Filed by Atlantic Coastal Acquisition Corp.

This communication is filed pursuant to Rule 425 under

the United States Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Atlantic Coastal Acquisition

Corp.

Commission File Number: 001-40158

Date: December 1, 2021

Essentium, Inc. and Atlantic Coastal Acquisition Corp.

Q&A with Blake Teipel and Jonathan Bailiff

December 1, 2021

Blake Teipel,

Ph.D. CEO and Co-Founder of Essentium

The thing that excites me the most about Essentium

is that this is an ecosystem that I know scales, it's the ecosystem that models itself financially, performance wise, throughput wise.

And just like a CNC mill, or a lathe, or a molding machine.

And when I worked at Caterpillar, when I worked

at John Deere, when I worked in manufacturing contexts, I was devoid of any opportunity to use additive. Because additive manufacturing

simply didn't scale.

And so when we, when we can now deliver the capabilities

of financial performance for the client on producing parts, and the mechanical property performance of molded, and milled parts with high

performance, thermoplastics, you sort of, have an all-in-one.

It's, kind of, a one-stop shop where an additive

ecosystem finally, really belongs on the factory floor. And that's really, I think, sort of, in summation, kind of, what separates

Essentium, really, from any other advanced additive company is we're factory floor ready, factory floor relevant, and factory floor focused.

Jonathan

Baliff, Interim CFO of Essentium

I mean that's right, Blake, I mean for me

as the Chief Financial Officer, but also somebody who has been in the Air Force, has been in industry, to see Essentium with our clients

so quickly get adoption, and the foundation of that adoption, obviously, is the team we built. But a lot of that foundation is also based

on the material sciences.

We start with the stuff, right, and the patents

that we have, the commercial viability of it, which has been proven with really tough customers like DOD, like Toyota, or like others,

really creates that foundation. That then, when you look at the systems themselves, what we call the robots; those then which have groundbreaking

technology also creates this virtuous cycle for the client.

And that virtuous cycle is a low cost, total cost

of operation. It provides a much faster level of both the servicing and creation of their products for their clients. And then finally,

you see an ability to do this in an ESG way, which our clients are demanding right now.

And this is a company that has been doing materials

for many, many years, has systems in place, and already an installed base that's very large, and very global. That ESG element is so important

to our client base whether it be DoD, automotive, or retail manufacturing. And so for us, being able to help them achieve those ESG goals

is hugely important.

Blake Teipel,

Ph.D. CEO and Co-Founder of Essentium

You know Jonathan, you're right because, again,

you, sort of, think about the next, sort of, 50 years of industrial progress, right? The world is, is consuming a lot as is well known.

And that consumption is based on supply chain architectures that were built around manufacturing technologies that were developed in the

last 50 years.

So you think about the next 50 years, the next,

sort of, long-term economic growth and industrial progress, that is power. That industrial progress, that's powered by advanced manufacturing

solutions. And so when you've got an advanced manufacturing solution with that low TCO, with the mechanical property performance, and

the breadth of materials.

Jonathan

Baliff, Interim CFO of Essentium

That's right.

Blake Teipel,

Ph.D. CEO and Co-Founder of Essentium

Then you have a one-stop shop to help propel factory

solutioning so that supply chain architects can say, okay I've got flexibility now.

Jonathan

Baliff, Interim CFO of Essentium

Right.

Blake Teipel,

Ph.D. CEO and Co-Founder of Essentium

I've got agility and resiliency in my decisioning.

And so that, that gets us, I think, propelled to be in a, in a good spot for a long time.

Jonathan

Baliff, Interim CFO of Essentium

And one of the other, why Essentium points that

it was important to the team is that we have partners, right?

Blake Teipel,

Ph.D. CEO and Co-Founder of Essentium

That's right.

Blake Teipel,

Ph.D. CEO and Co-Founder of Essentium

We have really strong partnerships, not just partners

who are using our products, our machines, our materials. We also have BASF, which has been a longtime investor in the company. They provide

us a tremendous amount of in-kind capital.

Jonathan

Baliff, Interim CFO of Essentium

That's right.

Jonathan

Baliff, Interim CFO of Essentium

That has allowed for the acceleration of growth

to this point. So how does this translate into the financial performance of the company? What I always like to say is that Essentium is

based, and its financials are based on, really, three foundations.

One is our material science, which really creates

that 545 customer base, that we're already providing low-cost materials, low-cost systems, and an ecosystem. And so the growth that we

see in that revenue stream is based on a pipeline of identifiable customers with an identifiable need, over a ten-year period of time.

And we can see that today, this financial performance is not based on the large TAMs that we talked about.

Blake Teipel,

Ph.D. CEO and Co-Founder of Essentium

Right.

Jonathan

Baliff, Interim CFO of Essentium

Even though those TAMs do exist. It's actually

based on a grounds up evaluation of our existing client base, but then clients that we're already talking to about providing them that

system. And when we talk about providing them a system, that's landing systems, and materials with them today, we generally, historically

have always seen a very high expansion.

Because of that total cost of ownership, the speed

by which we allow them to create their parts for their clients. And then finally, there is a, just higher level of part component structure,

and strength that we get for that lower cost, and speed.

Nobody else can match us for that, so that's the

underpinning that's based on the historical financial performance, which is pretty significant. We have really, a long track record of

providing to those 545 clients.

But then when you look at the financial performance

of how it goes forward, it's really based on that razor and razor blade approach. We generally capture the clients based on historical

performance. The razor, which has a tremendous amount of performance already with DoD, and others; when DoD bought one in in less than

two years, they're buying over 30, and we expect to see that in the future.

But most importantly, it also provides, every

year, a level of predictability because we have a level of annual recurring revenue from materials and services to all of our clients.

So that every year we're able to provide, which is very differentiated from other advanced manufacturing, a level of predictability of

our revenue streams.

Blake Teipel,

Ph.D. CEO and Co-Founder of Essentium

That's right.

Jonathan

Baliff, Interim CFO of Essentium

And then when you look then at our cost structure,

because of the IP, because we have very secure supply chains both on the material side: I mean, less than 20 yards away from us, we have

a very large factory that creates all of our materials here in Texas. That allows us to have much higher margins on our materials, again,

based on historic precedent.

And then obviously, in the future, an ability

to work those through our machines. When we're able to make that work for our clients; I talk about that virtuous cycle, we get almost

five times the amount of revenue from a, just a single machine that's sold.

And then when you talk about the expansion of

our clients from single digit machines to double, triple, and then soon, four digit amounts of systems, we're really able to create a

forecast that has both a level of predictability, and a level of compoundability which is very differentiated from other advanced manufacturing.

Blake Teipel,

Ph.D. CEO and Co-Founder of Essentium

So Jonathan, as we, as we, kind of, wind this

down, and as we think about, again, the implications, right, not just for our clients, not just for our partners, but also for, sort of,

the industrial base, we're really, sort of, here to, sort of, help the American industrial base, the global economy in the next, sort

of, power, the next 50 years of industrial progress.

But that's not, that's not possible at all without

just an incredibly talented team of men and women who are just dedicated. They're living this vision and living this dream to advanced

manufacturing globally.

I couldn't be more grateful for the amazing team

of just men and women who are here joining us, standing shoulder to shoulder with you and I. Because when our clients win, we win.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains certain forward-looking

statements within the meaning of the federal securities laws with respect to the proposed business combination (the “Proposed Business

Combination”) between Essentium and Atlantic Coastal, including statements regarding the benefits of the Proposed Business Combination,

the anticipated timing of the Proposed Business Combination, the services offered by Essentium and the markets in which it operates, and

Essentium’s projected future results. These forward-looking statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,”

“future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,”

“will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements

are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties that could cause the actual results to differ materially from the expected results. Many

factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not

limited to: (i) the risk that the Proposed Business Combination may not be completed in a timely manner or at all, which may adversely

affect the price of Atlantic Coastal’s securities, (ii) the risk that the acquisition by Essentium, Inc. of each of Compass

AC Holdings, Inc. and Whizz Systems, Inc. may not be completed in a timely manner or at all, (iii) the risk that the Proposed

Business Combination may not be completed by Atlantic Coastal’s business combination deadline and the potential failure to obtain

an extension of the business combination deadline if sought by Atlantic Coastal, (iv) the failure to satisfy the conditions to the

consummation of the Proposed Business Combination, including the receipt of the requisite approvals of Atlantic Coastal’s shareholders

and Essentium’s stockholders, respectively, the satisfaction of the minimum trust account amount following redemptions by Atlantic

Coastal’s public shareholders and the receipt of certain governmental and regulatory approvals, (v) the lack of a third party

valuation in determining whether or not to pursue the Proposed Business Combination, (vi) the occurrence of any event, change or

other circumstance that could give rise to the termination of the agreement and plan of merger, (vii) the effect of the announcement

or pendency of the Proposed Business Combination on Essentium’s business relationships, performance, and business generally, (viii) risks

that the Proposed Business Combination disrupts current plans of Essentium and potential difficulties in Essentium employee retention

as a result of the Proposed Business Combination, (ix) the outcome of any legal proceedings that may be instituted against Essentium

or against Atlantic Coastal related to the agreement and plan of merger or the Proposed Business Combination, (x) the ability to

maintain the listing of Atlantic Coastal’s securities on The Nasdaq Stock Market LLC, (xi) the price of Atlantic Coastal’s

securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which

Essentium plans to operate, variations in performance across competitors, changes in laws and regulations affecting Essentium’s

business and changes in the combined capital structure, (xii) the ability to implement business plans, forecasts, and other expectations

after the completion of the Proposed Business Combination, and identify and realize additional opportunities, (xiii) the impact of

the global COVID-19 pandemic, (xiv) the enforceability of Essentium’s intellectual property, including its patents, and the

potential infringement on the intellectual property rights of others, cyber security risks or potential breaches of data security, (xv) the

ability of Essentium to protect the intellectual property and confidential information of its customers, (xvi) the risk of downturns

in the highly competitive additive manufacturing industry, and (xviii) other risks and uncertainties described in Atlantic Coastal’s

registration statement on Form S-1 (File No. 333-253003), which was originally filed with the U.S. Securities and Exchange Commission

(the “SEC”) on February 11, 2021 (the “Form S-1”), and its subsequent Quarterly Reports on Form 10-Q.

The foregoing list of factors is not exhaustive. These forward-looking statements are provided for illustrative purposes only and are

not intended to serve as, and must not be relied on by an investors as, a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk

Factors” section of the Form S-1, Quarterly Reports on Form 10-Q, the Registration Statement (as defined below), the proxy

statement/prospectus contained therein, and the other documents filed by Atlantic Coastal from time to time with the SEC. These filings

identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those

contained in the forward-looking statements. These risks and uncertainties may be amplified by the COVID-19 pandemic, which has caused

significant economic uncertainty. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and Essentium and Atlantic Coastal assume no obligation and do not intend to update or revise

these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by securities

and other applicable laws. Neither Essentium nor Atlantic Coastal gives any assurance that either Essentium or Atlantic Coastal, respectively,

will achieve its expectations.

Additional Information and Where to Find It

In connection with the Potential Business Combination,

Atlantic Coastal will file a registration statement on Form S-4 (the “Registration Statement”) with the SEC, which will

include a preliminary proxy statement to be distributed to holders of Atlantic Coastal’s ordinary shares in connection with Atlantic

Coastal’s solicitation of proxies for the vote by Atlantic Coastal’s shareholders with respect to the Proposed Business Combination

and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of securities to be issued

to Essentium stockholders in connection with the Proposed Business Combination. After the Registration Statement has been filed and declared

effective, Atlantic Coastal will mail a definitive proxy statement, when available, to its shareholders. The Registration Statement will

include information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Atlantic

Coastal’s shareholders in connection with the Potential Business Combination. Atlantic Coastal will also file other documents regarding

the Proposed Business Combination with the SEC. Before making any voting decision, investors and security holders of Atlantic Coastal

and Essentium are urged to read the Registration Statement, the proxy statement/prospectus contained therein, and all other relevant documents

filed or that will be filed with the SEC in connection with the Proposed Business Combination as they become available because they will

contain important information about the Proposed Business Combination.

Investors and security holders will be able to

obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Atlantic

Coastal through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Atlantic Coastal may be obtained

free of charge from Atlantic Coastal’s website at www.Atlantic Coastalv.io or by written request to Atlantic Coastal at Atlantic

Coastal Acquisition Corp., 6 St Johns Lane, Floor 5, New York, NY 10013.

Participants in the Solicitation

Atlantic Coastal and Essentium and their respective

directors and officers may be deemed to be participants in the solicitation of proxies from Atlantic Coastal’s shareholders in connection

with the Proposed Business Combination. Information about Atlantic Coastal’s directors and executive officers and their ownership

of Atlantic Coastal’s securities is set forth in Atlantic Coastal’s filings with the SEC. To the extent that holdings of Atlantic

Coastal’s securities have changed since the amounts printed in the Form S-1, such changes have been or will be reflected on

Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and

other persons who may be deemed participants in the Proposed Business Combination may be obtained by reading the proxy statement/prospectus

regarding the Proposed Business Combination when it becomes available. You may obtain free copies of these documents as described in the

preceding paragraph.

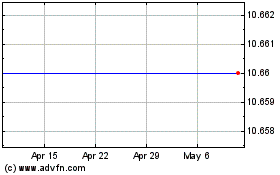

Atlantic Coastal Acquisi... (NASDAQ:ACAHU)

Historical Stock Chart

From Mar 2024 to Apr 2024

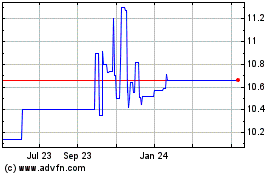

Atlantic Coastal Acquisi... (NASDAQ:ACAHU)

Historical Stock Chart

From Apr 2023 to Apr 2024