Advantage Solutions Inc. (NASDAQ: ADV) (“Advantage,” “Advantage

Solutions,” the “Company,” “we” or “our”), a leading provider of

outsourced sales and marketing services to consumer goods

manufacturers and retailers, today reported financial results for

its third quarter ended September 30, 2022.

“Advantage’s performance in the third quarter was highlighted by

13% year-over-year revenue growth. Similar to recent prior

quarters, this increase was driven largely by the ongoing recovery

in our in-store sampling and demonstration business, along with

further growth in retail merchandising services,” said Advantage

Solutions Chief Executive Officer, Jill Griffin. “Although we have

generated sequential revenue growth each quarter this year, the

labor market remains extremely challenging, worsening over the

course of 2022, and wage inflation and macro-economic conditions

continue to be dynamic. Notwithstanding ongoing investments in

wages to remain competitive and in infrastructure to improve our

overall recruitment efficiencies, we have not been able to hire

enough associates to meet the continued strong demand for our ‘must

have’ service offerings. As a result of these ongoing challenges,

the rebound we were expecting in the second half of 2022 will be

more muted than we had originally anticipated and we believe will

ultimately extend beyond this year. Therefore, we are reducing our

2022 full year Adjusted EBITDA outlook to a range of $430 million

to $440 million.”

Griffin continued, “Given the labor and inflationary headwinds

and the longer path to more normalized operating conditions, we

will be making a pivot with respect to our capital allocation

priorities. In the current environment, we intend to be much more

focused on de-leveraging our balance sheet with less emphasis on

M&A in the near term until macro-economic conditions improve.

Looking ahead, I remain confident that Advantage remains in a

strong position to drive profitable growth as market conditions

normalize.”

Third Quarter 2022 Highlights

- Revenues were $1,051.1 million for the third quarter of 2022,

representing an increase of $122.3 million, or 13.2%, from the

third quarter 2021 revenues of $928.8 million.

- Operating income was $46.8 million for the third quarter of

2022, representing a decrease of $18.8 million, or 28.6%, from the

third quarter 2021 operating income of $65.6 million.

- Net income was $23.2 million for the third quarter of 2022,

representing a decrease of $1.1 million, or 4.5%, from the third

quarter 2021 net income of $24.3 million.

- Adjusted EBITDA was $118.3 million for the third quarter of

2022, representing a decrease of $15.5 million, or 11.6%, from the

third quarter 2021 Adjusted EBITDA of $133.8 million.

The year-over-year increase in revenues was driven by $73.2

million of growth in the marketing segment (an increase of 22% year

over year) and $49.1 million of growth in the sales segment (an

increase of 8% year over year). Third quarter growth in the

marketing segment was driven primarily by the continued recovery in

in-store product demonstration and sampling services, partially

offset by a decrease in media spend by certain clients. The third

quarter growth in the sales segment was driven by an increase in

retail merchandising services and international businesses,

partially offset by a decrease in third-party selling and retailing

services.

The year-over-year decrease in operating income was primarily

due to ongoing investment in wage, recruiting activities and

employee benefit expenses, coupled with macro-economic

pressures.

The year-over-year decrease in net income was driven by the

decline in operating income, partially offset by a decline in

interest expense and the provision for income taxes.

The year-over-year decline in Adjusted EBITDA was primarily due

to the same items impacting the decline in operating income as

noted above.

Balance Sheet Highlights

As of September 30, 2022, the Company’s cash and cash

equivalents was $96.2 million, total debt was $2,082.4 million and

Net Debt was $1,986.2 million. The debt capitalization consists

primarily of the $1,302 million First Lien Term Loan and $775

million of senior secured notes as of September 30, 2022.

Fiscal Year 2022 Outlook

The confluence of an unprecedented tight labor market,

increasing inflationary pressures, and broad macro-economic

uncertainty are challenging consumers, retailers and CPG brands,

alike. As a result of these factors and others, the Company is

updating its fiscal year 2022 Adjusted EBITDA guidance range to

$430 million to $440 million, as compared to previously provided

Adjusted EBITDA range of $490 million to $510 million. Based on

strong customer demand, the Company remains confident that its

sampling and demonstration business will continue to build back in

2023.

Conference Call Details

Advantage will host a conference call at 5:00 p.m. ET on

November 9, 2022 to discuss its third quarter 2022 financial

performance and business outlook. To participate, please dial (844)

825-9789 within the United States or (412) 317-5180 outside the

United States approximately 10 minutes before the scheduled start

of the call. The conference ID for the call is 10171100. The

conference call will also be accessible live via audio broadcast on

the Investor Relations section of the Advantage website at

ir.advantagesolutions.net.

A replay of the conference call will be available online at

ir.advantagesolutions.net. In addition, an audio replay of the call

will be available for one week following the call and can be

accessed by dialing (844) 512-2921 within the United States or

(412) 317-6671 outside the United States. The replay ID is

10171100.

About Advantage Solutions

Advantage Solutions (NASDAQ: ADV) is a leading provider of

outsourced sales and marketing solutions to consumer goods

companies and retailers. Our data- and technology-driven services —

which include headquarter sales, retail merchandising, in-store and

online sampling, digital commerce, omnichannel marketing, retail

media and others — help brands and retailers of all sizes get

products into the hands of consumers, wherever they shop. As a

trusted partner and problem solver, we help our clients sell more

while spending less. Headquartered in Irvine, California, we

have offices throughout North America and strategic investments in

select markets throughout Africa, Asia, Australia and Europe

through which we serve the global needs of multinational, regional

and local manufacturers. For more information, please visit

advantagesolutions.net.

Forward-Looking Statements

Certain statements in this press release may be considered

forward-looking statements within the meaning of the federal

securities laws, including statements regarding the expected future

performance of Advantage's business and projected financial

results. Forward-looking statements generally relate to future

events or Advantage’s future financial or operating performance.

These forward-looking statements generally are identified by the

words “may”, “should”, “expect”, “intend”, “will”, “would”,

“could”, “estimate”, “anticipate”, “believe”, “predict”,

“potential” or “continue”, or the negatives of these terms or

variations of them or similar terminology. Such forward-looking

statements are predictions, projections and other statements about

future events that are based on current expectations and

assumptions and, as a result, are subject to risks, uncertainties

and other factors which could cause actual results to differ

materially from those expressed or implied by such forward looking

statements.

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by Advantage and its

management at the time of such statements, are inherently

uncertain. Factors that may cause actual results to differ

materially from current expectations include, but are not limited

to, the COVID-19 pandemic and the measures taken in response

thereto; the availability, acceptance, administration and

effectiveness of any COVID-19 vaccine; market-driven wage changes

or changes to labor laws or wage or job classification regulations,

including minimum wage; Advantage’s ability to continue to generate

significant operating cash flow; client procurement strategies and

consolidation of Advantage’s clients’ industries creating pressure

on the nature and pricing of its services; consumer goods

manufacturers and retailers reviewing and changing their sales,

retail, marketing and technology programs and relationships;

Advantage’s ability to successfully develop and maintain relevant

omni-channel services for our clients in an evolving industry and

to otherwise adapt to significant technological change; Advantage’s

ability to maintain proper and effective internal control over

financial reporting in the future; potential and actual harms to

Advantage’s business arising from the Take 5 Matter; Advantage’s

substantial indebtedness and our ability to refinance at favorable

rates; and other risks and uncertainties set forth in the section

titled “Risk Factors” in the Annual Report on Form 10-K and

Quarterly Report on Form 10-Q filed by the Company with the

Securities and Exchange Commission (the “SEC”) on March 1, 2022 and

November 9, 2022, respectively, and in its other filings made from

time to time with the SEC. These filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and Advantage assumes

no obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

Non-GAAP Financial Measures and Related

Information

This press release includes certain financial measures not

presented in accordance with generally accepted accounting

principles (“GAAP”), including Adjusted EBITDA and Net Debt. These

are not measures of financial performance calculated in accordance

with GAAP and may exclude items that are significant in

understanding and assessing Advantage’s financial results.

Therefore, the measures are in addition to, and not a substitute

for or superior to, measures of financial performance prepared in

accordance with GAAP, and should not be considered in isolation or

as an alternative to net income, cash flows from operations or

other measures of profitability, liquidity or performance under

GAAP. You should be aware that Advantage’s presentation of these

measures may not be comparable to similarly titled measures used by

other companies. Reconciliations of historical non-GAAP measures to

their most directly comparable GAAP counterparts are included

below.

Advantage believes these non-GAAP measures provide useful

information to management and investors regarding certain financial

and business trends relating to Advantage’s financial condition and

results of operations. Advantage believes that the use of Adjusted

EBITDA and Net Debt provides an additional tool for investors to

use in evaluating ongoing operating results and trends and in

comparing Advantage’s financial measures with other similar

companies, many of which present similar non-GAAP financial

measures to investors. Non-GAAP financial measures are subject to

inherent limitations as they reflect the exercise of judgments by

management about which expense and income are excluded or included

in determining these non-GAAP financial measures. Additionally,

other companies may calculate non-GAAP measures differently, or may

use other measures to calculate their financial performance, and

therefore Advantage’s non-GAAP measures may not be directly

comparable to similarly titled measures of other companies.

Adjusted EBITDA means net income (loss) before (i) interest

expense, net, (ii) provision for income taxes, (iii) depreciation,

(iv) impairment of goodwill and indefinite-lived assets, (v)

amortization of intangible assets, (vi) equity-based compensation

of Karman Topco L.P., (vii) changes in fair value of warrant

liability, (viii) stock-based compensation expense, (ix) fair value

adjustments of contingent consideration related to acquisitions,

(x) acquisition-related expenses, (xi) costs associated with

COVID-19, net of benefits received, (xii) EBITDA for economic

interests in investments, (xiii) restructuring expenses, (xiv)

litigation expenses (recovery), (xv) costs associated with the Take

5 Matter and (xvi) other adjustments that management believes are

helpful in evaluating our operating performance.

Net Debt represents the sum of current portion of long-term debt

and long-term debt, less cash and cash equivalents and debt

issuance costs. With respect to Net Debt, cash and cash equivalents

are subtracted from the GAAP measure, total debt, because they

could be used to reduce the debt obligations. We present Net Debt

because we believe this non-GAAP measure provides useful

information to management and investors regarding certain financial

and business trends relating to the Company’s financial condition

and to evaluate changes to the Company's capital structure and

credit quality assessment.

Due to rounding, numbers presented throughout this document may

not add up precisely to the totals provided and percentages may not

precisely reflect the absolute figures.

This press release also includes certain estimates and

projections of Adjusted EBITDA, including with respect to expected

fiscal 2022 results. Due to the high variability and difficulty in

making accurate estimates and projections of some of the

information excluded from Adjusted EBITDA, together with some of

the excluded information not being ascertainable or accessible,

Advantage is unable to quantify certain amounts that would be

required to be included in the most directly comparable GAAP

financial measures without unreasonable effort. Consequently, no

disclosure of estimated or projected comparable GAAP measures is

included and no reconciliation of such forward-looking non-GAAP

financial measures is included.

Advantage Solutions

Inc.Reconciliation of Net Income to Adjusted

EBITDA(Unaudited)

|

Consolidated |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

| |

2022 |

|

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

23,227 |

|

|

|

$ |

24,327 |

|

|

$ |

44,437 |

|

|

$ |

29,535 |

|

| Add: |

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

23,557 |

|

|

|

|

36,490 |

|

|

|

63,628 |

|

|

|

104,544 |

|

| Provision for income taxes |

|

1,158 |

|

|

|

|

8,276 |

|

|

|

11,523 |

|

|

|

16,582 |

|

| Depreciation and

amortization |

|

57,785 |

|

|

|

|

59,163 |

|

|

|

173,997 |

|

|

|

181,450 |

|

| Equity based compensation of

Topco(a) |

|

(828 |

) |

|

|

|

(5,575 |

) |

|

|

(7,142 |

) |

|

|

(10,031 |

) |

| Change in fair value of warrant

liability |

|

(1,100 |

) |

|

|

|

(3,491 |

) |

|

|

(21,456 |

) |

|

|

(5,024 |

) |

| Stock-based compensation

expense(b) |

|

7,174 |

|

|

|

|

7,854 |

|

|

|

29,906 |

|

|

|

25,497 |

|

| Fair value adjustments related to

contingent consideration related to acquisitions(c) |

|

(340 |

) |

|

|

|

3,221 |

|

|

|

5,448 |

|

|

|

5,776 |

|

| Acquisition-related

expenses(d) |

|

4,260 |

|

|

|

|

5,110 |

|

|

|

19,843 |

|

|

|

13,053 |

|

| EBITDA for economic interests in

investments(e) |

|

(2,474 |

) |

|

|

|

(3,620 |

) |

|

|

(7,546 |

) |

|

|

(6,616 |

) |

| Restructuring expenses(f) |

|

3,562 |

|

|

|

|

(394 |

) |

|

|

4,458 |

|

|

|

10,636 |

|

| Litigation(g) |

|

— |

|

|

|

|

(92 |

) |

|

|

(800 |

) |

|

|

(910 |

) |

| Costs associated with COVID-19,

net of benefits received(h) |

|

2,009 |

|

|

|

|

1,087 |

|

|

|

4,945 |

|

|

|

(948 |

) |

| Costs associated with the Take 5

Matter(i) |

|

278 |

|

|

|

|

1,400 |

|

|

|

2,088 |

|

|

|

3,611 |

|

| Adjusted EBITDA |

$ |

118,268 |

|

|

|

$ |

133,756 |

|

|

$ |

323,329 |

|

|

$ |

367,155 |

|

_________________

| (a) |

Represents expenses related to

(i) equity-based compensation expense associated with grants of

Common Series D Units of Karman Topco L.P. (“Topco”) made to one of

the equity holders of Topco and (ii) equity-based compensation

expense associated with the Common Series C Units of Topco. |

| (b) |

Represents non-cash compensation

expense related to the 2020 Incentive Award Plan and the 2020

Employee Stock Purchase Plan. |

| (c) |

Represents adjustments to the

estimated fair value of our contingent consideration liabilities

related to our acquisitions. See Note 6—Fair Value of Financial

Instruments to our unaudited condensed financial statements for the

three and nine months ended September 30, 2022 and 2021. |

| (d) |

Represents fees and costs

associated with activities related to our acquisitions and

restructuring activities including professional fees, due

diligence, and integration activities. |

| (e) |

Represents additions to reflect

our proportional share of Adjusted EBITDA related to our equity

method investments and reductions to remove the Adjusted EBITDA

related to the minority ownership percentage of the entities that

we fully consolidate in our financial statements. |

| (f) |

Represents fees and costs

associated with various internal reorganization activities among

our consolidated entities. |

| (g) |

Represents legal settlements that

are unusual or infrequent costs associated with our operating

activities. |

| (h) |

Represents (i) costs related to

implementation of strategies for workplace safety in response to

COVID-19, including employee-relief fund, additional sick pay for

front-line associates, medical benefit payments for furloughed

associates, and personal protective equipment; and (ii) benefits

received from government grants for COVID-19 relief. |

| (i) |

Represents costs associated with

the Take 5 Matter, primarily, professional fees and other related

costs, for the three and nine months ended September 30, 2022 and

2021, respectively. |

| |

|

Advantage Solutions

Inc.Reconciliation of Total Debt to Net

Debt(Unaudited)

| (in

millions) |

September 30, 2022 |

|

|

Current portion of long-term debt |

$ |

|

14.7 |

|

| Long-term debt, net of current

portion |

|

|

2,024.6 |

|

| Less: Debt issuance costs |

|

|

(43.1 |

) |

| Total Debt |

|

|

2,082.4 |

|

| Less: Cash and cash

equivalents |

|

|

96.2 |

|

|

Total Net Debt |

$ |

|

1,986.2 |

|

Contacts: Lasse GlassenAddo Investor

Relationsinvestorrelations@advantagesolutions.net

(424) 238-6249

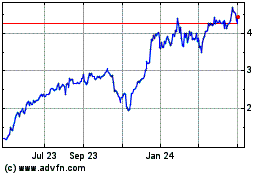

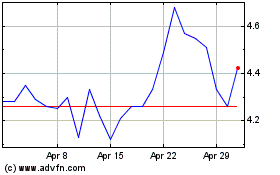

Advantage Solutions (NASDAQ:ADV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advantage Solutions (NASDAQ:ADV)

Historical Stock Chart

From Apr 2023 to Apr 2024