Filed Pursuant to Rule 424(b)(3)

Registration No. 333-258018

PROSPECTUS SUPPLEMENT NO. 5

To Prospectus dated March 23, 2022

PLAYSTUDIOS, Inc.

Up to 97,184,288 Shares of Class A Common Stock

Up to 9,204,168 Shares of Class A Common Stock Issuable Upon Exercise of Warrants

Up to 3,821,667 Warrants

This prospectus supplement no. 5 is being filed to update and supplement the information contained in the prospectus dated March 23, 2022 (as may be supplemented or amended from time to time, the “Prospectus”), which forms part of our registration statement on Form S-1 (No. 333-258018) with the information contained in our Current Report on Form 8-K which was filed with the Securities and Exchange Commission on June 10, 2022 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of up to an aggregate of 9,204,168 shares of our Class A common stock, $0.0001 par value per share (the “Class A common stock”), which consists of (i) up to 5,382,501 shares of our Class A common stock that are issuable upon the exercise of 5,382,501 warrants (the “Public Warrants”) by the holders thereof and (ii) up to 3,821,667 shares of Class A common stock that are issuable upon the exercise of 3,821,667 warrants (the “Private Placement Warrants,” and together with the Public Warrants, the “Warrants”).

The Prospectus and this prospectus supplement also relate to the resale from time to time by the selling securityholders named in the Prospectus (the “Selling Securityholders”) of (i) up to 97,184,288 shares of Class A common stock, including up to 10,693,624 shares of Class A common stock issuable as Earnout Shares (as defined in the Prospectus) and 1,444,962 shares of Class A common stock issuable upon the exercise of 1,444,962 options to purchase shares of Class A common stock (the “Class A Option Shares”) and (ii) 3,821,667 Private Placement Warrants. The shares of Class A common stock registered include 21,348,205 shares issuable upon conversion of: (i) 16,130,300 shares of our Class B common stock, par value $0.0001 per share (the “Class B common stock” and, together with the Class A common stock, our “common stock”), issued to Andrew S. Pascal, our Chairman of the Board and Chief Executive Officer, (ii) 3,026,112 shares of Class B common stock issuable as Earnout Shares and (iii) 2,191,793 shares of Class B common stock issuable upon the exercise of 2,191,793 options to purchase shares of Class B common stock (the “Class B Option Shares”, and together with the Class A Option Shares, the “Option Shares”). We will not receive any proceeds from the sale of shares of common stock or Private Placement Warrants by the Selling Securityholders pursuant to the Prospectus, except with respect to amounts received by us upon exercise of the Options Shares or Warrants.

The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to twenty votes per share and is convertible into one share of Class A common stock. Outstanding shares of Class B common stock, all of which are held by Mr. Pascal and certain of his affiliates, together with the shares of Class A common stock held by Mr. Pascal and certain of his affiliates, represent approximately 74.7% of the voting power of our outstanding capital stock as of June 10, 2022.

We registered the securities for resale pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling Securityholders. Our registration of the securities covered by the Prospectus does not mean that the Selling Securityholders will offer or sell any of the shares of Class A common stock or Private Placement Warrants. The Selling Securityholders may offer, sell or distribute all or a portion of their shares of Class A common stock or Private Placement Warrants publicly or through private transactions at prevailing market prices or at negotiated prices. We provide more information about how the Selling Securityholders may sell the shares of Class A common stock or Private Placement Warrants in the section titled “Plan of Distribution” in the Prospectus.

This prospectus supplement incorporates into the Prospectus the information contained in our attached Current Report on Form 8-K, which was filed with the Securities and Exchange Commission on June 10, 2022.

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and are subject to reduced public company reporting requirements. This prospectus supplement complies with the requirements that apply to an issuer that is an emerging growth company.

You should read this prospectus supplement in conjunction with the Prospectus. This prospectus supplement is qualified by reference to the Prospectus except to the extent that the information in this prospectus supplement supersedes the information contained in the Prospectus. This prospectus supplement is not complete without, and may not be delivered or utilized except in connection with, the Prospectus. If there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement. Terms used in this prospectus supplement but not defined herein shall have the meanings given to such terms in the Prospectus.

Our Class A common stock is currently listed on The Nasdaq Global Market (“Nasdaq”) under the symbol “MYPS”, and our Public Warrants are currently listed on The Nasdaq Global Market under the symbol “MYPSW”. On June 10, 2022, the closing price of our Class A common stock was $5.71 and the closing price for our Public Warrants was $1.00.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of the Prospectus and in the other documents that are incorporated by reference in the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is June 10, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

June 7, 2022

Date of Report (date of earliest event reported)

PLAYSTUDIOS, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

Delaware | | 001-39652 | | 88-1802794 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | |

10150 Covington Cross Drive, Las Vegas, Nevada | | 89144 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant's telephone number, including area code: (725) 877-7000

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock | | MYPS | | The Nasdaq Stock Market LLC |

| Redeemable warrants, each whole warrant exercisable for one Class A common stock at an exercise price of $11.50 | | MYPSW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

On June 7, 2022, PLAYSTUDIOS, Inc. (the "Company") held its 2022 Annual Meeting of Stockholders (the "Annual Meeting"). The proposals voted upon at the Annual Meeting and the final results of the stockholder vote on each proposal, as certified by The Carideo Group, the independent inspector of elections for the Annual Meeting, are described below.

Proposal 1: Election of Directors

All of the nominees for director listed in Proposal 1 in the Company’s Definitive Proxy Statement on Schedule 14A, as filed with the Securities and Exchange Commission on April 26, 2022, were elected by the Company’s stockholders to serve on the Company’s board of directors until the 2023 Annual Meeting of Stockholders or until his or her successor is elected and qualified, by the following vote:

| | | | | | | | | | | | | | | | | | | | |

| Nominee | | Votes For | | Votes Withheld | | Broker Non-Votes |

| Andrew Pascal | | 342,050,417 | | 1,319,473 | | 7,678,479 |

| James Murren | | 339,761,236 | | 3,608,654 | | 7,678,479 |

| Jason Krikorian | | 338,516,334 | | 4,853,556 | | 7,678,479 |

| Joe Horowitz | | 340,630,553 | | 2,739,337 | | 7,678,479 |

| Judy K. Mencher | | 339,767,943 | | 3,601,947 | | 7,678,479 |

| Steven J. Zanella | | 341,949,619 | | 1,420,271 | | 7,678,479 |

Proposal 2: Ratification of Appointment of Independent Auditors

The proposal to ratify the Audit Committee’s appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 was approved by the Company’s stockholders by the following vote:

| | | | | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstentions | | Broker Non-Votes |

| 346,226,402 | | 4,670,386 | | 151,581 | | — |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: June 10, 2022

| | | | | | | | | | | |

| PLAYSTUDIOS, Inc. |

| | | |

| By: | /s/ Scott Peterson |

| | Name: | Scott Peterson |

| | Title: | Chief Financial Officer |

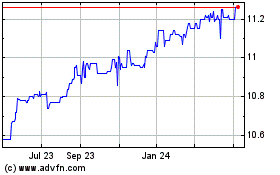

Acri Capital (NASDAQ:ACAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

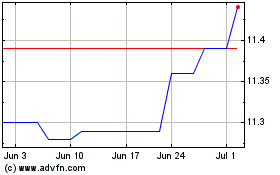

Acri Capital (NASDAQ:ACAC)

Historical Stock Chart

From Apr 2023 to Apr 2024