| | | | | |

Prospectus Supplement No. 5 (To Prospectus dated May 12, 2022) | Filed pursuant to Rule 424(b)(3) Registration No. 333-259514 |

This prospectus supplement updates, amends and supplements the prospectus dated May 12, 2022 (the “Prospectus”), which forms a part of our Registration Statement on Form S-1 (Registration No. 333-259514). Capitalized terms used in this prospectus supplement and not otherwise defined herein have the meanings specified in the Prospectus.

This prospectus supplement is being filed to update, amend and supplement the information included in the Prospectus with the information contained in our Current Report on Form 8-K filed with the SEC on February 1, 2023, which is set forth below.

This prospectus supplement is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, which is to be delivered with this prospectus supplement, and is qualified by reference thereto, except to the extent that the information in this prospectus supplement updates or supersedes the information contained in the Prospectus. Please keep this prospectus supplement with your Prospectus for future reference.

On January 31, 2022, the closing price of our Class A Common Stock was $4.31 per share and the closing price of our public warrants was $0.48 per warrant.

Investing in our securities involves a high degree of risks. You should review carefully the risks and uncertainties described in the section titled “Risk Factors” beginning on page 7 of the Prospectus, and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is February 1, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 26, 2023

AgileThought, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39157 | | 87-2302509 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | |

222 W. Las Colinas Blvd. Suite 1650E, Irving, Texas | | (971) 501-1140 | | 75039 |

| (Address of Principal Executive Offices) | | (Registrant's telephone number, including area code) | | (Zip Code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, $0.0001 par value per share

| | AGIL | | NASDAQ Capital Market |

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share | | AGILW | | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry Into a Material Definitive Agreement

Effective January 26, 2023, AgileThought, Inc. (“AgileThought”) entered into a Third Amendment (the “Exitus Amendment”) to the Simple Loan Facility Agreement (Contrato de Apertura de Crédito Simple) (the “Exitus Loan Facility”), by and among AgileThought Digital Solutions, S.A.P.I. de C.V., Exitus Capital, S.A.P.I. de C.V., SOFOM, E.N.R. and AgileThought.

The Exitus Amendment extends the maturity date of the Exitus Loan Facility from January 26, 2023 to July 26, 2023. In addition, AgileThought paid approximately $1.12 million of the principal amount of the facility on January 27, 2023, plus a fee of approximately $434,000, and has agreed to pay approximately $1 million of the principal amount of the facility on February 27, 2023. The remaining principal of approximately $1.58 million will be due and payable on the new maturity date of July 26, 2023.

AgileThought believes it has sufficient cash on hand to pay the principal amount and fees due on February 27, 2023. In addition AgileThought continuously evaluates alternatives to improve its profitability and working capital positions. AgileThought’s failure to pay the amounts when due on the Exitus Loan Facility or the Promissory Note (defined below) would constitute an event of default under the terms of such agreements and a cross-default under its Financing Agreement by and among AgileThought, AN Global LLC, certain subsidiaries of AgileThought, as guarantors, the financial institutions party thereto as lenders, and Blue Torch Finance LLC, as the administrative agent and collateral agent.

The foregoing description of the Exitus Amendment does not constitute a complete summary of the Exitus Amendment and is qualified by reference in its entirety to the full text of the Exitus Amendment to be filed as an exhibit to AgileThought’s next periodic report.

Item 3.02 Unregistered Sales of Equity Securities

The Exitus Amendment also contemplates the issuance of shares of AgileThought’s Class A Common Stock with a value of approximately $5.2 million, equal to approximately two times the current principal amount owing by AgileThought under the Exitus Loan Facility. The shares are intended to support AgileThought’s obligations under the Exitus Loan Facility as collateral and will be issued on or before February 10, 2023.

In connection with the Promissory Note (defined below), AgileThought also agreed to the issuance of shares of AgileThought’s Class A Common Stock to AGS Group LLC (“AGS”) with a value of approximately $1.8 million, equal to approximately two times the current principal amount owing by AgileThought under the Promissory Note. The shares are intended to support AgileThought’s obligations under the Promissory Note as collateral and will be issued on or before February 10, 2023.

The shares will be issued in a transaction exempt from registration pursuant to Section 4(a)(2) of the Securities Act and will be subject to a registration rights agreement to be entered into by and among AgileThought, Exitus and AGS.

Item 8.01 Other Events

Effective January 31, 2023, AgileThought entered into a second amended and restated subordinated promissory note (the “Promissory Note”) with AGS. The Promissory Note extended the maturity date of the obligations owing to AGS to March 31, 2023 and capitalized the interest accrued to January 31, 2023. The principal amount and accrued and unpaid interest equaled $885,200 on January 31, 2023. Interest on the $885,200 is due and payable in arrears on the extended maturity date of March 31, 2023 at 20 percent per annum from January 31, 2023 to the extended maturity date calculated on the actual number of days elapsed.

Item 9.01. Financial Statements and Exhibits

(d) Exhibit(s).

| | | | | | | | |

| Exhibit Number | | Exhibit Description |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 1, 2023

| | | | | | | | |

| AGILETHOUGHT, INC. |

| | |

| By: | /s/ Amit Singh |

| | Amit Singh |

| | Chief Financial Officer |

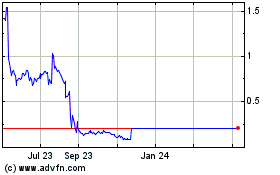

AgileThought (NASDAQ:AGIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

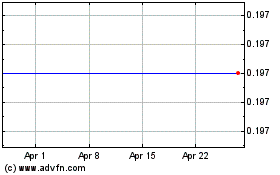

AgileThought (NASDAQ:AGIL)

Historical Stock Chart

From Apr 2023 to Apr 2024