Current Report Filing (8-k)

16 December 2022 - 8:03AM

Edgar (US Regulatory)

0000769397falseJanuary 3100007693972022-12-152022-12-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

December 15, 2022

Autodesk, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 000-14338 | | 94-2819853 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

One Market Street, Ste. 400 | | |

| San Francisco, | California | 94105 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

(415) 507-5000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[☐] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[☐] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[☐] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[☐] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | ADSK | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [☐]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

On December 15, 2022, the Board of Directors (the “Board”) of Autodesk, Inc. (the “Company”) amended and restated the Company’s Bylaws, effective immediately. The Bylaws were amended and restated, among other things, to update and revise the advance notice procedures for the nomination of directors or the proposal of other business at stockholder meetings; change certain provisions relating to stockholder nominees for election as a director to address the new universal proxy rules adopted by the Securities and Exchange Commission; update certain provisions related to stockholder meetings, including clarifying the Board may cancel, postpone or reschedule any previously scheduled annual meeting or special meeting of stockholders at any time; clarify the Company’s exclusive forum provisions; update provisions regarding indemnification; and make a variety of other language, clarifying and conforming changes and other technical edits and updates (including to account for changes in Delaware law).

The foregoing description of the amendment and restatement of the Bylaws is not complete and is qualified in its entirety by the full text of the amended and restated Bylaws, a copy of which is included as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 8.01. Other Events

On December 15, 2022 (the "Payment Date"), the Company repaid in full the $350.0 million aggregate principal amount of its outstanding 3.6% Notes due 2022 (the "Notes"). The Notes were issued pursuant to the Indenture dated as of December 13, 2012 (the "Indenture"), entered into between the Company and U.S. Bank National Association, as supplemented by the First Supplemental Indenture dated as of December 13, 2012 (the “First Supplemental Indenture”). The Payment Date is the date on which the “Outstanding” principal, as defined in the First Supplemental Indenture, was originally payable pursuant to the First Supplemental Indenture. On the Payment Date, the Company paid the aggregate outstanding principal amount of the Notes of approximately $350 million, plus the accrued and unpaid interest to, but not including, the Payment Date. As a result of the payment, the Indenture was satisfied and discharged as to the Notes as of the Payment Date.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

Exhibit No. Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | AUTODESK, INC. |

| | |

| | By: /s/ Ruth Ann Keene |

| | Ruth Ann Keene

Executive Vice President, Chief Legal Officer |

Date: December 15, 2022

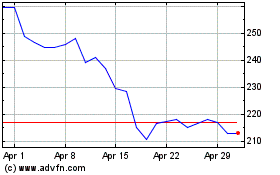

Autodesk (NASDAQ:ADSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

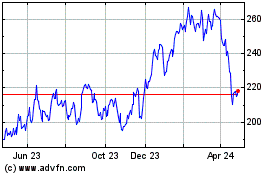

Autodesk (NASDAQ:ADSK)

Historical Stock Chart

From Apr 2023 to Apr 2024