DayDayCook (“DDC” or the “Company”), a leading content driven

direct-to-consumer brand in Hong Kong and Mainland China, announces

today that it has entered into a definitive merger agreement (the

“Merger Agreement”) with Ace Global Business Acquisition Limited

(“Ace”) (NASDAQ: ACBA, ACBAU, ACBAW), a special purpose acquisition

company, providing for a business combination that will result in

DayDayCook becoming a publicly listed company. Upon closing of the

transactions, the parties plan to remain NASDAQ-listed under a new

ticker symbol.

As part of the transaction, Ace aims to complete a private

investment in public equity (PIPE) of approximately $30-40MM, and

the combined company will have a pro forma firm value of

approximately $377-387MM at closing, assuming no shareholder

redemption. DayDayCook will receive $46.9MM in cash from Ace’s

trust account.

DayDayCook’s current management team will

continue running the combined Company after the transaction.

“Today, DDC is thrilled to announce the merger

with Ace to drive the creation of shareholder value. With the

success and experience of the Group’s entry to the RTH, RTC and

plant-based products in the market over the past two years,

management expects the Group’s revenue will increase rapidly over

the next few years, as market trend dictates that RTH and RTC

foods’ penetration will continue to deepen in the foreseeable

future. DDC expects to further develop its new RTH and RTC lines

and focus on plant-based products. The proportion of the RTC and

plant-based products are expected to increase significantly in the

future,” said Norma Chu, Founder and CEO of DDC.

“Ace Global’s goal has always been to build the

foundation of a successful public company via a merger. Throughout

this period, we have been looking for the best target company to

merge with, holding firmly to that standard with diligence and

patience. We are extremely proud and honored to become associated

with DDC, a company with an accomplished management team that will

be as good in creating sustainable shareholder value as they have

been in developing innovative future food culture that would bring

convenience to people’s lives,” said Eugene Wong, CEO of Ace. “We

are excited to be a part of this merger and we look forward to

working together to complete the transaction.”DayDayCook is a

digital publisher and merchandiser company, which is currently one

of the leading content-driven lifestyle brands for young food

lovers. The main products of DDC are ready-to-heat (RTH),

ready-to-cook (RTC) and plant-based food products, which bring

convenience and quality food choices to the people. DayDayCook

produces culinary and lifestyle content across major social media

and e-commerce platforms, promoting its products to attract and

retain customers. DDC has accumulated over 3 billion video views

and more than 10 million paid customers worldwide.

The RTC market size is expected to grow at 20%

CAGR to reach USD 150bn in 2027, driven by structural changes in

consumer behavior and preferences. DDC is well positioned to

capture this opportunity, leveraging its Omni-channel sales

strategy to span across traditional e-commerce, social-commerce,

and offline retailer networks. The company also has strategic

partnerships with key manufacturers to build a strong and nimble

supply chain.

DayDayCook has also launched plant-based products to address the

rising demand for healthier meal choices amongst consumers as well

as to promote a quality lifestyle to the company’s customer base.

Increasing contribution from plant-based products both in terms of

revenue and number of SKUs is a core strategy for DDC. This month,

DayDayCook announced a strategic investment with Proterra, further

strengthening the company’s commitment in future plant-based

business developments.

Key Transaction Terms

Under the terms of the Merger Agreement, Ace

will acquire DDC, resulting in DDC being a listed company on the

Nasdaq Capital Market. At the effective time of the transaction,

DDC’s shareholders and management will receive 30 million shares of

Ace’s common stock. In addition, DDC shareholders will be entitled

to receive earn-out consideration of up to an additional 3.6

million shares of Ace’s common stock, subject to DDC achieving

certain share price thresholds and revenue targets prior to certain

future dates, as set forth in the Merger Agreement.

The Benchmark Company, LLC and Brookline Capital

Markets, a Division of Arcadia Securities, LLC are acting as

financial advisors for this transaction. DLA Piper LLP is acting as

legal advisor to Ace Global Business Acquisition Limited. Loeb

& Loeb LLP is acting as the legal advisor to DDC.

The description of the transaction contained

herein is only a summary and is qualified in its entirety by

reference to the Merger Agreement relating to the transaction, a

copy of which will be filed by Ace with the SEC as an exhibit to a

Current Report on Form 8-K.

About DayDayCook

DayDayCook is a leading content driven

direct-to-consumer brand in China with millions of active viewers

and paid customers nationwide. DayDayCook’s vision is to inspire

Gen-Z consumers to enjoy cooking and discover a better lifestyle

through convenient and healthy product offerings. DayDayCook

creates video content with more than 1.4B views globally. Besides

fun cooking videos, DayDayCook also offers a full suite of healthy

and convenient ready-to-cook meal solutions serving millions of

customers each year in Chinese Mainland and Hong Kong.

About Ace Global Business Acquisition

Limited

Ace Global Business Acquisition Limited is a

British Virgin Islands company incorporated as a blank check

company for the purpose of entering into a merger, share exchange,

asset acquisition, share purchase, recapitalization, reorganization

or similar business combination with one or more businesses or

entities. The Company's efforts to identify a prospective target

business will not be limited to a particular industry or geographic

region, although the Company intends to focus on operating

businesses in the gaming and e-commerce sectors in the Greater

China, Japan and Southeast Asia regions.

Forward Looking Statement

This document (“Document”) is being provided to recipients

solely for information purpose and it is not intended to form the

basis of any investment decision or any decision in relation to a

transaction involving DDC Enterprise Limited (the “Company”) and/or

any of its subsidiaries and/or affiliates (collectively, the

“Group”). This Document does not constitute or contain an offer or

invitation or solicitation for the sale or purchase of securities

or any interest in the Group and neither this Document nor anything

contained herein shall form the basis of, or be relied upon in

connection with, any contract or commitment whatsoever. Neither the

information contained in this press release, nor any further

information made available by the Group or any of its directors,

officers, partners, employees, agents, representatives or advisors

will form basis of or be construed as a contract or any other legal

obligation.

Interested parties should conduct their own investigation and

analysis of the Group, financial condition and prospects, and of

the data set forth in this Document. None of the Group, or its

subsidiaries, shareholders or other affiliates, or any of their

respective directors, officers, partners, employees, agents,

representatives or advisors, make any representation or warranty,

express or implied, as to the accuracy or completeness of this

Document or the information contained in, or for any omissions

from, this Document or any other written or oral communications

transmitted to the recipient in the course of its evaluation of the

Group. In furnishing this Document, the Group does not undertake

any obligation to provide the recipient with access to any

additional information or to update this Document or to correct any

inaccuracies therein which may become apparent. This Document shall

neither be deemed an indication of the state or affairs of the

Group nor constitute an indication that there has been no change in

the state or affairs of the Group since the date thereof or since

the dates as of which information is given in the Document.

This Document may contain certain statements, estimates,

targets, forecasts and projections with respect to the Group,

including certain financial forecasts. Any such information is

subjective and would necessarily be prepared based upon certain

assumptions and analysis of information available at the relevant

time and may not prove to be correct. Accordingly, there is no

representation, warranty or assurance of any kind, express or

implied, that any such information will be correct or that any such

statements, estimates, targets, forecasts or projections will be

realized. This Document may also contain forward-looking

statements. All statements other than statements of historical fact

are statements that could be forward-looking statements. You can

identify these forward looking statements through the use of words

such as “may,” “will,” “can,” “anticipate,” “assume,” “should,”

“indicate,” “would,” “believe,” “contemplate,” “expect,” “seek,”

“estimate,” “continue,” “plan,” “point to,” “project,” “predict,”

“could,” “intend,” “target,” “potential” and other similar words

and expressions of the future. These forward-looking statements are

subject to risks and uncertainties that may cause actual future

experience and results to differ materially from those discussed in

these forward looking statements. Important factors that might

cause such a difference include, but are not limited to, the

timing, cost and uncertainty of the Group’s business initiatives

and the Group's ability to develop and monetize its business. None

of the members of the Group undertake any obligation to release any

revisions to such forward-looking statements to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events.

Important Information

Ace Global Business Acquisition Limited ("Ace"),

and their respective directors, executive officers and employees

and other persons may be deemed to be participants in the

solicitation of proxies from the holders of Ace ordinary shares in

respect of the proposed transaction described herein. Information

about Ace's directors and executive officers and their ownership of

Ace's ordinary shares is set forth in Ace's Annual Report on Form

10-K filed with the SEC, as modified or supplemented by any Form 3

or Form 4 filed with the SEC since the date of such filing. Other

information regarding the interests of the participants in the

proxy solicitation will be included in the Form S-4 pertaining to

the proposed transaction when it becomes available. These documents

can be obtained free of charge from the sources indicated

below.

In connection with the transaction described

herein, Ace will file relevant materials with the SEC including a

Registration Statement on Form S-4. Promptly after the registration

statement is declared effective, Ace will mail the proxy

statement/prospectus and a proxy card to each stockholder entitled

to vote at the special meeting relating to the transaction.

INVESTORS AND SECURITY HOLDERS OF ACE ARE URGED TO READ THESE

MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY

OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT

ACE WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION ABOUT ACE, DDC AND THE

TRANSACTION. The proxy statement/prospectus and other relevant

materials in connection with the transaction (when they become

available), and any other documents filed by Ace with the SEC, may

be obtained free of charge at the SEC's website (www.sec.gov).

CONTACT:Matt BlazeiSenior Equity Research

AnalystCORE IR516 222 2560www.coreir.com

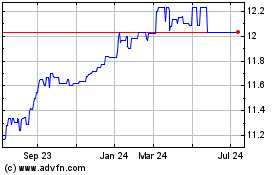

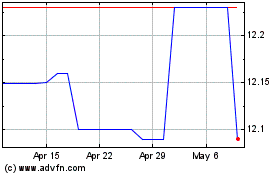

Ace Global Business Acqu... (NASDAQ:ACBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ace Global Business Acqu... (NASDAQ:ACBA)

Historical Stock Chart

From Apr 2023 to Apr 2024