Filed by Atlantic Coastal Acquisition Corp.

This communication is filed pursuant to Rule 425

under

the United States Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Atlantic Coastal Acquisition Corp.

Commission File Number: 001-40158

Date: December 1, 2021

The following is a transcript of an interview of Essentium’s

CEO conducted on “The Watch List” on the TD Ameritrade Network.

Nicole Petallides, TD Ameritrade

Today we have Blake Teipel, CEO of Essentium here to give us some updates.

Blake Triple, CEO of Essentium

Sure, Nicole, happy to. Thank you so much for having us on. So, we're

really excited to announce the transaction today. We're of course combining with a company called Atlantic Coastal; really a great team

there. We're going public at a valuation estimated 974 million. And so, it's just really rewarding to sort of see the market recognize

what we have felt for a long time, as we've been building a company that is already serving some global enterprise level clients. We're

excited to be able to bring those clients more, and better technologies at a better scale. And you know, your previous segment talked

a lot about supply chains--we are laser focused on the supply chain. We are a factory focused technology company and an ecosystem product

for machines, materials, software and services in the additive manufacturing space, so we're excited for the milestone.

Nicole Petallides, TD Ameritrade

It certainly feels like such a big chunk, when you talk about so many

different areas. And the supply chain issues are very real and they certainly don't seem to be abating anytime soon. Now of course, Powell

has said they will, everybody has said they will. In the meantime, can you give me a range of the order of urgency for you?

Blake Triple, CEO of Essentium

Yeah, well, when you look at the Port of Long Beach, and you see container

ships stacked up, dozens and dozens, and dozens deep, and then you hear folks who actually manage port operations, and they're saying,

we don't anticipate our flow through to materially improve for the next 24 to 36 months, you sort of have to say to yourself, well, if

this is America's top port, if it's one of the world's top ports, how can the supply chain solution be close at hand? We believe the short

answer is: it's not. But when you focus on resiliency, and you focus on flexibility, you look for a solution, like what Essentium has

through our high-speed printing solutions. We've got a broad base of materials in software, we partner with enterprises like the US Air

Force, Ford Motor Company, Lockheed Martin, we really try to make sure that these enterprises can be as resilient as they can be. And

we're focused on factory solutions with them. Consumer demand is not abating. As we've seen the holiday season is around the corner. We've

seen Black Friday shortages. Supply chain is front and center, and it's going to be an area, I think, of focus for a long time.

Nicole Petallides, TD Ameritrade

Yeah. And you mentioned some of your partnerships, shareholders, customers,

or I should say client base, very notable. As you mentioned, even in the US government. Tell me more about the growth projections and

how you obviously plan to really nurture those relationships and expand.

Blake Triple, CEO of Essentium

Yeah, 100%. So, you can sort of think about us a little bit like an

early stage, or like a 2013, Tesla. We've got a couple of our robots on the market. We've got about 50 different grades of material. So,

you think about materials, like materials are sort of the building block of everything. We've got one of the broadest materials portfolios

in the sort of industrial landscape. And so, we're gonna continue to focus on more and better robots, better software, and digital solutions,

digital products. Think about the next industrial revolution. It's built on the back of data, built on the back of data products: machines

talking to machines, machines talking to users that are separated by time and space. So, we're focused on those areas.

Nicole Petallides, TD Ameritrade

And I was about to say, I know you have an extensive intellectual property

basket with over 150 patents. Which ones are you most excited about?

Blake Triple, CEO of Essentium

Well, I'm a recovering material scientist Nicole. So, I can't--it's

difficult for me to not nerd out too much. On the material side, we've got some pretty fundamental nanomaterials technologies. We've combined

microwave energy and 3D printing. So just like you can heat a potato in the microwave and cook it quickly, we can heat parts, that way

that you're building, and that makes the parts stronger and more uniform. So, you can address some of the compromises that have been classically

present with old, outdated 3D printing technology. So, this isn't your grandfather's 3D printing. This is sort of cutting edge, multiple

energy mode technologies. And we've been recognized by that. We've won a number of awards and you know, the Air Force has kind of said,

“Hey, this is a technology to watch.” And so, we're excited; thrilled to be joining Team USA and partnering with them in some

of the largest contracts for additive in the history of the space, really. So, it's an exciting time to grow and scale.

Nicole Petallides, TD Ameritrade

Right, I think, obviously moving everything forward. And you mentioned

what's going on here at home: you said Lockheed Martin, Ford, among other aerospace, defense, government, blue chip industrial customers.

We're really going to think of Essentium as fully immersed here in our big US corporations, right?

Blake Triple, CEO of Essentium

You can think about us as behind the stuff, we're factory focused.

I mean, my background, I came from Caterpillar. Before that John Deere, before that a very short stint at NASA, focused on manufacturing

technology. So, we've been thinking about the industrial base for a long time. And I'm joined by just an incredible team of folks, just

working really hard on supply chain architectures, supply chain solutions, so that the Trans Pacific nature of much of the goods and services

that power the US economy today, that doesn't necessarily have to be the supply chain architecture.

Nicole Petallides, TD Ameritrade

Would you like to see a true shift? Would you like see a true shift

and have more of that happening right here at home in the United States of America?

Blake Triple, CEO of Essentium

Yeah, we'll see a shift. We absolutely will, Nicole. The industrial

base in the United States, whether it's the defense industrial base, or the general manufacturing industrial base, we're seeing a lot

of exciting things happen. And Essentium, through this announcement, we're excited to be part of that.

Nicole Petallides, TD Ameritrade

Yeah, nice to see you, congratulations. You'll come back and give us

some updates. Thank you very much.

Cautionary Statement Regarding Forward-Looking Statements

This document contains certain forward-looking

statements within the meaning of the federal securities laws with respect to the proposed business combination (the “Proposed Business

Combination”) between Essentium and Atlantic Coastal, including statements regarding the benefits of the Proposed Business Combination,

the anticipated timing of the Proposed Business Combination, the services offered by Essentium and the markets in which it operates, and

Essentium’s projected future results. These forward-looking statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,”

“future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,”

“will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements

are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties that could cause the actual results to differ materially from the expected results. Many

factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not

limited to: (i) the risk that the Proposed Business Combination may not be completed in a timely manner or at all, which may adversely

affect the price of Atlantic Coastal’s securities, (ii) the risk that the acquisition by Essentium, Inc. of each of Compass AC Holdings,

Inc. and Whizz Systems, Inc. may not be completed in a timely manner or at all, (iii) the risk that the Proposed Business Combination

may not be completed by Atlantic Coastal’s business combination deadline and the potential failure to obtain an extension of the

business combination deadline if sought by Atlantic Coastal, (iv) the failure to satisfy the conditions to the consummation of the Proposed

Business Combination, including the receipt of the requisite approvals of Atlantic Coastal’s shareholders and Essentium’s

stockholders, respectively, the satisfaction of the minimum trust account amount following redemptions by Atlantic Coastal’s public

shareholders and the receipt of certain governmental and regulatory approvals, (v) the lack of a third party valuation in determining

whether or not to pursue the Proposed Business Combination, (vi) the occurrence of any event, change or other circumstance that could

give rise to the termination of the agreement and plan of merger, (vii) the effect of the announcement or pendency of the Proposed Business

Combination on Essentium’s business relationships, performance, and business generally, (viii) risks that the Proposed Business

Combination disrupts current plans of Essentium and potential difficulties in Essentium employee retention as a result of the Proposed

Business Combination, (ix) the outcome of any legal proceedings that may be instituted against Essentium or against Atlantic Coastal related

to the agreement and plan of merger or the Proposed Business Combination, (x) the ability to maintain the listing of Atlantic Coastal’s

securities on The Nasdaq Stock Market LLC, (xi) the price of Atlantic Coastal’s securities may be volatile due to a variety of factors,

including changes in the competitive and highly regulated industries in which Essentium plans to operate, variations in performance across

competitors, changes in laws and regulations affecting Essentium’s business and changes in the combined capital structure, (xii)

the ability to implement business plans, forecasts, and other expectations after the completion of the Proposed Business Combination,

and identify and realize additional opportunities, (xiii) the impact of the global COVID-19 pandemic, (xiv) the enforceability of Essentium’s

intellectual property, including its patents, and the potential infringement on the intellectual property rights of others, cyber security

risks or potential breaches of data security, (xv) the ability of Essentium to protect the intellectual property and confidential information

of its customers, (xvi) the risk of downturns in the highly competitive additive manufacturing industry, and (xviii) other risks and uncertainties

described in Atlantic Coastal’s registration statement on Form S-1 (File No. 333-253003), which was originally filed with the U.S.

Securities and Exchange Commission (the “SEC”) on February 11, 2021 (the “Form S-1”), and its subsequent Quarterly

Reports on Form 10-Q. The foregoing list of factors is not exhaustive. These forward-looking statements are provided for illustrative

purposes only and are not intended to serve as, and must not be relied on by an investors as, a guarantee, an assurance, a prediction

or a definitive statement of fact or probability. You should carefully consider the foregoing factors and the other risks and uncertainties

described in the “Risk Factors” section of the Form S-1, Quarterly Reports on Form 10-Q, the Registration Statement (as defined

below), the proxy statement/prospectus contained therein, and the other documents filed by Atlantic Coastal from time to time with the

SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially

from those contained in the forward-looking statements. These risks and uncertainties may be amplified by the COVID-19 pandemic, which

has caused significant economic uncertainty. Forward-looking statements speak only as of the date they are made. Readers are cautioned

not to put undue reliance on forward-looking statements, and Essentium and Atlantic Coastal assume no obligation and do not intend to

update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required

by securities and other applicable laws. Neither Essentium nor Atlantic Coastal gives any assurance that either Essentium or Atlantic

Coastal, respectively, will achieve its expectations.

Additional Information and Where to Find It

In connection with the Potential Business Combination,

Atlantic Coastal will file a registration statement on Form S-4 (the “Registration Statement”) with the SEC, which will include

a preliminary proxy statement to be distributed to holders of Atlantic Coastal’s ordinary shares in connection with Atlantic Coastal’s

solicitation of proxies for the vote by Atlantic Coastal’s shareholders with respect to the Proposed Business Combination and other

matters as described in the Registration Statement, as well as the prospectus relating to the offer of securities to be issued to Essentium

stockholders in connection with the Proposed Business Combination. After the Registration Statement has been filed and declared effective,

Atlantic Coastal will mail a definitive proxy statement, when available, to its shareholders. The Registration Statement will include

information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Atlantic Coastal’s

shareholders in connection with the Potential Business Combination. Atlantic Coastal will also file other documents regarding the Proposed

Business Combination with the SEC. Before making any voting decision, investors and security holders of Atlantic Coastal and Essentium

are urged to read the Registration Statement, the proxy statement/prospectus contained therein, and all other relevant documents filed

or that will be filed with the SEC in connection with the Proposed Business Combination as they become available because they will contain

important information about the Proposed Business Combination.

Investors and security holders will be able to

obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Atlantic

Coastal through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Atlantic Coastal may be obtained

free of charge from Atlantic Coastal’s website at www.Atlantic Coastalv.io or by written request to Atlantic Coastal at Atlantic

Coastal Acquisition Corp., 6 St Johns Lane, Floor 5, New York, NY 10013.

Participants in the Solicitation

Atlantic Coastal and Essentium and their respective

directors and officers may be deemed to be participants in the solicitation of proxies from Atlantic Coastal’s shareholders in

connection with the Proposed Business Combination. Information about Atlantic Coastal’s directors and executive officers and their

ownership of Atlantic Coastal’s securities is set forth in Atlantic Coastal’s filings with the SEC. To the extent that holdings

of Atlantic Coastal’s securities have changed since the amounts printed in the Form S-1, such changes have been or will be reflected

on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and

other persons who may be deemed participants in the Proposed Business Combination may be obtained by reading the proxy statement/prospectus

regarding the Proposed Business Combination when it becomes available. You may obtain free copies of these documents as described in

the preceding paragraph.

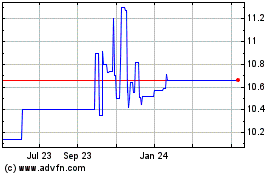

Atlantic Coastal Acquisi... (NASDAQ:ACAHU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atlantic Coastal Acquisi... (NASDAQ:ACAHU)

Historical Stock Chart

From Apr 2023 to Apr 2024