Acadia Pharma Shares Touch 52-Week Low After FDA AdCom Vote

22 June 2022 - 1:31AM

Dow Jones News

By Colin Kellaher

Shares of Acadia Pharmaceuticals Inc. lost a third of their

value and hit a new 52-week low after the latest setback in the

pharmaceutical company's efforts to win expanded U.S. Food and Drug

Administration approval for its Nuplazid antipsychotic drug.

Acadia late Friday said an FDA advisory committee voted 9-to-3

that the evidence presented doesn't support a conclusion that

Nuplazid is effective for the treatment of hallucinations and

delusions associated with Alzheimer's disease psychosis.

Nuplazid has been approved in the U.S. since 2016 to treat

hallucinations and delusions associated with Parkinson's disease

psychosis, and the FDA is weighing Acadia's request for expanded

use in patients with Alzheimer's, with a decision expected by Aug.

4.

Wall Street analysts in general believe that the advisory

committee vote means the FDA will once again reject the

application.

Acadia in 2020 filed for FDA approval of Nuplazid to treat

hallucinations and delusions associated with dementia-related

psychosis, but the agency turned the application away in April

2021, citing, among other things, a lack of statistical

significance in some of the subgroups of dementia.

The company resubmitted its application in February of this

year, this time seeking approval in patients with Alzheimer's

disease.

Acadia said it is disappointed with the vote, and that it

believes there is substantial evidence across multiple independent

clinical studies and endpoints that supports the efficacy of

Nuplazid in Alzheimer's disease psychosis.

The FDA isn't required to follow the advice of its advisory

committees, but it usually does, and analysts at Mizuho Securities

said in a research note that they expect the agency will once again

reject Acadia's application and request another study.

The negative advisory committee vote prompted several Wall

Street firms to cut their price targets on Acadia shares, as many

now expect the FDA to issue a so-called complete response letter,

or CRL, by Aug. 4, indicating that the agency won't approve the

application in its current form.

On a potentially positive note, Citi analyst Neena Bitritto-Garg

said a CRL could make Acadia a potential takeover target for

biopharmaceutical companies looking to boost their revenue.

Nuplazid sales exceeded $480 million last year, and the company has

forecast 2022 sales of $510 million to $560 million.

Acadia shares were recently changing hands at $12.64, down

35.2%, after hitting a 52-week low of $12.24 earlier in the

session.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

June 21, 2022 11:16 ET (15:16 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

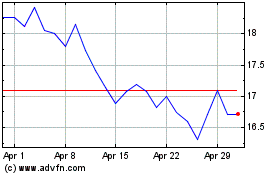

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

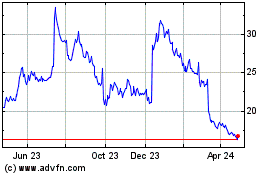

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Apr 2023 to Apr 2024