UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Schedule

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment

No. )

Filed by

the Registrant ☒

Filed by

a party other than the Registrant ☐

Check

the appropriate box:

| ☒ | Preliminary

Proxy Statement |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive

Proxy Statement |

| ☐ | Definitive

Additional Materials |

| ☐ | Soliciting

Material under § 240.14a-12 |

Acri

Capital Acquisition Corporation

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☐ | Fee

paid previously with preliminary materials. |

| ☐ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and

0-11 |

Acri Capital Acquisition Corporation

13284 Pond Springs Rd, Ste 405

Austin, Texas

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO BE

HELD January 24, 2023

To the Stockholders of Acri Capital Acquisition

Corporation:

You are cordially invited to

attend the special meeting (the “special meeting”) of stockholders of Acri Capital Acquisition Corporation (“Acri Capital”

the “Company,” “we,” “us” or “our”) to be held virtually on January 24, 2023 at 9:00 a.m.,

Eastern Time. You will be able to attend the special meeting online, vote and submit your questions during the special meeting by visiting

[_].

If you plan to attend

the virtual special meeting, please be sure to follow instructions found on your proxy card, voting instruction form or notice to consider

and vote upon the following proposals:

| |

● |

Proposal

No. 1 - The Extension Amendment Proposal – a proposal to amend the Company’s amended and restated certificate

of incorporation (the “Charter”) to amend the amount of monthly deposit (each, a “Monthly Extension Payment”)

required to be deposited in the trust account (the “Trust Account”) from $0.0333 for each public share to $[__] for each

public share for up to nine (9) times if the Company has not consummated its initial business combination by March 14, 2023 (the

nine (9) month anniversary of the closing of its initial public offering) (the “Extension Amendment Proposal”) (such

amendment to the Charter as set forth in Annex A is herein referred to as the “Extension Amendment”); |

| |

|

|

| |

● |

Proposal

No. 2 - The Adjournment Proposal – a proposal to adjourn the special meeting to a later date or dates, if necessary,

to permit further solicitation and vote of proxies if, at the time of the special meeting, there are not sufficient votes for, or

otherwise in connection with, the approval of the foregoing proposal (the “Adjournment Proposal”). |

If the stockholders approve the

Extension Amendment Proposal, for each public share that is not redeemed by the stockholders in connection with the Extension Amendment

Proposal (collectively, the “Remaining Shares”, each, a “Remaining Share”), for each monthly period, or portion

thereof during the Extension, the Company will make Monthly Extension Payment of $[__] per public share in the Trust Account .

If there is (i) no redemption of the public shares, the Monthly Extension Payment will be $[__], (ii) 50% redemption of the public shares,

the Monthly Extension Payment will be $[__], and (iii) 80% redemption of the public shares, the Monthly Extension Payment will be $[__].

The first Monthly Extension Payment after the approval of the Extension Amendment Proposal must be made prior to March 14, 2023, while

the second Monthly Extension Payment must be deposited into the Trust Account prior to 14th of each succeeding month until end of Extended

Termination Date (as defined below). We intend to issue a press release announcing the deposit of funds promptly after such funds are

deposited into the Trust Account.

Each of the proposals is more

fully described in the accompanying proxy statement.

The Adjournment Proposal will

only be presented at the special meeting if, based on the tabulated votes, there are not sufficient votes at the time of the special meeting

for, or otherwise in connection with, the approval of other proposals.

The Board has fixed the close

of business on December 28, 2022 (the “Record Date”) as the date for determining the stockholders entitled to receive notice

of and vote at the special meeting and any adjournment thereof. Only holders of record of the Company’s outstanding shares on that

date are entitled to have their votes counted at the special meeting or any adjournment. On the Record Date, there were 8,625,000 shares

of Class A common stock, par value $0.0001 per share (“Class A Common Stock”) issued and outstanding, all of which are public

shares and 2,156,250 shares of Class B common stock, par value $0.0001 per share (“Class B Common Stock”, together with Class

A Common Stock, “Common Stock”) issued and outstanding.

The purpose of the Extension

Amendment is to allow the Company to have more flexibility to complete the initial business combination. The Company’s initial public

offering (the “IPO”) prospectus (File No. 333-263477) (the “IPO Prospectus”) dated June 9, 2022 and the Charter

provide that we have until March 14, 2023 (the “Current Termination Date”) to complete a merger, capital stock exchange, asset

acquisition, stock purchase, recapitalization, reorganization or other similar business combination with one or more businesses or entities,

or an “initial business combination.” If we anticipate that we may not be able to consummate the initial business combination

by the Current Termination Date, we may, but are not obligated to, if requested by Acri Capital Sponsor LLC, a Delaware limited liability

company, our sponsor (the “Sponsor”) or its affiliates, extend the Termination Date up to nine (9) times by an additional

one month each time for a total of up to 9 months (the “Paid Extension

Period”) by depositing $287,212.5 per month (or $0.0333 per public share) into the Trust Account, affording the Company up

to eighteen (18) months from the closing of the IPO to complete our initial business combination (the end of such period, the “Extended

Termination Date”). Further, the IPO Prospectus and the Charter provide that the Company may modify the Current Termination Date

by amending the Charter approved by the affirmative vote of the holders of at least sixty-five percent (65%) of all then outstanding shares

of Common Stock.

The Board currently believes

that there will not be sufficient time before March 14, 2023 for the Company to complete the initial business combination. Under the circumstances,

the Sponsor wants to pay an extension amount that is substantially less than the $287,212.5 for Paid Extension Period as provided by the

Charter. If the Extension Amendment Proposal is approved, the Company will still have the right to extend the time for the Company to

complete its initial business combination from March 14, 2023 to December 14, 2023 (i.e., 18 months from the closing of the IPO), provided

that the Monthly Extension Payment of $[__] per public share is deposited into the Trust Account on or prior to the 14th day of each month

commencing from March until December 2023. In connection with the Extension Amendment, if there is (i) no redemption of the public shares,

the Monthly Extension Payment will be $[__], (ii) 50% redemption of the public shares, the Monthly Extension Payment will be $[__], and

(iii) 80% redemption of the public shares, the Monthly Extension Payment will be $[__]. The Company’s board has determined that,

given the Company’s expenditure of time, efforts and money on identifying suitable target business and completion of a business

combination, it is in the best interests of its stockholder to approve the Extension Amendment.

Although the approval of the

Extension Amendment Proposal is essential to the implementation of the Board’s plan to amend the Monthly Extension Payment, the

Board will retain the right to abandon and not implement the Extension Amendment at any time without any further action by stockholders.

If the Extension Amendment

Proposal is not approved, and the initial business combination is not consummated by March 14, 2023 (or by December 14, 2023 if extended),

the Company will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than

ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit

in the Trust Account including interest earned on the funds held in the Trust Account and not previously released to the Company to pay

its taxes or for working capital purposes (less up to $50,000 of interest to pay dissolution expenses), divided by the number of then

outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the

right to receive further liquidating distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following

such redemption, subject to the approval of the Company’s remaining stockholders and the Board, dissolve and liquidate, subject

in each case to the Company’s obligations under Delaware law to provide for claims of creditors and the requirements of other applicable

law. There will be no redemption rights or liquidating distributions with respect to our warrants, which will expire worthless in the

event the Company winds up. The Company would expect to pay the costs of liquidation from its remaining assets outside of the Trust Account

or available to the Company from interest income on the Trust Account balance.

You are not being

asked to vote on any proposed business combination at this time. If the Extension Amendment Proposal is approved and you do not elect

to have your public shares redeemed now, you will retain the right to vote on any proposed business combination when and if one is submitted

to stockholders and the right to redeem your public shares for a pro rata portion of the Trust Account in the event a proposed business

combination is approved and completed or the Company has not consummated a business combination by the Extended Termination Date.

Public stockholders of shares

of Class A Common Stock sold in the IPO may elect to redeem their shares for their pro rata portion of the funds available in the Trust

Account in connection with the Extension Amendment Proposal (the “Election”), regardless of whether such public stockholders

vote “FOR” or “AGAINST,” or abstain from voting on, the Extension Amendment Proposal or otherwise at the special

meeting. Public stockholders may make an Election regardless of whether such public stockholders were holders as of the Record Date. However,

the Company will not proceed with the Extension Amendment if the redemption of public shares in connection therewith would cause the Company

to have net tangible assets of less than $5,000,001. In the event that the redemption of public shares causes the net tangible assets

to be less than $5,000,001 and the Extension Amendment is not proceeded, the Company will be required to dissolve and liquidate its Trust

Account by returning the then remaining funds in such Trust Account to the public stockholders.

The Company believes that such

redemption right protects the Company’s public stockholders from having to sustain their investments for an unreasonably long period

if we fail to find a suitable acquisition in the timeframe initially contemplated by the Charter. In addition, regardless of whether public

stockholders vote “FOR” or “AGAINST,” or abstain from voting on, the Extension Amendment Proposal at the special

meeting, if the Extension Amendment Proposal is approved by the requisite vote of stockholders (and not abandoned), the remaining holders

of public shares will retain their right to redeem their public shares for their pro rata portion of the funds available in the Trust

Account upon consummation of an initial business combination when it is submitted to the stockholders, subject to any limitations set

forth in the Charter and the limitations contained in related agreements. Each redemption of shares by our public stockholders in connection

with the Extension will decrease the amount in our Trust Account.

PUBLIC STOKHOLDER ARE NOT REQUIRED

TO VOTE OR AFFIRMATIVELY VOTE EITHER FOR OR AGAINST THE EXTENSION AMENDMENT PROPOSAL IN ORDER TO REDEEM THEIR SHARES FOR A PRO RATA PORTION

OF THE FUNDS HELD IN THE TRUST ACCOUNT. THIS MEANS THAT PUBLIC STOKHOLDERS WHO HOLD PUBLIC SHARES ON OR BEFORE TWO BUSINESS DAYS BEFORE

THE SPECIAL MEETING MAY ELECT TO REDEEM THEIR SHARES WHETHER OR NOT THEY ARE HOLDERS OF THE RECORD DATE, AND WHETHER THEY VOTE FOR OR

AGAINST, OR ABSTAIN FROM VOTING ON, THE EXTENSION AMENDMENT PROPOSAL. YOU MAY TENDER YOUR SHARES BY EITHER DELIVERING YOUR STOCK CERTIFICATE

TO THE TRANSFER AGENT OR BY DELIVERING YOUR STOCK ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT WITHDRAWAL AT

CUSTODIAN) SYSTEM. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW

THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS.

We estimate, based on the value

of Trust Account as of the Record Date, that the per-share price at which public shares may be redeemed from cash held in the Trust Account

will be approximately $[__] pe share, subject to the actual value of the Trust Account at the time of the redemption. The closing price

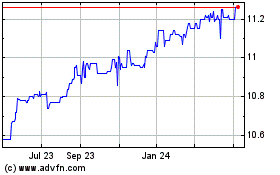

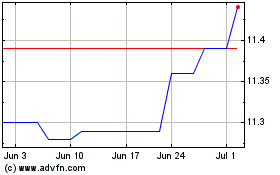

of Class A Common Stock on December 28, 2022, the Record Date, was $10.26. We cannot assure our stockholders that they will be able to

sell their shares of Class A Common Stock in the open market, even if the market price per share is higher than the redemption price stated

above, as there may not be sufficient liquidity in our securities when our stockholders wish to sell their shares.

In consideration of the Extension

Amendment Proposal, the Company’s stockholders should be aware that if the Extension Amendment Proposal is approved (and not abandoned),

the Company will incur additional expenses in seeking to complete an initial business combination, in addition to the Extension Payments.

Approval of the Extension Amendment

Proposal require the affirmative vote of the holders of at least 65% of the outstanding shares of Common Stock. The affirmative vote of

at least a majority of the votes cast by the stockholders present in person (including virtual presence) or represented by proxy at the

special meeting is required to approve the Adjournment Proposal.

After careful consideration

of all relevant factors, the Board has determined that the Extension Amendment Proposal is fair to and in the best interests of the Company

and its stockholders, and has declared it advisable and recommends that you vote or give instruction to vote “FOR” it. In

addition, the Board recommends that you vote “FOR” to direct the chairman of the special meeting to adjourn the special meeting,

if applicable.

Under Delaware law and the

Company’s bylaws, no other business may be transacted at the special meeting.

Enclosed is the proxy statement

containing detailed information concerning the Extension Amendment Proposal to be considered at the special meeting. Whether or not you

plan to attend the special meeting, we urge you to read this material carefully and vote your shares. We are providing the proxy statement

and the accompanying proxy card to our stockholders in connection with the solicitation of proxies to be voted at the special meeting

and at any adjournments or postponements of the special meeting. The proxy statement is dated [__], 2023 and is first being mailed to

stockholders of the Company on or about [__], 2023.

The Company is actively monitoring

the coronavirus (COVID-19) and is sensitive to the public health and travel concerns stockholders may have as well as the protocols

that federal, state, and local governments may impose. The Company will hold the special meeting virtually by means of electronic communication.

Whether or not you plan

to attend the special meeting, we urge you to read the proxy statement carefully and to vote your shares. Your vote is very important. If

you are a registered stockholder, please vote your shares as soon as possible by completing, signing, dating and returning the enclosed

proxy card in the postage-paid envelope provided. If you hold your shares in “street name” through a bank, broker or

other nominee, you will need to follow the instructions provided to you by your bank, broker or other nominee to ensure that your shares

are represented and voted at the special meeting. If you sign, date and return your proxy card without indicating how you wish to vote,

your proxy will be voted FOR the proposals to be considered at the special meeting, except that with respect to the Extension Amendment

Proposal, your votes without instruction how you wish to vote will be counted as broker “non-votes.”

We look forward to seeing

you at the meeting.

Dated: [__], 2023

| By Order of the Board of Directors, |

|

| |

|

|

|

| “Joy” Yi Hua |

|

| Chairwoman of the Board of Directors |

|

NEITHER THE U.S. SECURITIES AND EXCHANGE

COMMISSION NOR ANY U. S. STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THE ACCOMPANYING

PROXY STATEMENT OR PASSED UPON THEIR MERITS OR FAIRNESS, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THE PROXY STATEMENT. ANY

REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Acri

Capital Acquisition Corporation

13284 Pond Springs Rd, Ste 405

Austin, Texas

SPECIAL

MEETING OF STOCKHOLDERS

TO BE

HELD JANUARY 24, 2023

PROXY

STATEMENT

The special meeting of

stockholders (the “special meeting”) of Acri Capital Acquisition Corporation (“Acri Capital”, the

“Company,” “we,” “us” or

“our”), a Delaware corporation, will be held virtually on January 24, 2023 at 9:00 a.m., Eastern Time, to consider and

vote upon the following proposals:

| |

● |

Proposal

No. 1 - The Extension Amendment Proposal – a proposal to amend the Company’s amended and restated certificate

of incorporation (the “Charter”) to amend the amount of monthly deposit (each, a “Monthly Extension Payment”)

required to be deposited in the trust account ( the “Trust Account”) from $0.0333 for each public share to $[__] for

each public share for up to nine (9) times if the Company has not consummated its initial business combination by March 14, 2023

(the nine (9) month anniversary of the closing of its initial public offering) (the “Extension Amendment Proposal”) (such

amendment to the Charter as set forth in Annex A is herein referred to as the “Extension Amendment”); |

| |

● |

Proposal

No. 2 - The Adjournment Proposal – a proposal to adjourn the special meeting to a later date or dates, if necessary,

to permit further solicitation and vote of proxies if, at the time of the special meeting, there are not sufficient votes for, or

otherwise in connection with, the approval of the foregoing proposals (the “Adjournment Proposal”). |

If the stockholders approve the

Extension Amendment Proposal, for each public share that is not redeemed by the stockholders in connection with the Extension Amendment

Proposal (collectively, the “Remaining Shares”, each, a “Remaining Share”), for each monthly period, or portion

thereof during the Extension, the Company will deposit $[__] per public share per month in the Trust Account. If

there is (i) no redemption of the public shares, the Monthly Extension Payment will be $[__], (ii) 50% redemption of the public shares,

the Monthly Extension Payment will be $[__], and (iii) 80% redemption of the public shares, the Monthly Extension Payment will be $[__].

The first Monthly Extension Payment after the approval of the Extension Amendment Proposal must be made prior to March 14, 2023, while

the second Monthly Extension Payment must be deposited into the Trust Account prior to 14th of each succeeding month until end of Extended

Termination Date (as defined below). We intend to issue a press release announcing the deposit of funds promptly after such funds are

deposited into the Trust Account.

Due to the COVID-19 pandemic,

Acri Capital will hold the special meeting virtually. You will be able to attend the special meeting online, vote and submit your questions

during the special meeting by visiting [__].

If you plan to attend the virtual

special meeting, please be sure to follow instructions found on your proxy card, voting instruction form or notice.

The Board has fixed the close

of business on December 28, 2022 (the “Record Date”) as the date for determining the stockholders entitled to receive notice

of and vote at the special meeting and any adjournment thereof. Only holders of record of the Company’s outstanding shares on that

date are entitled to have their votes counted at the special meeting or any adjournment. On the Record Date, there were 8,625,000 shares

of Class A common stock, par value $0.0001 per share (“Class A Common Stock”) issued and outstanding, all of which are public

shares and 2,156,250 shares of Class B common stock, par value $0.0001 per share (“Class B Common Stock”, together with Class

A Common Stock, “Common Stock”) issued and outstanding.

The purpose of the Extension Amendment

is to allow the Company to have more flexibility to complete the initial business combination. The Charter of the Company provides that

we have until March 14, 2023 to complete an initial business combination. If we anticipate that we may not be able to consummate an initial

business combination by March 14, 2023, we may, but are not obligated to, if requested by the Sponsor or its affiliates, extend the time

we need to complete an initial business combination (the “Combination Period”) up to nine (9) times by an additional one month

each time for a total of up to 9 months (the “Paid Extension Period”) by depositing $287,212.5 per month ($0.0333 per public

share) into our Trust Account, affording us up to December 14, 2023 to complete our initial business combination (the “Extended

Termination Date”). Further, the Charter provides that we may modify the time and substance of the Combination Period by amending

the Charter approved by the affirmative vote of the holders of at least sixty-five percent (65%) of all then outstanding shares of Common

Stock.

The Board currently believes that

there will not be sufficient time before March 14, 2023 for the Company to complete an initial business combination. If the Extension

Amendment Proposal is approved, the Company will still have the right to extend the Combination Period from March 14, 2023 to December

14, 2023 (i.e., 18 months from the closing of the IPO), provided that the Monthly Extension Payment of $[__] per public share is deposited

into the Trust Account on or prior to the 14th day of each month commencing from March until December 2023. In connection with the Extension

Amendment, if there is (i) no redemption of the public shares, the Monthly Extension Payment will be $[__], (ii) 50% redemption of the

public shares, the Monthly Extension Payment will be $[__], and (iii) 80% redemption of the public shares, the Monthly Extension Payment

will be $[__]. The Company’s board has determined that, given the Company’s expenditure of time, efforts and money on identifying

suitable target business and completion of a business combination, it is in the best interests of its stockholder to approve the Extension

Amendment.

A quorum of 50% of the Company’s

shares outstanding as of the Record Date, present in person (including virtual presence) or by proxy, will be required to conduct the

special meeting. Provided that there is a quorum, Approval of the Extension Amendment Proposal requires the affirmative vote of the holders

of at least sixty-five percent (65%) of the then outstanding shares of Common Stock.

Public stockholders of shares

of Common Stock sold in the IPO may elect to redeem their shares for their pro rata portion of the funds available in the Trust Account

in connection with the Extension Amendment Proposal (the “Election”), regardless of whether such public stockholders vote

“FOR” or “AGAINST,” or abstain from voting on, the Extension Amendment Proposal or otherwise at the special meeting.

Public stockholders may make an Election regardless of whether such public stockholders were holders as of the Record Date. However, the

Company will not proceed with the Extension Amendment if the redemption of public shares in connection therewith would cause the Company

to have net tangible assets of less than $5,000,001. In the event that the redemption of public shares causes the net tangible assets

to be less than $5,000,001 and the Extension Amendment is not proceeded, the Company will be required to dissolve and liquidate its Trust

Account by returning the then remaining funds in such Trust Account to the public stockholders. If the Extension Amendment Proposal is

approved by the requisite vote of stockholders (and not abandoned), the remaining holders of public shares will retain their right to

redeem their public shares for their pro rata portion of the funds available in the Trust Account upon consummation of an initial business

combination when it is submitted to the stockholders, subject to any limitations set forth in the Charter and the limitations contained

in related agreements. In addition, public stockholders who vote for the Extension Amendment Proposal and do not make the Election would

be entitled to redemption if the Company has not completed a business combination by the Extended Termination Date. The withdrawal of

funds from the Trust Account in connection with the Election will reduce the amount held in the Trust Account following the redemption,

and the amount remaining in the Trust Account may be significantly reduced from the approximately $88.4 million held in the Trust Account

as of September 30, 2022. In such event, we may need to obtain additional funds to complete a business combination and there can be no

assurance that such funds will be available on terms acceptable to the parties or at all.

If the Extension Amendment

Proposal is not approved, and the initial business combination not consummated by March 14, 2023 (or by December 14, 2023 if extended),

the Company will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than

ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit

in the Trust Account including interest earned on the funds held in the Trust Account and not previously released to the Company to pay

its taxes or for working capital purposes (less up to $50,000 of interest to pay dissolution expenses), divided by the number of then

outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the

right to receive further liquidating distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following

such redemption, subject to the approval of the Company’s remaining stockholders and the Board, dissolve and liquidate, subject

in each case to the Company’s obligations under Delaware law to provide for claims of creditors and the requirements of other applicable

law. Holders of warrants will receive no proceeds in connection with the liquidation with respect to such rights or warrants, which will

expire worthless. The Company would expect to pay the costs of liquidation from its remaining assets outside of the Trust Account or available

to the Company from interest income on the Trust Account balance.

Prior to the IPO, we issued

certain shares of Class B Common Stock (the “Founder Shares”) to Acri Capital Sponsor LLC, a Delaware limited liability company

(the “Sponsor”), our officers, directors, and/or their designees (collectively with the Sponsor, the “Founders”).

In the IPO, we issued and sold to the public, units, each consisting of one share of Common Stock and one-half of one warrant. Our Founders

have waived their redemption rights with respect to their Founder Shares and

public shares in connection with a stockholder vote to approve an amendment to our Charter with respect to any other provision relating

to stockholders’ rights or pre-initial business combination activity. Holders of warrants will receive no proceeds

in connection with the liquidation with respect to such warrants, which will expire worthless.

The Sponsor has agreed that

it will be liable to us if and to the extent any claims by a third party for services rendered or products sold to us, or by a prospective

target business with which we have discussed entering into a transaction agreement, reduce the amount of funds in the Trust Account to

below (i) $10.20 per public share or (ii) such lesser amount per public share held in the Trust Account as of the date of the liquidation

of the Trust Account due to reductions in the value of the trust assets, in each case net of the interest which may be withdrawn to pay

taxes. This liability will not apply with respect to any claims by a third party who executed a waiver of any and all rights to seek access

to the Trust Account and except as to any claims under our indemnity of the underwriters of our initial public offering against certain

liabilities, including liabilities under the Securities Act. Moreover, in the event that an executed waiver is deemed to be unenforceable

against a third party, then the Sponsor will not be responsible to the extent of any liability for such third party claims. We have not

independently verified whether the Sponsor has sufficient funds to satisfy its indemnity obligations and believe that the Sponsor’s

only assets are securities of the Company. We have not asked the Sponsor to reserve for such indemnification obligations. None of our

officers will indemnify us for claims by third parties including, without limitation, claims by vendors and prospective target businesses.

Nevertheless, we cannot assure you that the per share distribution from the Trust Account, if the Company liquidates, will not be less

than $10.20, plus interest, due to unforeseen claims of potential creditors.

Under the Delaware General

Corporation Law (the “DGCL”), stockholders may be held liable for claims by third parties against a corporation to the extent

of distributions received by them in a dissolution. The pro rata portion of the Trust Account distributed to our public stockholders upon

the redemption of 100% of our outstanding public shares in the event we do not complete our initial business combination within the required

time period may be considered a liquidation distribution under Delaware law. If the corporation complies with certain procedures set forth

in Section 280 of the DGCL intended to ensure that it makes reasonable provision for all claims against it, including a 60-day notice

period during which any third-party claims can be brought against the corporation, a 90-day period during which the corporation may reject

any claims brought, and an additional 150-day waiting period before any liquidating distributions are made to stockholders, any liability

of stockholders with respect to a liquidating distribution is limited to the lesser of such stockholder’s pro rata share of the

claim or the amount distributed to the stockholder, and any liability of the stockholder would be barred after the third anniversary of

the dissolution.

However, because we will not

be complying with Section 280 of the DGCL, Section 281(b) of the DGCL requires us to adopt a plan, based on facts known to us at such

time that will provide for our payment of all existing and pending claims or claims that may be potentially brought against us within

the subsequent ten years. However, because we are a blank check company, rather than an operating company, and our operations will be

limited to searching for prospective target businesses to acquire, the only likely claims to arise would be from our vendors (such as

lawyers, investment bankers, etc.) or prospective target businesses.

Approval of the Extension will

constitute consent for Acri Capital to instruct the trustee to (i) remove from the Trust Account an amount (the “Withdrawal Amount”)

equal to the number of public shares properly redeemed multiplied by the per-share price, equal to the aggregate amount then on deposit

in the Trust Account, including interest not previously released to us to pay our taxes, divided by the number of then outstanding public

shares and (ii) deliver to the holders of such redeemed public shares their portion of the Withdrawal Amount. The remainder of such funds

shall remain in the Trust Account and be available for use by us to complete a business by the Current Termination Date (or by the Extended

Termination Date, if extended). Holders of public shares who do not redeem their public shares now will retain their redemption rights

and their ability to vote on any business combination through March 14, 2023 (or up to September 14, 2023).

This proxy statement contains

important information about the special meeting and the proposals. Please read it carefully and vote your shares.

This proxy statement, including

the form of proxy, are first being mailed to stockholders on or about [__], 2023.

TABLE

OF CONTENTS

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

These Questions and Answers

are only summaries of the matters they discuss. They do not contain all of the information that may be important to you. You should read

carefully the entire document, including the annexes to this proxy statement.

| Q. |

Why am I receiving this proxy statement? |

A. This proxy statement and the accompanying

materials are being sent to you in connection with the solicitation of proxies by the board of directors (the “Board”), for

use at the special meeting of stockholders in lieu of the annual meeting of stockholders (the “special meeting”) to be held

on virtually January 24, 2022 at 9:00 a.m., Eastern Time, or at any adjournments or postponements thereof. You will be able to attend

the special meeting online, vote and submit your questions during the special meeting by visiting [__].

If you plan to attend the virtual special meeting,

please be sure to follow instructions found on your proxy card, voting instruction form or notice.

This proxy statement summarizes the information

that you need to make an informed decision on the proposals to be considered at the special meeting. |

| |

|

|

| Q. |

What is being voted on? |

A. You are being asked to vote on a proposal to amend Company’s amended and restated certificate of incorporation (the “Charter”) to amend the amount of monthly deposit (each, a “Monthly Extension Payment”) required to be deposited in the trust account (the “Trust Account”) from $0.0333 for each public share to $[__] for each public shares for up to nine (9) times if the Company has not consummated its initial business combination by March 14, 2023 (the nine (9) month anniversary of the closing of its initial public offering) (the “Extension Amendment Proposal) (such amendment to the Charter as set forth in Annex A is herein referred to as the “Extension Amendment”); |

| |

|

|

| Q. |

What is the purpose of the Extension Amendment? |

A. The purpose of the Extension Amendment is to allow the Company to have more flexibility to complete the initial business combination.

The Charter provides that we have until March 14, 2023 (the “Current Termination

Date”) to complete a merger, capital stock exchange, asset acquisition, stock purchase, recapitalization, reorganization or other

similar business combination with one or more businesses or entities, or an “initial business combination.” If we anticipate

that we may not be able to consummate an initial business combination by the Current Termination Date, we may, but are not obligated to,

if requested by our sponsor or its affiliates, extend the time we need to complete an initial business combination (the “Combination

Period”) up to nine (9) times by an additional one month each time for a total of up to 9 months (the “Paid Extension Period”)

by depositing $287,212.5 per month ($0.0333 per public share) into our Trust Account, affording the Company December 14, 2023 to complete

our initial business combination the “Extended Termination Date”). |

| |

|

If the Extension Amendment Proposal is approved,

the Company will still have the right to extend the Combination Period from March 14, 2023 to December 14, provided that the Monthly

Extension Payment of $[__] per public share is deposited into the Trust Account. If there is (i) no redemption of the public shares,

the Monthly Extension Payment will be $[__], (ii) 50% redemption of the public shares, the Monthly Extension Payment will be $[__], and

(iii) 80% redemption of the public shares, the Monthly Extension Payment will be $[__] . The Company’s board has determined that,

given the Company’s expenditure of time, efforts and money on identifying suitable target business and completion of a business

combination, it is in the best interests of its stockholder to approve the Extension Amendment.

If the Extension Amendment Proposal is approved,

such approval will constitute consent for us to remove an amount from the Trust Account (the “Withdrawal Amount”) equal to

the number of public shares properly redeemed multiplied by the per-share price, equal to the aggregate amount then on deposit in the

Trust Account, including interest not previously released to us to pay our taxes, divided by the number of then outstanding public share,

and deliver to the holders of redeemed public shares their portion of the Withdrawal Amount and retain the remainder of the funds in the

Trust Account for our use in connection with consummating a business combination on or before the Extended Termination Date. We will not

proceed with the Extension if redemptions of our public shares cause us to have less than $5,000,001 of net tangible assets following

approval of the Extension Amendment Proposal.

If the Extension Amendment Proposal is approved,

the removal of the Withdrawal Amount from the Trust Account in connection with the Election (as defined below) will reduce the amount

held in the Trust Account following the Election. We cannot predict the amount that will remain in the Trust Account if the Extension

Amendment is approved and the amount remaining in the Trust Account may be only a fraction of the approximately $88.4 million that was

in the Trust Account as of September 30, 2022, which could impact our ability to consummate a business combination.

If the Extension Amendment Proposal is not approved,

and the initial business combination not consummated by March 14, 2023 (or by December 14, 2023 if extended), the Company will (i) cease

all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter,

redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account including

interest earned on the funds held in the Trust Account and not previously released to the Company to pay its taxes or for working capital

purposes (less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which

redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidating

distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to

the approval of the Company’s remaining stockholders and the Board, dissolve and liquidate, subject in each case to the Company’s

obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. The Company would expect

to pay the costs of liquidation from its remaining assets outside of the Trust Account or available to the Company from interest income

on the Trust Account balance.

You are not being asked to vote on any proposed

business combination at this time. If the Extension Amendment Proposal is approved and you do not elect to redeem your public shares in

connection with the Elections, you will retain the right to vote on any proposed business combination when and if one is submitted to

stockholders and the right to redeem your public shares for a pro rata portion from the Trust Account in the event a proposed business

combination is approved and completed or the Company has not consummated a business combination by the Extended Termination Date. |

| Q. |

Why should I vote for the Extension Amendment Proposal? |

A. The approval of the Extension Amendment

Proposal is essential to the implementation of the Board’s plan to amend the Monthly Extension Payment in order to extend the Combination

Period beyond March 14, 2023.

Our Board believes stockholders will benefit from

the Company consummating a business combination and is proposing the Extension Amendment Proposal to allow us to more flexibility to complete

the initial business combination.

The Charter provides that if our stockholders

approve an amendment to modify A) the substance or timing of our obligation to allow redemption in connection with our initial business

combination or to redeem 100% of our public shares if we do not complete our initial business combination within the completion period

or extended completion period, or (B) with respect to any other provision relating to stockholders’ rights or pre-initial business

combination activity , we will provide our public stockholders with the opportunity to redeem all or a portion of their shares of

Common Stock upon such approval at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account,

including interest earned on the funds held in the Trust Account and not previously released to the Company to pay its taxes or for working

capital purposes (less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares.

We believe that this provision of the Charter was included to protect our stockholders from having to sustain their investments for an

unreasonably long period if we failed to find a suitable business combination in the timeframe contemplated by the Charter. The Board

also believes, however, that it is in the best interests of our stockholders to provide the Company more flexibility to complete a business

combination. |

| |

|

|

| Q. |

What is Monthly Extension Payment and how it impacts the redemption price? |

A. If the stockholder

approves the Extension Amendment Proposal, the Company will have the right to extend the Combination Period from March 14, 2023 to December

14, 2023, provided that, for each public share that is not redeemed by the stockholders in connection with the Extension Amendment Proposal

(collectively, the “Remaining Shares”, each, a “Remaining Share”), for each monthly period, the Monthly Extension

Payment of $[__] per public share is deposited into the Trust Account, If there is (i) no redemption of the public shares, the Monthly

Extension Payment will be $[__], (ii) 50% redemption of the public shares, the Monthly Extension Payment will be $ [__], and (iii) 80%

redemption of the public shares, the Monthly Extension Payment will be $[__]. The first Monthly Extension Payment after the approval

of the Extension Amendment Proposal must be made prior to March 14, 2023, while the second Extension Payment must be deposited into the

Trust Account prior to 14th of each succeeding month until the end of Paid Extension Period. We intend to issue a press release announcing

the deposit of Monthly Extension Payment after such funds are deposited into the Trust Account.

We estimate, based on the value of Trust Account

as of the Record Date, that the per-share price at which public shares may be redeemed from cash held in the Trust Account will be approximately

$[__] pe share, subject to the actual value of the Trust Account at the time of the redemption. If the Extension Amendment Proposal is

approved and the Company takes full nine months to complete an initial business combination, the redemption amount per share at the meeting

for the initial business combination or the Company’s subsequent liquidation will be approximately $[__], including nine Monthly

Extension Payment. If you are a public shareholder and elect not to redeem the shares of Common Stock in connection with the Extension

Amendment Proposal, you may be entitled to a redemption price of $[__] in comparison to the current redemption amount of $[__] per share

(solely based on the redemption price as of the current Record Date, subject to the actual value of the Trust Account at the time of the

redemption and full nine-month extension). |

| Q. |

How do the Founders intend to vote their shares? |

A. Prior to the IPO, we issued certain

shares of Class B Common Stock (the “Founder Shares”) to Acri Capital Sponsor LLC, a Delaware limited liability company (the

“Sponsor”), our officers, directors, and their designees (collectively with the Sponsor, the “Founders”). The

Founders are expected to vote any Founder Shares and any shares of Class A Common Stock held in favor of all of the proposals.

Our Founders have agreed to waive their redemption

rights with respect to any Founder Shares and any public shares held by them in connection with the completion of our initial business

combination and to waive their redemption rights with respect to their Founder Shares and public shares in connection with a stockholder

vote to approve an amendment to the Charter (A) to modify the substance or timing of our obligation to allow redemption in connection

with our initial business combination or to redeem 100% of our public shares if we do not complete our initial business combination within

the completion period or extended completion period, or (B) with respect to any other provision relating to stockholders’ rights

or pre-initial business combination activity.

On the Record Date, the Founders beneficially

owned and were entitled to vote 2,156,250 shares of Class B Common Stock, representing approximately 20.0% of our issued and outstanding

Common Stock. The Founders did not beneficially own any public shares as of such date. |

| |

|

|

| Q. |

How does the Board of Directors recommend I vote? |

A. After careful consideration of all relevant factors, the Board has determined that the Extension Amendment Proposal is fair to and in the best interests of the Company and our stockholders. The Board recommends that you vote or give instruction to vote “FOR” the Extension Amendment Proposal. The Board also recommends that you vote “FOR” the Adjournment Proposal. The Adjournment Proposal will only be put forth for a vote if there are not sufficient votes for, or otherwise in connection with, the approval of the other proposals at the special meeting |

| |

|

|

| Q. |

Who may vote at the special meeting? |

A. The Board has fixed the close of business on December 28, 2022 as the date for determining the stockholders entitled to vote at the special meeting and any adjournment thereof. Only holders of record of the Company’s outstanding shares on that date are entitled to have their votes counted at the special meeting or any adjournment. |

| |

|

|

| Q. |

How many votes must be present to hold the special meeting? |

A quorum of 50% of the Company’s shares outstanding as of the Record Date, present in person (including virtual presence) or by proxy, will be required to conduct the special meeting. |

| |

|

|

| Q. |

How many votes do I have? |

A. You are entitled to cast one vote at the special meeting for each share you held as of December 28, 2022, the Record Date for the special meeting. As of the close of business on the Record Date, there were 10,781,250 outstanding shares, including 8,625,000 outstanding public shares. |

| Q. |

What is the proxy card? |

A. The proxy card enables you to appoint the representatives named on the card to vote your shares at the special meeting in accordance with your instructions on the proxy card. That way, your shares will be voted whether or not you attend the special meeting. Even if you plan to attend the special meeting, it is strongly recommended that you complete and return your proxy card before the special meeting date, in case your plans change. |

| |

|

|

| Q. |

What is the difference between a stockholder of record and a beneficial owner of shares held in street name? |

A. Stockholder of Record. If

your shares are registered directly in your name with the Company’s transfer agent, VStock Transfer, LLC, you are considered the

stockholder of record with respect to those shares, and the Company sent the proxy materials directly to you.

Beneficial Owner of Shares Held in Street Name. If

your shares are held in an account at a brokerage firm, bank, broker-dealer, nominee or other similar organization, then you are the beneficial

owner of shares held in “street name,” and the proxy materials were forwarded to you by that organization. The organization

holding your account is considered the stockholder of record for purposes of voting at the special meeting. As a beneficial owner, you

have the right to instruct that organization how to vote the shares held in your account. Those instructions are contained in a “voting

instruction form” containing information substantially similar to the information set forth on the proxy card. |

| |

|

|

| Q. |

What vote is required to approve the Extension Amendment Proposal? |

A. Approval of the Extension Amendment

Proposal requires the affirmative vote of the holders of at least sixty-five percent (65%) of the then outstanding shares of Common Stock.

With respect to the Extension Amendment Proposal, abstentions and broker non-votes will have the same effect as “AGAINST”

votes.

Approval of the Adjournment Proposal requires

the affirmative vote of at least a majority of the votes cast by the stockholders present in person (including virtual presence) or represented

by proxy at the special meeting. The Adjournment Proposal will only be put forth for a vote if there are not sufficient votes for, or

otherwise in connection with, the approval of the other proposals at the special meeting. |

| |

|

|

| Q. |

What if I don’t want to vote for the Extension Amendment Proposal? |

A. If you do not want the Extension

Amendment Proposal to be approved, you must abstain, not vote, or vote against the proposals. You will be entitled to make the Election

to redeem your shares for cash in connection with this vote regardless of whether you vote for or against, or abstain from voting on,

the Extension Amendment Proposal. If you do not make the Election, you will retain your right to redeem your public shares for a pro rata

portion of the funds available in the Trust Account if an initial business combination is approved and completed, subject to any limitations

set forth in the Charter.

In addition, public stockholders who do not make

the Election would be entitled to redemption if the Company has not completed a business combination by the Combination Period.

If the Extension Amendment Proposal is approved

(and not abandoned) and you exercise your redemption right with respect to your public shares, you will no longer own your public shares

once the Extension Amendment Proposal becomes effective. |

| Q. |

Will you seek any further extensions to liquidate the Trust Account? |

A. Other than the Paid Extension Period as described in this proxy statement, we do not currently anticipate seeking any further extensions to consummate a business combination. We have provided the Election for all holders of public shares, including those who vote for the Extension Amendment Proposal and holders should receive the funds shortly after the special meeting which is scheduled for January 24, 2022. Those holders of public shares who elect not to redeem their shares now shall retain redemption rights with respect to future business combinations, or, if we do not consummate a business combination by March 14, 2023, such holders shall be entitled to their pro rata portion of the Trust Account on such date. |

| |

|

|

| Q. |

What happens if the Extension Amendment Proposal is not approved? |

A. If the Extension Amendment Proposal is

not approved, and the initial business combination not consummated by March 14, 2023 (or by December 14, 2023 if extended), the Company

will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business

days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the

Trust Account including interest earned on the funds held in the Trust Account and not previously released to the Company to pay its taxes

or for working capital purposes (less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding

public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive

further liquidating distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption,

subject to the approval of the Company’s remaining stockholders and the Board, dissolve and liquidate, subject in each case to the

Company’s obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. The Company

would expect to pay the costs of liquidation from its remaining assets outside of the Trust Account or available to the Company from interest

income on the Trust Account balance.

The Founders have waived their rights to liquidating distributions from the

Trust Account with respect to any Founder Shares held by them if we fail to complete our initial business combination within the Combination

Period, although they will be entitled to liquidating distributions from the Trust Account with respect to any public shares they hold

if we fail to complete our initial business combination within the Combination Period |

| |

|

|

| Q. |

If the Extension Amendment Proposal is approved, what happens next? |

A. If the Extension Amendment Proposal

is approved, we will file an amendment to the Charter with the Secretary of State of the State of Delaware in the form of Annex A

hereto to amend the Monthly Extension Payment. We will remain a reporting company under the Exchange Act, and our units, Class A

Common Stock, and warrants will remain publicly traded. We will then continue to work to consummate a business combination by March 14,

2023 (or by December 14, 2023 if extended).

|

| |

|

|

| |

|

If the Extension Amendment is implemented, the

removal of the Withdrawal Amount from the Trust Account in connection with the Election will reduce the amount held in the Trust Account,

and the percentage interest of the Company’s shares held by the Founders will increase. We cannot predict the amount that will remain

in the Trust Account if the Extension Amendment is implemented, and the amount remaining in the Trust Account may be only a fraction of

the amount that was in the Trust Account as of September 30, 2022. However, we will not proceed with the Extension Amendment if the number

of redemptions of our public shares causes us to have less than $5,000,001 of net tangible assets following approval of the Extension

Amendment Proposal. |

| Q. |

Would I still be able to vote on any business combination if I exercise my redemption rights? |

A. Unless you elect to redeem all of your shares, you will be able to vote on any business combination when it is submitted to stockholders. If you disagree with the business combination, you will retain your right to redeem your public shares upon consummation of a business combination in connection with the stockholder vote to approve the business combination, subject to any limitations set forth in the charter. |

| |

|

|

| Q |

Would I still be able to exercise my redemption rights if I vote against or abstain from voting on the Extension Amendment Proposal? |

A. Public stockholders may elect to redeem their shares for a pro rata portion of the funds available in the Trust Account in connection with the Extension Amendment Proposal regardless of how such public stockholders vote in regard to the Extension Amendment Proposal or otherwise at the special meeting. However, the Company will not proceed with the Extension Amendment if the redemption of public shares in connection therewith would cause the Company to have net tangible assets of less than $5,000,001. In the event that the redemption of public shares causes the net tangible assets to be less than $5,000,001 and the Extension Amendment is not proceeded, the Company will be required to dissolve and liquidate its Trust Account by returning the then remaining funds in the Trust Account to the public stockholders. Public stockholders are not required to affirmatively vote either for or against the Extension Amendment Proposal in order to redeem their shares for a pro rata portion of the funds held in the Trust Account. This means that public stockholders who hold public shares on or before such date that is two business days before the special meeting may elect to redeem their shares whether or not they are holders of the Record Date, and whether or not they vote for the Extension Amendment Proposal or even abstain from voting on. You may tender your shares by either delivering your share certificate to the transfer agent or by delivering your shares electronically using the depository trust company’s DWAC (deposit withdrawal at custodian) system. If you hold the shares in street name, you will need to instruct the account executive at your bank or broker to withdraw the shares from your account in order to exercise your redemption rights. |

| |

|

|

| Q. |

What is the deadline for voting my shares? |

A. If you are a stockholder of record, you may mark, sign, date and return the enclosed proxy card, which must be received before the special meeting, in order for your shares to be voted at the special meeting. If you are a beneficial owner, please read the voting instruction form provided by your bank, broker, trust or other nominee for information on the deadline for voting your shares. |

| |

|

|

| Q. |

Is my vote confidential? |

A. Proxies, ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed except as may be necessary to meet legal requirements. |

| |

|

|

| Q. |

Where will I be able to find the voting results of the special meeting? |

A. We will announce preliminary voting results at the special meeting. The final voting results will be tallied by the inspector of election and published in the Company’s Current Report on Form 8-K, which the Company is required to file with the SEC within four business days following the special meeting. |

| |

|

|

| Q. |

Who bears the cost of soliciting proxies? |

A. The Company will bear the cost of soliciting proxies in the accompanying form and will reimburse brokerage firms and others for expenses involved in forwarding proxy materials to beneficial owners or soliciting their execution. In addition to solicitations by mail, the Company, through its directors and officers, may solicit proxies in person, by telephone or by electronic means. Such directors and officers will not receive any special remuneration for these efforts. We have retained Advantage Proxy, Inc. to assist us in soliciting proxies for a nominal fee plus reasonable out-of-pocket expenses. |

| Q. |

How can I submit my proxy or voting instruction form? |

A. Whether you are a stockholder of record

or a beneficial owner, you may direct how your shares are voted without attending the special meeting. If you are a stockholder of record,

you may submit a proxy to direct how your shares are voted at the special meeting, or at any adjournment or postponement thereof. Your

proxy can be submitted by completing, signing and dating the proxy card you received with this proxy statement and then mailing it in

the enclosed prepaid envelope. If you are a beneficial owner, you must submit voting instructions to your bank, broker, trust or other

nominee in order to authorize how your shares are voted at the special meeting, or at any adjournment or postponement thereof. Please

follow the instructions provided by your bank, broker, trust or other nominee.

Submitting a proxy or voting instruction form

will not affect your right to vote in person should you decide to attend the special meeting. However, if your shares are held in the

“street name” of your broker, bank or another nominee, you must obtain a proxy from the broker, bank or other nominee to vote

in person at the special meeting. That is the only way we can be sure that the broker, bank or nominee has not already voted your shares. |

| |

|

|

| Q. |

How do I change my vote? |

A. If you have submitted a proxy to

vote your shares and wish to change your vote, you may do so by delivering a later-dated, signed proxy card to Advantage Proxy, Inc.,

our proxy solicitor, prior to the date of the special meeting or by voting in person at the special meeting. Attendance at the special

meeting alone will not change your vote. You also may revoke your proxy by sending a notice of revocation to: Advantage Proxy, Inc., P.O. Box

13581, Des Moines, WA 98198.

If your shares are held of record by a brokerage

firm, bank or other nominee, you must instruct your broker, bank or other nominee that you wish to change your vote by following the procedures

on the voting instruction form provided to you by the broker, bank or other nominee. If your shares are held in street name, and you wish

to attend the special meeting and vote at the special meeting, you must bring to the special meeting a legal proxy from the broker, bank

or other nominee holding your shares, confirming your beneficial ownership of the shares and giving you the right to vote your shares. |

| Q. |

How are votes counted? |

A. Votes will be counted by the inspector

of election appointed for the meeting, who will separately count “FOR”, “AGAINST” or “WITHHOLD” votes,

as well as abstentions and broker non-votes.

Approval of the Extension Amendment Proposal requires

the affirmative vote of the holders of at least sixty-five percent (65%) of all then outstanding shares of Common Stock.

Approval of the Adjournment Proposal requires

the affirmative vote of at least a majority of the votes cast by the stockholders present in person (including virtual presence) or represented

by proxy at the special meeting. The Adjournment Proposal will only be put forth for a vote if there are not sufficient votes for, or

otherwise in connection with, the approval of the other proposals at the special meeting.

With respect to the Extension Amendment Proposal,

abstentions and broker non-votes will have the same effect as “AGAINST” votes. Abstentions will be counted in connection with

the determination of whether a valid quorum is established.

If your shares are held by your broker as your

nominee (that is, in “street name”), you may need to obtain a proxy form from the institution that holds your shares and follow

the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your

broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary”

items. For discretionary items your broker has the discretion to vote shares held in street name in the absence of your voting instructions.

On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes. The

Extension Amendment Proposal is considered as a non-discretionary item. |

| |

|

|

| Q. |

If my shares are held in “street name,” will my broker automatically vote them for me? |

A. With respect to the Extension Amendment Proposal, your broker can vote your shares only if you provide them with instructions on how to vote. You should instruct your broker to vote your shares. Your broker can tell you how to provide these instructions. |

| |

|

|

| Q. |

What is a quorum requirement? |

A. A quorum of stockholders is necessary

to hold a valid meeting. A quorum will be present with regard to each of the proposals if at least a majority of the outstanding shares

of Common Stock on the record date are represented by stockholders present at the meeting or by proxy at the special meeting.

Your shares will be counted towards the quorum

only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at

the special meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman

of the special meeting may adjourn the special meeting to another date. |

| Q. |

Who can vote at the special meeting? |

A. Only holders of record of Common Stock

at the close of business on December 28, 2022, the Record Date, are entitled to have their vote counted at the special meeting and any

adjournments or postponements thereof. On the Record Date, 10,781,250 shares of Common Stock, including 8,625,000 public shares, were

outstanding and entitled to vote.

Stockholder of Record: Shares Registered in

Your Name. If on the record date your shares were registered directly in your name with our transfer agent, VStock Transfer, LLC,

then you are a stockholder of record. As a stockholder of record, you may vote in person at the special meeting or vote by proxy. Whether

or not you plan to attend the special meeting in person, we urge you to fill out and return the enclosed proxy card to ensure your vote

is counted.

|

| |

|

|

| |

|

Beneficial Owner: Shares Registered in the

Name of a Broker or Bank. If on the Record Date your shares were held, not in your name, but rather in an account at a brokerage firm,

bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy

materials are being forwarded to you by that organization. As a beneficial owner, you have the right to direct your broker or other agent

on how to vote the shares in your account. You are also invited to attend the special meeting. However, since you are not the stockholder

of record, you may not vote your shares in person at the special meeting unless you request and obtain a valid proxy from your broker

or other agent. |

| |

|

|

| Q. |

What interests do the Founders have in the approval of the proposals? |

A. The Founders have interests in the proposals that may be different from, or in addition to, your interests as a stockholder. These interests include ownership of Founder Shares and the possibility of future compensatory arrangements. See the section entitled “Proposal No.1 – The Extension Amendment Proposal—Interests of the Founders.” |

| |

|

|

| Q. |

What if I object to the Extension Amendment Proposal? Do I have appraisal rights? |

A. If you do not want the Extension Amendment Proposal to be approved, you must vote against such proposals, abstain from voting, or refrain from voting. If holders of public shares do not elect to redeem their public shares, such holders shall retain redemption rights in connection with any future business combination we propose. You will still be entitled to make the Election if you vote against, abstain or do not vote on the Extension Amendment Proposal. In addition, public stockholders who do not make the Election would be entitled to redemption if we have not completed a business combination by March 14, 2023. Our stockholders do not have appraisal rights in connection with the Extension Amendment Proposal under the DGCL. |

| |

|

|

| Q. |

What happens to our warrants if the Extension Amendment Proposal is not approved? |

A. If the Extension Amendment Proposal is not approved, and the initial business combination not consummated by March 14, 2023 (or by December 14, 2023 if extended), the Company will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account including interest earned on the funds held in the Trust Account and not previously released to the Company to pay its taxes or for working capital purposes (less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidating distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of the Company’s remaining stockholders and the Board, dissolve and liquidate, subject in each case to the Company’s obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. There will be no redemption rights or liquidating distributions with respect to our warrants, which will expire worthless in the event the Company winds up. |

| |

|

|

| Q. |

What happens to our warrants if the Extension Amendment Proposal is approved? |

A. If the Extension Amendment Proposal is approved, we will continue our efforts to consummate a business combination until end of the Paid Extension Period, and will retain the blank check company restrictions previously applicable to us. The warrants will remain outstanding in accordance with their terms. |

| Q. |

What do I need to do now? |

A. We urge you to read carefully and consider the information contained in this proxy statement, including the annexes, and to consider how the proposals will affect you as our stockholder. You should then vote as soon as possible in accordance with the instructions provided in this proxy statement and on the enclosed proxy card. |

| |

|

|

| Q. |

How do I vote? |

A. If you are a holder of record of Common

Stock, you may vote in person at the special meeting or by submitting a proxy for the special meeting. Whether or not you plan to attend

the special meeting in person, we urge you to vote by proxy to ensure your vote is counted. You may submit your proxy by completing, signing,

dating and returning the enclosed proxy card in the accompanying pre-addressed postage paid envelope. You may still attend the special

meeting and vote in person if you have already voted by proxy.

If your shares of Common Stock are held in “street

name” by a broker or other agent, you have the right to direct your broker or other agent on how to vote the shares in your account.

You are also invited to attend the special meeting. However, since you are not the stockholder of record, you may not vote your shares

in person at the special meeting unless you request and obtain a valid proxy from your broker or other agent. |

| |

|

|

| Q |

How do I redeem my shares of Common Stock? |

A. If the Extension Amendment is implemented,

each public stockholder may seek to redeem such stockholder’s public shares for its pro rata portion of the funds available in the

Trust Account, less any income taxes owed on such funds but not yet paid. You will also be able to redeem your public shares in connection

with any stockholder vote to approve a proposed business combination, or if the Company has not consummated a business combination by

March 14, 2023.

In connection with tendering your shares for redemption,

you must elect either to physically tender your share certificates to VStock Transfer, LLC, the Company’s transfer agent, at 18

Lafayette Place, Woodmere, NY 11598, Attn: Chief Executive Officer, at least two business days prior to the special meeting or to deliver

your shares to the transfer agent electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) System,

which election would likely be determined based on the manner in which you hold your shares.

Certificates that have not been tendered in accordance

with these procedures at least two business days prior to the special meeting will not be redeemed for cash. Any request for redemption,

once made by a public stockholder, may not be withdrawn once submitted to us unless our Board determines (in its sole discretion) to permit

the withdrawal of such redemption request (which they may do in whole or in part). In addition, if you deliver your shares for redemption

to the transfer agent and later decide prior to the special meeting not to redeem your shares, you may request that the transfer agent

return the shares (physically or electronically). You may make such request by contacting our transfer agent at the address listed above. |

| Q. |

What should I do if I receive more than one set of voting materials? |

A. You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards, if your shares are registered in more than one name or are registered in different accounts. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Please complete, sign, date and return each proxy card and voting instruction card that you receive in order to cast a vote with respect to all of your shares. |

| |

|

|

| Q. |

Who can help answer my questions? |

A. If you have questions about the

proposals or if you need additional copies of the proxy statement or the enclosed proxy card, you should contact our proxy solicitor at:

Advantage Proxy, Inc.

P.O. Box 13581

Des Moines, WA 98198

Attn: Karen Smith

Toll Free: (877) 870-8565

Collect: (206) 870-8565

Email: ksmith@advantageproxy.com

If you are a holder of public shares and you intend

to seek redemption of your shares, you will need to deliver your share certificates (if any) and other redemption forms (either physically

or electronically) to our transfer agent at the address below at least one (1) business day prior to the vote at the extraordinary general

meeting. If you have questions regarding the certification of your position or delivery of your subunit certificates (if any) and other

redemption forms, please contact:

VStock Transfer, LLC

18 Lafayette Place,