ACNB Corporation (NASDAQ: ACNB), financial holding company for ACNB

Bank and ACNB Insurance Services, Inc., announced record financial

results with net income of $27,834,000 for the year ended December

31, 2021. Compared to net income of $18,394,000 for the year ended

December 31, 2020, this is an increase of $9,440,000 or 51.3% over

comparable year-end period results. Basic earnings per share was

$3.19 and $2.13 for the year ended December 31, 2021 and 2020,

respectively, which is an increase of $1.06 or 49.8%. These record

results for 2021 are primarily attributable to higher fee income

and lesser loan loss provision compared to the year of 2020, as

well as one-time merger expenses related to the acquisition of FCBI

in the first quarter of 2020.

The Corporation reported net income of

$4,495,000 for the three months ended December 31, 2021. Compared

to net income of $7,049,000 for the three months ended December 31,

2020, this is a decrease of $2,554,000 or 36.2% less than

comparable period results. This decrease was largely attributable

to the contraction of net interest income due to lower loan volume

and rates, one-time expenses related to the core banking system

conversion, and lower fee income primarily associated with reduced

sales of residential mortgages as interest rates increased in 2021.

Basic earnings per share was $0.52 and $0.81 for the three months

ended December 31, 2021 and 2020, respectively, which is a decrease

of $0.29 or 35.8%.

“2021 has proven to be a year of record

earnings, which was not anticipated at the outset given the

COVID-19 pandemic environment. Despite the continued challenges

faced due to the pandemic, ACNB Corporation ended the year with

earnings of nearly $28 million, a 3% increase in the cash dividends

paid per common share to the Corporation’s shareholders, and a safe

and sound organization with solid capital, liquidity and asset

quality,” said James P. Helt, ACNB Corporation President &

Chief Executive Officer. “By the end of the third quarter of 2021,

ACNB Bank was fortunate to no longer have in effect any temporary

loan modifications or deferrals due to the pandemic for any

customers, which is a reflection of the resolve of the communities

served. Moreover, as the year progressed, PPP loans were either

forgiven or paid off resulting in only $18.5 million remaining at

December 31, 2021, from total PPP loan originations of

approximately $223 million. These efforts, among others, to assist

Bank customers during the pandemic required much staff time and

dedication, but is a testimony to our commitment as a community

banking organization.”

Mr. Helt continued, “As 2022 begins, there are a

number of exciting initiatives on the horizon as we refocus our

energies on strategic initiatives to grow both organically and

inorganically. ACNB Bank’s core system conversion in September 2021

was a major component of the ongoing core and digital banking

transformation project in support of growth. The Bank also recently

announced construction plans for a new Upper Adams Office in the

Biglerville, Pennsylvania, community to effectively consolidate

three existing office locations later this year. In addition, the

insurance agency subsidiary has changed its name and rebranded as

ACNB Insurance Services, Inc. effective January 1, 2022, to better

align its identity with ACNB Corporation and ACNB Bank. 2022 will

have its own challenges as the year unfolds, but it has begun with

momentum and vigor to further our vision to be the independent

financial services provider of choice in the core markets served by

building relationships and finding solutions.”

Revenues

Total revenues, defined as net interest income

plus noninterest income, for the year ended December 31, 2021, were

$93,930,000 or an increase of 1.0% over total revenues of

$93,002,000 for 2020. Total interest income for 2021 was

$78,159,000, or a decrease of 8.4%, as compared to total interest

income of $85,290,000 for the year ended December 31, 2020,

primarily due to 2021 market interest rate decreases in conjunction

with lower loan volume.

Loans

Total loans outstanding were $1,468,427,000 at

December 31, 2021. Year over year, loans outstanding decreased by

$169,357,000, or 10.3%, since December 31, 2020. The decrease in

loans year over year is largely attributable to the forgiveness of

PPP loans, sale of most new residential mortgages, and payoff of

loans in the residential mortgage, consumer and government lending

portfolios. Conversely, new loan production for all business lines

totaled $423,965,000 for the year ended December 31, 2021, which is

an increase of 19.4% over the year of 2020. Despite the intense

competition in the Corporation’s market areas, there is a continued

management focus on asset quality and disciplined underwriting

standards in the loan origination process. As a result of sound

loan risk metrics, combined with low credit losses in the

portfolio, the provision for loan losses for the year ended

December 31, 2021, was $50,000 and the allowance for loan losses

stood at $19,033,000 at December 31, 2021.

Deposits

Total deposits were $2,426,389,000 at December

31, 2021. Deposits increased by $240,864,000, or 11.0%, from

December 31, 2020. These results are primarily attributable to

continued, slow economic conditions increasing the level of

deposits held by existing and new customers, including the segment

of municipal depositors.

Net Interest Income and

Margin

Net interest income decreased by $1,824,000 to

$71,244,000 for the year ended December 31, 2021, a decrease of

2.5% in comparison to the year ended December 31, 2020. The net

interest margin for 2021 was 2.82%, compared to 3.35% for the same

period of 2020. Both net interest income and the net interest

margin were negatively impacted by market rate decreases in tandem

with lesser loans as a percentage in the earning asset mix, as well

as more lower yielding investments and liquidity assets.

Noninterest Income

Noninterest income for 2021 was $22,686,000, an

increase of $2,752,000 or 13.8% over the prior year ended December

31, 2020. The increase was broad based and included both fee income

from the sale of residential mortgage loans and revenue from wealth

management activities, which grew 18.6% in comparison to the year

ended December 31, 2020, and reached $3,169,000 for 2021.

Noninterest Expense

Noninterest expense for 2021 was $58,861,000, a

decrease of $2,299,000 or 3.8% over the prior year ended December

31, 2020, and due mainly to one-time merger expenses incurred in

2020 and continued expense management.

Dividends

Quarterly cash dividends paid to ACNB

Corporation shareholders in 2021 totaled $8,968,000 in the

aggregate, or $1.03 per common share, including the special cash

dividend of $0.02 per common share paid on June 15, 2021. On a per

common share basis, there was a year-over-year increase of 3.0% in

cash dividends paid to ACNB Corporation shareholders from 2020 to

2021. In 2020, ACNB Corporation paid a $1.00 dividend per common

share for total dividends paid to shareholders in the aggregate

amount of $8,685,000.

COVID-19 Pandemic

As previously reported, ACNB Corporation

implemented numerous initiatives to support and protect employees

and customers during the COVID-19 pandemic. These efforts continue

with current information and guidelines related to ongoing COVID-19

initiatives and communications available at acnb.com. As of

September 30, 2021, ACNB Corporation’s community banking

subsidiary, ACNB Bank, no longer had any temporary loan

modifications or deferrals for either commercial or consumer

customers, furthering the positive trend of improvement in 2021. In

comparison, at December 31, 2020, the Bank had outstanding

approvals for temporary loan modifications and deferrals for 48

loans totaling $36,123,155 in principal balances, representing 2.2%

of the total loan portfolio.

Paycheck Protection Program

ACNB Bank serves as an active participant in the

PPP, as authorized initially by the Coronavirus Aid, Relief, and

Economic Security (CARES) Act and subsequently by the Coronavirus

Response and Relief Supplemental Appropriations Act. As of December

31, 2021, ACNB Bank had closed and funded 2,217 PPP loans totaling

$223,036,703, resulting in approximately $9,500,000 in total fee

income. Of this fee income amount, $2,875,000, before costs, was

recognized in 2020 and another $5,627,000, before costs, was

recognized in 2021 as an adjustment to interest income yield, with

the remainder to be recognized in future quarters as an adjustment

to interest income yield. At December 31, 2021, there was an

outstanding balance of $18,540,986 in PPP loans as a result of

forgiveness and repayments to date. Currently, the Bank is

assisting the remainder of PPP customers with the processing of

applications for loan forgiveness through the Small Business

Administration (SBA).

ACNB Bank Update

On January 12, 2022, ACNB Bank announced plans

to build a full-service community banking office to serve the Upper

Adams area of Adams County, PA. The new office location will offer

enhanced services and conveniences, as well as will deploy new

design concepts in the office lobby with the goal of streamlining

and improving the customer experience. Upon completion of

construction of the Upper Adams Office in Fall 2022, the plan is to

consolidate operations of the three current ACNB Bank offices in

the Upper Adams geography.

ACNB Insurance Services, Inc.

Update

On January 6, 2022, ACNB Corporation announced

the name change and rebranding of the insurance subsidiary to ACNB

Insurance Services, Inc. from Russell Insurance Group, Inc.

effective January 1, 2022. This rebranding reinforces the common

ownership by ACNB Corporation of both ACNB Bank and the insurance

agency, as well as makes this affiliation more visible for

businesses and consumers in order to leverage cross-selling

opportunities in the shared communities served.

About ACNB Corporation

ACNB Corporation, headquartered in Gettysburg,

PA, is the $2.8 billion financial holding company for the

wholly-owned subsidiaries of ACNB Bank, Gettysburg, PA, and ACNB

Insurance Services, Inc., formerly Russell Insurance Group, Inc.,

Westminster, MD. Originally founded in 1857, ACNB Bank serves its

marketplace with banking and wealth management services, including

trust and retail brokerage, via a network of 20 community banking

offices, located in the four southcentral Pennsylvania counties of

Adams, Cumberland, Franklin and York, as well as loan offices in

Lancaster and York, PA, and Hunt Valley, MD. As divisions of ACNB

Bank operating in Maryland, FCB Bank and NWSB Bank serve the local

marketplace with a network of five and six community banking

offices located in Frederick County and Carroll County, MD,

respectively. ACNB Insurance Services, Inc. is a full-service

agency with licenses in 44 states. The agency offers a broad range

of property, casualty, health, life and disability insurance

serving personal and commercial clients through office locations in

Westminster, Germantown and Jarrettsville, MD, and Gettysburg, PA.

For more information regarding ACNB Corporation and its

subsidiaries, please visit acnb.com.

Non-GAAP Financial Measures

ACNB Corporation uses non-GAAP financial

measures to provide information useful to investors in

understanding our operating performance and trends, and to

facilitate comparisons with the performance of our peers.

Management uses these measures internally to assess and better

understand our underlying business performance and trends related

to core business activities. The non-GAAP financial measures and

key performance indicators we use may differ from the non-GAAP

financial measures and key performance indicators other financial

institutions use to measure their performance and trends.

Non-GAAP financial measures should be viewed in

addition to, and not as an alternative for, our reported results

prepared in accordance with GAAP. In the event of such a disclosure

or release, the Securities and Exchange Commission’s (SEC)

Regulation G requires: (i) the presentation of the most directly

comparable financial measure calculated and presented in accordance

with GAAP and (ii) a reconciliation of the differences between the

non-GAAP financial measure presented and the most directly

comparable financial measure calculated and presented in accordance

with GAAP. Reconciliations of GAAP to non-GAAP operating measures

to the most directly comparable GAAP financial measures are

included in the tables at the end of this release.

Management believes merger-related expenses are

not organic costs attendant to operations and facilities. These

charges principally represent expenses to satisfy contractual

obligations of the acquired entity, without any useful benefit to

us, to convert and consolidate the entity’s records, systems and

data onto our platforms, and professional fees related to the

transaction. These costs are specific to each individual

transaction and may vary significantly based on the size and

complexity of the transaction.

SAFE HARBOR AND FORWARD-LOOKING STATEMENTS -

Should there be a material subsequent event prior to the filing of

the Annual Report on Form 10-K with the Securities and Exchange

Commission, the financial information reported in this press

release is subject to change to reflect the subsequent event. In

addition to historical information, this press release may contain

forward-looking statements. Examples of forward-looking statements

include, but are not limited to, (a) projections or statements

regarding future earnings, expenses, net interest income, other

income, earnings or loss per share, asset mix and quality, growth

prospects, capital structure, and other financial terms, (b)

statements of plans and objectives of Management or the Board of

Directors, and (c) statements of assumptions, such as economic

conditions in the Corporation’s market areas. Such forward-looking

statements can be identified by the use of forward-looking

terminology such as “believes”, “expects”, “may”, “intends”,

“will”, “should”, “anticipates”, or the negative of any of the

foregoing or other variations thereon or comparable terminology, or

by discussion of strategy. Forward-looking statements are subject

to certain risks and uncertainties such as local economic

conditions, competitive factors, and regulatory limitations. Actual

results may differ materially from those projected in the

forward-looking statements. Such risks, uncertainties and other

factors that could cause actual results and experience to differ

from those projected include, but are not limited to, the

following: the effects of governmental and fiscal policies, as well

as legislative and regulatory changes; the effects of new laws and

regulations, specifically the impact of the Coronavirus Response

and Relief Supplemental Appropriations Act, the Coronavirus Aid,

Relief, and Economic Security Act, the Tax Cuts and Jobs Act and

the Dodd-Frank Wall Street Reform and Consumer Protection Act;

impacts of the capital and liquidity requirements of the Basel III

standards; the effects of changes in accounting policies and

practices, as may be adopted by the regulatory agencies, as well as

the Financial Accounting Standards Board and other accounting

standard setters; ineffectiveness of the business strategy due to

changes in current or future market conditions; future actions or

inactions of the United States government, including the effects of

short- and long-term federal budget and tax negotiations and a

failure to increase the government debt limit or a prolonged

shutdown of the federal government; the effects of economic

conditions particularly with regard to the negative impact of

severe, wide-ranging and continuing disruptions caused by the

spread of Coronavirus Disease 2019 (COVID-19) and the responses

thereto on the operations of the Corporation and current customers,

specifically the effect of the economy on loan customers’ ability

to repay loans; the effects of competition, and of changes in laws

and regulations on competition, including industry consolidation

and development of competing financial products and services; the

risks of changes in interest rates on the level and composition of

deposits, loan demand, and the values of loan collateral,

securities, and interest rate protection agreements, as well as

interest rate risks; difficulties in acquisitions and integrating

and operating acquired business operations, including information

technology difficulties; challenges in establishing and maintaining

operations in new markets; the effects of technology changes;

volatilities in the securities markets; the effect of general

economic conditions and more specifically in the Corporation’s

market areas; the failure of assumptions underlying the

establishment of reserves for loan losses and estimations of values

of collateral and various financial assets and liabilities; acts of

war or terrorism; disruption of credit and equity markets; the

ability to manage current levels of impaired assets; the loss of

certain key officers; the ability to maintain the value and image

of the Corporation’s brand and protect the Corporation’s

intellectual property rights; continued relationships with major

customers; and, potential impacts to the Corporation from

continually evolving cybersecurity and other technological risks

and attacks, including additional costs, reputational damage,

regulatory penalties, and financial losses. We caution readers not

to place undue reliance on these forward-looking statements. They

only reflect management’s analysis as of this date. The Corporation

does not revise or update these forward-looking statements to

reflect events or changed circumstances. Please carefully review

the risk factors described in other documents the Corporation files

from time to time with the SEC, including the Annual Reports on

Form 10-K and Quarterly Reports on Form 10-Q. Please also carefully

review any Current Reports on Form 8-K filed by the Corporation

with the SEC.

ACNB

CORPORATIONFinancial Highlights

Unaudited Consolidated Condensed

Statements of IncomeDollars in thousands, except per share

data

|

|

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

| INCOME STATEMENT

DATA |

|

|

|

|

|

|

|

|

Interest income |

$ |

18,674 |

|

$ |

21,472 |

|

$ |

78,159 |

|

$ |

85,290 |

|

Interest expense |

|

1,324 |

|

|

2,570 |

|

|

6,915 |

|

|

12,222 |

|

Net interest income |

|

17,350 |

|

|

18,902 |

|

|

71,244 |

|

|

73,068 |

|

Provision for loan losses |

|

- |

|

|

1,040 |

|

|

50 |

|

|

9,140 |

|

Net interest income after provision for loan losses |

|

17,350 |

|

|

17,862 |

|

|

71,194 |

|

|

63,928 |

|

Noninterest income |

|

5,543 |

|

|

5,863 |

|

|

22,686 |

|

|

19,934 |

|

Merger-related expenses |

|

- |

|

|

- |

|

|

- |

|

|

5,965 |

|

Noninterest expense |

|

17,367 |

|

|

14,938 |

|

|

58,861 |

|

|

55,195 |

|

Income before income taxes |

|

5,526 |

|

|

8,787 |

|

|

35,019 |

|

|

22,702 |

|

Provision for income taxes |

|

1,031 |

|

|

1,738 |

|

|

7,185 |

|

|

4,308 |

|

Net income |

$ |

4,495 |

|

$ |

7,049 |

|

$ |

27,834 |

|

$ |

18,394 |

|

Basic earnings per share |

$ |

0.52 |

|

$ |

0.81 |

|

$ |

3.19 |

|

$ |

2.13 |

|

|

|

|

|

|

|

|

|

|

NON-GAAP MEASURES |

|

|

|

|

|

|

|

|

INCOME STATEMENT DATA |

|

|

|

|

|

|

|

|

Net income |

$ |

4,495 |

|

$ |

7,049 |

|

$ |

27,834 |

|

$ |

18,394 |

|

Merger-related expenses, net of income taxes |

|

- |

|

|

- |

|

|

- |

|

|

4,639 |

|

Adjusted net income (non-GAAP)* |

$ |

4,495 |

|

$ |

7,049 |

|

$ |

27,834 |

|

$ |

23,033 |

|

Adjusted basic earnings per share (non-GAAP)* |

$ |

0.52 |

|

$ |

0.81 |

|

$ |

3.19 |

|

$ |

2.67 |

|

|

|

|

|

|

|

|

|

|

*See Non-GAAP Financial Measures above. |

|

|

|

|

|

|

|

Unaudited Selected Financial

DataDollars in thousands, except per share data

| |

December 31, 2021 |

|

|

December 31, 2020 |

| BALANCE SHEET

DATA |

|

|

|

|

|

Assets |

$ |

2,786,987 |

|

|

|

$ |

2,555,362 |

|

|

Securities |

$ |

446,161 |

|

|

|

$ |

350,182 |

|

|

Loans, total |

$ |

1,468,427 |

|

|

|

$ |

1,637,784 |

|

|

Allowance for loan losses |

$ |

19,033 |

|

|

|

$ |

20,226 |

|

|

Deposits |

$ |

2,426,389 |

|

|

|

$ |

2,185,525 |

|

|

Borrowings |

$ |

69,902 |

|

|

|

$ |

92,209 |

|

|

Stockholders’ equity |

$ |

272,114 |

|

|

|

$ |

257,972 |

|

| COMMON SHARE

DATA |

|

|

|

|

|

Basic earnings per share |

$ |

3.19 |

|

|

|

$ |

2.13 |

|

|

Cash dividends paid per share |

$ |

1.03 |

|

|

|

$ |

1.00 |

|

|

Book value per share |

$ |

31.35 |

|

|

|

$ |

29.62 |

|

|

Number of common shares outstanding |

8,679,206 |

|

|

|

8,709,393 |

|

| SELECTED

RATIOS |

|

|

|

|

|

Return on average assets |

1.03 |

% |

|

|

0.78 |

% |

|

Return on average equity |

10.52 |

% |

|

|

7.39 |

% |

|

Non-performing loans to total loans |

0.40 |

% |

|

|

0.48 |

% |

|

Net charge-offs to average loans outstanding |

0.08 |

% |

|

|

0.16 |

% |

|

Allowance for loan losses to non-acquired loans (non-GAAP)* |

1.66 |

% |

|

|

1.65 |

% |

|

Allowance for loan losses to total loans |

1.30 |

% |

|

|

1.23 |

% |

|

Allowance for loan losses to non-performing loans |

326.30 |

% |

|

|

251.16 |

% |

|

|

|

|

|

|

|

|

|

* See Non-GAAP Financial Measures above. |

|

|

|

|

|

|

| Contact: |

Lynda L.

Glass |

| |

EVP/Secretary & |

| |

Chief Governance Officer |

| |

717.339.5085 |

| |

lglass@acnb.com |

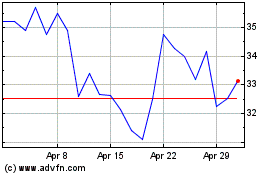

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Apr 2023 to Apr 2024