Amended Statement of Beneficial Ownership (sc 13d/a)

17 December 2022 - 8:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange of 1934

(Amendment No. 13)

| Afya Limited |

| (Name of Issuer) |

| |

| Class A Common Shares, par value $0.00005 per share |

| (Title of Class of Securities) |

| |

| G01125106 |

| (CUSIP Number) |

| |

|

Denise Abel

Bertelsmann SE & Co. KGaA

Carl-Bertelsmann-Strasse 270

33311 Gütersloh, Germany

with copies to:

Michael Davis, Esq.

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

|

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) |

| |

|

|

| |

December 16, 2022 (December 15, 2022) |

|

| |

(Date of Event which Requires Filing of this Statement) |

|

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box.☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are

to be sent.

*The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (the “Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| 1 |

NAME OF REPORTING PERSON

Bertelsmann SE & Co. KGaA

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (See Instructions)

WC

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Germany

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

—

|

| 8 |

SHARED VOTING POWER

35,122,332

|

| 9 |

SOLE DISPOSITIVE POWER

35,122,332

|

| 10 |

SHARED DISPOSITIVE POWER

—

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

35,122,332 (1)

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

47.98% (2)(3)

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions)

CO

|

| 1 |

NAME OF REPORTING PERSON

Erste WV Gütersloh GmbH

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (See Instructions)

WC

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Germany

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

—

|

| 8 |

SHARED VOTING POWER

35,122,332

|

| 9 |

SOLE DISPOSITIVE POWER

35,122,332

|

| 10 |

SHARED DISPOSITIVE POWER

—

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

35,122,332 (1)

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

47.98% (2)(3)

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions)

CO

|

| (1) |

Aggregate amount beneficially owned by Bertelsmann SE & Co. KGaA (“Bertelsmann”) and Erste WV Gütersloh GmbH, a wholly-owned direct subsidiary of Bertelsmann (“Erste” and collectively with Bertelsmann, the “Reporting Person”) consists of 29,074,134 Class B common shares and 6,048,198 Class A common shares held of record by the Reporting Person. Each Class B common share held of record by the Reporting Person is convertible into one Class A common share at the option of its holder at any time. |

| (2) |

Represents the quotient obtained by dividing (a) the number of Class B common shares and Class A common shares beneficially owned by the Reporting Person as set forth in Row 11 by (b) the sum of (i) 44,133,783 Class A common shares outstanding as of September 30, 2022 as reported by the Issuer in its Current Report on Form 6-K, filed with the Securities and Exchange Commission (the “Commission”) on November 21, 2022 (as reduced by the number of treasury shares as reported to the Reporting Person by the Issuer on May 12, 2022), and (ii) the aggregate number of Class B common shares beneficially owned by the Reporting Person. The aggregate number of Class B common shares beneficially owned by the Reporting Person as set forth in clauses “(a)” and “(b)” of this footnote are treated as converted into Class A common shares only for the purpose of computing the percentage ownership of the Reporting Person. As of December 31, 2021, the number of Class A common shares outstanding was 44,133,783 and the percentage beneficially owned was 34.3%. |

| (3) |

Each Class A common share is entitled to one vote, and each Class B common share is entitled to ten votes. The percentage reported does not reflect the ten for one voting power of the Class B common shares because the Class B common shares are treated as converted into Class A common shares for the purpose of this report. |

Explanatory Note

This Amendment No. 13 (the “Amendment”)

amends and supplements the Schedule 13D filed by the Reporting Person on August 10, 2021 (the “Original Schedule 13D”, as

further amended on March 4, 2022, “Amendment No. 1”, as further amended on April 18, 2022, “Amendment No. 2”,

as further amended on April 25, 2022, “Amendment No. 3,” as further amended on May 4, 2022, “Amendment No. 4,”

as further amended on May 23, 2022, “Amendment No. 5,” as further amended on May 27, 2022, “Amendment No. 6,”

as further amended on August 1, 2022, “Amendment No. 7,” as further amended on August 31, 2022, “Amendment No. 8,”

as further amended on September 23, 2022, “Amendment No. 9,” as further amended on October 24, 2022, “Amendment No.

10,” as further amended on November 9, 2022, “Amendment No. 11,” as further amended on November 29, 2022, “Amendment

No. 12,” and, as amended and supplemented by this Amendment, the “Schedule 13D”). Except as specifically provided herein,

this Amendment does not modify any of the information previously reported on the Original Schedule 13D, Amendment No. 1, Amendment No.

2, Amendment No. 3, Amendment No. 4, Amendment No. 5, Amendment No. 6, Amendment No. 7, Amendment No. 8, Amendment No. 9, Amendment No.

10, Amendment No. 11 or Amendment No. 12. Capitalized terms not otherwise defined in this Amendment shall have the same meanings ascribed

thereto in the Original Schedule 13D. This Schedule 13D relates to the Class A common shares, par value $0.00005, of Afya Limited, an

exempted liability company incorporated under the laws of the Cayman Islands (the “Issuer”), having its registered offices

at Alameda Oscar Niemeyer, No. 119, Salas 502, 504, 1,501 and 1,503, Vila da Serra, Nova Lima, Minas Gerais Brazil.

| Item 4. |

Purpose of Transaction.

|

This Amendment

No. 13 amends and supplements Item 4 of the Original Schedule 13D (as amended by Amendment No. 1, Amendment No. 2, Amendment No. 3, Amendment

No. 4, Amendment No. 5, and Amendment No. 6) as follows:

As previously disclosed on Amendment No. 6, the

Reporting Person entered into a Trading Plan on May 26, 2022 pursuant to Rule 10b5-1 of the Act

with an unaffiliated third-party broker (the “Broker”) (the “Existing Trading Plan”). On December 15, 2022,

the Reporting Person entered into an amendment to the Trading Plan (the “Trading Plan Amendment”).

Under the Existing Trading Plan, the Broker was authorized and directed to purchase Class A common shares of the Issuer in open market

transactions on behalf of the Reporting Person, subject to certain conditions, with an aggregate purchase price of up to $129 million.

Under the Trading Plan Amendment, the Broker is authorized and directed to purchase an additional number of Class A common shares of the

Issuer in open market transactions on behalf of the Reporting Person, subject to certain conditions, with an aggregate purchase price

of up to $200 million. Such additional purchases may only commence once the purchases under the Existing Trading Plan have been completed

but in no event before January 16, 2023. In addition, the Trading Plan Amendment extended the term of the Existing Trading Plan to May

31, 2024, unless terminated earlier in accordance with its terms. There can be no certainty that any Class A common shares will be purchased

under the Trading Plan Amendment.

The foregoing description of the Trading Plan

Amendment does not purport to be complete and is qualified in its entirety by reference to the copy included as Exhibit 99.1 to this Schedule

13D.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

The information set forth in Item 4 of this Amendment

No. 13 is incorporated herein by reference.

| Item 7. |

Material to be Filed as Exhibits. |

| 99.1 |

First Amendment to the Stock Purchase Plan Engagement Agreement, dated December 15, 2022, by and between Erste, BofA Securities, Inc. and the Issuer. |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement is true, complete and correct.

| Dated: December 16, 2022 |

|

| |

|

| |

BERTELSMANN SE & CO. KGAA |

| |

|

| |

By: |

ppa /s/ Martin Dannhoff |

| |

Name: Martin Dannhoff |

| |

Title: SVP Corporate Legal |

| |

|

| |

By: |

ppa /s/ Denise Abel |

| |

Name: Denise Abel |

| |

Title: SVP Corporate Legal |

| |

|

| |

ERSTE WV GÜTERSLOH GMBH |

| |

|

| |

By: |

/s/ Martin Dannhoff |

| |

Name: Martin Dannhoff |

| |

Title: Director |

| |

By: |

/s/ Denise Abel |

| |

Name: Denise Abel |

| |

Title: Director |

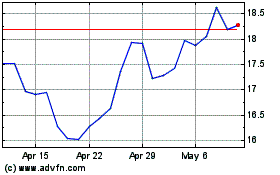

Afya (NASDAQ:AFYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Afya (NASDAQ:AFYA)

Historical Stock Chart

From Apr 2023 to Apr 2024