Filed by Atlantic Coastal Acquisition Corp.

This communication is filed pursuant to Rule 425

under

the United States Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Atlantic Coastal Acquisition Corp.

Commission File Number: 001-40158

Date: December 1, 2021

Key Customer Memo

When: December 1, 2021

From: Blake Teipel

To: Key Customers

Subject: Essentium is Going Public!

Dear Valued Partner,

I am pleased to share with you some exciting news about our company:

today we announced that Essentium plans to go public and the combined company will list on the Nasdaq Stock Market through a business

combination with Atlantic Coastal Acquisition Corp. (“Atlantic Coastal”) (Nasdaq: ACAH).

This highly strategic transaction will provide Essentium with significant

additional financial resources that will enable us continue transforming the future landscape of supply chains by delivering truly distributed

and sustainable manufacturing and operating solutions. We believe that going public will allow us to service mission critical verticals

and deliver tangible value to our customers across the aerospace and defense, automotive, biomedical, consumer goods, contract manufacturing,

electronics manufacturing, and energy and alternatives industries. Ultimately, we look forward to deploying our increased capital to become

stronger partners to you.

While our company’s ownership structure will change upon close

of the transaction, we will continue to operate as “Essentium” under my continued direction as Chief Executive Officer, with

the support of our experienced management team, including Chief Operating Officer Lars Uffhausen, and Chief Financial Officer Jonathan

Bailiff. The newly combined company is expected to be listed on the Nasdaq Stock Market under the ticker symbol “ADTV” and

will be positioned to grow with new financial resources as a public company.

As we enter this new phase, we will remain focused on execution and

operational excellence as we continue to provide our strategic partners and customers with a great experience utilizing our disruptive

additive manufacturing technology.

Thank you for being a great partner. For more information, you can

view a press release on this announcement below. Please don’t hesitate to reach out with any questions.

Sincerely,

Dr. Blake Teipel

CEO of Essentium

Customer FAQs

Customer / Partner Specific FAQs

Q – Will my contact at Essentium change?

A – No. Your contact at Essentium will not change as a

result of this transaction.

Q – What will happen to existing contracts, proposals, and

business initiatives previously submitted by Essentium?

A – All previous business contracts, proposals, and initiatives

previously submitted will continue to be serviced by the same teams as prior to the business combination.

Q – What is the purpose of the Essentium and Atlantic Coastal

business combination?

A – The Essentium and Atlantic Coastal business combination

will result in Essentium becoming a public company with significant additional financial resources that will enable it to accelerate its

growth, strengthen its capital structure, and expand its market leading product innovation strategy to offer its customers enhanced support

across the additive manufacturing and 3D printing markets.

Typical Public Company FAQs

Q – What is the change occurring

at Essentium?

A – Essentium’s business is

becoming publicly traded and the combined company will be listed on the Nasdaq Stock Market (Nasdaq: ADTV).

Q – What does it mean to be a

“U.S. public company”?

A – To be a U.S. public company means

that the company is permitted to offer its securities (stock, bonds, etc.) for sale to the general public, typically through a stock exchange.

Q – What is the reason or benefit(s)

for going public?

A – Becoming a public company provides

Essentium with a number of benefits, including:

|

|

·

|

access to a broader source of capital to help fund our growth;

|

|

|

·

|

the ability to support our growth and operations; and

|

|

|

·

|

improved awareness and brand recognition.

|

Additionally, going public will provide us with

significant financial resources that will enable us to continue transforming the future landscape of supply chains by delivering truly

distributed, sustainable manufacturing and operating solutions.

Going public has been part of the long-term vision

for Essentium, and our business model has always focused on growth. However, we do not expect it to change our long-term strategies or

day-to-day operations. We are proud of what we are building, and we will continue to operate in a seamless manner once Essentium becomes

a publicly traded company.

Q – Will our company name change?

A – No, we will continue to operate

under the Essentium name.

Q – Will our company website URL change?

A – Our company website URL will

not change.

Q – What exchange will Essentium

list on and what will the ticker symbol be?

A – Immediately upon the closing

of the proposed transaction, Essentium is expected to list on the Nasdaq Stock Market under a new ticker “ADTV.”

Q – Has Essentium’s management

committed to stay on after the transaction is complete?

A – We expect Essentium’s existing

management team, which is dedicated to our long-term success, to continue to lead the company.

Essentium’s management team possesses a deep scientific and supply

chain background and includes Chief Executive Officer Blake Teipel, Chief Operating Officer Lars Uffhausen, Chief Financial Officer Jonathan

Bailiff, as well as Chief Development Officer Elisa Teipel, Chief Commercial Officer Blake Mosher, Chief Technology Officer Jeff Lumetta,

and Chief Supply Chain Officer Erik Gjovik.

Q – Who will be the board members

of the public company?

A – Essentium will be guided by an

experienced Board of Directors, and Essentium’s Chief Executive Officer, Blake Teipel will continue to lead the combined company

along with the current management team, including Chief Operating Officer Lars Uffhausen, Chief Financial Officer Jonathan Bailiff. Additional

details about the proposed Board structure will be provided in future public filings with the SEC.

Q – How will becoming a public

company affect the business?

A – We expect that becoming a public

company will primarily impact our capital structure and have little practical impact on our day-to-day operations. We will continue to

remain focused on operational excellence.

We expect the only items to change will be our

new status and reporting duties as a public entity. Our management team will remain the same. Our commitment to our employees, partners,

and customers will not change. We may hire additional personnel to support our ability to comply with public company obligations, to function

as a public company, and strengthen our growth.

Q – What will the new organizational

structure look like?

A – Our leadership structure will remain the same,

under the leadership of our Chief Executive Officer, Blake Teipel, Chief Operating Officer Lars Uffhausen, Chief Financial Officer Jonathan

Bailiff, as well as Chief Development Officer Elisa Teipel, Chief Commercial Officer Blake Mosher, Chief Technology Officer Jeff Lumetta,

and Chief Supply Chain Officer Erik Gjovik. Additional details about the proposed Board structure will be provided in future public filings

with the SEC.

Cautionary Statement Regarding Forward-Looking Statements

This document contains certain forward-looking

statements within the meaning of the federal securities laws with respect to the proposed business combination (the “Proposed Business

Combination”) between Essentium and Atlantic Coastal, including statements regarding the benefits of the Proposed Business Combination,

the anticipated timing of the Proposed Business Combination, the services offered by Essentium and the markets in which it operates, and

Essentium’s projected future results. These forward-looking statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,”

“future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,”

“will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements

are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties that could cause the actual results to differ materially from the expected results. Many

factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not

limited to: (i) the risk that the Proposed Business Combination may not be completed in a timely manner or at all, which may adversely

affect the price of Atlantic Coastal’s securities, (ii) the risk that the acquisition by Essentium, Inc. of each of Compass AC Holdings,

Inc. and Whizz Systems, Inc. may not be completed in a timely manner or at all, (iii) the risk that the Proposed Business Combination

may not be completed by Atlantic Coastal’s business combination deadline and the potential failure to obtain an extension of the

business combination deadline if sought by Atlantic Coastal, (iv) the failure to satisfy the conditions to the consummation of the Proposed

Business Combination, including the receipt of the requisite approvals of Atlantic Coastal’s shareholders and Essentium’s

stockholders, respectively, the satisfaction of the minimum trust account amount following redemptions by Atlantic Coastal’s public

shareholders and the receipt of certain governmental and regulatory approvals, (v) the lack of a third party valuation in determining

whether or not to pursue the Proposed Business Combination, (vi) the occurrence of any event, change or other circumstance that could

give rise to the termination of the agreement and plan of merger, (vii) the effect of the announcement or pendency of the Proposed Business

Combination on Essentium’s business relationships, performance, and business generally, (viii) risks that the Proposed Business

Combination disrupts current plans of Essentium and potential difficulties in Essentium employee retention as a result of the Proposed

Business Combination, (ix) the outcome of any legal proceedings that may be instituted against Essentium or against Atlantic Coastal related

to the agreement and plan of merger or the Proposed Business Combination, (x) the ability to maintain the listing of Atlantic Coastal’s

securities on The Nasdaq Stock Market LLC, (xi) the price of Atlantic Coastal’s securities may be volatile due to a variety of factors,

including changes in the competitive and highly regulated industries in which Essentium plans to operate, variations in performance across

competitors, changes in laws and regulations affecting Essentium’s business and changes in the combined capital structure, (xii)

the ability to implement business plans, forecasts, and other expectations after the completion of the Proposed Business Combination,

and identify and realize additional opportunities, (xiii) the impact of the global COVID-19 pandemic, (xiv) the enforceability of Essentium’s

intellectual property, including its patents, and the potential infringement on the intellectual property rights of others, cyber security

risks or potential breaches of data security, (xv) the ability of Essentium to protect the intellectual property and confidential information

of its customers, (xvi) the risk of downturns in the highly competitive additive manufacturing industry, and (xviii) other risks and uncertainties

described in Atlantic Coastal’s registration statement on Form S-1 (File No. 333-253003), which was originally filed with the U.S.

Securities and Exchange Commission (the “SEC”) on February 11, 2021 (the “Form S-1”), and its subsequent Quarterly

Reports on Form 10-Q. The foregoing list of factors is not exhaustive. These forward-looking statements are provided for illustrative

purposes only and are not intended to serve as, and must not be relied on by an investors as, a guarantee, an assurance, a prediction

or a definitive statement of fact or probability. You should carefully consider the foregoing factors and the other risks and uncertainties

described in the “Risk Factors” section of the Form S-1, Quarterly Reports on Form 10-Q, the Registration Statement (as defined

below), the proxy statement/prospectus contained therein, and the other documents filed by Atlantic Coastal from time to time with the

SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially

from those contained in the forward-looking statements. These risks and uncertainties may be amplified by the COVID-19 pandemic, which

has caused significant economic uncertainty. Forward-looking statements speak only as of the date they are made. Readers are cautioned

not to put undue reliance on forward-looking statements, and Essentium and Atlantic Coastal assume no obligation and do not intend to

update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required

by securities and other applicable laws. Neither Essentium nor Atlantic Coastal gives any assurance that either Essentium or Atlantic

Coastal, respectively, will achieve its expectations.

Additional Information and Where to Find It

In connection with the Potential Business Combination,

Atlantic Coastal will file a registration statement on Form S-4 (the “Registration Statement”) with the SEC, which will include

a preliminary proxy statement to be distributed to holders of Atlantic Coastal’s ordinary shares in connection with Atlantic Coastal’s

solicitation of proxies for the vote by Atlantic Coastal’s shareholders with respect to the Proposed Business Combination and other

matters as described in the Registration Statement, as well as the prospectus relating to the offer of securities to be issued to Essentium

stockholders in connection with the Proposed Business Combination. After the Registration Statement has been filed and declared effective,

Atlantic Coastal will mail a definitive proxy statement, when available, to its shareholders. The Registration Statement will include

information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Atlantic Coastal’s

shareholders in connection with the Potential Business Combination. Atlantic Coastal will also file other documents regarding the Proposed

Business Combination with the SEC. Before making any voting decision, investors and security holders of Atlantic Coastal and Essentium

are urged to read the Registration Statement, the proxy statement/prospectus contained therein, and all other relevant documents filed

or that will be filed with the SEC in connection with the Proposed Business Combination as they become available because they will contain

important information about the Proposed Business Combination.

Investors and security holders will be able to

obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Atlantic

Coastal through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Atlantic Coastal may be obtained

free of charge from Atlantic Coastal’s website at www.Atlantic Coastalv.io or by written request to Atlantic Coastal at Atlantic

Coastal Acquisition Corp., 6 St Johns Lane, Floor 5, New York, NY 10013.

Participants in the Solicitation

Atlantic Coastal and Essentium and their respective

directors and officers may be deemed to be participants in the solicitation of proxies from Atlantic Coastal’s shareholders in connection

with the Proposed Business Combination. Information about Atlantic Coastal’s directors and executive officers and their ownership

of Atlantic Coastal’s securities is set forth in Atlantic Coastal’s filings with the SEC. To the extent that holdings of Atlantic

Coastal’s securities have changed since the amounts printed in the Form S-1, such changes have been or will be reflected on Statements

of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons

who may be deemed participants in the Proposed Business Combination may be obtained by reading the proxy statement/prospectus regarding

the Proposed Business Combination when it becomes available. You may obtain free copies of these documents as described in the preceding

paragraph.

Atlantic Coastal Acquisi... (NASDAQ:ACAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

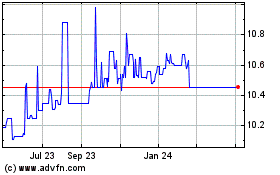

Atlantic Coastal Acquisi... (NASDAQ:ACAH)

Historical Stock Chart

From Apr 2023 to Apr 2024