As filed with the Securities

and Exchange Commission on August 12, 2021

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

Antelope Enterprise Holdings Ltd.

(Exact name of registrant as specified in its

charter)

|

British Virgin

Islands

|

|

Not Applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employe

Identification No.)

|

c/o Jinjiang Hengda Ceramics Co., Ltd.

Junbing Industrial Zone, Anhai, Jinjiang City,

Fujian Province, PRC

Telephone: +86 (595) 8576 5053

(Address of principal executive offices, including

zip code)

Copies to:

Ralph V. De Martino, Esq.

Schiff Hardin LLP

901 K Street NW, Suite 700

Washington, DC 20001

Tel: (202)724-6848

Fax: (202) 778-6460

Approximate date of commencement of proposed sale to the public: From

time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the SEC pursuant to Rule

462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of

securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ¨

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of

the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

|

Title of Security Being Registered

|

|

Amount Being

Registered (1)

|

|

|

Proposed Maximum Aggregate

Offering Price (2)

|

|

|

Amount of

Registration Fee

|

|

|

Shares, par value $0.024 per share, to be offered by the selling shareholders

|

|

|

2,218,702

|

|

|

$

|

6,500,797

|

|

|

$

|

710

|

|

(1) All of the shares being

registered are offered by the Selling Shareholders listed in the registration statement. Accordingly, this registration statement includes

an indeterminate number of additional shares of common stock issuable for no additional consideration pursuant to any stock dividend,

stock split, recapitalization or other similar transaction effected without the receipt of consideration, which results in an increase

in the number of outstanding shares of our common stock. In the event of a stock split, stock dividend or similar transaction involving

our common stock, in order to prevent dilution, the number of shares registered shall be automatically increased to cover the additional

shares in accordance with Rule 416(a) under the Securities Act of 1933.

(2) Estimated solely for the purpose of calculating

the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low prices

per share of the registrant’s shares as reported on the Nasdaq Capital Market on August 11, 2021.

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting an offer to buy securities in any

state where the offer or sale is not permitted.

Subject to Completion, dated

[_], 2021

PRELIMINARY PROSPECTUS

2,218,702 Shares, 566,379 sold in a private

placement and 1,652,323

issuable upon exercise of outstanding warrants

sold in private placements, offered by the Selling Shareholders,

of

Antelope Enterprise Holdings, Ltd.

This prospectus relates to

the offer and sale of up to 566,379 shares of our common shares in a private placement at a price of $2.32 per share (the “December

2020 Shares”), 588,236 shares of our common shares issuable upon the exercise of warrants at an exercise price of $3.57 per share

(the “February 2021 Warrants”), up to 58,824 of our common shares issuable upon the exercise of placement agent warrants

at an exercise price of $4.46 per share (the “February 2021 Placement Agent Warrants”), up to 913,875 of our common shares

issuable upon the exercise of warrants at an exercise price of $3.48 per share (the “June 2021 Warrants”), and up to 91,388of

our common shares issuable upon the exercise of placement agent warrants at an exercise price of $4.35 per share (the “June 2021

Placement Agent Warrants”). Our common shares are issuable upon exercise of these warrants which are currently held by certain

Selling Shareholders named in this prospectus. We issued the June 2021 Warrants and the June 2021 Placement Agent Warrants in connection

with the June 2021 capital raising transaction, and the February 2021 Warrants and the February 2021 Placement Agent Warrants - in connection

with the February 2021 capital raising transaction. The shares issuable upon exercise of such warrants may be offered for sale from time

to time by the Selling Shareholders. We will receive proceeds from any exercises of the above warrants, but not from the sale of the

underlying common shares.

The Selling Shareholders

may sell any or all of the shares on any stock exchange, market or trading facility on which the Shares are traded or in privately negotiated

transactions at fixed prices that may be changed, at market prices prevailing at the time of sale or at negotiated prices. Information

on the Selling Shareholders and the times and manners in which they may offer and sell our shares is described under the sections entitled

“Selling Shareholders” and “Plan of Distribution” in this prospectus. While we will bear all costs, expenses

and fees in connection with the registration of the Shares, we will not receive any of the proceeds from the sale of our shares by the

Selling Shareholders.

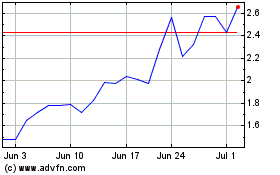

Our shares are currently

traded on the Nasdaq Stock Market under the symbol “AEHL”. On August 11, 2021, the closing price for our shares on Nasdaq

was $2.83 per share.

We may amend or supplement

this prospectus from time to time by filing amendments or supplements as required.

Investing in our securities involves risks.

See “Risk Factors” beginning on page 6 of this prospectus.

Neither the Securities and Exchange Commission

(the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy

or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated [_], 2021

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we filed with the Securities and Exchange Commission. Under this registration process, the selling shareholders

may from time to time sell up to 588,236 Shares in one or more offerings. This prospectus provides you with a general description of

the securities that our selling shareholders may offer. Specific information about the offering may also be included in a prospectus

supplement, which may update or change information included in this prospectus. You should read both this prospectus and any prospectus

supplement together with additional information described under the heading “Where You Can Find More Information.”

You should rely only on the

information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by or

on our behalf. Neither we, nor the selling shareholders, have authorized any other person to provide you with different or additional

information. Neither we, nor the selling shareholders, take responsibility for, nor can we provide assurance as to the reliability of,

any other information that others may provide. The selling shareholders are not making an offer to sell these securities in any jurisdiction

where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus

or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have

changed since those dates.

Except as otherwise set forth

in this prospectus, neither we nor the selling shareholders have taken any action to permit a public offering of these securities outside

the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United

States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering

of these securities and the distribution of this prospectus outside the United States.

Certain Defined Terms and Conventions

Unless otherwise indicated,

references in this prospectus to:

|

|

•

|

“China” or the “PRC”

are to the People’s Republic of China, excluding, for the purpose of this prospectus only, Taiwan and the special administrative

regions of Hong Kong and Macau.

|

|

|

|

“Warrants” collectively refers to the February 2021 Warrants,

February 2021 Placement Agent Warrants, June 2021 Warrants, and June 2021 Placement Agent Warrants.

|

|

|

•

|

“RMB” and “Renminbi” are to the legal currency

of China (see “Exchange Rate Information” for translations of RMB into U.S. dollars in this prospectus). This prospectus

contains translations of certain RMB amounts into U.S. dollar amounts at specified rates. We make no representation that the RMB

or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or RMB, as the case

may be, at any particular rate or at all (also see “Risk Factors”). On August [ ], 2021, the exchange rate was RMB [

] to US$1.00.

|

|

|

•

|

“shares” are to our shares, par value US$0.024 per share.

|

|

|

•

|

“US$” and “U.S. dollars” are to the legal currency

of the United States.

|

|

|

•

|

“we,” “us,” “our,” refer to Antelope

Enterprise Holdings, Ltd., a British Virgin Islands company, and its subsidiaries, including Success Winner Limited (“Success

Winner”), a British Virgin Islands company and wholly owned subsidiary, Stand Best Creation Limited (“Stand Best”),

a Hong Kong company and wholly owned subsidiary of Success Winner and the entity that wholly owns Jinjiang Hengda Ceramics Co., Ltd.

(“Hengda”), a PRC operating company that in turn wholly owns Jiangxi Hengdali Ceramic Materials Co., Ltd. (“Hengdali”),

and Fujian Province Hengdali Building Materials Co., Ltd. each a PRC operating company.

|

WHERE YOU CAN FIND MORE INFORMATION

For the purposes of this

section, the term registration statement means the original registration statement and any and all amendments including the schedules

and exhibits to the original registration statement or any amendment. This prospectus does not contain all of the information included

in the registration statement we filed. For further information regarding us and the Shares offered in this prospectus, you may desire

to review the full registration statement, including the exhibits. The registration statement, including its exhibits and schedules,

may be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Room 1580, Washington, D.C.

20549. You may obtain information on the operation of the public reference room by calling 1-202-551-8090. Copies of such materials are

also available by mail from the Public Reference Branch of the SEC at 100 F Street, N.E., Washington, D.C. 20549 at prescribed rates.

In addition, the SEC maintains a website (http://www.sec.gov) from which interested persons can electronically access the registration

statement, including the exhibits and schedules to the registration statement.

We are subject to the reporting

requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are applicable to a foreign private

issuer. In accordance with the Exchange Act, we file reports with the SEC, including annual reports on Form 20-F. We also furnish to

the SEC under cover of Form 6-K material information required to be made public in the British Virgin Islands, filed with and made public

by any stock exchange or automated quotation system or distributed by us to our shareholders. As a foreign private issuer, we are exempt

from the rules under the Exchange Act prescribing the furnishing and content of proxy statements to shareholders. In addition, our officers,

directors and principal shareholders are exempt from the “short-swing profits” reporting and liability provisions contained

in Section 16 of the Exchange Act and related Exchange Act rules.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate

by reference” the information we file with them. This means that we can disclose important information to you by referring you

to those documents. Each document incorporated by reference is current only as of the date of such document, and the incorporation by

reference of such documents should not create any implication that there has been no change in our affairs since the date thereof or

that the information contained therein is current as of any time subsequent to its date. The information incorporated by reference is

considered to be a part of this prospectus and should be read with the same care. When we update the information contained in documents

that have been incorporated by reference by making future filings with the SEC, the information incorporated by reference in this prospectus

is considered to be automatically updated and superseded. In other words, in the case of a conflict or inconsistency between information

contained in this prospectus and information incorporated by reference into this prospectus, you should rely on the information contained

in the document that was filed later.

We incorporate by reference

the documents listed below:

|

|

•

|

our Annual Report on Form 20-F for the fiscal year ended December 31,

2020 filed with the SEC on April 29, 2021 and

|

|

|

•

|

our report on Form 6-K dated June 16, 2021, respectively;

|

|

|

•

|

with respect to each offering of securities under this prospectus,

all our subsequent Annual Reports on Form 20-F and any report on Form 6-K that (i) we file or furnish with the SEC on or after the

date on which this prospectus is first filed with the SEC and until the termination or completion of the offering under this prospectus

and (ii) indicates that it is being incorporated by reference in this prospectus.

|

Unless expressly incorporated

by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished to, but not filed with, the

SEC. We will provide to each person, including any beneficial owner, who receives a copy of this prospectus, upon written or oral request,

without charge, a copy of any or all of the documents we refer to above which we have incorporated by reference in this prospectus, except

for exhibits to such documents unless the exhibits are specifically incorporated by reference into this prospectus. You should direct

your requests to the attention of our chief financial officer at our principal executive office located in c/o Junbing Industrial Zone,

Anhai, Jinjiang City, Fujian Province, PRC. Our telephone number at this address is +86 (595) 8576 5053 and our fax number is Fax: +86

(595) 8576 5059.

You should rely only on the

information contained or incorporated by reference in this prospectus, in any applicable prospectus supplement or any related free writing

prospectus that we may authorize to be delivered to you. We have not authorized any other person to provide you with different information.

If anyone provides you with different or inconsistent information, you should not rely on it. We will not make an offer to sell these

securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus,

the applicable supplement to this prospectus or in any related free writing prospectus is accurate as of its respective date, and that

any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate

otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

PROSPECTUS SUMMARY

Our Business

We are a Chinese manufacturer

of ceramic tiles used for exterior siding and for interior flooring and design in residential and commercial buildings. The ceramic tiles,

sold under the “HD” or “Hengda,” “HDL” or “Hengdeli”, “Pottery Capital of Tang

Dynasty”, “TOERTO” and ”WULIQIAO” brands are available in over two thousand styles, colors and size combinations.

Currently, we have five principal product categories: porcelain tiles, glazed tiles, glazed porcelain tiles, rustic tiles, and polished

glazed tiles. Ceramic tiles are widely used in the PRC as a construction material for residential and commercial buildings. Ceramic tiles

are used for flooring, interior walls for decorative purposes and on exterior siding due to their resistance to temperature, extreme

environments, erosion, abrasion and discoloration for extended periods of time. Our manufacturing facilities operated by Jinjiang Hengda

Ceramics Co., Ltd. are located in Jinjiang, Fujian Province, and our manufacturing facilities operated by Jiangxi Hengdali Ceramic Materials

Co., Ltd. are located in Gaoan, Jiangxi Province.

Corporate Information

Our principal executive

office is located at Junbing Industrial Zone, Anhai, Jinjiang City, Fujian Province, People’s Republic of China. Our telephone

number at this address is +86 595 8576 5053. Our registered office is Craigmuir Chambers, Road Town, Tortola, British Virgin Islands,

and our registered agent is Harneys Corporate Services Limited. We maintain a website at http://www.cceramics.com that contains information

about our company. Information on this web site is not part of this prospectus.

December 2020 Private Placement

On December 7, 2020, the

Company executed subscription agreements (each a “Subscription Agreement”) in connection with a $1,314,001 private placement

of its ordinary shares with three accredited investors at the price of $2.32 per share (the “December 2020 Shares”). All

respective purchasers in the offering were “accredited investors” (as such term is defined under rules and regulations promulgated

under the Securities Act), and the Company sold the securities in the Offering in reliance upon an exemption from registration contained

in Section 4(2) and Rule 506 under the Securities Act. There were no discounts or brokerage fees associated with this offering. The net

proceeds of the offering were used for working capital and general corporate purposes.

February 2021 Capital Raising Transaction

On February 12, 2021, we

entered into a Securities Purchase Agreement with certain institutional investors for the sale by the Company of 588,236 shares at a

purchase price of $3.57 per share. The shares were offered by us pursuant to the shelf registration statement on Form F-3 (File No. 333-228182),

which was declared effective by the Securities and Exchange Commission on November 19, 2019. Concurrently with the sale of the shares,

the Company also sold the February 2021 Warrants to purchase 588,236 shares. The aggregate gross proceeds of this offering were approximately

$2.1 million, before commissions and expenses. Subject to certain beneficial ownership limitations, the five-year February 2021 Warrants

will be immediately exercisable at an exercise price equal to $3.57 per share, subject to adjustments as provided under the terms of

the February 2021 Warrants, and will terminate on the five-year anniversary of the initial exercise date of the February 2021 Warrants.

The closing of the sales of these securities took place on February 17, 2021.

The warrants and

the shares issuable upon exercise of the warrants were sold without registration under the Securities Act in reliance on the exemptions

provided by Section 4(a)(2) of the Securities Act as transactions not involving a public offering and Rule 506 promulgated under the

Securities Act as sales to accredited investors, and in reliance on similar exemptions under applicable state laws.

Dawson James Securities,

Inc. acted as our exclusive placement agent, on a best-efforts basis, in connection with the offering. We agreed to pay the Placement

Agent a cash placement fee equal to 8% of the gross proceeds of the offering, plus other expenses of the Placement Agent not to exceed

$45,000. The Placement Agent also received five-year February 2021 Placement Agent Warrants to purchase up to a number of common shares

equal to 5% of the aggregate number of shares sold in the offering, including the warrant shares issuable upon exercise of the warrants,

which such Placement Agent warrants have substantially the same terms as the February 2021 Warrants sold in the offering, except that

such February 2021 Placement Agent Warrants have an exercise price of $4.46 per share and will be exercisable six months from the effective

date of this offering and will terminate on the five year anniversary of the effective date of this offering.

June 2021 Capital Raising Transaction

On June 10, 2021,

we entered into Securities Purchase Agreements with three institutional accredited investors pursuant to which it sold 913,875 of the

Company’s common shares at the per share price of $3.48 (which was priced in excess of the average of the five-day closing price

for the Company’s common shares preceding execution of the SPA, which was $3.42). In a concurrent private placement, we sold to

such investors June 2021 Warrants to purchase 913,875 common shares (the “June 2021 Warrants”). The June 2021 Warrants have

an exercise price per share of $3.42, subject to adjustment, and have a term of five years. The June 2021 Warrants were sold without

registration under the Securities in reliance on the exemptions provided by Section 4(a)(2) of the Securities Act as transactions not

involving a public offering and Rule 506 promulgated under the Securities Act as sales to accredited investors. The proceeds of the transaction

will be used for working capital and general working purposes. The transactions yielded gross proceeds to the Company of $3,180,285,

before payment of commissions and expenses.

Dawson James Securities,

Inc. acted as the Company’s exclusive placement agent in connection with this offering. The Company paid the Placement Agent a

fee equal to 8.0% of the gross proceeds of the offering, and a non-accountable expense allowance of $35,000. In addition, the Company

issued June 20201 Placement Agent Warrants to the Placement Agent to purchase a number of common shares equal to 5.0% of the aggregate

number of shares sold to the investors in this offering, as well as the warrant shares issuable upon exercise of the June 2021 Warrants

issued in the concurrent private placement, as additional placement agency compensation. The June 2021 Placement Agent Warrants have

substantially the same terms as the June 2021 Warrants, except that the June 2021 Placement Agent Warrants will have an exercise price

of $4.35. The Placement Agent received customary indemnification in connection with the offering.

RISK FACTORS

Any investment in the shares

is speculative and involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described

under “Risk Factors” in our most recent Annual Report on Form 20-F, or any updates in our reports on Form 6-K, together with

all of the other information appearing in, or incorporated by reference into, this prospectus and any applicable prospectus supplement.

The risks so described are not the only risks facing our company. Additional risks not presently known to us or that we currently deem

immaterial may also impair our business operations. Our business, financial condition and results of operations could be materially adversely

affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or

part of your investment.

The Warrants may not have value

The February 2021 Warrants

being offered in this offering have an exercise price of $3.57 per share and the June 2021 Warrants have an exercise price of $3.48.

In the event that our common stock does not exceed the exercise price of the February 2021Warrants or the June 2021 Warrants during the

period when such warrants are exercisable, such warrants may not have any value.

Holders of our Warrants will have no

rights as shareholders until they acquire shares of our common stock, if ever.

The holders of the Warrants

have no rights with respect to our common stock until they acquire shares upon exercise of such Warrants. Upon such exercise, they will

be entitled to exercise the rights of a holder of common stock only as to matters for which the record date occurs after the exercise

date.

There is no public

market for the Warrants being offered by us in this offering and an active trading market for the same is not expected to develop.

There is no established

public trading market for the Warrants being offered in this offering, and we do not expect a market to develop. Without an active market,

the liquidity of the Warrants will be severely limited.

NOTE REGARDING FORWARD-LOOKING

STATEMENTS

Some of the information

in this prospectus, any prospectus supplement, and the documents we incorporate by reference contains forward-looking statements within

the meaning of the federal securities laws. You should not rely on forward-looking statements in this prospectus, any prospectus supplement,

or the documents we incorporate by reference. Forward-looking statements typically are identified by use of terms such as “anticipate,”

“believe,” “plan,” “expect,” “future,” “intend,” “may,” “will,”

“should,” “estimate,” “predict,” “potential,” “continue,” and similar words,

although some forward-looking statements are expressed differently. This prospectus, any prospectus supplement, and the documents we

incorporate by reference may also contain forward-looking statements attributed to third parties relating to their estimates regarding

the growth of our markets. All forward-looking statements address matters that involve risks and uncertainties, and there are many important

risks, uncertainties and other factors that could cause our actual results, as well as those of the markets we serve, levels of activity,

performance, achievements and prospects to differ materially from the forward-looking statements contained in this prospectus, any prospectus

supplement, and the documents we incorporate by reference. You should also consider carefully the statements under “Risk Factors”

and other sections of this prospectus, any prospectus supplement, and the documents we incorporate by reference, which address additional

facts that could cause our actual results to differ from those set forth in the forward-looking statements. We caution investors not

to place significant reliance on the forward-looking statements contained in this prospectus, any prospectus supplement, and the documents

we incorporate by reference. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result

of new information, future developments or otherwise.

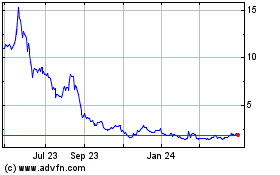

PRICE RANGE OF OUR SHARES

Our shares have been listed

on the NASDAQ Stock Market under the symbols CCCL, since January 18, 2011. Our shares were listed on the NASDAQ Capital Market from November

3, 2010 through January 17, 2011 and were relisted on the Nasdaq Capital Market on March 23, 2016 following the listing transfer where

it is trading now under the same symbol “CCCL.” Our shares were listed on the NASDAQ Global Market from January 18, 2011

until March 22, 2016. The shares were previously quoted on the OTC Bulletin Board from December 29, 2009 through November 2, 2010.

The following tables set

forth, for the calendar quarters indicated and through August 11, 2021, the quarterly high and low sale prices for our shares, as reported

on NASDAQ Stock Market and the OTC Bulletin Board, as applicable. The OTC Bulletin Board market quotations reflect inter-dealer prices,

without retail mark-up, mark-down or commission and may not necessarily reflect actual transactions. Prior to June 28, 2016, the sale

prices of our shares were retroactively restated to reflect the 8:1 reverse split effected on that date.

|

|

|

Shares

|

|

|

|

|

High

|

|

|

Low

|

|

|

Annual Highs and Lows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012

|

|

|

36.32

|

|

|

|

11.76

|

|

|

2013

|

|

|

32.48

|

|

|

|

15.84

|

|

|

2014

|

|

|

20.48

|

|

|

|

5.92

|

|

|

2015

|

|

|

11.36

|

|

|

|

6.00

|

|

|

2016

|

|

|

8.64

|

|

|

|

2.09

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarterly Highs and Lows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

9.92

|

|

|

|

6.48

|

|

|

Second Quarter

|

|

|

11.36

|

|

|

|

8.88

|

|

|

Third Quarter

|

|

|

9.28

|

|

|

|

6.00

|

|

|

Fourth Quarter

|

|

|

9.60

|

|

|

|

6.00

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

8.64

|

|

|

|

2.80

|

|

|

Second Quarter

|

|

|

4.08

|

|

|

|

2.09

|

|

|

Third Quarter

|

|

|

5.30

|

|

|

|

2.19

|

|

|

Fourth Quarter

|

|

|

3.02

|

|

|

|

2.10

|

|

|

|

|

|

|

|

|

|

|

|

|

2017

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

2.53

|

|

|

|

2.08

|

|

|

Second Quarter

|

|

|

2.26

|

|

|

|

1.32

|

|

|

Third Quarter

|

|

|

1.68

|

|

|

|

1.31

|

|

|

Fourth Quarter

|

|

|

2.39

|

|

|

|

1.32

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

2.69

|

|

|

|

1.43

|

|

|

Second Quarter

|

|

|

1.76

|

|

|

|

1.37

|

|

|

Third Quarter

|

|

|

1.87

|

|

|

|

1.32

|

|

|

Fourth Quarter

|

|

|

3.67

|

|

|

|

0.80

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

2.08

|

|

|

|

1.38

|

|

|

Second Quarter

|

|

|

1.76

|

|

|

|

0.80

|

|

|

Third Quarter

|

|

|

0.93

|

|

|

|

0.73

|

|

|

Fourth Quarter

|

|

|

1.06

|

|

|

|

0.67

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

2.70

|

|

|

|

1.11

|

|

|

Second Quarter

|

|

|

2.82

|

|

|

|

1.14

|

|

|

Third Quarter

|

|

|

3.12

|

|

|

|

1.83

|

|

|

Fourth Quarter

|

|

|

2.64

|

|

|

|

1.97

|

|

|

|

|

|

|

|

|

|

|

|

|

2021

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

4.90

|

|

|

|

2.42

|

|

|

Second Quarter

|

|

|

7.70

|

|

|

|

2.46

|

|

(Source: http://finance.yahoo.com)

On August 11, 2021, the closing

price of our shares on the NASDAQ Stock Market was 2.83, with 5,906,866 shares issued and outstanding as of the same date.

CAPITALIZATION

The following table sets

forth our capitalization as of December 31, 2020. Because we will not be receiving any proceeds pursuant to the sale of any Shares by

the selling shareholders, our capitalization table is not adjusted to reflect such sales. You should read the following table in conjunction

with our financial statements, which are incorporated by reference into this prospectus.

|

Capitalization

|

|

As of

|

|

|

(in RMB except share data)

|

|

December

31, 2020

|

|

|

Common shares

issued

|

|

|

3,674,370

|

|

|

Par Value Amount

|

|

|

590,996

|

|

|

Additional Paid-In Capital

|

|

|

456,990,525

|

|

|

Statutory Reserves

|

|

|

135,343,158

|

|

|

Retained Earnings

|

|

|

(494,067,462)

|

|

|

Accumulated Other Comprehensive Income

|

|

|

(1,508,868)

|

|

|

|

|

|

|

|

|

Total:

|

|

|

97,348,349

|

|

USE OF PROCEEDS

We will receive proceeds

from any exercises of the warrants, but not from the sale of the underlying common stock. The selling shareholders will receive all of

the net proceeds from the sale of any shares offered by them under this prospectus. The selling shareholders will pay any underwriting

discounts and commissions and expenses incurred by the selling shareholders for brokerage, accounting, tax, legal services or any other

expenses incurred by the selling shareholders in disposing of these shares. We will bear all other costs, fees and expenses incurred

in effecting the registration of the Shares covered by this prospectus.

DIVIDEND POLICY

We paid a cash dividend of

US$0.10 (equivalent to RMB0.61) per share each on August 13, 2013 and January 14, 2014, respectively, to our shareholders which totaled

in aggregate US$4.1 million (equivalent to RMB24.9 million). Also, we paid a cash dividend of US$0.0125 (equivalent to RMB0.08) per share

each on August 14, 2014 and January 14, 2015, respectively, to its shareholders which totaled in aggregate US$0.5 million (equivalent

to RMB3.2 million).

We do not currently have

any plans to pay any cash dividends in the foreseeable future on our shares being sold in this offering. We currently intend to retain

most, if not all, of our available funds and any future earnings to operate and expand our business. The payment of dividends by entities

organized in China is subject to limitations. Regulations in the PRC currently permit payment of dividends only out of accumulated profits

as determined in accordance with PRC accounting standards and regulations. Each of our Chinese subsidiaries is also required to set aside

at least 10% of its after-tax profit based on China’s accounting standards each year to its general reserves until the cumulative

amount of such reserves reach 50% of its registered capital. These reserves are not distributable as cash dividends. The board of directors

of our PRC subsidiaries, each of which is a wholly foreign owned enterprise, has the discretion to allocate a portion of its after-tax

profits to its staff welfare and bonus funds, which is likewise not distributable to its equity owners except in the event of a liquidation

of the foreign-invested enterprise. If we decide to pay dividends in the future, these restrictions may impede our ability to pay dividends.

In addition, if any of these Chinese entities incurs debt on its own behalf in the future, the instruments governing the debt may restrict

its ability to pay dividends or make other distributions to us. Our Board of Directors has discretion on

whether to pay dividends. Even if our board of directors decides to pay dividends, the form, frequency and amount will depend upon our

future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors

that our board of directors may deem relevant.

SELLING SHAREHOLDERS

This prospectus covers the

public resale of the Shares owned by the selling shareholders named below. Such selling shareholders may from time to time offer and

sell pursuant to this prospectus any or all of the Shares owned by them. The selling shareholders, however, make no representations that

the Shares will be offered for sale. The tables below present information regarding the selling shareholders and the Shares that each

such selling shareholder may offer and sell from time to time under this prospectus.

Unless otherwise indicated,

all information with respect to ownership of our Shares of the selling shareholders has been furnished by or on behalf of the selling

shareholders and is as of August 11, 2021. We believe, based on information supplied by the selling shareholders, that except as may

otherwise be indicated in the footnotes to the tables below, the selling shareholders have sole voting and dispositive power with respect

to the Shares reported as beneficially owned by them. Because the selling shareholders identified in the tables may sell some or all

of the Shares owned by them which are included in this prospectus, and because, except as set forth herein, there are currently no agreements,

arrangements or understandings with respect to the sale of any of the Shares, no estimate can be given as to the number of Shares available

for resale hereby that will be held by the selling shareholders upon termination of this offering. In addition, the selling shareholders

may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time,

the Shares they hold in transactions exempt from the registration requirements of the Securities Act after the date on which they provided

the information set forth on the table below. We have, therefore, assumed for the purposes of the following table, that the selling shareholders

will sell all of the Shares owned beneficially by them that are covered by this prospectus, but will not sell any other Ordinary Shares

that they presently own. However, we are not aware of any agreements, arrangements or understandings with respect to the sale of any

of the Shares by any of the selling shareholders. Beneficial ownership for the purposes of this table is determined in accordance with

the rules and regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person

has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire

such powers within 60 days.

The selling shareholders

and intermediaries through whom such securities are sold may be deemed “underwriters” within the meaning of the Securities

Act with respect to the Shares offered by this prospectus, and any profits realized or commissions received may be deemed underwriting

compensation. Additional selling shareholders not named in this prospectus will not be able to use this prospectus for resales until

they are named in the tables above by prospectus supplement or post-effective amendment. Transferees, successors and donees of identified

selling shareholders will not be able to use this prospectus for resales until they are named in the tables above by prospectus supplement

or post-effective amendment. If required, we will add transferees, successors and donees by prospectus supplement in instances where

the transferee, successor or donee has acquired its Shares from holders named in this prospectus after the effective date of this prospectus.

The following table sets forth:

|

|

•

|

the name of each selling shareholder holding Shares;

|

|

|

•

|

the number of Shares beneficially owned by each selling shareholder

prior to the sale of the Shares covered by this prospectus;

|

|

|

•

|

the number of Shares that may be offered by each selling shareholder

pursuant to this prospectus;

|

|

|

•

|

the number of Shares to be beneficially owned by each selling shareholder

following the sale of the Shares covered by this prospectus; and

|

|

|

•

|

the percentage of our issued and outstanding Shares to be owned by

each selling shareholder before and after the sale of the Shares covered by this prospectus.

|

|

Name of Selling Shareholder

|

|

Number of

Shares

Beneficially

Owned

Prior to this

Offering (7)

|

|

|

% of

Outstanding

Shares

Beneficially

Owned

Before Sale

of Shares (7)

|

|

|

Number of

Shares

Available

Pursuant to

this

Prospectus

|

|

|

Number of

Shares

Beneficially

Owned

After Sale

of Shares (8)

|

|

|

% of

Outstanding

Shares

Beneficially

Owned

After Sale

of Shares (8)

|

|

|

Anson Advisors Inc. (1)

|

|

294,753(12)

|

|

|

4.99%(12)

|

|

|

500,703

|

|

|

0

|

|

|

*

|

|

|

Intracoastal Capital, LLC (2)

|

|

294,753(13)

|

|

|

4.99%(13)

|

|

|

500,703

|

|

|

125,643

|

|

|

2.13%

|

|

|

CVI Investments, Inc. (3)

|

|

294,753(14)

|

|

|

4.99%(14)

|

|

|

500,704

|

|

|

125,643

|

|

|

2.13%

|

|

|

Dawson James Securities, Inc. (4)

|

|

228,980

|

|

|

3.88%

|

|

|

115,028

|

|

|

0

|

|

|

1.9%

|

|

|

Robert Keyser, Jr. (5)

|

|

72,961

|

|

|

1.2%

|

|

|

17,592

|

|

|

0

|

|

|

*

|

|

|

Douglas Armstrong (6)

|

|

72,961

|

|

|

1.2%

|

|

|

17,592

|

|

|

0

|

|

|

*

|

|

|

Chen Shengrong (9)

|

|

64,655

|

|

|

1.1%

|

|

|

64,655

|

|

|

0

|

|

|

*

|

|

|

Yu Min (10)

|

|

129,310

|

|

|

2.19%

|

|

|

129,310

|

|

|

0

|

|

|

*

|

|

|

Zheng Weilai (11)

|

|

977,755

|

|

|

16.55%

|

|

|

372,414

|

|

|

605,341

|

|

|

10.25%

|

|

|

(1)

|

The address of the selling shareholder is 155 University Avenue, Suite 207, Toronto, Ontario, Canada

M5H 3B7.

|

|

(2)

|

The address of the selling shareholder is 2211A Lakeside Drive, Bannockburn, IL 60015.

|

|

(3)

|

The address of the selling shareholder is c/o Heights Capital Management, Inc, 1010 California

Street, Suite 3250, San Francisco, CA 94111.

|

|

(4)

|

The address of the selling shareholder is 1 North Federal Highway, 5th Floor, Boca Raton, FL 33432.

|

|

(5)

|

The address of the selling shareholder is 1 North Federal Highway, 5th Floor, Boca Raton, FL 33432.

Does not include securities owned by Dawson James Securities, Inc. By virtue of his position as Chairman and CEO of Dawson James,

Securities, Inc., Mr. Keyser may be deemed to beneficially own the securities owned by Dawson James, Securities, Inc. Mr.

Keyser disclaims ownership of those securities.

|

|

(6)

|

The address of the selling shareholder is 1 North Federal Highway, 5th Floor, Boca Raton, FL 33432.

|

|

(7)

|

Based on 5,906,866 shares outstanding as of the date of this prospectus.

|

|

(8)

|

Assumes that the selling shareholder sells all of the shares offered hereby.

|

|

*

|

Less than 1%

|

|

(9)

|

The address of the selling shareholder is 42-1-4 Yudu Villa, 2 Tong Yi Lu, Jinniu District, Chengdu,

Sichuan, PRC.

|

|

(10)

|

The address of the selling shareholder is 203, 2 Dong, Lang Shi Lv Se Jie Qu, 199 Ying Hui Lu,

Cheng Hua District, Chengdu, Sichuan, PRC.

|

|

(11)

|

The address of the selling shareholder is 2302 Unit 1 Block 2, Phase 1, 88 Hui Yuan Dong Lu, Jinjiang

District, Chengdu, Sichuan, PRC.

|

|

(12)

|

The total number of shares of Common Stock issuable upon the exercise of Warrants exercise is 626,346.

The resale of 500,703 shares issuable upon Warrant exercise are subject to this registration statement and the resale of 125,643

shares issuable upon Warrant exercise are the subject of a separate registration statement, but the number of shares reflected as

beneficially owned is shown at 294,753 or 4.99% of the outstanding number of shares of Common Stock by virtue of a provision set

forth in each warrant that precludes the exercise by the holder if and to the extent that any such exercise would cause the number

of shares of Common Stock held by the holder to exceed 4.99%.

|

|

(13)

|

The total number of shares of Common Stock issuable upon the exercise of Warrants is 626,346. The

resale of 500,703 shares issuable upon Warrant exercise are subject to this registration statement and the resale of 125,643 shares

issuable upon Warrant exercise are the subject of a separate registration statement, but the number of shares reflected as

beneficially owned is shown at 294,753 or 4.99% of the outstanding number of shares of Common Stock by virtue of a provision set

forth in each warrant that precludes the exercise by the holder if and to the extent that any such exercise would cause the number

of shares of Common Stock held by the holder to exceed 4.99%.

|

|

(14)

|

The number of shares of Common issuable upon the exercise of Warrants is 500,704 and the offer

and resale of all such shares are subject to this registration statement, but the number of shares reflected as beneficially owned

is shown at 294,753 or 4.99% of the outstanding by virtue of a provision set forth in each warrant that precludes the exercise by

the holder if and to the extent that any such exercise would cause the number of shares of Common Stock held by the holder to exceed

4.99%.

|

PLAN

OF DISTRIBUTION

The selling shareholders,

which as used herein includes donees, pledgees, transferees or other successors-in-interest selling Shares or interests in Shares received

after the date of this prospectus from a selling shareholder as a gift, pledge, partnership distribution or other transfer, may, from

time to time, sell, transfer or otherwise dispose of any or all of the Shares on any stock exchange, market or trading facility on which

the Shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time

of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling shareholders may use any one or more of the following

methods when disposing of Shares:

|

|

•

|

ordinary brokerage transactions and transactions in which the broker-dealer

solicits purchasers;

|

|

|

•

|

block trades in which the broker-dealer will attempt to sell the Shares

as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

purchases by a broker-dealer as principal and resale by the broker-dealer

for its account;

|

|

|

•

|

an exchange distribution in accordance with the rules of the applicable

exchange;

|

|

|

•

|

privately negotiated transactions;

|

|

|

•

|

short sales effected after the date the registration statement of which

this prospectus is a part is declared effective by the SEC;

|

|

|

•

|

through the writing or settlement of options or other hedging transactions,

whether through an options exchange or otherwise;

|

|

|

•

|

broker-dealers may agree with the selling shareholders to sell a specified

number of such Shares at a stipulated price per share;

|

|

|

•

|

a combination of any such methods of sale; and

|

|

|

•

|

any other method permitted by applicable law.

|

The selling shareholders

may, from time to time, pledge or grant a security interest in some or all of the Shares owned by them and, if they default in the performance

of their secured obligations, the pledgees or secured parties may offer and sell the Shares, from time to time, under this prospectus,

or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of

selling shareholders to include the pledgee, transferee or other successors in interest as selling shareholders under this prospectus.

The selling shareholders also may transfer the Shares in other circumstances, in which case the transferees, pledgees or other successors

in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale

of their Shares or interests therein, the selling shareholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of such Shares in the course of hedging the positions they assume. The selling

shareholders may also sell Shares short and deliver these securities to close out their short positions, or loan or pledge the Shares

to broker-dealers that in turn may sell these securities. The selling shareholders may also enter into option or other transactions with

broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such

broker-dealer or other financial institution of the Shares offered by this prospectus, which shares such broker-dealer or other financial

institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to

the selling shareholders from the sale of the Shares offered by them will be the purchase price of such Shares less discounts or commissions,

if any. Each of the selling shareholders reserves the right to accept and, together with their agents from time to time, to reject, in

whole or in part, any proposed purchase of ordinary shares to be made directly or through agents. We will not receive any of the proceeds

from the resale of the Shares.

The selling shareholders

also may resell all or a portion of their Ordinary Shares in open market transactions in reliance upon Rule 144 under the Securities

Act, provided that they meet the criteria and conform to the requirements of that rule.

The selling shareholders

and any underwriters, broker-dealers or agents that participate in the sale of the Shares therein may be “underwriters” within

the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of

the Ordinary Shares may be underwriting discounts and commissions under the Securities Act. Selling shareholders who are “underwriters”

within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities

Act.

To the extent required, the

Shares to be sold, the names of the selling shareholders, the respective purchase prices and public offering prices, the names of any

agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying

prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the

securities laws of some states, if applicable, the Shares may be sold in these jurisdictions only through registered or licensed brokers

or dealers. In addition, in some states the Shares may not be sold unless it has been registered or qualified for sale or an exemption

from registration or qualification requirements is available and is complied with.

We have advised the selling

shareholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of Shares in the market and to

the activities of the selling shareholders and their affiliates. In addition, to the extent applicable, we will make copies of this prospectus

(as it may be supplemented or amended from time to time) available to the selling shareholders for the purpose of satisfying the prospectus

delivery requirements of the Securities Act. The selling shareholders may indemnify any broker-dealer that participates in transactions

involving the sale of the Shares against certain liabilities, including liabilities arising under the Securities Act. We have agreed

to indemnify the selling shareholders against liabilities, including liabilities under the Securities Act and state securities laws,

relating to the registration of the Ordinary Shares offered by this prospectus.

EXPENSES

We estimate the fees and

expenses to be incurred by us in connection with the resale of the ordinary shares in this offering, other than underwriting discounts

and commissions, to be as follows:

|

SEC registration fee

|

|

$

|

710

|

|

|

Legal fees and expenses

|

|

$

|

20,000

|

|

|

Accounting fees and expenses

|

|

$

|

5,000

|

|

|

Miscellaneous expenses

|

|

$

|

1,000

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

26,710

|

|

All amounts are estimated except the SEC registration

fee.

LEGAL MATTERS

We are being represented

by Schiff Hardin LLP, Washington, DC with respect to legal matters of United States federal securities. The validity of the shares offered

in this offering and legal matters as to British Virgin Islands law will be passed upon for us by Harney Westwood & Riegels. Legal

matters will be passed upon for any underwriters, dealers or agents by counsel named in the applicable prospectus supplement.

EXPERTS

The financial statements

incorporated by reference in this prospectus have been audited by Centurion ZD CPA & Co., our independent registered public accounting

firm, and are included in reliance upon such reports given upon the authority of said firm as experts in auditing and accounting.

ENFORCEABILITY OF CIVIL

LIABILITIES

Many of our officers and

directors, and some of the experts named in this prospectus, are residents of PRC or elsewhere outside of the U.S., and all of our assets

and the assets of such persons are located outside the U.S. As a result, it may be difficult for investors in the U.S. to effect service

of process within the U.S. upon such directors, officers and representatives of experts who are not residents of the U.S. or to enforce

against them judgments of a U.S. court predicated solely upon civil liability under U.S. federal securities laws or the securities laws

of any state within the U.S.

Substantially all of our

operations and records, and most of our senior management are located in the PRC. Our shareholders have limited ability to assert and

collect on claims in litigation against us and our principals. In addition, corporate organization and structure could further impede

the ability of a person to prove a claim or collect on a judgment against the Company. Finally, China has very restrictive secrecy laws

that prohibit the delivery of many of the financial records maintained by a business located in China to third parties absent Chinese

government approval. Since discovery is an important part of proving a claim in litigation, and since most if not all of the Company’s

records are in China, Chinese secrecy laws could frustrate efforts to prove a claim against the Company or its management. In order to

commence litigation in the United States against an individual such as an officer or director, that individual must be served. While

directors and officers of a Delaware corporation are routinely served for purposes of a suit against them in Delaware for breach of fiduciary

duty and there are means of serving individuals who reside outside the United States in other litigation, generally service requires

the cooperation of the country in which a defendant resides. China has a history of failing to cooperate in efforts to effect such service

upon Chinese citizens in China. These and other similar PRC laws and regulations could substantially impair our shareholders abilities

to investigate and prosecute claims against our Company, our officers and our directors.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

|

Item 8.

|

Indemnification

of Directors and Officers

|

British Virgin Islands law

does limit the extent to which a company’s memorandum and articles of association may provide for indemnification of officers and

directors. The Company’s memorandum and articles of association provides for indemnification of its officers and directors for

any liability incurred in their capacities as such, except through their own fraud or willful default to the extent permitted under BVI

law. Indemnification is only available to a person who acted in good faith and in what that person believed to be in the best interests

of the Company.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company pursuant

to the foregoing provisions, the Company has been informed that in the opinion of the Securities and Exchange Commission such indemnification

is against public policy as expressed in the Securities Act and is theretofore unenforceable.

* To be filed by amendment.

|

|

(1)

|

Incorporated by reference to exhibits of the same number filed with

the Registrant’s Registration Statement on Form F-3 filed on April 16, 2018.

|

|

|

|

|

|

|

(2)

|

Incorporated by reference to exhibit of the

same number filed with the Company’s Form 6-K filed with the SEC on February 16, 2021.

|

|

|

(3)

|

Incorporated by reference to exhibit of the same number filed with

the Company’s Form 6-K filed with the SEC on June 16, 2021.

|

|

|

(a)

|

The undersigned registrant hereby undertakes:

|

|

|

(1)

|

to file, during any period in which offers or sales are being made,

a post-effective amendment to this registration statement:

|

|

|

(i)

|

To include any prospectus required by section 10(a)(3) of the Securities

Act of 1933;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events

arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually

or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the

foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed

that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in

the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent

no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee”

table in the effective registration statement;

|

|

|

(iii)

|

To include any material information with respect

to the plan of distribution not previously disclosed in the registration statement or any material change to such information in

the registration statement;

|

Provided, however, that paragraphs

(a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information otherwise required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to section 13 or

section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained

in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

|

|

(2)

|

That, for the purpose of determining any liability

under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof.

|

|

|

(3)

|

To remove from registration by means of a post-effective

amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(4)

|

To file a post-effective amendment to the registration

statement to include any financial statements required by Item 8.A. of Form 20-F at the start of any delayed offering or throughout

a continuous offering; provided, however, that a post-effective amendment need not be filed to include financial statements and information

otherwise required by Section 10(a)(3) of the Act or §210.3-19 if such financial statements and information are contained in

periodic reports filed with or furnished to the SEC by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange

Act of 1934 that are incorporated by reference in this registration statement.

|

|

|

(5)

|

That, for the purpose of determining liability

under the Securities Act of 1933 to any purchaser:

|

|

|

(i)

|

If the registrant is relying on Rule 430B:

|

|

|

(A)

|

Each prospectus filed by the registrant pursuant

to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of

and included in the registration statement; and

|

|

|

(B)

|

Each prospectus required to be filed pursuant

to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant

to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities

Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus

is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus.

As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall

be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which

that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that

is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede

or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or

made in any such document immediately prior to such effective date; or

|

|

|

(ii)

|

If the registrant is subject to Rule 430C, each

prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements

relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the

registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made

in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed

incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a

purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration

statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of

first use.

|

|

|

(6)

|

That, for the purpose of determining liability

of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

|

The undersigned registrant undertakes that in

a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting

method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following

communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities

to such purchaser:

|

|

(i)

|

Any preliminary prospectus or prospectus of the

undersigned registrant relating to the offering required to be filed pursuant to Rule 424; (ii) Any free writing prospectus relating

to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; (iii) The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and (iv) Any other communication that is an offer

in the offering made by the undersigned registrant to the purchaser.

|

|

|

(b)

|

The undersigned registrant hereby undertakes that,

for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant

to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit

plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in

the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(c)

|

Insofar as indemnification for liabilities arising

under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the

foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission

such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim

for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such

director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion

of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of

whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue.

|

|

|

(d)

|

The undersigned registrant hereby further undertakes

that:

|

|

|

(1)

|

For purposes of determining any liability under

the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance

upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4), or 497(h) under the

Securities Act of 1933 shall be deemed to be part of this registration statement as of the time it was declared effective.

|

|

|

(2)

|

For the purpose of determining any liability under

the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof.

|

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements