Filed by Atlantic Coastal Acquisition Corp.

This communication is filed pursuant to Rule 425 under

the United States Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Atlantic Coastal Acquisition

Corp.

Commission File Number: 001-40158

Date: December 1, 2021

Essentium, Inc. and Atlantic Coastal Acquisition Corp.

Audio NetRoadshow Transcript

December 1, 2021

Shahraab

Ahmad, Chairman and CEO of Atlantic Coastal Acquisition Corp.

Hi everyone. My name is Shahraab Ahmad. I am the

CEO of Atlantic Coastal which is merging with Essentium. Just a little background about Atlantic Coastal search for a merger target. We

looked at a large number of companies. Focused very much in the mobility space with companies with the revolutionary technology that is

already commercial. We were not looking to buy any science projects, but something that is already built to scale and is looking for the

right growth capital.

What we realized very quickly is that a lot of

these companies often have the right technology, but do not necessarily have the management breadth to come up with the ability to deploy

the capital immediately. One of the things that we love about Essentium is that you will meet the CEO today. You will meet the CFO today.

But behind them, there is a pool of managers that have worked at large-scale organizations, built large-scale organizations, and really

know how to scale quickly. As we complete this transaction and Essentium gets the growth capital, they will be able to hit the ground

running and deploy the capital prudently and effectively very quickly.

Another reason we love Essentium is Blake Teipel

the CEO. There are very few times that you come across a CEO who has the level of technical knowledge – in this case material science

knowledge – that Blake has, combined with such great business acumen. We think this is an amazing combination and will serve Essentium

well. The other thing you realize over time is that Essentium is a really mature company. It is a really well-built company. A lot of

that comes down to Blake himself.

Also on the call today is Jonathan Baliff who

is the interim CFO of Essentium. JB brings with him a host of public company experience. He has been a public CFO. He has been a public

CEO. He spent 12 years at the US Air Force, and also has a background in investment banking. JB just completed the de-SPAC of Genesis

Park which was a SPAC that merged with Red Wire where he was a president and ran the M&A process. So obviously JB knows the SPAC and

M&A process as well. We think that will help tremendously in making this a smooth transaction going forward.

On the Atlantic Coastal side, you have me Shahraab

Ahmad with 20 years of public and private market experience. I have raised billions of dollars for the funds that I have worked for. I

have been investing in the mobility space since 2012, which is how me and Tony Eisenberg, our Chief Strategy Officer, know each other.

Tony has a background in the private investing markets with a particular focus on ESG and the industrial sector.

The biggest proponent of Essentium within the

Atlantic Coastal team has been Burt Jordan, the President of our SPAC. Burt has spent 30 years in the auto industry, of which 20 years

were spent as an executive at Ford. His last role there was running Ford’s $80 billion annual procurement budget and the supply

chain. He has also been involved in a number of tech initiatives at Ford, including JVs with technology partners such as Blackberry and

Nvidia, and with that I will hand it over to Burt to talk about how he sees the process going forward.

Burt Jordan,

President of Atlantic Coastal Acquisition Corp.

Hello and thank you Shahraab. As Shahraab noted, I

have spent 30 years in the automotive industry and more specifically in the supply chain working with manufacturing companies. Shahraab

is correct. Essentium does excite me. As you probably know, the automotive industry is going through the most disruptive time in its history

as it transitions to electrified vehicles coupled with connectivity and mobility services. You add in Industry 4.0 and the current supply

chain issues and bottlenecks, Essentium is the perfect answer. As I look at the automotive industry there are some very specific areas

that can assist in driving the businesses forward.

As it relates to spare parts, they can assist

in multiple ways. First with the OEMs they can provide systems, and the OEMs can eliminate inventory and the need to hold tools for vehicles

that are no longer in production. They can also help the OEMs and dealers by having systems at the dealers so the dealers can print parts

in real-time and eliminate the need to have customers waiting days, weeks, and in the current environment potentially months. You can

even carry it further in the spare parts business as Essentium can support the after-market shops such as Pep Boys, AutoZone, et cetera.

Then as you think about the manufacturing plants

themselves, they could support the tool cribs and the needed spare parts in the facilities. Further, they can support the supply base

by providing tools, fixtures, and jigs to support the parts that need to be built. These are just some of the areas that Essentium could

support right out of the gate. Today you will hear some of the things they are doing with the DoD. But this could be extended not only

to the DoD and the automotive area, but other areas in the consumer products area and even further into the aerospace industry. I think

Essentium has the ability to transform many industries and businesses. With that, I will turn it back over to Shahraab.

Shahraab

Ahmad, Chairman and CEO of Atlantic Coastal Acquisition Corp.

Thank you Burt. Just a little bit more about Atlantic

Coastal. Our team has extensive capital market experience through Burt Jordan and Brian Dobbs’ extensive experience in running large-scale

organizations. We have a number of VC’s on our team who successfully invested in next generation companies. As a sponsor, we feel

very confident that we are properly able to do due diligence and understand the opportunity here.

Just to go over the main items of the transaction,

we are merging with Essentium, which is valued at a $974 million enterprise value, implying a 4.6 times 2023 revenue multiple. It is highly

attractive versus peers and coming at a substantial discount. We will go through the mechanics of the discount later in the presentation.

Atlantic Coastal has $345 million in trust. We

are raising a $42 million PIPE alongside. All of Essentium’s current shareholders are rolling over their equity. With that I will

pass it over to Blake Teipel, the CEO of Essentium.

Blake Teipel,

Ph.D. CEO and Co-Founder of Essentium

Essentium is laser focused on the transition for

industry 4.0. We facilitate seamless transitioning for supply chain architects and manufacturing engineers to use advanced manufacturing

solutions like high-speed additive manufacturing. Essentium has an extrusion-based architecture. We sell holistic end-to-end ecosystem

solutions inclusive of the machine, the materials, the software, and the service contracts. This is represented in a razor and razor-blade

business model and underpins the forecast of the financial aspects of this transaction.

From a company standpoint we have over 150 patents

in our portfolio. Our patents are differentiated around materials, machines, software, and process. We have been working with the Department

of Defense since 2019, and we have over $30 million in DoD contracts. These are comprised of the largest DoD contracts ever awarded for

additive manufacturing development. This is distinctive as no other additive manufacturing company in the space has a contract portfolio

of this size. Essentium is not only a DoD company, however, we are not only an A&D company as well. We are a dual-use company serving

a variety of industrial verticals in every major sector.

So in addition to the $30 million in DoD contracts,

we have a $3.4 billion pipeline visibility on the commercial side of our business. This is a pipeline comprised of a lifetime value in

revenue opportunity against commercial conversations with identified opportunities where our sales leads are speaking now to known and

identified potential clients. From a total addressable market perspective, we have a $318 billion TAM which is the broadest across any

additive manufacturing opportunity. The reason we can access such a broad TAM is the breadth of our materials and the low total cost of

ownership of our ecosystem.

We bring together speed, strength, and scale unlocking

ground-breaking value for the future of manufacturing. Our company started in 2013 as a research services company. We focused on contracts

from the National Science Foundation, Ford Motor Company, PepsiCo, and others. We are focused on creating the next generation of essential

materials. We won an industry award from the Society of Manufacturing Engineers for groundbreaking technology known now as FlashFuse.

FlashFuse simply put is the combination of electromagnetic energy and 3D printing. You can think of it as a microwave combined with a

3D printer. This creates volumetric heating for the printed part and creates printed parts that have the mechanical properties of an injection

molded part. Industry first that is totally distinctive.

In 2017 we started developing the technology at

broader scale. In 2018 BASF venture capital led our series A round. This was the first VC-led round where BASF venture capital took the

lead. BASF has been a three-peat investor in Essentium and is standing tall. It is pre-committed in the pipe portion of this transaction.

In 2019 we began working with the US Department

of Defense for the Air National Guard at Lackland Air Base in San Antonio, Texas. In 2020, we were then awarded a $26.5 million extension

of the initial award. This was a contract which represents the largest developmental award ever given for the development of holistic

capabilities based on advanced manufacturing technologies of additive manufacturing in the history of the Air Force. We also were shipping

our units internationally, including to China, Israel, Canada, and so forth.

Now in 2021 and beyond, today, we are poised on

the cusp of rapid, expansive, commercialization based on this history of R&D. We are not backing away from R&D, however. We were

selected for an incremental award from the US Air Force to develop differentiated and disruptive metals additive manufacturing technology,

which I will describe in greater detail later in the day. We are also working with Palantir to develop highly secure end-to-end data security

products to securitize the digital threat.

Essentially as you can see here, there will be

structural tailwinds underpinning the growth of the stock for a long time to come. The world is becoming a less secure place as you can

see from everything from trade wars to the pandemic. We are seeing glimpses of solutioning for this from a distributive manufacturing

and distributive production perspective. Additive manufacturing underpins a key pillar of the growth into distributive manufacturing.

In particular, additive manufacturing has an incredible ESG profile. I just want to highlight from a sustainability aspect, there is on

average 70% lower waste and 70% lower energy consumed in the production of a part that is 3D printed or additively manufactured versus

the classic subtractive machining-based approach.

In addition to this, inherent value, which is

unique in additive, also our technology limits the carbon footprint of supply chains by pushing inventories to the cloud, reducing the

total size of production runs because you do not need to overproduce to anticipate end of life service parts. Those service parts can

simply be additively manufactured at the end of life, which again results in further environmental improvements, greater sustainability

profile for the technology, and cost savings for the users of the technology itself.

We already are shipping holistic ecosystems comprised

of polymer additive machines, advanced polymer and composite materials, and a holistic services offering. Speaking now about the polymer

machines themselves again, our machines were built like a semi-conductor capital equipment-based robot. Which means we have a high-speed

precision robotics architecture for our motion system. This means we print parts very fast. On average, we can produce the parts five

to 15 times faster than traditional additive manufacturing. This allows a high degree of data accuracy as well and facilitates the qualification

of additional materials for the US Department of Defense. Additional materials for flight critical applications.

We produced in-house. We have a materials manufacturing

factory. We produce in-house polymers and composite recipes, over 50 different grades of materials. We have a robust patent portfolio

and since we produce materials in house at our factory in Austin, Texas we actually have an incredible amount of trade secret know-how

that protects again the know-how and the ability for us to produce our grades of materials. We have a holistic service offering in the

form of service contracts and high-touch service initiatives with clients again like the US Air Force, the Air National Guard, Reebok,

and others who we have helped get into certification and/or get into production using our ecosystem.

In the future, systems that we are building on

the right-hand part of the page, this is page 13. We are building a robust cloud-edge compute solution to allow operation of our

systems at the edge of an area of contestable logistics in particular for the DoD. And also we are building software, security, and digital

threat solutions both internally and with our partner Palantir.

We are also building robust metal additive manufacturing

systems and inherent consumables. This will prepare Essentium and position Essentium to be a one-stop-shop or truly comprehensive ecosystem

enabling advanced manufacturing at greater scales than ever before. Speaking about scale, we are bringing together the cost vector and

the capability vector. Speaking now about the latter. The capability vector is shown illustratively on the left-hand part of the page.

We can match the ZX tensile properties of injection molded parts with our proprietary flash use technology, whereas other additive manufacturing

techniques simply cannot. You combine this capability with a low total cost of ownership. We performed an apples-to-apples comparison

of a one-pound nylon part. You could see the cost curve. It is classic for injection molding as the job size increases, the cost per part

decreases. You should amortize in, for example the cost of tooling and the cost of the molding itself. This is a classic well understood

phenomenon.

Now the two horizontal lines on the upper part

of the graph and the upper part of the figure, you have a light gray line. That is an $84 average part cost for again a one-pound nylon

part produced on a classic additive manufacturing system. The incumbent technology. Our technology cuts this cost down to on average $17

per part, allowing greater scale. Now we are cost effective at around 10,000 parts or more per job. This allows the production at greater

scales of additively manufactured parts. Again, in sum here is the combination of high capability that is the ability to match the strength

of injection molded parts and low total cost of ownership that you can find distinctively with Essentium.

What this means for clients with DoD. We started

working in 2019 with a single system for the US Air Guard at Lackland Air Base, 149th Fighter Wing in San Antonio, Texas. In

2020 we were awarded as part of the inaugural class of a strategic financing contract in the US Department of Defense for the Air Force.

AF works with the contracting office, we picked up customers including the Air Force Lifecycle Management Center, the Rapid Sustainment

Office, the Air National Guard, and the Air Force Research Laboratories. You can see the system build as we have increased the shipment

of our systems to these clients. But it is more than just the shipment of systems. This contract provides programmatic revenue which goes

out for a period of four years. We are one year in, so that leaves three years remaining in the award. Based on the initial success, we

are seeing the increase of new customers from the DoD added to the portfolio. We have already started shipping to the Army and the US

Navy. That is in 2021. You can see the evolution of the anticipated growth of the systems inclusive of polymer and metal systems as we

go.

Speaking now about the metals solution, we have

been notified of an award for the development of disruptive metals technology built on an extrusion-based ecosystem, again funded by the

US Air Force with interest from the US Space Force. I will get into more detail on that later in the deck. This shows a selected representation

of Essentium’s existing client base across every major industrial vertical. From left to right you can see our corporate partnerships,

including the fact BASF, by the way, is also a customer. Palantir is a customer as well, and we are working well on solutions with them.

I am sorry. Palantir is a vendor to Essentium and working with solutions with them to bring to the market in greater scale.

Materialise is as well as an investor and a partner

on software products. We anticipate seeing a launch of an extrusion-based software solution in conjunction with Materialise in the near-term.

We have clients across the government and military in the aerospace and defense sectors. As you move from left to right across the page,

what you can see is a broad representation of blue-chip customers across every major industrial vertical. These are existing Essentium

clients, in some cases these in fact are repeat clients.

You can see this represented on the left-hand

part of the page. This is phase one. This is the existing addressable market that Essentium can access today based on our plastic and

composite based ecosystem. Incremental to this, you can see the representation of an $85 billion addressable market that is unlocked as

we launch our metals printers anticipated to hit the marketplace in 2023. Incremental to that, is the combination of data and software

products that Essentium is working on now both internally and with partners as we bring a holistic digital suite to the marketplace again

in the out years across the forecast. Add all these together, and you have a $318 billion total addressable market which is the largest

that you can see for any additive manufacturing technology.

I would like to illustrate the global presence

of our company and introduce you to members of our management team. On the top half of the page you can see that Essentium has a

global presence. We are headquartered in Austin, Texas with our machine and supply chain center of excellence out of Irvine, California,

as well as the other sites that you can see here. I am joined today on the call by my colleague Jonathan Baliff, our Interim CFO who has

a long-standing background with the US Air Force as well as public equity capital markets with his time at Credit Suisse. Then also he

is an operating partner at Genesis Park. Then recently on the buy-side from the Genesis Park SPAC that merged successfully and conducted

a de-SPAC with Redwire. Jonathan joins our team with a strong and robust operating background. We are glad to have him on board.

In addition, I will share a couple quick

vignettes of other members of our management team. For example, Lars Uffhausen our COO, built a small company, Wolfe Engineering, up from

a job shop into a billion-dollar business that was later acquired by Jabil Corporation. Lars went to join the Strategic Capabilities Group

at the Jabil Executive Office with a $12 billion revenue contribution.

Elisa Teipel has worked as a Chief Development

Officer at Essentium for a long time. She has held contracts with the National Science Foundation. She has worked with Ford Motor Company.

She also spearheads now most importantly the Essentium X Group which aligns with our government business, through the US Air Force, and

the other branches of service.

Blake Mosher, our Chief Commercial Officer, is

a long-term revenue formator. He built tier one serving companies like Ford and Dell.

Jeff Lumetta was the Chief Technology Officer

at Jabil Corporation. He started out as a test engineer and worked his way up over a 30-year career at Jabil. By the time he retired,

he had a worldwide engineering responsibility, and Jabil had a $22 billion market cap. Jeff came out of retirement to join Essentium and

help build out Essentium, that same type of company with a global presence, and globally expansive production reach to serve clients like

Jabil. He knows again what good looks like, as well as the rest of our team.

Erik Gjovik has an aerospace background, and then

he also has a semiconductor capital equipment background working on Orthodyne Electronics. After that he had a short stint at Apple where

he had worldwide responsibility as a supply-based engineering manager for laptop machining for the Apple MacBook Pro Retinas. He had 13,000

CNC mills under his command. He then had a short stent at Jabil, and then left to become a co-founder at Essentium.

Flipping now to discuss our advanced technology

and how it is protected and proprietary, we now are in discussion around our proprietary systems technology. If you look at our systems,

we have small printers, medium, and large printers. We are currently in the market with our HSE180 and our HSE280i. We are launching an

HSE240 in the spring of 2022. We anticipate launching a metals machine in 2023. The expansion of our product line on the machine’s

side, this represents the razor part of our razor/razor blade business model. This expansion of our machines is a big portion of the organic

growth that is represented in the financial model that Jonathan will go through in a few minutes.

Popping the hood of the system for a minute, if

you take a look inside what you will find is we use an all-linear motion system comprised of highly advanced linear motors, servo driven

X-Y controls in which we can achieve 3D acceleration one meter per second motion at one-micron positional accuracy. We use high-spec heated

nozzles with incredible wear resistance in one of the sharpest heat breaks in the industry. This provides rapid response and incredibly

high temperature capabilities.

Since we use linear motors, we have the opportunity

to use what is called IDEX or independent extrusion architecture. This allows dual-head capability inside of our machines. For example,

Essentium’s 280i is a dual head system with independent extruders allowing copy mode and multiple operating modes, completely turbo

charging even further the production throughput of this high-class system. Finally, our flash fuse technology is the combination of electromagnetic

energy and 3D printing, which for the first time provides parts that create uniform mechanical properties which unlocks functional end-use

full-scale manufacturing. We are in development now on advanced metal printing capabilities that work on and expand our extrusion-based

workflow.

You can see the outcomes that we can create, illustratively

we are again anywhere between five and 15 times faster on average than classic extrusion. For example, in a month we can produce around

ten times the amount of parts for this particular type of geometry. That is on the left-hand side of the page. On the right-hand side

of the page the US Air Force contracted with the University of Dayton Research Institute to provide independent third-party analysis

of our all-in average system operating costs. As you can see, we are on average 80% lower cost than incumbent technology.

Essentium again manufactures and offers over 50

different grades of polymer and composite materials with a broad mode of patents protecting the process, the material, the formulation,

the fillers, et cetera. We produce both monofilament and multi-layered filament. The bulk of our production centers on a true monofilament

technology capability. We have seminal patents in this space where multi-layered filament really matters. We can create a core shell architecture

with a distinctive outer layer of electrically active nanomaterials. What this means is I can produce 3D printer materials that are clean

room safe and are electrically conductive and electrically dissipative. These dissipative properties and conductive properties are shown

illustratively in the figure on the bottom right-hand part of the page. We can produce again clean room safe electrostatically dissipated

or ESD safe materials.

To discuss our metals at a high level, we are

developing a distinctive and disruptive metals technology that expands our extrusion-based franchise for metals systems that combine high

throughput extrusion-based workflows on printer, on printer metallurgy, and a sinter-free post processing operation. We unlock metallurgies

from the broadest range of metals known. Everything from bare aluminums all the up to refractory metals. We also produce microstructures

that are suitable for safety critical applications without necessarily requiring extensive OC treatment in a secondary operation.

We have shown in sum that Essentium has proprietary

groundbreaking technology that is being used for both indirect and direct solutions. That is to say functional end-use parts in factories

and functional end-use parts that have to do with consumer applications. This is such as end-use factory parts like tooling, jigs and

fixtures, masking, et cetera. We serve every mission critical vertical that you could imagine. Aerospace, automotive, energy and alternative

energies, biomedical, and many other examples.

And finally, on the right-hand part of the page we

have demonstrated customer impact such as case studies shown here where we are not only able to deliver incredible cost saving and value

creation for our clients in low volume high-spec applications like aerospace and defense. But also in clients with much greater volumes

as we help folks like Reebok and Mercury Systems get into production using Essentium’s HSE – that is our high-speed extrusion

ecosystem and our groundbreaking materials.

With that, I will turn it over to Jonathan

Baliff our CFO to discuss the financials of our go-to-market, our revenue opportunities, and our unit economics. Jonathan, please take

it away.

Jonathan

Baliff, Interim CFO of Essentium

Thank you Blake. The next number of pages I

will help show and explain the differentiation and competitive advantage of Essentium translated into our financial forecast. There are

a couple items I want to note before I begin. First, Essentium has a clear and defined path of achieving our growth plan with multiple

ways of growing organically. Second, underpinning the growth is a number of the items that Blake has already mentioned. Specifically,

we started as a materials company. We started making the ink, and that created a very large client base of over 500 clients that then

are moving into using our systems. When you look at that value proposition of a faster, a lower cost, a stronger product you can see that

we create a land and expand that creates both compounding growth, but also a larger and higher level of visibility of that growth as we

enter each year.

Third, this is what we mean by our razor and razor

blade model. It creates both excellent near-term revenue visibility from the previous year’s installed systems. Then it also creates

a compounding revenue opportunity as we have seen with the Department of Defense. When they buy one machine, they then buy 17, and then

they buy 30. It goes on. That creates both material, service, and software revenue that we call annual recurring revenue. Which is a highly

differentiated revenue, then gross margin, and then eventually free cash flow story compared to other additive and advanced manufacturing

companies.

As I have said, the razor and razor blade model

allows Essentium to see a compounded growth with our over 500 client base today. But that client base also provides a level of visibility

into both near-term and forecast revenue that we think is highly differentiated from other advanced manufacturing companies. We have a

$3.4 billion lifetime value for our revenue in today’s pipeline, and that drives the revenue forecast that you will see in a few

minutes. A lot of the revenue is also highly predictive because it is based on the systems using our materials, which Blake has already

spoken about having significant IP, significant better usage, and significantly better cost and strength for our clients.

So let’s us just take 2021 as an example.

As we come into the year into 2021, we already had $3.4 million recurring revenue from the install base of systems from previously sold

systems and again this greater than 500 client base. In 2021, there is a predictability of those system sales which creates both revenue

for the systems, and also for the annual recurring revenue, which again is made up of materials, services, and software.

When you then look at the $3.4 billion. We see

a level of predictability of additional pipeline opportunity. You know the $3.4 billion has roughly one-third of it with existing clients

today. But there is additional pipe volume opportunities for adjacencies in clients in the automotive, the aerospace, and electronics

that we can see today in this pipeline. So the total revenue opportunity is much higher than what we generally predict on a year-to-year

basis. You see that also in 2022 and beyond.

Not only does the Essentium business model provide

a high level of revenue visibility and predictability year-over-year, it also provides a revenue compounding due to the highly attractive

system economics. As you can see on the left-hand side of the page we receive roughly 4.8 times a total revenue opportunity for every

system sale. This is based on fairly prudent historical norms. So, for an average system sale of $169,800 we generally will receive $820,000

over a ten-year time period. And these machines are made to be used for greater than 15 years. When you look at the level of repeatability

of this revenue and the level of compounding nature of that, it allows for a much higher level of compounded growth, given that Essentium

started as a materials company, produces a system that really beats the competition, and provides a customer value paradigm that is unmatched.

Then when you look at the number of systems that we have already sold, we expect to have an 85 system install base by the end of this

year. You can see the level of compounding that you will get off of an initial system.

As you can see from the right-hand side of the

page, due to this extremely attractive system economics, also for our clients, the visibility that we get out of the $3.4 billion pipeline

we expect to have 85 cumulative installed base of systems by the end of 2021. We expect to significantly grow that base of systems based

on that $3.4 billion pipeline of an identifiable client with an identifiable need with an identifiable system. Remember, that $3.4 billion

pipeline has approximately one-third of existing clients that are using Essentium’s systems and materials today.

So this page sums up the revenue forecast

from the previous two pages where we talked about both the predictability and the compounding nature of our razor and razor blade

model. Again, we have 545 customers today that drives a lot of the visibility and compoundability of that $3.4 billion pipeline. As you

can see on gross margin, we start in the low 50%, and that is both for materials, services, software, and then also obviously the system

sales. That grows, but in a very measured way even though our system sales through the forecast we get a much higher installed base. We

are being very prudent about the way we think about gross margins, and not giving ourselves that much scale benefit in the forecast.

I think the thing that differentiates this forecast

the most is just the ability to see recurring revenue go from roughly 13.7% in 2021 to over 54% in 2025. This allows for both again a

higher level of visibility, a higher level of compounding as we work with our existing client base which makes up a large portion of our

$3.4 billion pipeline.

This is an organic forecast, and not dependent

on M&A. So everything that you have just seen in the revenue growth is through identifiable discreet machine material and services

demand. We do believe there is adjacent M&A, but that adjacent M&A will be focused on expanding our competitive advantage in complementary

technologies. We consider select M&A in a focused way, with technology synergies leading the way, as we leverage our client’s

scale with both DoD and global customers.

This page is a summation of the previous

pages, but I want to reiterate a few items about our system economics that create the compounded revenue growth, the predictability of

that revenue, and then the EBITDA and cash flow that you see in this forecast on the page. Our systems growth is grounded in a $3.4 billion

highly vetted pipeline of identified and distinct opportunities with almost one-third of this pipeline through existing clients, especially

the DoD and a global client customer base that is highly diversified. This revenue growth which is based on historic norms, starts with

a ten-year client partnership that delivers almost five times the revenue for each system sale. But as importantly, this razor and razor

blade business model delivers high near-term revenue visibility, and it also delivers higher margins. Turning to gross profit and gross

margin.

As you can see historically, in 2020 we achieved

47.6% gross margin percentage. We expect to achieve greater than 50% throughout this forecast. Even though the system scales significantly,

we are not assuming for prudency a significant change in gross margin percentage. We only go from roughly 50.3% in 2021 to 56.8% in 2025.

Turning to operating expenses. As you can see

here, we significantly grow our operating expenses in the early years of the forecast. We are including a prudent assumption of operating

expenses as we scale the sales channels to meet the $3.4 billion of demand that we see today. These expenses are mostly going to service

engineers, sales engineers, and build out of the service channels to meet the significant demand that we are seeing for systems and materials

for Essentium. This business plan when you look at capital expenditures is incredibly efficient. A lot of the capital expenditures are

provided by our clients today and are included in the revenue streams as we go forward with DoD and other clients. You can see there is

a high level of conversion of EBITDA into free cash flow.

As you can see, as Essentium clients purchase

more systems, we create much more operating leverage through both our existing sales channels as we meet the current demand that we see

in 2023 and beyond. And that is what yields a significant higher level of free cash flow as we achieve that operating leverage. I will

now turn it over to Shahraab to finish up our presentation.

Shahraab

Ahmad, Chairman and CEO of Atlantic Coastal Acquisition Corp.

To go over the transaction details, we are merging

with Essentium, which is valued at a $974 million enterprise value, implying a 4.6 times 2023 revenue multiple. This is highly attractive

versus peers and comes in at a meaningful discount.

As we look to this technology we wanted to understand

two key things. What we needed to understand was, was the technology really that truly differentiated? Was the technology truly differentiated

in a way that customers actually care about? To do the due diligence, we hired a technical advisor – he works in M&A for one

of the largest material science companies in the U.S. We asked him to answer both questions for us. And the answer he came back with was

a resounding yes on both counts.

To us, Essentium will be the first company in

the public markets that is able to truly deliver a mass manufacturing solution using additive manufacturing technologies, but also to

be able to build a ecosystem between manufacturing systems, materials, software, and services that combines to create a true and unique

razor and razor blade model.

Here we can see that Essentium’s enterprise

value is coming at a ~60% discount to the median of the comparables. This is obviously a very attractive discount and a highly compelling

valuation. But for Atlantic Coastal this is not just about investing at Essentium at a deep discount to the market and watching it trade

up over time. We believe that we will be highly value add to Essentium. We are appointing two members to the board who will be helping

both in the automotive and defense space. Over time we believe that this company’s revolutionary technology as well as its unique

business model will really help drive value add for shareholders.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains certain forward-looking

statements within the meaning of the federal securities laws with respect to the proposed business combination (the “Proposed Business

Combination”) between Essentium and Atlantic Coastal, including statements regarding the benefits of the Proposed Business Combination,

the anticipated timing of the Proposed Business Combination, the services offered by Essentium and the markets in which it operates, and

Essentium’s projected future results. These forward-looking statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,”

“future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,”

“will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements

are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties that could cause the actual results to differ materially from the expected results. Many

factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not

limited to: (i) the risk that the Proposed Business Combination may not be completed in a timely manner or at all, which may adversely

affect the price of Atlantic Coastal’s securities, (ii) the risk that the acquisition by Essentium, Inc. of each of Compass

AC Holdings, Inc. and Whizz Systems, Inc. may not be completed in a timely manner or at all, (iii) the risk that the Proposed

Business Combination may not be completed by Atlantic Coastal’s business combination deadline and the potential failure to obtain

an extension of the business combination deadline if sought by Atlantic Coastal, (iv) the failure to satisfy the conditions to the

consummation of the Proposed Business Combination, including the receipt of the requisite approvals of Atlantic Coastal’s shareholders

and Essentium’s stockholders, respectively, the satisfaction of the minimum trust account amount following redemptions by Atlantic

Coastal’s public shareholders and the receipt of certain governmental and regulatory approvals, (v) the lack of a third party

valuation in determining whether or not to pursue the Proposed Business Combination, (vi) the occurrence of any event, change or

other circumstance that could give rise to the termination of the agreement and plan of merger, (vii) the effect of the announcement

or pendency of the Proposed Business Combination on Essentium’s business relationships, performance, and business generally, (viii) risks

that the Proposed Business Combination disrupts current plans of Essentium and potential difficulties in Essentium employee retention

as a result of the Proposed Business Combination, (ix) the outcome of any legal proceedings that may be instituted against Essentium

or against Atlantic Coastal related to the agreement and plan of merger or the Proposed Business Combination, (x) the ability to

maintain the listing of Atlantic Coastal’s securities on The Nasdaq Stock Market LLC, (xi) the price of Atlantic Coastal’s

securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which

Essentium plans to operate, variations in performance across competitors, changes in laws and regulations affecting Essentium’s

business and changes in the combined capital structure, (xii) the ability to implement business plans, forecasts, and other expectations

after the completion of the Proposed Business Combination, and identify and realize additional opportunities, (xiii) the impact of

the global COVID-19 pandemic, (xiv) the enforceability of Essentium’s intellectual property, including its patents, and the

potential infringement on the intellectual property rights of others, cyber security risks or potential breaches of data security, (xv) the

ability of Essentium to protect the intellectual property and confidential information of its customers, (xvi) the risk of downturns

in the highly competitive additive manufacturing industry, and (xviii) other risks and uncertainties described in Atlantic Coastal’s

registration statement on Form S-1 (File No. 333-253003), which was originally filed with the U.S. Securities and Exchange Commission

(the “SEC”) on February 11, 2021 (the “Form S-1”), and its subsequent Quarterly Reports on Form 10-Q.

The foregoing list of factors is not exhaustive. These forward-looking statements are provided for illustrative purposes only and are

not intended to serve as, and must not be relied on by an investors as, a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk

Factors” section of the Form S-1, Quarterly Reports on Form 10-Q, the Registration Statement (as defined below), the proxy

statement/prospectus contained therein, and the other documents filed by Atlantic Coastal from time to time with the SEC. These filings

identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those

contained in the forward-looking statements. These risks and uncertainties may be amplified by the COVID-19 pandemic, which has caused

significant economic uncertainty. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and Essentium and Atlantic Coastal assume no obligation and do not intend to update or revise

these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by securities

and other applicable laws. Neither Essentium nor Atlantic Coastal gives any assurance that either Essentium or Atlantic Coastal, respectively,

will achieve its expectations.

Additional Information and Where to Find It

In connection with the Potential Business Combination,

Atlantic Coastal will file a registration statement on Form S-4 (the “Registration Statement”) with the SEC, which will

include a preliminary proxy statement to be distributed to holders of Atlantic Coastal’s ordinary shares in connection with Atlantic

Coastal’s solicitation of proxies for the vote by Atlantic Coastal’s shareholders with respect to the Proposed Business Combination

and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of securities to be issued

to Essentium stockholders in connection with the Proposed Business Combination. After the Registration Statement has been filed and declared

effective, Atlantic Coastal will mail a definitive proxy statement, when available, to its shareholders. The Registration Statement will

include information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Atlantic

Coastal’s shareholders in connection with the Potential Business Combination. Atlantic Coastal will also file other documents regarding

the Proposed Business Combination with the SEC. Before making any voting decision, investors and security holders of Atlantic Coastal

and Essentium are urged to read the Registration Statement, the proxy statement/prospectus contained therein, and all other relevant documents

filed or that will be filed with the SEC in connection with the Proposed Business Combination as they become available because they will

contain important information about the Proposed Business Combination.

Investors and security holders will be able to

obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Atlantic

Coastal through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Atlantic Coastal may be obtained

free of charge from Atlantic Coastal’s website at www.Atlantic Coastalv.io or by written request to Atlantic Coastal at Atlantic

Coastal Acquisition Corp., 6 St Johns Lane, Floor 5, New York, NY 10013.

Participants in the Solicitation

Atlantic Coastal and Essentium and their respective

directors and officers may be deemed to be participants in the solicitation of proxies from Atlantic Coastal’s shareholders in connection

with the Proposed Business Combination. Information about Atlantic Coastal’s directors and executive officers and their ownership

of Atlantic Coastal’s securities is set forth in Atlantic Coastal’s filings with the SEC. To the extent that holdings of Atlantic

Coastal’s securities have changed since the amounts printed in the Form S-1, such changes have been or will be reflected on

Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and

other persons who may be deemed participants in the Proposed Business Combination may be obtained by reading the proxy statement/prospectus

regarding the Proposed Business Combination when it becomes available. You may obtain free copies of these documents as described in the

preceding paragraph.

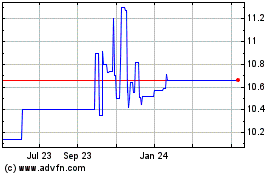

Atlantic Coastal Acquisi... (NASDAQ:ACAHU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atlantic Coastal Acquisi... (NASDAQ:ACAHU)

Historical Stock Chart

From Apr 2023 to Apr 2024