Current Report Filing (8-k)

09 February 2023 - 8:07AM

Edgar (US Regulatory)

FALSE000182095300018209532022-11-082022-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 8, 2023

Affirm Holdings, Inc.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39888 | | 84-2224323 |

(State or other jurisdiction of incorporation) | | (Commission

File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

| 650 California Street | | |

San Francisco, California | | 94108 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (415) 984-0490

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class: | Trading symbol(s) | Name of exchange on which registered |

| Class A common stock, $0.00001 par value | AFRM | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 8, 2023, the Affirm Holdings, Inc. (the "Company") issued a Shareholder Letter (the “Letter”) regarding its financial results for the second fiscal quarter ended December 31, 2022. A copy of the Letter is attached hereto as Exhibit 99.1, and the information in Exhibit 99.1 is incorporated herein by reference.

The Letter attached hereto as Exhibit 99.1 includes certain non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures are contained in the Letter and the financial tables attached thereto.

The information in this Item 2.02 and in Exhibit 99.1 attached hereto shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended.

Item 2.05. Costs Associated with Exit or Disposal Activities.

On February 8, 2023, the Company committed to a restructuring plan (the “Plan”) designed to manage its operating expenses in response to current macroeconomic conditions and ongoing business prioritization efforts. The Plan provides for a reduction of the Company’s workforce by approximately 500 employees, representing approximately 19% of the Company’s employees. In connection with the Plan, the Company is also reevaluating its need for leased office space and has decided to fully vacate a portion of its San Francisco office. The Company expects implementation of the Plan to be substantially complete by the end of fiscal 2023.

The Company expects to incur approximately $35 million to $39 million in total restructuring costs, which includes cash expenditures of $24 million to $28 million relating to one-time employee severance and other employment termination benefits and non-cash expenditures of approximately $11 million relating to the acceleration of amortization expense for the lease assets that we expect to incur in connection with the partial office closure. The Company expects to record the majority of the associated charges and the majority of the associated cash expenditures in the third fiscal quarter of 2023.

The estimates of the costs and expenditures that the Company expects to incur in connection with the Plan, and the timing thereof, are subject to a number of assumptions and actual amounts may differ materially from estimates. The Company may also incur costs and expenditures not currently contemplated due to unanticipated events that may occur in connection with the implementation of the Plan.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements including, but not limited to, statements related to the terms and conditions of the Plan, the number of employees affected by the Plan, the estimated amount of restructuring costs to be incurred in connection with the Plan, the cash expenditures expected to be incurred in connection with the Plan, and the expected timing of recognition of the charges associated with the Plan. These forward-looking statements are based on management’s beliefs and assumptions and on information available to management as of the date they are made. However, investors should not place undue reliance on any such forward-looking statements because they speak only as of the date they are made. The Company does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results, events and developments to differ materially from the Company’s historical experience and its present expectations or projections. These risks and uncertainties include, but are not necessarily limited to, those described in the Company’s filings with the Securities and Exchange Commission.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | AFFIRM HOLDINGS, INC. |

| | |

| By: | /s/ Michael Linford |

| | Name: Michael Linford |

| | Title: Chief Financial Officer |

Date: February 8, 2023

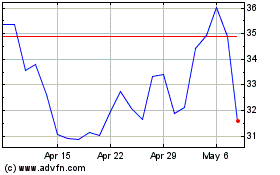

Affirm (NASDAQ:AFRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Affirm (NASDAQ:AFRM)

Historical Stock Chart

From Apr 2023 to Apr 2024