Balance as of December 31, 2021 | $ | 393 | | | $ | 393 | |

| Foreign currency translation | (6) | | | (6) | |

| Balance as of March 31, 2022 | $ | 387 | | | $ | 387 | |

| | | | | | | | | | | |

| Currency

Translation

Adjustment | | Total Accumulated

Other Comprehensive

Income |

| Balance as of December 31, 2020 | $ | 481 | | | $ | 481 | |

| Foreign currency translation | (296) | | | (296) | |

| Balance as of March 31, 2021 | $ | 185 | | | $ | 185 | |

Stock Repurchase Program

On November 10, 2021, the Company’s Board of Directors approved a stock repurchase program authorizing the Company to purchase up to $50.0 million of the Company’s Class A common stock over a period of 12 months. Subject to applicable rules and regulations, the shares may be purchased from time to time in the open market or in privately negotiated transactions. Such purchases will be at times and in amounts as the Company deems appropriate, based on factors such as market conditions, legal requirements and other business considerations. As of March 31, 2022, the Company has not repurchased any Class A common stock under the stock repurchase program.

NOTE 16—STOCK-BASED COMPENSATION

2011 and 2021 Equity Incentive Plans

The Company has two equity incentive plans: Old PLAYSTUDIOS' 2011 Omnibus Stock and Incentive Plan (the “2011 Plan”) and the 2021 Equity Incentive Plan (the “2021 Plan”). The 2021 Plan provides for the grant of non-qualified stock options, incentive stock options, stock appreciation rights, restricted stock, restricted stock units and other stock awards, and performance awards to employees, officers, non-employee directors and independent service providers of the Company. The 2021 Plan became effective immediately upon the closing of the Business Combination and replaces the 2011 Plan and no additional awards will be available under the 2011 Plan.

Each Old PLAYSTUDIOS stock option from the 2011 Plan that was outstanding immediately prior to the Business Combination and held by current employees or service providers, whether vested or unvested, was converted into an option to purchase approximately 0.233 shares of common stock (each such option, an “Exchanged Option”). Except as specifically provided in the Merger Agreement, following the Business Combination, each Exchanged Option continues to be governed by the same terms and conditions (including vesting and exercisability terms) as were applicable to the corresponding former Old PLAYSTUDIOS option immediately prior to the consummation of the Business Combination. All equity awards activity was retroactively restated to reflect the Exchanged Options.

The number of shares of common stock available under the 2021 Plan will increase annually on the first day of each calendar year, beginning with the calendar year ending December 31, 2022, with such annual increase equal to the lesser of (i) 5% of the number of shares of common stock issued and outstanding on the last business day of the immediately preceding fiscal year and (ii) an amount determined by the Company's Board of Directors. If any award (or any award under the 2011 Plan) is forfeited, cancelled, expires, terminates or otherwise lapses or is settled in cash, in whole or in part, without the delivery of Class A common stock or Class B common stock, then the shares (including both the Class A common stock and Class B common stock) covered by such forfeited, expired, terminated or lapsed award shall again be available as shares for grant under the 2021 Plan.

As of March 31, 2022, the Company has 15.7 million shares of Class A common stock reserved for issuance under the 2021 Plan.

Stock-Based Compensation

The following table summarizes stock-based compensation expense that the Company recorded in income (loss) from operations for the periods shown:

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2022 | | 2021 | | | | |

| Selling and marketing | $ | 319 | | | $ | 21 | | | | | |

| General and administrative | 3,149 | | | 383 | | | | | |

| Research and development | 3,400 | | | 496 | | | | | |

| Stock-based compensation expense | $ | 6,868 | | | $ | 900 | | | | | |

| Capitalized stock-based compensation | $ | 1,101 | | | $ | 209 | | | | | |

Stock Options