Adaptive Biotechnologies Corporation (“Adaptive Biotechnologies”)

(Nasdaq: ADPT), a commercial stage biotechnology company that aims

to translate the genetics of the adaptive immune system into

clinical products to diagnose and treat disease, today reported

financial results for the quarter ended March 31, 2022.

“We started the year strong and completed a strategic

reorganization of our company around two key business areas: MRD

and Immune Medicine,” said Chad Robins, chief executive officer and

co-founder of Adaptive Biotechnologies. “I am encouraged by the

solid momentum across both business areas as we optimize our

resource allocation to capitalize on the multiple opportunities

ahead.”

Recent Highlights

- Revenue of $38.6

million for the first quarter 2022, representing a 0.5% increase

from the first quarter 2021.

- clonoSEQ test volume

in the first quarter 2022 grew 45% versus the first quarter of

prior year and 12% over the fourth quarter of 2021.

- Signed expanded MRD

pan-portfolio agreement with major partner in MM and CLL for the

use of MRD status as a clinical endpoint.

- Recognized $3.0

million in MRD regulatory milestone revenue resulting from a

biopharmaceutical partner who used data from our MRD assay to

support its drug approval.

- Completed analysis

from immuneSense Lyme blinded data from 990 participants,

confirming T-Detect Lyme is nearly twice as sensitive as the

current standard of care (54% T-Detect Lyme vs 30% STTT

sensitivity, both at 99% specificity). T-Detect Lyme offering to be

made available during 2022 Lyme season.

- Entered a new T-MAP

collaboration with the Janssen Pharmaceutical Companies of Johnson

& Johnson to map T cell responses to RSV to support

Janssen’s RSV vaccine program.

- Announced the

appointment of Tycho Peterson as chief financial officer, who

brings several decades of financial leadership and experience

within the life science and diagnostic industries.

First Quarter 2022 Financial

Results

Revenue was $38.6 million for the quarter ended March 31, 2022,

representing a 0.5% increase from the first quarter in the prior

year. Immune Medicine revenue was $20.8 million for the quarter,

representing a 4% increase from the first quarter in the prior

year. MRD revenue was $17.8 million for the quarter, representing a

3% decrease from the first quarter in the prior year.

Operating expenses were $101.7 million for the first quarter of

2022, compared to $79.7 million in the first quarter of the prior

year, representing an increase of 28%.

Net loss was $62.8 million for the first quarter of 2022,

compared to $40.6 million for the same period in 2021.

Cash, cash equivalents and marketable securities was $500.7

million as of March 31, 2022.

2022 Financial Guidance

Adaptive Biotechnologies reiterates full year

2022 revenue to be in the range of $185 million to $195

million.

Webcast and Conference Call

Information

Adaptive Biotechnologies will host a conference call to discuss

its first quarter 2022 financial results after market close on

Wednesday, May 4, 2022 at 4:30 PM Eastern Time. The conference call

can be accessed at http://investors.adaptivebiotech.com. The

webcast will be archived and available for replay at least 90 days

after the event.

About Adaptive Biotechnologies

Adaptive Biotechnologies (“we” or “our”) is a

commercial-stage biotechnology company focused on harnessing the

inherent biology of the adaptive immune system to transform the

diagnosis and treatment of disease. We believe the adaptive immune

system is nature’s most finely tuned diagnostic and therapeutic for

most diseases, but the inability to decode it has prevented the

medical community from fully leveraging its capabilities. Our

proprietary immune medicine platform reveals and translates the

massive genetics of the adaptive immune system with scale,

precision and speed to develop products in life sciences research,

clinical diagnostics and drug discovery. We have three commercial

products and a robust clinical pipeline to diagnose, monitor and

enable the treatment of diseases such as cancer, autoimmune

disorders, and infectious diseases. Our goal is to develop and

commercialize immune-driven clinical products tailored to each

individual patient.

Forward-Looking Statements

This press release contains forward-looking statements that are

based on management’s beliefs and assumptions and on information

currently available to management. All statements contained in this

release other than statements of historical fact are

forward-looking statements, including statements regarding our

ability to develop, commercialize and achieve market acceptance of

our current and planned products and services, our research and

development efforts and other matters regarding our business

strategies, use of capital, results of operations and financial

position and plans and objectives for future operations.

In some cases, you can identify forward-looking statements by

the words “may,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “ongoing” or the negative of

these terms or other comparable terminology, although not all

forward-looking statements contain these words. These statements

involve risks, uncertainties and other factors that may cause

actual results, levels of activity, performance or achievements to

be materially different from the information expressed or implied

by these forward-looking statements. These risks, uncertainties and

other factors are described under "Risk Factors," "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" and elsewhere in the documents we file with the

Securities and Exchange Commission from time to time. We caution

you that forward-looking statements are based on a combination of

facts and factors currently known by us and our projections of the

future, about which we cannot be certain. As a result, the

forward-looking statements may not prove to be accurate. The

forward-looking statements in this press release represent our

views as of the date hereof. We undertake no obligation to update

any forward-looking statements for any reason, except as required

by law.

ADAPTIVE MEDIALaura

Cooper205-908-5603media@adaptivebiotech.com

ADAPTIVE INVESTORSKarina Calzadilla, Vice

President, Investor Relations201-396-1687Carrie Mendivil, Gilmartin

Groupinvestors@adaptivebiotech.com

|

Adaptive BiotechnologiesCondensed Consolidated

Statements of Operations(in thousands, except share and per share

amounts)(unaudited) |

| |

| |

|

Three Months Ended March 31, |

|

| |

|

2022 |

|

|

2021 |

|

|

Revenue |

|

$ |

38,620 |

|

|

$ |

38,442 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

13,192 |

|

|

|

9,991 |

|

|

Research and development |

|

|

37,839 |

|

|

|

33,772 |

|

|

Sales and marketing |

|

|

26,093 |

|

|

|

20,604 |

|

|

General and administrative |

|

|

24,144 |

|

|

|

14,936 |

|

|

Amortization of intangible assets |

|

|

419 |

|

|

|

419 |

|

|

Total operating expenses |

|

|

101,687 |

|

|

|

79,722 |

|

| Loss from operations |

|

|

(63,067 |

) |

|

|

(41,280 |

) |

| Interest and other income,

net |

|

|

271 |

|

|

|

638 |

|

| Net loss |

|

|

(62,796 |

) |

|

|

(40,642 |

) |

|

Add: Net loss attributable to noncontrolling interest |

|

|

60 |

|

|

|

— |

|

| Net loss attributable to

Adaptive Biotechnologies Corporation |

|

$ |

(62,736 |

) |

|

$ |

(40,642 |

) |

| Net loss per share

attributable to Adaptive Biotechnologies Corporation common

shareholders, basic and diluted |

|

$ |

(0.44 |

) |

|

$ |

(0.29 |

) |

| Weighted-average shares used

in computing net loss per share attributable to Adaptive

Biotechnologies Corporation common shareholders, basic and

diluted |

|

|

141,697,252 |

|

|

|

138,967,754 |

|

| |

|

|

|

|

|

|

|

|

|

Adaptive BiotechnologiesCondensed Consolidated Balance

Sheets(in thousands, except share and per share

amounts) |

|

|

|

March 31, 2022 |

|

|

December 31, 2021 |

|

|

|

|

(unaudited) |

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

114,805 |

|

|

$ |

139,065 |

|

|

Short-term marketable securities (amortized cost of $250,448 and

$214,115, respectively) |

|

|

248,757 |

|

|

|

213,996 |

|

|

Accounts receivable, net |

|

|

22,518 |

|

|

|

17,409 |

|

|

Inventory |

|

|

21,002 |

|

|

|

19,263 |

|

|

Prepaid expenses and other current assets |

|

|

12,038 |

|

|

|

13,015 |

|

|

Total current assets |

|

|

419,120 |

|

|

|

402,748 |

|

| Long-term assets |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

85,994 |

|

|

|

85,262 |

|

|

Operating lease right-of-use assets |

|

|

85,634 |

|

|

|

87,678 |

|

|

Long-term marketable securities (amortized cost of $140,202 and

$218,163, respectively) |

|

|

137,110 |

|

|

|

217,145 |

|

|

Restricted cash |

|

|

2,382 |

|

|

|

2,138 |

|

|

Intangible assets, net |

|

|

8,107 |

|

|

|

8,526 |

|

|

Goodwill |

|

|

118,972 |

|

|

|

118,972 |

|

|

Other assets |

|

|

874 |

|

|

|

875 |

|

|

Total assets |

|

$ |

858,193 |

|

|

$ |

923,344 |

|

| Liabilities and

shareholders’ equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

5,959 |

|

|

$ |

3,307 |

|

|

Accrued liabilities |

|

|

10,407 |

|

|

|

9,343 |

|

|

Accrued compensation and benefits |

|

|

6,651 |

|

|

|

15,642 |

|

|

Current portion of operating lease liabilities |

|

|

8,545 |

|

|

|

5,055 |

|

|

Current portion of deferred revenue |

|

|

83,504 |

|

|

|

80,460 |

|

|

Total current liabilities |

|

|

115,066 |

|

|

|

113,807 |

|

| Long-term liabilities |

|

|

|

|

|

|

|

|

|

Operating lease liabilities, less current portion |

|

|

104,978 |

|

|

|

106,685 |

|

|

Deferred revenue, less current portion |

|

|

84,894 |

|

|

|

98,750 |

|

|

Total liabilities |

|

|

304,938 |

|

|

|

319,242 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Shareholders’ equity |

|

|

|

|

|

|

|

|

|

Preferred stock: $0.0001 par value, 10,000,000 shares authorized at

March 31, 2022 and December 31, 2021; no shares issued and

outstanding at March 31, 2022 and December 31, 2021 |

|

|

— |

|

|

|

— |

|

|

Common stock: $0.0001 par value, 340,000,000 shares authorized at

March 31, 2022 and December 31, 2021; 142,183,258 and 141,393,865

shares issued and outstanding at March 31, 2022 and December 31,

2021, respectively |

|

|

14 |

|

|

|

14 |

|

|

Additional paid-in capital |

|

|

1,339,601 |

|

|

|

1,324,006 |

|

|

Accumulated other comprehensive loss |

|

|

(4,783 |

) |

|

|

(1,137 |

) |

|

Accumulated deficit |

|

|

(781,627 |

) |

|

|

(718,891 |

) |

|

Total Adaptive Biotechnologies Corporation shareholders’

equity |

|

|

553,205 |

|

|

|

603,992 |

|

|

Noncontrolling interest |

|

|

50 |

|

|

|

110 |

|

|

Total shareholders’ equity |

|

|

553,255 |

|

|

|

604,102 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

858,193 |

|

|

$ |

923,344 |

|

|

|

|

|

|

|

|

|

|

|

Revenue Reclassification and clonoSEQ

Test Volume

We previously disclosed revenue bifurcated into sequencing and

development financial statement captions and now present total

revenue on our unaudited condensed consolidated statements of

operations.

The following table presents the amount of sequencing revenue

and development revenue recognized under our Immune Medicine and

MRD market opportunities for the periods presented (in thousands,

unaudited):

| |

|

Three Months Ended |

|

| |

|

December 31,2021 |

|

|

September 30,2021 |

|

|

June 30,2021 |

|

|

March 31,2021 |

|

|

Immune Medicine revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sequencing revenue |

|

$ |

6,860 |

|

|

$ |

8,170 |

|

|

$ |

5,404 |

|

|

$ |

4,048 |

|

|

Development revenue |

|

|

14,514 |

|

|

|

15,445 |

|

|

|

17,635 |

|

|

|

16,057 |

|

|

Total Immune Medicine revenue |

|

|

21,374 |

|

|

|

23,615 |

|

|

|

23,039 |

|

|

|

20,105 |

|

| MRD revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sequencing revenue |

|

|

16,201 |

|

|

|

13,936 |

|

|

|

13,151 |

|

|

|

11,126 |

|

|

Development revenue |

|

|

355 |

|

|

|

1,916 |

|

|

|

2,315 |

|

|

|

7,211 |

|

|

Total MRD revenue |

|

|

16,556 |

|

|

|

15,852 |

|

|

|

15,466 |

|

|

|

18,337 |

|

|

Total revenue |

|

$ |

37,930 |

|

|

$ |

39,467 |

|

|

$ |

38,505 |

|

|

$ |

38,442 |

|

| |

|

Three Months Ended |

|

| |

|

December 31,2020 |

|

|

September 30,2020 |

|

|

June 30,2020 |

|

|

March 31,2020 |

|

|

Immune Medicine revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sequencing revenue |

|

$ |

3,310 |

|

|

$ |

3,691 |

|

|

$ |

2,036 |

|

|

$ |

3,170 |

|

|

Development revenue |

|

|

17,155 |

|

|

|

12,438 |

|

|

|

12,856 |

|

|

|

11,077 |

|

|

Total Immune Medicine revenue |

|

|

20,465 |

|

|

|

16,129 |

|

|

|

14,892 |

|

|

|

14,247 |

|

| MRD revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sequencing revenue |

|

|

9,399 |

|

|

|

7,585 |

|

|

|

5,949 |

|

|

|

6,299 |

|

|

Development revenue |

|

|

321 |

|

|

|

2,585 |

|

|

|

147 |

|

|

|

364 |

|

|

Total MRD revenue |

|

|

9,720 |

|

|

|

10,170 |

|

|

|

6,096 |

|

|

|

6,663 |

|

|

Total revenue |

|

$ |

30,185 |

|

|

$ |

26,299 |

|

|

$ |

20,988 |

|

|

$ |

20,910 |

|

We also previously disclosed the number of clonoSEQ reports

provided to ordering physicians in the United States, referred to

as “clinical sequencing volume” or “clinical sequencing volume,

excluding T-Detect COVID volume” in the “Management’s Discussion

and Analysis of Financial Condition and Results of Operations”

section of certain of our SEC filings. We now present the number of

clonoSEQ reports and results we have provided to ordering

physicians in the United States and international technology

transfer sites, collectively referred to as “clonoSEQ test volume.”

Our clonoSEQ test volume does not include sample results from our

biopharmaceutical customers or academic institutions utilizing our

MRD services.

The following table presents our clonoSEQ test volume for the

periods presented:

| |

|

Three Months Ended |

|

| |

|

December 31,2021 |

|

|

September 30,2021 |

|

|

June 30,2021 |

|

|

March 31,2021 |

|

|

Clinical sequencing volume, excluding T-Detect COVID volume |

|

|

6,356 |

|

|

|

5,928 |

|

|

|

5,475 |

|

|

|

4,757 |

|

| clonoSEQ reports or results

provided to international technology transfer sites |

|

|

494 |

|

|

|

413 |

|

|

|

422 |

|

|

|

543 |

|

|

clonoSEQ test volume |

|

|

6,850 |

|

|

|

6,341 |

|

|

|

5,897 |

|

|

|

5,300 |

|

| |

|

Three Months Ended |

|

| |

|

December 31,2020 |

|

|

September 30,2020 |

|

|

June 30,2020 |

|

|

March 31,2020 |

|

|

Clinical sequencing volume |

|

|

4,509 |

|

|

|

4,023 |

|

|

|

3,136 |

|

|

|

3,518 |

|

| clonoSEQ reports or results

provided to international technology transfer sites |

|

|

704 |

|

|

|

375 |

|

|

|

310 |

|

|

|

238 |

|

|

clonoSEQ test volume |

|

|

5,213 |

|

|

|

4,398 |

|

|

|

3,446 |

|

|

|

3,756 |

|

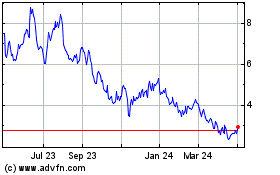

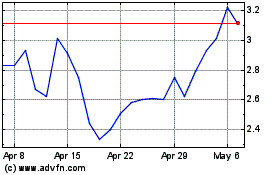

Adaptive Biotechnologies (NASDAQ:ADPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adaptive Biotechnologies (NASDAQ:ADPT)

Historical Stock Chart

From Apr 2023 to Apr 2024