UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 Under

the Securities Exchange Act of 1934

For the month of December 2021

Commission File Number: 001-39179

Addex

Therapeutics Ltd

(Translation of registrant’s name into English)

Chemin des Mines 9

CH-1202 Geneva,

Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INCORPORATION BY REFERENCE

This disclosure in this Report on Form 6-K under the heading “Registered

Direct Offering and Concurrent Private Offering” and Exhibits 4.1, 4.2, 5.1, 10.1, 23.1 and 99.1 hereto, shall be deemed to be incorporated

by reference into the registration statements on Form F-3 (disclosure in this Registration No. 333-255089) and Form S-8

(Registration No. 333-255124) of Addex Therapeutics Ltd (including any prospectuses forming a part of such registration statements)

and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently

filed or furnished.

REGISTERED

DIRECT OFFERING AND CONCURRENT PRIVATE OFFERING

On December 16, 2021, Addex Therapeutics

Ltd (“Addex” or the “Company”) entered into a securities purchase agreement (the “Purchase Agreement”)

with an institutional investor (the “Purchaser”), pursuant to which the Company agreed to sell and issue, in a registered

direct offering, 3,752,202 shares in the form of 625,367 American Depositary Shares (“ADSs”), at a gross purchase price

of $6.50 per ADS, which is equivalent to CHF 1.00 per share (the “Registered Offering”). The ADSs are being offered by the

Company pursuant to an effective shelf registration statement on Form F-3, which was originally filed with the Securities and Exchange

Commission (the “SEC”) on April 7, 2021 and was declared effective on April 13, 2021 (File No. 333-255089)

(the “Registration Statement”) and a prospectus supplement thereunder.

Pursuant to the Purchase Agreement, in a concurrent

private placement, the Company also agreed to sell and issue to the Purchaser unregistered warrants (the “Unregistered Warrants”)

to purchase up to 9,230,772 shares in the form of 1,538,462 ADSs as well as unregistered pre-funded warrants to purchase up to 5,478,570

shares in the form of 913,095 ADSs (the “Unregistered Pre-Funded Warrants” and together with the Unregistered Warrants, the

“Purchase Warrants”) (the “Private Placement” and together with the Registered Offering, the “Offering”).

The Unregistered Warrants will be exercisable 60 days after the issuance date at an exercise price of $6.50 per ADS and will expire six

years from the issuance date. The Unregistered Pre-Funded Warrants have an exercise price of $0.01 per ADS and will be exercisable immediately.

Pursuant to the terms of Purchase Agreement, we intend to file a registration statement on Form F-1 covering the sale of the ordinary

shares underlying the Purchase Warrants (the “Resale Registration Statement). Upon effectiveness of the Resale Registration

Statement, the shares underlying the Purchase Warrants will be freely tradeable in the United States. The Offering is expected to

close on or about December 21, 2021, subject to customary closing conditions. The aggregate gross proceeds to the Company from the

Offering are expected to be $10.0 million, before deducting fees payable to the placement agent and other offering expenses payable by

the Company.

Pursuant to the terms of the Purchase Agreement,

the Company agreed (i) not to issue, enter into an agreement to issue or announce the issuance or proposed issuance of any of its

ADSs, ordinary shares or ordinary share equivalents, or (ii) file any registration statement or any amendment or supplement

thereto, subject to certain exceptions, until the later of (a) 90 days following the closing of this offering and (b) the date

the Resale Registration Statement is declared effective by the SEC; provided, however, such restriction shall not extend beyond the date

that such shares underlying the Unregistered Pre-Funded Warrants may be sold by the purchaser pursuant to Rule 144 under the Securities Act.

In addition, pursuant to the terms of the Purchase Agreement, the Company also agreed that until the 18-month anniversary of the closing

of the Offering, upon any issuance by it of ADSs, ordinary shares or ordinary share equivalents to any person other than the Company

or any of its subsidiaries for cash consideration, indebtedness or a combination of units thereof, the purchaser in this Offering shall,

in the aggregate, have the right to participate in such financing in an amount equal to 50% of the aggregate amount of such subsequent

financing, on the same terms, conditions and price provided for in such subsequent financing.

The Purchase Warrants and the shares issuable

in the form of ADSs issuable upon exercise of the Purchase Warrants (the “Purchase Warrant Shares”) have not been registered

under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to the Registration Statement and are instead

being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and/or Rule 506(b) promulgated

thereunder. In connection with the Purchaser’s execution of the Purchase Agreement, such Purchaser represented to the Company that

it is either an “accredited investor” as defined in Rule 501(a)(1), (a)(2), (a)(3), (a)(7), (a)(8), (a)(9), (a)(12) or

(a)(13) under the Securities Act or a “qualified institutional buyer” as defined in Rule 144A under the Securities

Act.

Pursuant to a letter agreement dated as of September 27, 2021,

the Company engaged H.C. Wainwright & Co., LLC (“Wainwright”) to act as its exclusive placement agent in connection

with the Offering. The Company has agreed to pay Wainwright a cash fee of 6.75% of the aggregate gross proceeds in the Offering, excluding

the proceeds, if any, from the exercise of the Purchase Warrants. The Company also agreed to pay Wainwright an additional 1.0% of the

aggregate gross proceeds in the Offering as a management fee, up to $100,000 of Wainwright’s actual outside legal expenses incurred

by Wainwright in connection with this Offering and certain other expenses in connection with the Offering in an aggregate amount not to

exceed $30,950.

The foregoing descriptions of the Purchase Agreement

and the Purchase Warrants are not complete and are qualified in their entireties by reference to the full text of the Purchase Agreement,

the form of Unregistered Warrants and the form of Unregistered Pre-Funded Warrants, copies of which are filed herewith as Exhibit 10.1,

Exhibit 4.1 and Exhibit 4.2, respectively, to this Report on Form 6-K and are incorporated by reference herein. On December 17,

2021, the Company also issued a press release announcing the Offering. A copy of the press release is attached as Exhibit 99.1 hereto.

This Report on Form 6-K shall not

constitute an offer to sell or the solicitation of an offer to buy any securities of the Company, nor shall there be any offer, solicitation,

or sale of the Company’s securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of such jurisdiction.

FORWARD-LOOKING STATEMENTS

This Report on Form 6-K contains forward-looking

statements that are subject to a number of risks and uncertainties, including statements about the Offering, the consummation of the Offering,

the size of the Offering, the expected proceeds from the Offering, the intended use of proceeds of the Offering and the timing of the

closing of the Offering. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results,

performance or achievements to be materially different from those implied by such statements, and therefore these statements should not

be read as guarantees of future performance or results. Some of the risks and uncertainties that could cause actual results, performance

or achievements to differ include, without limitation, risks associated with market conditions and the satisfaction of customary closing

conditions related to Offering. Additional risk factors related to the Company, its business and the Offering are discussed under “Risk

Factors” in our Annual Report on Form 20-F for the year ended December 31, 2020, the final prospectus supplement and accompanying

prospectus and other filings with the SEC. All forward-looking statements are based on the Company’s current beliefs as well as

assumptions made by and information currently available to the Company. Except as required by law, the Company expressly disclaims any

obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any

change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based,

whether as a result of new information, future events or otherwise.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Addex Therapeutics Ltd

(Registrant)

|

|

|

|

|

Date: December 17, 2021

|

/s/ Tim Dyer

Tim Dyer

Chief Executive Officer

|

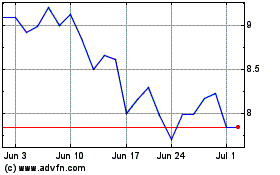

Addex Therapeutics (NASDAQ:ADXN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Addex Therapeutics (NASDAQ:ADXN)

Historical Stock Chart

From Apr 2023 to Apr 2024