Survey Finds Grocery Industry Changing Tactics to Navigate Inflation and Changing Shopper Behavior

11 October 2022 - 7:05AM

Price increases at the shelf may slow next year as a majority of

consumer packaged goods manufacturers and retailers believe price

points are “more important” in today’s marketplace and fewer than

40% of product makers say they plan to increase their list price in

the first half of 2023, according to a report by Advantage Sales, a

division of Advantage Solutions.

“Advantage Sales Outlook | October 2022,” based on more

than 100 responses to a survey of selected Advantage Sales clients

and customers, found one-fourth of manufacturers plan no price

increases and 37% are unsure if they’ll take a first-half price

hike.

When list price bump-ups occur, a majority of retailers (62%)

say they are passing most of the increase to the shelf, but still

compressing their margins. Very few (5%) say they’re raising

retails higher than the increase to enhance their margins.

“We’re seeing manufacturers and retailers considering and

implementing new tactics to combat the effects of inflation on

their costs and on shoppers’ price sensitivity and the negative

impact of continued supply chain challenges,” said Jill Blanchard,

president, client solutions for Advantage Solutions. “In some

areas, they’re on the same page and working together for mutual

benefit. But there are areas where their individual goals may be at

odds with those of their business partners.”

Blanchard pointed to other key findings in the report, among

them:

- Manufacturers’ most-cited strategies for navigating

inflationary costs in the first half of 2023 are investing in

supply-chain efficiencies and enforcing existing payment

terms.

- During the past six months, six in 10 surveyed manufacturers

have decreased their trade spending. Eight in 10 are planning to

reduce trade marketing funds to some degree in the first half of

2023 and seven in 10 will cut other marketing spending.

- To meet the needs of price-conscious consumers, retailers are

focusing primarily on price points; they report planning to expand

private-brand assortments, increase promotional offerings and

consider longer-term price reductions. Manufacturers' top strategy

is marketing their products as trusted, high-quality brands.

- Nearly nine in 10 retailers say their assortments will include

more private brands over the next 12 months. To compete,

manufacturers say they’ll lean into product innovation, marketing

and new packaging architecture.

- If deflation occurs, most manufacturers will invest in their

brands through marketing; half expect to drop savings to the bottom

line to improve their P&Ls. Most retailers, though, would

consider lowering their everyday price and increasing

promotions.

- Despite continued investments and opportunities in digital

commerce, manufacturers and retailers expect most of their growth

to come from brick-and-mortar sales.

Download the full Advantage Sales Outlook | October 2022

report.

About Advantage Sales

Advantage Sales, a division of Advantage Solutions, is a leading

sales agency and business solutions provider in the retail and

consumer goods industry. Advantage Sales offers a full range of

services — including headquarter sales services; digital shelf

management; analytics, insights and intelligence; retail services;

and business process outsourcing — that create value for clients by

helping them grow sales, reduce costs and quickly execute

go-to-market strategies. Our solutions drive growth for clients by

maximizing the availability of their brands across retail,

foodservice and online channels and by optimizing how they are

priced, positioned and promoted.

Visit advantagesales.net to learn more.

About Advantage Solutions

Advantage Solutions is a leading provider of outsourced sales

and marketing solutions to consumer goods companies and retailers.

Our data- and technology-driven services — which include

headquarter sales, retail merchandising, in-store and online

sampling, digital commerce, omnichannel marketing, retail media and

others — help brands and retailers of all sizes get products into

the hands of consumers, wherever they shop. As a trusted partner

and problem solver, we help our clients sell more while spending

less. Headquartered in Irvine, California, we have offices

throughout North America and strategic investments in select

markets throughout Africa, Asia, Australia and Europe through which

we serve the global needs of multinational, regional and local

manufacturers. Learn more at advantagesolutions.net.

ContactWill MintonVice President, Corporate MarketingAdvantage

Solutionspress@advantagesolutions.net

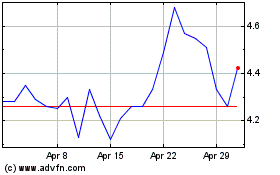

Advantage Solutions (NASDAQ:ADV)

Historical Stock Chart

From Mar 2024 to Apr 2024

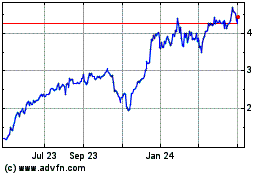

Advantage Solutions (NASDAQ:ADV)

Historical Stock Chart

From Apr 2023 to Apr 2024