Amended Tender Offer Statement by Issuer (sc To-i/a)

18 May 2022 - 8:08PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on May 17, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 3)

PLAYSTUDIOS, INC.

(Name of Subject Company (Issuer))

PLAYSTUDIOS, INC. (Offeror)

(Names of Filing Persons (Identifying Status as Offeror, Issuer or Other Person))

Warrants exercisable for Class A Common Stock at an exercise price of $11.50 per share

(Title of Class of Securities)

72815G116

(CUSIP Number of Class of Securities)

Andrew Pascal

Chief Executive Officer

PLAYSTUDIOS, Inc.

10150 Covington Cross Drive

Las Vegas, NV 89144

(725) 877-7000

(Name, Address, and Telephone Numbers of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With copies to:

| | | | | | | | |

Joel Agena

General Counsel

PLAYSTUDIOS, Inc.

10150 Covington Cross Drive

Las Vegas, NV 89144

(725) 877-7000 | | Rachel Paris, Esq.

DLA Piper LLP (US)

2000 University Avenue

East Palo Alto, CA 94303

(650) 833-2234 |

☐ Check the box if the filing relates solely to preliminary communications before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

| | | | | |

| ☐ | third-party tender offer subject to Rule 14d-1. |

| ☒ | issuer tender offer subject to Rule 13e-4. |

| ☐ | going-private transaction subject to Rule 13e-3. |

| ☐ | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☒

If applicable, check the appropriate box(es) below to designate the appropriate rule provision relied upon:

| | | | | |

| ☐ | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ☐ | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

EXPLANATORY NOTE

This Amendment No. 3 (“Amendment No. 3”) further amends the Tender Offer Statement on Schedule TO filed by PLAYSTUDIOS, Inc., a Delaware corporation (the “Company”), on April 1, 2022, as amended by the Amendment No. 1 to the Tender Offer Statement on Schedule TO filed by the Company on April 14, 2022, as further amended by Amendment No. 2 to the Tender Offer Statement on Schedule TO filed by the Company on April 28, 2022 (together with any additional amendments and supplements, the “Schedule TO”), relating to the tender offer by the Company to purchase for cash up to 10,996,361 of its outstanding warrants to purchase Class A common stock, par value $0.0001, at a price of $1.00 per warrant, without interest (the “Offer Purchase Price”), on the terms and conditions set forth in the Amended and Restated Offer to Purchase and Consent Solicitation and the Amended and Restated Letter of Transmittal and Consent filed by the Company as exhibits to the Schedule TO. The Amended and Restated Offer to Purchase and Consent Solicitation and the Amended and Restated Letter of Transmittal and Consent, together with any amendments or supplements thereto, collectively constitute the “Offer”.

Concurrently with the Offer, the Company also solicited consents from holders of its outstanding warrants to amend (the “Warrant Amendment”) the Warrant Agreement, dated as of October 22, 2020, by and between the Company and Continental Stock Transfer & Trust Company (the “Warrant Agreement”), which governs all of the warrants, to permit the Company to redeem each outstanding warrant for $0.90 in cash, without interest (the “Redemption Price”), which Redemption Price is 10% less than the Offer Purchase Price.

This Amendment No. 3 is being filed to report the results of the Offer.

Item 11. Additional Information.

Item 11 of the Schedule TO is hereby amended and supplemented by adding the following paragraph:

“The Offer expired midnight, Eastern Time, at the end of the day on May 13, 2022 (the “Expiration Date”), in accordance with its terms. Broadridge Corporate Issuer Solutions, Inc., the depositary for the Offer, has indicated that as of the Expiration Date, (i) 1,792,463 outstanding Public Warrants, or approximately 25% of the outstanding Public Warrants were validly tendered and not withdrawn in the Offer, and (ii) none of the outstanding Private Placement Warrants had been validly tendered and not validly withdrawn from the Offer. Pursuant to the terms of the Offer, the Company expects to pay an aggregate of $1,792,463 in cash in exchange for such Public Warrants. The Company received the approval of approximately 25% of the outstanding Public Warrants to the Warrant Amendment, which is less than the 65% of the outstanding Public Warrants required to effect the Warrant Amendment as it relates to the Public Warrants.

On May 17, 2022, the Company issued a press release announcing the results of the Offer as set forth above. A copy of the press release is filed as Exhibit (a)(5)(iv) to the Schedule TO and is incorporated herein by reference.”

Only those items amended are reported in this Amendment No. 3. Except as amended hereby to the extent specifically provided herein, the information contained in the Schedule TO, the Amended and Restated Offer to Purchase and Consent Solicitation, the Amended and Restated Letter of Transmittal and Consent and the other exhibits to the Schedule TO remains unchanged and are hereby expressly incorporated into this Amendment No. 3 by reference. This Amendment No. 3 should be read with the Schedule TO.

Item 12. Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| (a)(1)(A)* | | |

| (a)(1)(B)* | | |

| (a)(1)(C)* | | |

| (a)(1)(D)* | | |

| (a)(1)(E)* | | |

| (a)(2)-(4) | | Not Applicable |

| (a)(5)(i)* | | |

| (a)(5)(ii)* | | |

| (a)(5)(iii)* | | |

| (a)(5)(iv) | | |

| (b) | | Not Applicable |

| (d)(1) | | |

| (d)(2) | | |

| (g) | | Not Applicable |

| (h) | | Not Applicable |

| 107 | | |

*Previously filed.

Item 12(b). Exhibits.

Filing Fee Exhibit

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Schedule TO is true, complete and correct.

Dated: May 17, 2022

| | | | | | | | | | | |

| PLAYSTUDIOS, Inc. |

| | | |

| By: | /s/ Andrew Pascal |

| | Name: | Andrew Pascal |

| | Title: | Chief Executive Officer |

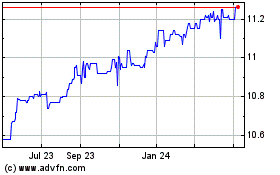

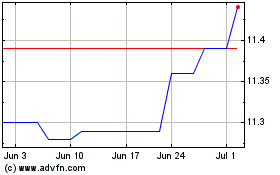

Acri Capital (NASDAQ:ACAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acri Capital (NASDAQ:ACAC)

Historical Stock Chart

From Apr 2023 to Apr 2024