Adverum Biotechnologies, Inc. (Nasdaq: ADVM), a clinical-stage

company that aims to establish gene therapy as a new standard of

care for highly prevalent ocular diseases, today announced

financial results for the third quarter ended September 30, 2022.

“The third quarter was instrumental for Adverum, as we dosed our

first subject in our Phase 2 LUNA trial of Ixo-vec evaluating the

2E11 dose and a new, lower 6E10 dose, along with enhanced

prophylactic steroid regimens for the treatment of wet AMD,” stated

Laurent Fischer, M.D., president and chief executive officer of

Adverum Biotechnologies. “We look forward to sharing interim data

from LUNA throughout 2023. We are incredibly excited with our

progress in advancing our investigational gene therapy candidate

Ixo-vec, which we believe has the potential to transform the

treatment paradigm for patients with wet age-related macular

degeneration and meaningfully reduce the burden of frequent

anti-VEGF injections. The transformational potential of Ixo-vec was

recognized by the European Medicines Agency earlier this summer

with its granting Ixo-vec with Priority Medicines designation.”

Dr. Fischer continued, “We presented two-year, end of study,

safety and efficacy data from our OPTIC trial at the recent Annual

Meeting of The Retina Society, indicating that a single IVT

injection of Ixo-vec was generally well tolerated and can maintain

or improve vision, as well as improve intraretinal and subretinal

fluid volume in wet AMD patients. We are encouraged by the data

demonstrating that a single intravitreal injection of Ixo-vec can

lead to stable and persistent aflibercept protein levels through

three years resulting in better fluid control known to be

associated with favorable vision outcomes, as well as decreasing

treatment burden by an 81-98% reduction in mean annualized

anti-VEGF injections. These data strengthen the emerging

benefit-risk profile of Ixo-vec as we further evaluate the 2E11 and

6E10 doses in LUNA. We believe Ixo-vec, with its continuous

expression of aflibercept over years, can bring immense value to

patients with an improved quality of life, caregivers, retinal

specialists, payers and the healthcare systems.”

Recent Highlights

- In July 2022, Adverum completed an Investigational New Drug

amendment with the U.S. Food and Drug Administration to advance a

Phase 2 trial of Ixo-vec in wet AMD.

- In September 2022, Adverum dosed the first subject in its Phase

2 LUNA trial evaluating Ixo-vec at the 2x10^11 vg/eye (2E11) and

6x10^10 vg/eye (6E10) dose levels, with enhanced prophylactic

steroid regimens.

- Adverum presented data from the OPTIC trial of Ixo-vec at three

key scientific meetings:

- An oral presentation at the American Society of Retina

Specialists detailed an 81%-98% reduction in annualized anti-VEGF

injections and demonstrated continuous therapeutic aflibercept

protein levels through three years following a single, intravitreal

(IVT) injection of Ixo-vec. Ixo-vec was generally well tolerated at

the 2E11 dose, along with data demonstrating that mean

best-corrected visual acuity and central subfield thickness were

maintained or improved in subjects in the OPTIC trial.

- An oral presentation at the American Academy of Ophthalmology

2022 Annual Meeting detailed anatomical improvements in

intraretinal fluid (IRF) and subretinal fluid (SRF). In the 2E11

dose group, there was a 93% and 55% reduction in mean IRF and SRF

volume, respectively, from baseline to week 48, following a single

IVT dose of Ixo-vec.

- An oral presentation at The Retina Society’s 2022 Annual

Meeting detailed two-year, end of study data for all OPTIC cohorts,

including new data documenting that 80% and 53% of the participants

in the 6x10^11 vg/eye and 2E11 dose groups, respectively, were

supplemental injection free over two years.

Financial Results for the Three Months Ended September

30, 2022

- Cash, cash equivalents and short-term

investments were $203.3 million as of September 30, 2022,

compared to $305.2 million as of December 31, 2021. Adverum expects

the September 30, 2022 cash position to fund operations into

2025.

- Research and development expenses were

$23.8 million for the three months ended September 30, 2022,

compared to $24.1 million for the same period in 2021. Research and

development expenses decreased primarily due lower

facilities-related expenses, lower headcount following the

restructuring and lower consultant costs; partially offset by

restructuring costs and higher clinical trial-related expenses.

Stock-based compensation expense included in research and

development expenses was $1.4 million for the third quarter of

2022.

- General and administrative expenses were $17.2

million for the three months ended September 30, 2022, compared to

$14.5 million for the same period in 2021. General and

administrative expenses increased primarily due to reversal of

sublease income and restructuring costs; partially offset by lower

personnel-associated costs following the restructuring and

facilities-related expenses. Stock-based compensation expense

included in general and administrative expenses was $3.1 million

for the third quarter of 2022.

- Net loss was $40.1 million, or $0.40 per basic

and diluted share, for the three months ended September 30, 2022,

compared to $38.4 million, or $0.39 per basic per basic and diluted

share, for the same period in 2021.

About Wet Age-Related Macular Degeneration

Wet AMD, also known as neovascular AMD or nAMD, is an advanced

form of AMD, affecting approximately 10% of patients living with

AMD. Wet AMD is a leading cause of blindness in patients over 65

years of age, with a prevalence of approximately 20 million

individuals worldwide living with this condition. The incidence of

new cases of wet AMD is expected to grow significantly worldwide as

populations age. AMD is expected to impact 288 million people

worldwide by 2040, with wet AMD accounting for approximately 10% of

those cases.

About OPTIC Trial of ADVM-022 in Wet AMD

ADVM-022, ixoberogene soroparvovec (Ixo-vec), is Adverum’s

clinical-stage gene therapy product candidate being developed for

the treatment of wet AMD. Ixo-vec utilizes a proprietary vector

capsid, AAV.7m8, carrying an aflibercept coding sequence under the

control of a proprietary expression cassette. Unlike other

ophthalmic gene therapies that require surgery to administer the

gene therapy under the retina (sub-retinal approach) Ixo-vec has

the advantage of being administered as a one-time IVT injection in

the office and is designed to deliver long-term efficacy and reduce

the burden of frequent anti-VEGF injections, optimize patient

compliance, and improve vision outcomes for patients with wet

AMD.

The OPTIC trial is designed as a multi-center, open-label,

dose-ranging, safety, and efficacy trial of Ixo-vec in participants

with wet AMD who have demonstrated responsiveness to anti-VEGF

treatment. Patients in OPTIC are treatment-experienced, and

previously required frequent anti-VEGF injections to manage their

wet AMD and to maintain functional vision.

About LUNA Trial of Ixo-vec in Wet AMD

Ixoberogene soroparvovec (Ixo-vec) is Adverum’s clinical-stage

gene therapy product candidate being developed for the treatment of

wet AMD. Ixo-vec utilizes an engineered, proprietary vector capsid,

AAV.7m8, carrying an aflibercept coding sequence under the control

of a proprietary expression cassette. Unlike other ophthalmic gene

therapies that require surgery to administer the gene therapy under

the retina (sub-retinal approach), Ixo-vec has the advantage of

being administered as a one-time IVT injection in the office and is

designed to deliver long-term efficacy and reduce the burden of

frequent anti-vascular endothelial growth factor (VEGF) injections,

optimize patient compliance, and improve vision outcomes for

patients with wet AMD.

The LUNA trial is a multicenter, double-masked, randomized,

parallel-group Phase 2 study evaluating two doses of Ixo-vec,

including the 2x10^11 vg/eye (2E11) dose and a new, lower 6x10^10

vg/eye (6E10) dose, in wet AMD. The trial will randomize up to 72

participants equally across two doses and four prophylactic steroid

regimens in 40 sites in the U.S. and Europe. The primary endpoints

include the mean change in best-corrected visual acuity (BCVA) from

baseline to one year and the incidence and severity of adverse

events.

About Adverum Biotechnologies

Adverum Biotechnologies (NASDAQ: ADVM) is a clinical-stage

company that aims to establish gene therapy as a new standard of

care for highly prevalent ocular diseases with the aspiration of

developing functional cures for these diseases to restore vision

and prevent blindness. Leveraging the research capabilities of its

proprietary, intravitreal (IVT) platform, Adverum is developing

durable, single-administration therapies, designed to be delivered

in physicians’ offices, to eliminate the need for frequent ocular

injections to treat these diseases. Adverum is evaluating its novel

gene therapy candidate, ixoberogene soroparvovec (Ixo-vec, formerly

referred to as ADVM-022), as a one-time, IVT injection for patients

with neovascular or wet age-related macular degeneration. By

overcoming the challenges associated with current treatment

paradigms for these debilitating ocular diseases, Adverum aspires

to transform the standard of care, preserve vision, and create a

profound societal impact around the globe. For more information,

please visit www.adverum.com.

Forward-looking Statements

Statements contained in this press release regarding events or

results that may occur in the future are “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements include but are not limited to

statements regarding the potential benefits of Ixo-vec, the timing

of preliminary data from the LUNA trial evaluating the same, as

well as cash runway to fund operations into 2025. Actual results

could differ materially from those anticipated in such

forward-looking statements as a result of various risks and

uncertainties, including risks inherent to, without limitation:

Adverum’s novel technology, which makes it difficult to predict the

timing of commencement and completion of clinical trials;

regulatory uncertainties; enrollment uncertainties; the results of

early clinical trials not always being predictive of future

clinical trials and results; and the potential for future

complications or side effects in connection with use of Ixo-vec.

Additional risks and uncertainties facing Adverum are set forth

under the caption “Risk Factors” and elsewhere in Adverum’s

Securities and Exchange Commission (SEC) filings and reports,

including Adverum’s Quarterly Report on Form 10-Q for the quarter

ended June 30, 2022 filed with the SEC on August 11, 2022. All

forward-looking statements contained in this press release speak

only as of the date on which they were made. Adverum undertakes no

obligation to update such statements to reflect events that occur

or circumstances that exist after the date on which they were

made.

Corporate & Investor Inquiries

Anand ReddiVice President, Head of Corporate Strategy, External

Affairs and EngagementAdverum Biotechnologies, Inc.T:

650-649-1358E: areddi@adverum.com

Media

Megan TalonAssociate Director, Corporate CommunicationsAdverum

Biotechnologies, Inc.T: 650-649-1006E: mtalon@adverum.com

|

Adverum Biotechnologies, Inc. |

|

Consolidated Balance Sheets |

|

(In thousands) |

|

|

|

|

|

|

|

|

|

September 30 |

|

December 31 |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

(Unaudited) |

|

|

(1) |

|

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

84,430 |

|

|

$ |

34,195 |

|

|

Short-term investments |

|

|

118,834 |

|

|

|

270,993 |

|

|

Lease incentive receivable |

|

|

- |

|

|

|

5,709 |

|

|

Prepaid expenses and other current assets |

|

9,979 |

|

|

|

6,248 |

|

|

Total current assets |

|

|

213,243 |

|

|

|

317,145 |

|

|

Property and equipment, net |

|

|

36,579 |

|

|

|

33,060 |

|

|

Operating lease right-of-use assets |

|

|

79,882 |

|

|

|

86,000 |

|

|

Restricted cash |

|

|

2,503 |

|

|

|

2,503 |

|

|

Deferred rent receivable |

|

|

- |

|

|

|

769 |

|

|

Deposit and other long-term assets |

|

|

155 |

|

|

|

250 |

|

|

Total assets |

|

$ |

332,362 |

|

|

$ |

439,727 |

|

|

|

|

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

846 |

|

|

$ |

1,387 |

|

|

Lease liability, current portion |

|

|

11,236 |

|

|

|

1,886 |

|

|

Accrued expenses and other current liabilities |

|

|

16,539 |

|

|

|

18,047 |

|

|

Total current liabilities |

|

|

28,621 |

|

|

|

21,320 |

|

|

Lease liability, net of current portion |

|

|

94,464 |

|

|

|

101,108 |

|

|

Other noncurrent liabilities |

|

|

940 |

|

|

|

1,114 |

|

|

Total liabilities |

|

|

124,025 |

|

|

|

123,542 |

|

|

Stockholders' equity: |

|

|

|

|

|

Common stock |

|

|

10 |

|

|

|

10 |

|

|

Additional paid-in capital |

|

|

980,156 |

|

|

|

964,965 |

|

|

Accumulated other comprehensive loss |

|

|

(1,953 |

) |

|

|

(714 |

) |

|

Accumulated deficit |

|

|

(769,876 |

) |

|

|

(648,076 |

) |

|

Total stockholders' equity |

|

|

208,337 |

|

|

|

316,185 |

|

|

Total liabilities and stockholders' equity |

$ |

332,362 |

|

|

$ |

439,727 |

|

|

|

|

|

|

|

|

(1) Derived from Adverum's annual audited consolidated financial

statements. |

| |

|

|

|

|

|

Adverum Biotechnologies, Inc. |

|

Consolidated Statements of Operations |

|

(In thousands except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months endedSeptember 30, |

|

Nine months endedSeptember 30, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

License revenue |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

7,500 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

23,849 |

|

|

|

24,069 |

|

|

|

77,078 |

|

|

|

66,657 |

|

|

General and administrative |

|

|

17,188 |

|

|

|

14,453 |

|

|

|

46,117 |

|

|

|

52,546 |

|

|

Total operating expenses |

|

|

41,037 |

|

|

|

38,522 |

|

|

|

123,195 |

|

|

|

119,203 |

|

|

Operating loss |

|

|

(41,037 |

) |

|

|

(38,522 |

) |

|

|

(123,195 |

) |

|

|

(111,703 |

) |

|

Other income, net |

|

|

923 |

|

|

|

160 |

|

|

|

1,450 |

|

|

|

572 |

|

|

Net loss before income taxes |

|

|

(40,114 |

) |

|

|

(38,362 |

) |

|

|

(121,745 |

) |

|

|

(111,131 |

) |

|

Income tax provision |

|

|

(17 |

) |

|

|

- |

|

|

|

(55 |

) |

|

|

- |

|

|

Net loss |

|

$ |

(40,131 |

) |

|

$ |

(38,362 |

) |

|

$ |

(121,800 |

) |

|

$ |

(111,131 |

) |

|

Net loss per share — basic and diluted |

|

$ |

(0.40 |

) |

|

$ |

(0.39 |

) |

|

$ |

(1.23 |

) |

|

$ |

(1.13 |

) |

|

Weighted-average common shares outstanding - basic and diluted |

|

|

99,475 |

|

|

|

98,126 |

|

|

|

99,027 |

|

|

|

97,966 |

|

|

|

|

|

|

|

|

|

|

|

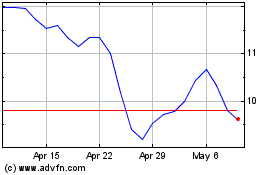

Adverum Biotechnologies (NASDAQ:ADVM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adverum Biotechnologies (NASDAQ:ADVM)

Historical Stock Chart

From Apr 2023 to Apr 2024