Affinity Bancshares, Inc. (NASDAQ:“AFBI”) (the

“Company”), the holding company for Affinity Bank (the “Bank”),

today announced net income of $1.8 million for the three months

ended June 30, 2022 as compared to $2.3 million for the three

months ended June 30, 2021. For the six months ended June 30, 2022,

net income was $3.6 million as compared to $4.5 million for the six

months ended June 30, 2021.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220726006107/en/

AFBI Selected Data (Graphic: Business

Wire)

For the three months

ended,

Performance Ratios:

June 30, 2022

March 31, 2022

December 31, 2021

September 30, 2021

June 30, 2021

Return on average assets (1)

0.95%

0.97%

0.66%

0.91%

1.18%

Return on average equity (1)

6.13%

5.97%

4.36%

6.00%

7.95%

Net interest margin (1)

4.06%

4.47%

3.60%

3.74%

4.06%

Efficiency ratio

67.23%

69.00%

74.29%

65.87%

58.30%

(1) Annualized.

Results of Operations

Net income was $1.8 million for the three months ended June 30,

2022, as compared to $2.3 million for the three months ended June

30, 2021, as a result of a decrease in Payroll Protection Program

(PPP) loan related interest and fee income as we have been

receiving forgiveness payments for these loans partially offset by

a decrease in interest expense. Net income was $3.6 million for the

six months ended June 30, 2022, as compared to $4.5 million for the

six months ended June 30, 2021, as a result of lower interest and

fee income on PPP loans partially offset by a decrease in interest

expense primarily related to the recognition of remaining discounts

upon the payoff of acquired Federal Home Loan Bank advances.

Net Interest Income and

Margin

Net interest income decreased $269,000, and was $7.1 million for

the three months ended June 30, 2022, compared to $7.4 million for

the three months ended June 30, 2021, as a result of a decrease in

Payroll Protection Program (PPP) loan related interest and fee

income as we have been receiving forgiveness payments for these

loans partially offset by a decrease in interest expense. Net

interest income decreased $859,000, and was $14.9 million for the

six months ended June 30, 2022, compared to $15.8 million for the

six months ended June 30, 2021, as a result of a decrease in PPP

loan related interest and fee income as we have been receiving

forgiveness payments for these loans partially offset by a decrease

in interest expense primarily related to the recognition of

remaining discounts upon the payoff of acquired Federal Home Loan

Bank advances. Average interest-earning assets decreased by $27.1

million, and was $702.9 million for the three months ended June 30,

2022, compared to $730.0 for the three months ended June 30, 2021.

Average interest-earning assets decreased by $29.1 million, and was

$698.1 million for the six months ended June 30, 2022, compared to

$727.2 million for the six months ended June 30, 2021. This

decrease was a result of the decrease in PPP loans as forgiveness

payments were received for both the three- and six-month periods

ended June 30, 2022. The Company’s net interest margin remained

constant at 4.06% for the three months ended June 30, 2022, and

June 30, 2021. Net interest margin for the six months ended June

30, 2022, decreased to 4.27% from 4.33% for the six months ended

June 30, 2021. For the three months ended June 30, 2022, the cost

of average interest-bearing liabilities decreased to 0.47% from

0.70% for the three months ended June 30, 2021, as a result of

paying off Federal Home Loan Bank advances and decreasing deposit

rates related to the decrease in market rates. For the six months

ended June 30, 2022, the cost of average interest-bearing

liabilities decreased to 0.02% from 0.72% for the six months ended

June 30, 2021, as a result of paying off Federal Home Loan Bank

advances and recognizing $1.0 million in accretion from fair value

adjustments on acquired advances. The total cost of deposits was

0.46% for the three months ended June 30, 2022, compared to 0.65%

for the three months ended June 30, 2021. For the six months ended

June 30, 2022, the total cost of deposits was 0.47% compared to

0.69% for the six months ended June 30, 2021. The decrease was due

to decreasing deposit rates related to the decrease in market rates

for both the three- and six-month periods ended June 30, 2022.

Provision for Loan

Losses

For the three months ended June 30, 2022, the provision for loan

loss expense was $217,000 compared to $300,000 for the three months

ended June 30, 2021. For the six months ended June 30, 2022, the

provision for loan loss expense was $467,000 compared to $750,000

for the six months ended June 30, 2021. We increased our provision

expense in 2021 due to the uncertainty related to the COVID-19

pandemic. We continue to assess current economic conditions when

determining the level of provision expense. Net loan charge offs

were $25,000 for the six months ended June 30, 2022, compared to

net loan recoveries of $276,000 for the six months ended June 30,

2021.

Non-interest Income

For the three months ended June 30, 2022, noninterest income

increased $42,000 to $648,000 compared to $606,000 for the three

months ended June 30, 2021. For the six months ended June 30, 2022,

noninterest income decreased $91,000 to $1.2 million compared to

$1.3 million for the six months ended June 30, 2021. This was a

result of the decrease in other non-interest income as income was

received in 2021 for a bank-owned life insurance death benefit

claim and no such benefit claim was received in 2022.

Non-interest Expense

Operating expenses increased $564,000, and were $5.2 million for

the three months ended June 30, 2022, compared to $4.7 million for

the three months ended June 30, 2021. For the six months ended June

30, 2022, operating expenses increased $431,000, and were $11.0

million for the six months ended June 30, 2022, compared to $10.6

million for the six months ended June 30, 2021. The increase in

salaries and employee benefits were due to the Company’s strategic

initiative to attract and retain talent for both the three- and

six-month periods ended June 30, 2022.

Income Tax Expense

We recorded income tax expense of $552,000 for three months

ended June 30, 2022, compared to $725,000 for the three months

ended June 30, 2021. For the six months ended June 30, 2022, income

tax expense was $1.1 million compared to $1.3 million for the six

months ended June 30, 2021. The lower tax expense for both the

three- and six-month periods ended June 30, 2022, was primarily due

to lower pretax income.

Financial Condition

Total assets decreased by $21.4 million to $766.7 million at

June 30, 2022, from $788.1 million at December 31, 2021. The

decrease was due primarily to a decrease in cash and cash

equivalents of $56.4 million due to paying off Federal Home Loan

Bank advances, partially offset by an increase in net loans. Cash

and equivalents decreased $56.4 million, to $55.0 million at June

30, 2022, from $111.8 million at December 31, 2021, as excess

liquidity was utilized to payoff Federal Home Loan Bank advances.

Total investment securities available for sale decreased by $4.0

million at June 30, 2022, as compared to December 31, 2021, as our

unrealized loss on the investment portfolio increased due to the

rise in interest rates. Total net loans increased $38.5 million to

$614.4 million at June 30, 2022 from $575.8 million at December 31,

2021, including Paycheck Protection Program (PPP) loans of $916,000

and $17.9 million at June 30, 2022 and December 31, 2021,

respectively. Loans increased due to our continued success with our

strategic initiatives to grow organically and diversify our loan

portfolio. This includes adding additional lenders to our business

development team. Deposits increased by $11.4 million to $626.2

million at June 30, 2022 compared to $614.8 million at December 31,

2021, which reflected an increase in interest-bearing, market rate,

and non-interest-bearing deposits of $23.0 million. The

loan-to-deposit ratio at June 30, 2022 was 98.1%, as compared to

93.7% at December 31, 2021. Stockholders’ equity decreased to

$115.4 million at June 30, 2022, as compared to $121.0 million at

December 31, 2021, primarily due to the decrease in additional paid

in capital from the repurchase of 308,602 shares of common stock

totaling $4.8 million with an average price per share of $15.48 as

well as an increase in accumulated other comprehensive loss related

to our investment portfolio.

Asset Quality

The Company’s non-performing loans remained constant at $7.0

million at June 30, 2022 and December 31, 2021. The allowance for

loan losses as a percentage of non-performing loans was 129.5% at

June 30, 2022, as compared to 122.1% at December 31, 2021. The

Company’s allowance for loan losses was 1.44% of total loans at

June 30, 2022, as compared to 1.46% of total loans at December 31,

2021.

About Affinity Bancshares,

Inc.

The Company is a Maryland corporation based in Covington,

Georgia. The Company’s banking subsidiary, Affinity Bank, opened in

1928 and currently operates a full-service office in Atlanta,

Georgia, two full-service offices in Covington, Georgia, and a loan

production office serving the Alpharetta and Cumming, Georgia

markets.

Forward-Looking

Statements

In addition to historical information, this release may contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, which describe the future

plans, strategies and expectations of the Company. Forward-looking

statements can be identified by the use of words such as

“estimate,” “project,” “believe,” “intend,” “anticipate,” “assume,”

“plan,” “seek,” “expect,” “will,” “may,” “should,” “indicate,”

“would,” “contemplate,” “continue,” “target” and words of similar

meaning. Forward-looking statements are based on our current

beliefs and expectations and are inherently subject to significant

business, economic and competitive uncertainties and contingencies,

many of which are beyond our control. In addition, these

forward-looking statements are subject to assumptions with respect

to future business strategies and decisions that are subject to

change. Accordingly, you should not place undue reliance on such

statements. We are under no duty to and do not take any obligation

to update any forward-looking statements after the date of this

report. Factors which could have a material adverse effect on the

operations of the Company and its subsidiaries include, but are not

limited to, changes in general economic conditions, interest rates

and inflation; changes in asset quality; our ability to access

cost-effective funding; fluctuations in real estate values; changes

in laws or regulations; changes in technology; failures or breaches

of our IT security systems; our ability to introduce new products

and services and capitalize on growth opportunities; our ability to

successfully integrate acquired operations or assets; changes in

accounting policies and practices; our ability to retain key

employees; the impact of the COVID-19 pandemic; and the effects of

natural disasters and geopolitical events. These risks and other

uncertainties are further discussed in the reports that the Company

files with the Securities and Exchange Commission.

Average Balance Sheets

The following tables set forth average balance sheets, average

yields and costs, and certain other information for the periods

indicated. No tax-equivalent yield adjustments have been made, as

the effects would be immaterial. All average balances are monthly

average balances. Non-accrual loans were included in the

computation of average balances. The yields set forth below include

the effect of deferred fees, discounts, and premiums that are

amortized or accreted to interest income or interest expense.

For the Three Months Ended

June 30,

2022

2021

Average Outstanding

Balance

Interest

Average Yield/Rate

Average Outstanding

Balance

Interest

Average Yield/Rate

(Dollars in thousands)

Interest-earning assets:

Loans excluding PPP loans

$

609,646

$

7,212

4.73

%

$

505,912

$

6,310

4.99

%

PPP loans

3,750

71

7.58

%

107,154

1,687

6.30

%

Securities

46,461

279

2.40

%

29,619

163

2.20

%

Interest-earning deposits

41,856

79

0.76

%

84,950

39

0.18

%

Other investments

1,187

12

3.95

%

2,346

18

3.06

%

Total interest-earning assets

702,900

7,653

4.36

%

729,981

8,217

4.50

%

Non-interest-earning assets

51,662

57,220

Total assets

$

754,562

$

787,201

Interest-bearing liabilities:

Savings accounts

$

82,478

87

0.42

%

$

93,598

103

0.44

%

Interest-bearing checking accounts

97,618

45

0.19

%

84,571

44

0.21

%

Market rate checking accounts

150,863

93

0.25

%

131,466

128

0.39

%

Certificates of deposit

90,194

259

1.15

%

108,936

409

1.50

%

Total interest-bearing deposits

421,153

484

0.46

%

418,571

684

0.65

%

FHLB advances

14,341

27

0.76

%

45,610

123

1.08

%

Other borrowings

137

1

1.71

%

—

—

—

Total interest-bearing liabilities

435,631

512

0.47

%

464,181

807

0.70

%

Non-interest-bearing liabilities

202,296

206,119

Total liabilities

637,927

670,300

Total stockholders' equity

116,635

116,901

Total liabilities and stockholders'

equity

$

754,562

$

787,201

Net interest income

$

7,141

$

7,410

Net interest rate spread (1)

3.89

%

3.80

%

Net interest-earning assets (2)

$

267,269

$

265,800

Net interest margin (3)

4.06

%

4.06

%

Average interest-earning assets to

interest- bearing liabilities

161.35

%

157.26

%

(1)

Net interest rate spread represents the

difference between the weighted average yield on interest-earning

assets and the weighted average rate of interest-bearing

liabilities.

(2)

Net interest-earning assets represent

total interest-earning assets less total interest-bearing

liabilities.

(3)

Net interest margin represents net

interest income divided by average total interest-earning

assets.

For the Six Months Ended June

30,

2022

2021

Average Outstanding

Balance

Interest

Average Yield/Rate

Average Outstanding

Balance

Interest

Average Yield/Rate

(Dollars in thousands)

Interest-earning assets:

Loans excluding PPP loans

$

596,429

$

14,004

4.70

%

$

501,596

$

12,514

4.99

%

PPP loans

8,035

275

6.84

%

115,260

4,577

7.94

%

Securities

47,549

539

2.27

%

26,701

256

1.92

%

Interest-earning deposits

45,026

97

0.43

%

81,469

82

0.20

%

Other investments

1,094

17

3.21

%

2,169

36

3.29

%

Total interest-earning assets

698,133

14,932

4.28

%

727,195

17,465

4.80

%

Non-interest-earning assets

52,661

55,514

Total assets

$

750,794

$

782,709

Interest-bearing liabilities:

Savings accounts

$

84,326

169

0.40

%

$

93,881

210

0.45

%

Interest-bearing checking accounts

96,949

87

0.18

%

90,509

95

0.21

%

Market rate checking accounts

147,677

182

0.25

%

127,858

261

0.41

%

Certificates of deposit

92,318

549

1.19

%

119,366

915

1.53

%

Total interest-bearing deposits

421,270

987

0.47

%

431,614

1,481

0.69

%

FHLB advances

11,596

(948

)

(16.35

)%

37,624

219

1.16

%

Other borrowings

69

1

1.70

%

69

14

41.69

%

Total interest-bearing liabilities

432,935

41

0.02

%

469,307

1,714

0.72

%

Non-interest-bearing liabilities

198,680

201,098

Total liabilities

631,615

670,405

Total stockholders' equity

119,179

112,304

Total liabilities and stockholders'

equity

$

750,794

$

782,709

Net interest income

$

14,891

$

15,751

Net interest rate spread (1)

4.26

%

4.08

%

Net interest-earning assets (2)

$

265,197

$

257,888

Net interest margin (3)

4.27

%

4.33

%

Average interest-earning assets to

interest-bearing liabilities

161.26

%

154.95

%

(1)

Net interest rate spread represents the

difference between the weighted average yield on interest-earning

assets and the weighted average rate of interest-bearing

liabilities.

(2)

Net interest-earning assets represent

total interest-earning assets less total interest-bearing

liabilities.

(3)

Net interest margin represents net

interest income divided by average total interest-earning

assets.

AFFINITY BANCSHARES,

INC.

Consolidated Balance

Sheets

June 30, 2022

December 31, 2021

(unaudited)

(audited)

(In thousands)

Assets

Cash and due from banks, including reserve

requirement of $0 at June 30, 2022 and December 31, 2021

$

8,111

$

16,239

Interest-earning deposits in other

depository institutions

47,288

95,537

Cash and cash equivalents

55,399

111,776

Investment securities

available-for-sale

44,551

48,557

Other investments

1,400

2,476

Loans, net

614,358

575,825

Other real estate owned

3,538

3,538

Premises and equipment, net

4,048

3,783

Bank owned life insurance

15,549

15,377

Intangible assets

18,653

18,749

Accrued interest receivable and other

assets

9,183

8,007

Total assets

$

766,679

$

788,088

Liabilities and Stockholders'

Equity

Liabilities:

Savings accounts

$

82,742

$

86,745

Interest-bearing checking

96,176

91,387

Market rate checking

159,900

145,969

Non-interest-bearing checking

198,177

193,940

Certificates of deposit

89,180

96,758

Total deposits

626,175

614,799

Federal Home Loan Bank advances

20,000

48,988

Accrued interest payable and other

liabilities

5,133

3,333

Total liabilities

651,308

667,120

Stockholders' equity:

Common stock (par value $0.01 per share,

40,000,000 shares authorized; 6,590,362 issued and outstanding at

June 30, 2022 and 6,872,634 issued and outstanding at December 31,

2021

65

69

Preferred stock (10,000,000 shares

authorized, no shares outstanding at June 30, 2022 and December 31,

2021

—

—

Additional paid in capital

63,497

68,038

Unearned ESOP shares

(4,899

)

(5,004

)

Retained earnings

61,797

58,223

Accumulated other comprehensive loss

(5,089

)

(358

)

Total stockholders' equity

115,371

120,968

Total liabilities and stockholders'

equity

$

766,679

$

788,088

AFFINITY BANCSHARES,

INC.

Consolidated Statements of

Income

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2022

2021

2022

2021

(In thousands)

Interest income:

Loans, including fees

$

7,283

$

7,997

$

14,279

$

17,091

Investment securities, including

dividends

291

181

556

292

Interest-earning deposits

79

39

97

82

Total interest income

7,653

8,217

14,932

17,465

Interest expense:

Deposits

484

684

987

1,481

Borrowings

28

123

(947

)

233

Total interest expense

512

807

40

1,714

Net interest income before provision for

loan losses

7,141

7,410

14,892

15,751

Provision for loan losses

217

300

467

750

Net interest income after provision for

loan losses

6,924

7,110

14,425

15,001

Noninterest income:

Service charges on deposit accounts

393

376

785

709

Other

255

230

458

625

Total noninterest income

648

606

1,243

1,334

Noninterest expenses:

Salaries and employee benefits

2,959

2,511

5,901

4,894

Deferred compensation

64

62

131

126

Occupancy

541

644

1,123

1,696

Advertising

118

100

198

180

Data processing

497

517

990

999

Other real estate owned

—

7

—

19

Net (gain) on sale of other real estate

owned

—

(126

)

—

(127

)

Legal and accounting

203

226

385

402

Organizational dues and subscriptions

133

91

264

161

Director compensation

51

50

102

100

Federal deposit insurance premiums

52

67

112

140

Writedown of premises and equipment

—

—

—

873

FHLB prepayment penalties

—

—

647

—

Other

619

524

1,142

1,101

Total noninterest expenses

5,237

4,673

10,995

10,564

Income before income taxes

2,335

3,043

4,673

5,771

Income tax expense

552

725

1,099

1,321

Net income

$

1,783

$

2,318

$

3,574

$

4,450

Basic earnings per share

$

0.27

$

0.34

$

0.53

$

0.65

Diluted earnings per share

$

0.27

$

0.34

$

0.53

$

0.64

Explanation of Non-GAAP Financial

Measures

Reported amounts are presented in accordance with GAAP. The

Company’s management believes that the supplemental non-GAAP

information, which consists of reported net income less interest

and fees income on PPP loans provides a better comparison of the

amount of the Company’s earnings. Management also believes that

reported loans less PPP loans, deferred loan fees and other loan

adjustments (consisting of loans in process), provides a better

comparison of the amount of the Company’s loan portfolio.

Additionally, the Company believes this information is utilized by

regulators and market analysts to evaluate a company’s financial

condition and, therefore, such information is useful to investors.

These disclosures should not be viewed as a substitute for

financial results in accordance with GAAP, nor are they necessarily

comparable to non-GAAP performance measures which may be presented

by other companies. Refer to the Non-GAAP Reconciliation table at

the end of this document for details on the earnings impact of

these items.

June 30, 2022

March 31, 2022

December 31, 2021

September 30, 2021

June 30, 2021

(In thousands)

Non-GAAP Reconciliation

Total Loans

$

623,359

$

601,693

$

584,384

$

571,170

$

590,011

Plus:

Fair Value Marks

1,157

1,239

1,350

1,422

1,529

Deferred Loan fees

873

958

958

1,077

1,666

Less:

Payroll Protection

Program Loans

916

7,146

18,124

32,204

73,020

Indirect Auto

Dealer Reserve

2,386

2,058

1,846

1,724

1,495

Other Loan

Adjustments

82

69

224

102

447

Gross Loans

$

622,005

$

594,617

$

566,498

$

539,639

$

518,244

June 30, 2022

March 31, 2022

December 31, 2021

September 30, 2021

June 30, 2021

(In thousands)

Non-GAAP Reconciliation

Net Income

$

1,783

$

1,791

$

1,318

$

1,805

$

2,318

Less:

PPP Interest Income

9

30

59

121

269

PPP Fee Income

62

174

271

741

1,419

Plus:

Tax Effect

17

47

84

208

403

Non-GAAP Net Income

$

1,729

$

1,634

$

1,072

$

1,151

$

1,033

June 30, 2022

March 31, 2022

December 31, 2021

September 30, 2021

June 30, 2021

(In thousands)

Non-GAAP Reconciliation

Total Equity

$

115,371

$

116,358

$

120,968

$

119,703

$

117,635

Minus:

Goodwill

17,219

17,219

17,219

17,219

17,219

Core Deposit Intangible

1,435

1,483

1,530

1,578

1,626

Tangible Common Equity

96,717

97,656

102,219

100,906

98,790

Divided By:

Outstanding Shares

6,590

6,619

6,873

6,873

6,873

Tangible Book Value Per Share

$

14.68

$

14.75

$

14.87

$

14.68

$

14.37

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220726006107/en/

Edward J. Cooney Chief Executive Officer (678)742-9990

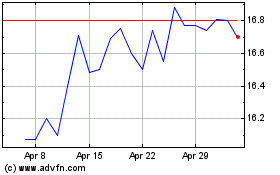

Affinity Bancshares (NASDAQ:AFBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Affinity Bancshares (NASDAQ:AFBI)

Historical Stock Chart

From Apr 2023 to Apr 2024