This prospectus relates to the public offering of units (“Units”), with each Unit consisting of one share of the Company’s common stock, par value $0.01 per share, and one warrant (the “Warrants”) to purchase one share of common stock at a price of $4.25 per share. The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of common stock and Warrants are immediately separable and will be issued separately in this offering. Each Warrant offered hereby is immediately exercisable on the date of issuance and will expire five years from the date of issuance.

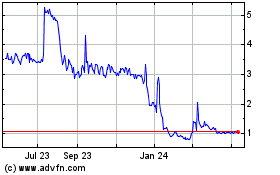

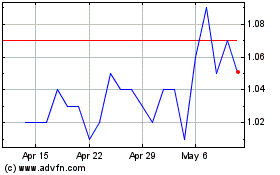

Through August 8, 2022, our common stock was quoted on the OTCPK, one of the OTC Markets Group over-the-counter markets, under the trading symbol “AIMD.” On August 5, 2022, the closing sale price for our common stock was $10.50 (after giving effect to our reverse stock split at a ratio of 1-for-15). As of August 9, 2022, our common stock and Warrants are listed on the Nasdaq Capital Market, or Nasdaq under the symbols “AIMD” and “AIMDW,” respectively.

Unless otherwise noted, the share and per share information in this prospectus reflects, other than in our financial statements and the notes thereto, a reverse stock split of our authorized and outstanding common stock at a ratio of 1-for-15 which became effective at 8:00pm ET on August 8, 2022.

Upon completion of this offering, assuming that the underwriters do not exercise their over-allotment or representative’s warrants, and none of our Warrants or other outstanding warrants or options to purchase our common stock are exercised, Ainos Inc., a Cayman Islands company, our principal shareholder and its affiliates will beneficially own approximately 68.4% of our common stock (or approximately 68% of our common stock if the over-allotment option is exercised) and we will be a “controlled company” within the meaning of the listing rules of The Nasdaq Stock Market LLC.

We have granted the underwriters a 45-day option to purchase up to an additional 117,000 shares of common stock at a purchase price of $4.24 per share and/or up to an additional 117,000 Warrants at a purchase price of $0.01 per Warrant, less in each case, the underwriting discount, solely to cover over-allotments, if any.

The underwriters expect to deliver the Units offered hereby to purchasers on or about August 11, 2022, subject to customary closing conditions.

The date of this prospectus is August 8, 2022.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC under the Securities Act. This prospectus does not contain all of the information included in the registration statement. For further information, we refer you to the registration statement, including its exhibits, filed with the SEC. Statements contained in this prospectus about the contents of any document are not necessarily complete. If SEC rules require that a document be filed as an exhibit to the registration statement, please see such document for a complete description of these matters. You should carefully read this prospectus, together with the additional information described under the headings “Where You Can Find More Information.”

Neither we nor the underwriter have authorized anyone to provide you with any information or to make any representations other than that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the underwriter are making an offer to sell securities in any jurisdiction in which the offer or sale is not permitted. The information in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our shares of common stock and the information in any free writing prospectus that we may provide to you in connection with this offering is accurate only as of the date of that free writing prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

For investors outside the United States: We have not and the underwriter has not, done anything that would permit this offering, or possession or distribution of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to those jurisdictions.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Notice Regarding Forward-Looking Statements.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been, or will be, filed or incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find More Information.”

All product and company names are trademarks of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Throughout this prospectus, the terms “we,” “us,” “our,” and “our Company” and “the Company” refer to Ainos, Inc., a Texas corporation.

| | PROSPECTUS SUMMARY This summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you or that you should consider before investing in our common stock. You should read the entire prospectus carefully, especially the information under “Risk Factors” set forth in this prospectus and the information included in any prospectus supplement or free writing prospectus that we have authorized for use in connection with this offering. This prospectus contains forward-looking statements, based on current expectations and related to future events and our future financial performance, that involve risks and uncertainties. Our actual results may vary materially from those discussed in the forward-looking statements as a result of various factors, including, without limitation, those set forth under “Risk Factors,” as well as other matters described in this prospectus. See “Cautionary Notice Regarding Forward-Looking Statements.” Except as otherwise indicated, all information in this prospectus assumes no exercise of the Underwriter’s over-allotment option to purchase additional Units from us in this offering. Overview We are a diversified medtech company focused on the development of novel point-of-care testing (POCT), low-dose interferon therapeutics and synthetic RNA (SRNA)-driven preventative medicine. Since inception, we have focused on the research of low-dose non-injectable interferon therapeutics. We have recently expanded our product candidates into POCT devices in order to diversify corporate revenue streams. Our POCT devices are based on core technologies involving COVID-19 POCT products and other POCT products that detect volatile organic compounds (VOC) emitted by the human body. We believe our core technologies empower a telehealth-enabled future for precision medicine with abilities to test anywhere, strengthen the immune system and expedite development of novel precision treatments. We believe the following attributes differentiate us from other diversified life science companies: | |

| | · | Intuitive Point-of-Care Testing | |

| | · | Telehealth-Friendly Rapid Testing | |

| | · | AI Powered VOC Testing Platform | |

| | · | Decades of Proprietary Interferon Clinical Research | |

| | · | Capital-Efficient Business Model | |

| | · | Outsourced Manufacturing | |

| | · | Global Distribution Partnership | |

| | Our product portfolio includes the following product and product candidates: COVID-19 Antigen Rapid Test Kit and Cloud-based Test Management Apps. Our cloud-based test management platform is comprised of the Ainos COVID-19 Antigen Rapid Test Kit, a personal management application, or app, and an enterprise management app. We anticipate our management apps will allow individuals and/or organizations to seamlessly manage tests, trace infections, and share results. As the first commercialized product we sell, we currently market the Ainos COVID-19 Antigen Rapid Test Kit in Taiwan under emergency use authorization (EUA) for healthcare professional use and self-test use issued by the Taiwan Federal and Drug Administration (TFDA) to TCNT, the product manufacturer. We expect TCNT to apply for EUA authorization from the U.S. Food and Drug Administration (“FDA”) sometime in the second half of 2022. COVID-19 Nucleic Acid Test Kit. This solution consists of a color-changing assay and a portable test equipment. The assay is compatible with most standard Polymerase Chain Reaction (PCR) machines and delivers test results within 40 minutes. We also expect to offer portable, low-cost test equipment intended to help medical professionals quickly scale testing capacity. Upon TCNT receiving regulatory approval, we will market the product under the Ainos brand name, with TCNT manufacturing the product. The candidate is currently under EUA review by the TFDA and we expect TCNT to submit for EUA review by the FDA sometime in the second half of 2022. VOC POCT - Ainos Flora. The Ainos Flora device is designed to perform a non-invasive test for female vaginal health and certain sexually transmitted diseases (STDs) including chlamydia, gonorrhea and trichomoniasis, within a few minutes. We expect Ainos Flora will provide convenient, discreet, rapid testing in a point-of-care setting which will allow women to self-test at home. We intend to collaborate with TCNT to conduct clinical trials in Taiwan, after which we expect TCNT will submit applications for TFDA approval for marketing in Taiwan and FDA 510(k) clearance for marketing in the U.S. sometime in the second half of 2022. | |

| | VOC POCT - Ainos Pen. Our Ainos Pen device is a cloud-connected, multi-purpose, portable breath analyzer that is intended to monitor health conditions including oral, gastrointestinal, liver, and renal health within minutes. We expect consumers to be empowered to share their self-test results with their physicians through in-person and telehealth medical consultations. We intend to explore commercialization opportunities with third-party collaborators as a consumer health device sometime in the second half of 2022. VOC POCT - CHS430. The CHS430 device is intended to provide non-invasive testing for ventilator-associated pneumonia within 10 minutes. We plan to be the exclusive sales agent for CHS430, pursuant to our Product Development Agreement with our co-developer, TCNT. We intend to collaborate with TCNT to conduct clinical trials in Taiwan, after which we expect TCNT to submit applications for TFDA approval for marketing in Taiwan and FDA 510(k) clearance for marketing in the U.S. in 2023. Very Low-Dose Oral Interferon Alpha (VELDONA). VELDONA is a low-dose oral interferon alpha (IFN-α) formulation based on our nearly four decades of research on IFN-α’s potential treatment applications. Our leading product candidate is a low-dose oral treatment for COVID-19. We have conducted a parallel study based on VELDONA alone and joint study with Innopharmax, Inc. We recently completed our animal studies and subsequently we plan to initiate Phase 2/3 clinical trials for the VELDONA-only program sometime in mid-2022 in Taiwan. We also plan to advance our VELDONA development efforts for disease indications such as thrombocytopenia and Sjögren’s syndrome in 2023. Synthetic RNA (SRNA). We are developing a SRNA technology platform in Taiwan. Our initial focus is to develop a potential COVID-19 mRNA vaccine platform using the full-length spike or the receptor-binding domain (RBD) gene sequence of the alpha and delta variants as reference sequences. We plan to continue developing these technologies with the goal of initiating clinical trials in Taiwan in 2023. Growth Strategy Key elements of our growth strategy include innovating and expand our applications; creating multiple revenue streams; driving ecosystem adoption; expanding our installed base; broadening our global footprint; increasing value-added services; and scaling production with manufacturing partners. We expect to employ several core growth strategies: | |

| | · | Execute rollout of our multi-staged technology roadmap | |

| | · | Launch POCTs through a staged regulatory approval approach | |

| | · | Build an AI Nose technology platform | |

| | · | Establish a VOC analytics service | |

| | · | Implement a focused approach on the development of low-dose interferon therapeutics | |

| | · | Invest in SRNA research | |

| | · | Expand global footprint through distributors | |

| | · | Work with select manufacturers | |

| | Recent Developments The following are highlights of recent major corporate milestones that we believe will serve as catalysts for us to develop and commercialize a multi-faceted product portfolio pipeline over the next several years: In order to facilitate our diversification strategy through development and commercialization of an expanded base of product offerings we secured a strategic investor, Ainos Inc., a Cayman Islands company focused on the development of intellectual property and patent assets for point-of-care testing diagnostics (“Ainos KY”), in early 2021. In exchange for majority interest in our company, we acquired an intellectual property portfolio from Ainos KY. See “Our Corporate History and Structure.” Through this relationship, we have implemented several strategic initiatives over the past year to augment our product development pipeline and achieve a strengthened financial position. | |

| | In June 2021, we became the master sales and marketing agent for the Ainos COVID-19 Antigen Rapid Test Kit and Ainos COVID-19 Nucleic Acid Test Kit. Since then we began marketing Ainos COVID-19 Antigen Rapid Test Kit in Taiwan. We appointed Inabata as a non-exclusive worldwide distributor of our products candidates upon commercialization under a five year distribution agreement commencing November 2021. We also entered into a Memorandum of Understanding effective November 2021 with Inabata’s subsidiary, Taiwan Inabata Sangyo Co., Ltd. (“Taiwan Inabata”), under which Taiwan Inabata will coordinate business development, working capital, logistics, and coordination of procurement of raw materials in support of our products upon commercialization. In December 2021, we entered into a strategic relationship with InnoPharmax, Inc., a biopharmaceutical company focused on new oral drug formulations, to jointly develop and promote an orally administered CICCT for the treatment of COVID-19 and potentially other viral infections. During 2021, Ainos KY provided us $3,000,000 principal amount of working capital advances in exchange for notes convertible at Ainos KY’s election into shares of our common stock at a conversion price of $3.00 per share, subject to adjustment. Ainos KY intends to convert the notes into shares of common stock immediately prior to completion of this offering See “Certain Relationships and Related Party Transactions” in this prospectus for more information. In January 2022, we acquired additional intellectual property and equipment assets from Ainos KY including technical know-how, medical device manufacturing, testing and office equipment in Taiwan and hired certain of Ainos KY’s R&D personnel in exchange for a $26,000,000 convertible note (the “APA Convertible Note”). The APA Convertible Note will automatically convert into shares of our common stock immediately prior to the closing of this offering at a conversion price equal to 80% of the per Unit public offering price. See “Our Corporate History and Structure.” In March 2022, we issued a non-convertible note to Ainos KY in the principal amount of $800,000, at a 1.85% per annum interest rate, with a maturity date of February 28, 2023. We intend to use the proceeds from the note for working capital. From March 28 to April 11, 2022, we issued non-interest bearing convertible notes in the aggregate principal amount of $1,400,000 due on March 30, 2027 (the “March 2027 Convertible Notes”) to certain investors, including a note in the principal amount of $500,000 to ASE Test Inc., a minority owner of Ainos KY. The March 2027 Convertible Notes will automatically convert into shares of our common stock immediately prior to the closing of this offering at a conversion price equal to 80% of the per Unit public offering price. Listing on the Nasdaq Capital Market Through August 8, 2022, our common stock was quoted on the OTCPK, one of the OTC Markets Group over-the-counter markets, under the trading symbol “AIMD.” As of August 9, 2022, our common stock and Warrants are listed on the Nasdaq Capital Market, or Nasdaq under the symbols “AIMD” and “AIMDW,” respectively. . Reverse Stock Split We previously obtained the written consent of the holder of a majority of the outstanding shares of our common stock to effect an amendment to our restated certificate of incorporation to effect a reverse stock split of our common stock at a ratio to be determined by our Board prior to the effective time of the amendment of not more than 1-for-50. The reverse stock split will not impact the number of authorized shares of common stock which will remain at 300,000,000 shares. In connection with the offering to which this registration statement on Form S-1 and prospectus relate, our Board determined to effect a reverse stock split of our common stock at a ratio of 1-for 15 which became effective at 8:00pm ET on August 8, 2022. Unless otherwise noted, the share and per share information in this prospectus reflects, other than in our financial statements and the notes thereto, a reverse stock split of our authorized and outstanding common stock at a ratio of 1-for-15. | |

| | Our Corporate History and Structure Ainos, Inc. (f/k/a Amarillo Biosciences, Inc.), is a Texas corporation formed on June 26, 1984. Under our former name of Amarillo Biosciences, Inc., we completed an initial public offering on the Nasdaq SmallCap Market in August 1996 and have traded on the U.S. over-the-counter market since October 1999. On October 31, 2013, we filed a voluntary petition for reorganization under Chapter 11 of the United States bankruptcy code. We emerged from bankruptcy on January 23, 2015. In 2017, we created a Taiwan branch office, Ainos Inc. Taiwan Branch (USA) (“Taiwan Branch”), to conduct research and development, including clinical trials, in Taiwan. The Taiwan Branch also serves as an operational hub to access Asian markets. In December 2020, we entered into a securities purchase agreement with Ainos KY which closed on April 15, 2021. Pursuant to the securities purchase agreement, we acquired exclusive rights and ownership of certain of Ainos KY’s intellectual property and patent assets in the areas of VOC sensing and diagnostics. We issued 8,333,333 shares of our common stock to Ainos KY, resulting in Ainos KY owning approximately 70.3% of our outstanding shares. As part of the transaction, we also increased our authorized common stock to 300,000,000 shares and changed our name to Ainos Inc. In November 2021, we entered into an asset purchase agreement with Ainos KY, which closed on January 30, 2022, pursuant to which we acquired additional intellectual property assets of Ainos KY in the area of COVID-19 diagnostics and VOCs in exchange for a non-interest bearing convertible note in the principal amount of $26,000,000. The note will convert into shares of common stock immediately prior to closing of the offering at a conversion price equal to 80% of the per Unit offering price. Ainos KY currently holds 48.5% of our outstanding shares and following conversion of the convertible notes held by Ainos KY and the issuance and sale of the shares in this offering, will own 61.4% of our then outstanding shares. The following diagram illustrates our current corporate structure:

| |

| | Controlled Company Upon the completion of this offering, Ainos KY, our principal shareholder, and its affiliates will beneficially own approximately 68.4% of our common stock (approximately 68.0% if the over-allotment option is exercised in full) and we will be a “controlled company” within the meaning of the listing rules of The Nasdaq Stock Market LLC. As long as our principal shareholder owns at least 50% of the voting power of our Company, we are a “controlled company” as defined under Nasdaq Listing Rules. As a controlled company, we are permitted to rely on certain exemptions from Nasdaq’s corporate governance rules, including: | |

| | · | an exemption from the rule that a majority of our board of directors must be independent directors; | |

| | · | an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and | |

| | · | an exemption from the rule that our director nominees must be selected or recommended solely by independent directors. | |

| | The majority of our Board consists of non-independent directors. Although we have elected to be deemed a controlled company our Compensation Committee is composed of two independent directors and our Audit Committee is composed of three independent directors of which two members are qualified as an “audit committee expert” as defined by the SEC. We do not have a Nominations and Corporate Governance Committee and our Board is responsible for nominations and corporate governance. Pursuant to our Corporate Governance Policies the Board is responsible for filling Board vacancies and nominations of candidates to the Board. As a result, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements. Implications of Being a Smaller Reporting Company We are a “smaller reporting company” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and have elected to take advantage of certain of the scaled disclosures available to smaller reporting companies. Accordingly we may provide less public disclosure than larger public companies, including the inclusion of only two years of audited consolidated financial statements and only two years of management’s discussion and analysis of financial condition and results of operations disclosure and the inclusion of reduced disclosure about our executive compensation arrangements. As a smaller reporting company, we are also exempt from compliance with the auditor attestation requirements pursuant to the Sarbanes-Oxley Act. . As a result, the information that we provide to our shareholders may be different than you might receive from other public reporting companies in which you hold equity interests. We will continue to be a “smaller reporting company” until we have $250 million or more in public float (based on our common stock) measured as of the last business day of our most recently completed second fiscal quarter or, in the event we have no public float or a public float (based on our common stock) that is less than $700 million, annual revenues of $100 million or more during the most recently completed fiscal year. Going Concern Our independent registered public accounting firm, PWR CPA, LLP, has expressed doubt in their audit opinion for our financial statements for the year ended December 31, 2021 about our ability to continue as a going concern. We have generated minimal revenue and have an accumulated deficit totaling $10,108,916 since inception. In order to obtain the necessary capital to sustain operations, management’s plans include, among other things, the possibility of pursuing new equity sales and/or making additional debt borrowings, There can be no assurances, however, that we y will be successful in obtaining additional financing, or that such financing will be available on favorable terms, if at all. If we are unable to obtain financing in the amounts and on terms deemed acceptable, the business and future success may be adversely affected and we may cease operations. | |

| | Corporate Information Our principal executive offices are located at 8880 Rio San Diego Drive, Ste. 800, San Diego, CA 92108, and our telephone number is (858) 869-2986. We maintain a website at www.ainos.com. Information contained on or accessible through our website is not, and should not be considered, part of, or incorporated by reference into, this prospectus. Summary Risk Factors Participating in this offering involves substantial risk. Our ability to execute our strategy is also subject to certain risks. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under the heading “Risk Factors” in deciding whether to invest in our securities. These risks include, but are not limited to, the following: Risks related to our limited operating history, financial position, and need for additional capital | |

| | · | We have a history of operating losses that are expected to continue for the foreseeable future, and we are unable to predict the extent of future losses, or whether we will generate significant revenues or achieve or sustain profitability. | |

| | · | Our revenue for at least the near term will almost exclusively depend on sales of our COVID-19 test kits until we can develop, obtain regulatory clearance or other appropriate authorization for, and commercialize additional product candidates. | |

| | · | We have generated very little revenue from product sales and may never become profitable. | |

| | · | We need to raise additional capital to operate our business. If we fail to obtain the capital necessary to fund our operations, we will be unable to continue or complete our product development. | |

| | · | We may be unable to access the capital markets and even if we can raise additional funding, we may be required to do so on terms that are dilutive to you. | |

| | · | Our operating results may fluctuate significantly, which will make our future results difficult to predict and could cause our results to fall below expectations. | |

| | | | |

| | Risks related to product development and regulatory process | |

| | | | |

| | · | We and/or our collaboration partner have conducted and intend to conduct clinical trials for selected product candidates at sites outside the United States, and for any of our product candidates for which we seek approval in the United States, the FDA may not accept data from trials conducted in such locations or may require additional U.S.-based trials. | |

| | · | Our long-term prospects depend in part upon discovering, developing and commercializing additional products, including diagnostic testing devices, which may fail in development or suffer delays that adversely affect their commercial viability. | |

| | · | Even if a current or future product candidate, including medical device products, receives marketing approval, it may fail to achieve the degree of market acceptance by physicians, patients, third-party payors and others in the medical community necessary for commercial success | |

| | · | We, or TCNT, may not obtain approval for our product candidates in any jurisdictions. | |

| | · | Even if we are able to commercialize any product candidates, such products may become subject to unfavorable pricing regulations or third-party coverage and reimbursement policies, which would harm our business. | |

| | · | Any disruption in our research and development facilities could adversely affect our business, financial condition and results of operations. | |

| | · | If product liability lawsuits are brought against us, we may incur substantial liabilities and may be required to limit commercialization of any approved products. | |

| | · | Our business and operations would be adversely affected in the event that our computer systems or those of our partners, contract research organizations, contractors, consultants or other third parties we work with were to suffer system failures, cyber-attacks, loss of data or other security incidents. | |

| | | |

| | Risks related to reliance on third parties | |

| | | |

| | · | We may form or seek strategic partnerships or enter into additional licensing arrangements in the future, and we may not realize the benefits of such alliances or licensing arrangements. | |

| | · | Our employees, independent contractors, consultants, commercial or strategic partners, principal investigators or CROs may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements and insider trading, which could have a material adverse effect on our business. | |

| | | |

| | Risks related to intellectual property, patents, and data privacy | |

| | | |

| | · | Intellectual property rights vary across foreign jurisdictions, and we may not be able to protect our intellectual property rights throughout the world. | |

| | · | If we and our collaborators are unable to obtain and maintain sufficient patent and other intellectual property protection for our product candidates and technology, our competitors could develop and commercialize products and technology similar or identical to ours, and we may not be able to compete effectively in our market or successfully commercialize any product candidates we may develop. | |

| | · | We may become involved in lawsuits to protect or enforce our patents or other intellectual property, which could be expensive, time-consuming and unsuccessful, and issued patents directed towards our technology and product candidates could be found invalid or unenforceable if challenged. | |

| | · | Patent terms may be inadequate to protect our competitive position on our product candidates for an adequate amount of time. | |

| | · | If we are unable to protect the confidentiality of our trade secrets, our business and competitive position could be harmed. | |

| | · | Changes in patent laws could diminish the value of patents in general, thereby impairing our ability to protect our product candidates. | |

| | | |

| | Risks related to related to our business | |

| | | |

| | · | We will need to increase the size of our Company and may not effectively manage our growth. | |

| | · | Our future success depends on our ability to retain key executives and to attract, retain and motivate qualified personnel. | |

| | · | The POCT market is extremely competitive and rapidly evolving, making it difficult to evaluate our business and future prospects. | |

| | · | Our business entails a significant risk of product liability and if we are unable to obtain sufficient insurance coverage such inability could have an adverse effect on our business and financial condition. | |

| | · | Our business activities may be subject to the U.S. Foreign Corrupt Practices Act, or the FCPA, and similar anti-bribery and anti-corruption laws of other countries in which we operate, including Taiwan, as well as U.S. and certain foreign export controls, trade sanctions, and import laws and regulations. Compliance with these legal requirements could limit our ability to compete in foreign markets and subject us to liability if we violate them. | |

| | | |

| | Risks related to our securities | |

| | | |

| | · | An active trading market for our common stock may not develop and the market price of our common stock could be volatile. | |

| | · | We do not intend to pay dividends for the foreseeable future and, as a result, our ability to achieve a return on your investment will depend on appreciation in the price of our common stock. | |

| | · | Our controlling shareholder, executive officers, directors, and their affiliates will continue to exercise significant influence over our Company after this offering, which will limit your ability to influence corporate matters and could delay or prevent a change in corporate control. | |

| | · | As a “controlled company” under the rules of the Nasdaq Capital Market, we may choose to exempt our company from certain corporate governance requirements that could have an adverse effect on our public shareholders. | |

| | · | We have acquired, and may in the future acquire, assets and technologies as part of our business strategy. | |

| | · | If we acquire companies or technologies in the future, they could prove difficult to integrate, disrupt our business, dilute stockholder value, and adversely affect our operating results and the value of our common stock. | |

| | · | Any failure to maintain effective internal control over financial reporting could harm us. | |

| | · | Our issuance of additional capital stock in connection with financings, acquisitions, investments, our 2021 Stock Incentive Plan or otherwise will dilute all other stockholders. | |

| | · | Our management has broad discretion in the use of proceeds from our offering and our use may not produce a positive rate of return. | |

| | | | |

| The Offering |

| | | | | |

| | Units being offered by us........................................................ | | 780,000 Units. Each Unit consists of one share of common stock and one Warrant to purchase one share of common stock. The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The common stock and Warrants will be immediately separable and will be issued separately in this offering. | |

| | | | | |

| | Offering Price | | $4.25 per Unit. | |

| | | | | |

| | Common Stock Outstanding Before this Offering: | | 9,625,287 shares of common stock | |

| | | | | |

| | Total shares of common stock outstanding immediately after this offering | | 19,478,423 shares of common stock (or 19,595,423 shares of common stock if the underwriters exercise their over-allotment option in full, and assuming in each case, no exercise of the Warrants). | |

| | | | | |

| | Description of the Warrants | | The Warrants will have an exercise price of $4.25 per share of common stock, will be immediately exercisable and will expire five years from the date of issuance. Each Warrant is exercisable for one share of common stock, subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock. A holder may not exercise any portion of a Warrant to the extent that the holder, together with its affiliates and any other person or entity acting as a group, would own more than 4.99% of our outstanding shares of common stock after exercise, as such ownership percentage is determined in accordance with the terms of the Warrants, except that upon notice from the holder to us, the holder may waive such limitation up to a percentage, not in excess of 9.99%. This prospectus also relates to the offering of the common stock issuable upon exercise of the Warrants. To better understand the terms of the Warrants, you should carefully read the “Description of Capital Stock” section of this prospectus. You should also read the form of Warrant, which is filed as an exhibit to the registration statement that includes this prospectus. | |

| | | | | |

| | Over-Allotment Option | | Pursuant to the underwriting agreement, we granted to the underwriter an option, exercisable within 45 days after the closing of this offering to acquire up to an additional 117,000 shares of common stock and/or up to an additional 117,000 Warrants, in each case, solely for the purpose of covering over-allotments, if any. | |

| | | | | |

| | Representative’s Warrants | | We will issue to the representative of the underwriters as compensation, upon closing of this offering, the Representative’s Warrants entitling the representative to purchase a number of shares of common stock equal to 5% of the aggregate number of shares of common stock issued in this offering, including shares of common stock issued pursuant to the exercise of the over-allotment option at an exercise price of $4.68 per share (110% of the price per Unit offered hereby). The Representative’s Warrants will have a term of five years and may be exercised at any time and from time to time, in whole or in part, during the four and one half year period commencing 180 days from the effective date of the registration statement of which this prospectus is a part. This prospectus also relates to the offering of shares of common stock issuable upon exercise of the Representative’s Warrants. | |

| | | | | |

| | Lock-up | | We, each of our officers, directors and 5% or more holders of our outstanding common stock as of the effective date of this prospectus (and all holders of securities exercisable for or convertible into shares of common stock) have agreed to enter into customary “lock-up” agreements in favor of the underwriters pursuant to which such persons and entities have agreed, not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any securities of the Company without the prior written consent of Maxim Group LLC, (excluding the issuance of shares of common stock upon the exercise of currently outstanding equity awards under the our employee benefit plans) for a period of 180 days from the effective date of this prospectus. See “Underwriting” for additional information. | |

| | | | | |

| | Use of Proceeds | | We estimate that we will receive net proceeds of approximately $2.1 million from our sale of Units in this offering (or $2.6 million if the underwriters exercise their over-allotment in full) after deducting underwriting discounts and estimated offering expenses payable by us. We intend to use the net proceeds of this offering for product commercialization, technology development, commercial scale up of our activities, clinical trials and working capital and other general corporate purposes. See “Use of Proceeds.” | |

| | | | | |

| | Nasdaq Symbol | | Through August 8, 2022, our common stock was quoted on the OTCPK, one of the OTC Markets Group over-the-counter markets, under the trading symbol “AIMD.” As of August 9, 2022, our common stock and Warrants are listed on the Nasdaq Capital Market, or Nasdaq under the symbols “AIMD” and “AIMDW,” respectively | |

| | | | | |

| | Risk Factors | | Investing in our securities involves a high degree of risk. You should carefully review and consider “Risk Factors” beginning on page 11 of this prospectus. | |

| | | | | |

| | Transfer Agent, Registrar and Warrant Agent | | Our transfer agent and registrar for our common stock and our warrant agent for the Warrants is American Stock Transfer & Trust Company, LLC. | |

| | | | | |

| | Dividend Policy | | We have never declared or paid any cash dividends on our common stock. We do not anticipate paying any cash dividends in the foreseeable future. | |

| | | | | |

| | Assumptions Used Throughout This Prospectus Unless otherwise stated in this prospectus, the total number of shares of common stock outstanding after this offering is based on 9,625,287 shares outstanding following the reverse stock split, and includes the issuance of 9.073,137 shares of common stock upon the conversion of the APA Convertible Note, the March 2027 Convertible Notes and $3,000,000 aggregate principal amount of convertible notes plus accrued interest thereon held by Ainos KY immediately prior to completion of this offering. Unless otherwise stated in this prospectus, the total number of shares of common stock outstanding excludes the following: | |

| | | |

| | · | 144,644 shares of common stock issuable upon the conversion of outstanding convertible promissory notes at a weighted average conversion price of approximately $2.70 per share, which are not converting concurrently with the consummation of this offering; | |

| | · | 30,174 shares of common stock issuable upon the exercise of outstanding warrants at an exercise price of $4.05 per share; | |

| | · | 36,666 shares of common stock issuable upon the exercise of outstanding equity awards under our 2018 Officers, Directors, Employees and Consultants Nonqualified Stock Option Plan at a weighted average exercise price of $5.70 per share; | |

| | · | 1,333,333 shares of common stock reserved for future issuance under our 2021 Stock Incentive Plan; | |

| | · | 50,000 shares of common stock reserved for future issuance under our 2021 Employee Stock Purchase Plan; | |

| | · | 39,000 shares of common stock, underlying the Representative’s Warrants to be issued to the representative of the underwriters at an exercise price of $4.68 per share; and | |

| | · | 780,000 shares of our common stock underlying the Warrants to be issued in this offering. | |

| | Unless otherwise indicated, this prospectus reflects and assumes the following: | |

| | | | |

| | · | no exercise of outstanding options or warrants described above; | |

| | · | no exercise of the Warrants; and | |

| | · | no exercise by the underwriter of its over-allotment option. | |

| | | | |

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below in addition to the other information contained in this prospectus and any prospectus supplement before deciding whether to invest in shares of our common stock. If any of the following risks occur, our business, financial condition or operating results could be harmed. In that case, the trading price of our common stock could decline and you may lose part or all of your investment. In the opinion of management, the risks discussed below represent the material risks known to us. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also impair our business, financial condition and operating results and adversely affect the market price of our common stock.

Risks related to our limited operating history, financial position, and need for additional capital

We have a history of operating losses that are expected to continue for the foreseeable future, and we are unable to predict the extent of future losses, or whether we will generate significant revenues or achieve or sustain profitability.

We are focused on product development and have generated minimal revenue to date. Additionally, we expect to continue to incur operating losses until we are able to commercialize or license our products. These operating losses have adversely affected and are likely to continue to adversely affect our working capital, total assets and stockholders’ deficit. We have generated operating losses of $2,083,062 and $522,109 in the three months ended March 31, 2022 and 2021, respectively. As of December 31, 2021, we had net operating loss carryforwards of approximately $20,747,517 for federal income tax purposes expiring in 2022 through 2041. We expect to make substantial expenditures and incur increasing operating costs in the future and our accumulated deficit will increase significantly as we expand development and clinical trial activities for our product candidates. Because of the risks and uncertainties associated with product development, we are unable to predict the extent of any future losses, whether we will ever generate significant revenues or if we will ever achieve or sustain profitability.

We believe that our cash on hand, along with the anticipated net proceeds from the sale of products and additional financing, including this offering, will enable us to fund our operations over the medium term based on our current plan. We are dependent on obtaining, and are continuing to pursue, necessary funding from outside sources, including obtaining additional funding from the issuance of securities in order to continue our operations. Without adequate funding, we may not be able to meet our obligations. The successful commercialization of any of our products will require us to perform a variety of functions, including:

| | · | continuing to undertake preclinical and clinical development; |

| | · | engaging in the development of product candidate formulations and manufacturing processes; |

| | · | interacting with the applicable regulatory authorities and pursuing other required steps for regulatory approval; |

| | · | engaging with payors and other pricing and reimbursement authorities; |

| | · | submitting marketing applications to and receiving approval from the applicable regulatory authorities; and |

| | · | manufacturing the applicable products and product candidates in accordance with regulatory requirements and, if ultimately approved, conducting sales and marketing activities in accordance with health care, Taiwan Food and Drug Administration (the “TFDA”), the FDA, and similar foreign regulatory authority laws and regulations. |

Our revenue for at least the near term will almost exclusively depend on sales of the Ainos COVID-19 test kits until we can develop, obtain regulatory clearance or other appropriate authorization for, and commercialize additional product candidates.

We expect that sales of the Ainos COVID-19 Antigen Rapid Test Kits will account for majority of our revenue until at least such time as we can commercialize additional tests or other products. As a result, our ability to execute our growth strategy and become profitable in the near term will depend upon consumer adoption of the Ainos COVID-19 Antigen Rapid Test Kits. We currently have a very small number of customers for the Ainos COVID-19 Antigen Rapid Test Kits in Taiwan. We may not be able to successfully acquire new customers in a timely manner or at all. If we are unable to expand our customer base, we may not be able to increase our revenue. Adoption and use of the Ainos COVID-19 Antigen Rapid Test Kits will depend on several factors, including, but not limited to the accuracy, affordability and ease of use of our product as compared to other products and products that compete with the Ainos COVID-19 Antigen Rapid Test Kits.

Because we expect virtually all of our revenue for at least the near term to be generated from sales of the Ainos COVID-19 Antigen Rapid Test Kits in Taiwan, the failure of the Ainos COVID-19 Antigen Rapid Test Kits to gain market acceptance or retain regulatory authorization under our EUA in Taiwan may have a material adverse effect on our business, operating results and financial condition.

We have generated very little revenue from product sales and may never become profitable.

Our ability to generate product sales and achieve profitability depends on our ability, alone or with collaborative partners, to successfully complete the development of, and obtain the regulatory approvals necessary to commercialize our current and future product candidates. Our product candidates will require additional clinical, manufacturing, and non-clinical development, regulatory approval, commercial manufacturing arrangements, establishment of a commercial organization, significant marketing efforts, and further investment before we generate significant product sales.

We cannot assure you that we will meet our timelines for our development programs, which may be delayed or not completed for a number of reasons. Our ability to generate future revenues from product sales depends heavily on our, or our collaborators’, ability to successfully:

| | · | complete research and obtain favorable results from preclinical and clinical development of our current and future product candidates, including addressing any clinical holds that may be placed on our development activities by regulatory authorities; |

| | · | seek and obtain regulatory and marketing approvals for any of our product candidates for which we complete clinical trials, as well as their manufacturing facilities; |

| | · | launch and commercialize any of our product candidates for which we obtain regulatory and marketing approval by establishing a sales force, marketing, and distribution infrastructure or, alternatively, collaborating with a commercialization partner; |

| | · | qualify for coverage and establish adequate reimbursement by government and third-party payors for any of our product candidates for which we obtain regulatory and marketing approval; |

| | · | develop, maintain, and enhance a sustainable, scalable, reproducible, and transferable manufacturing process for the product candidates we may develop; |

| | · | establish and maintain supply and manufacturing capabilities or capacities internally or with third parties that can provide adequate, in both amount and quality, products, and services to support clinical development and the market demand for any of our product candidates for which we obtain regulatory and marketing approval; |

| | · | obtain market acceptance of current or any future product candidates and effectively compete to establish market share; |

| | · | maintain a continued acceptable safety and efficacy profile of our product candidates following launch; |

| | · | address competing technological and market developments; |

| | · | implement internal systems and infrastructure, as needed; |

| | · | negotiate favorable terms in any collaboration, licensing, or other arrangements into which we may enter and performing our obligations in such collaborations; |

| | · | maintain, protect, enforce, defend, and expand our portfolio of intellectual property rights, including patents, trade secrets, and know-how; |

| | · | avoid and defend against third-party interference, infringement, and other intellectual property claims; and |

| | · | attract, hire, and retain qualified personnel. |

Even if one or more of our current and future product candidates are approved for commercial sale, we anticipate incurring significant costs associated with commercializing any approved product candidate. Our expenses could increase beyond our expectations if we are required by the TFDA, the FDA or other regulatory authorities to perform clinical and other studies in addition to those that we currently anticipate. If we are required to conduct additional clinical trials or other testing of our product candidates that we develop beyond those that we currently expect, if we are unable to successfully complete clinical trials of our product candidates or other testing, if the results of these trials or tests are not positive or are only modestly positive, or if there are safety concerns, we may be delayed in obtaining marketing approval for our product candidates, not obtain marketing approval at all, or obtain more limited approvals. Even if we are able to generate revenues from the sale of any approved product candidates, we may not become profitable and may need to obtain additional funding to continue operations.

Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable would decrease the value of the Company and could impair our ability to raise capital, maintain our research and development efforts, expand our business or continue our operations. A decline in the value of our Company also could cause you to lose all or part of your investment.

Our business, operations and clinical development plans and timelines and supply chain could be adversely affected by the effects of epidemics, including the ongoing COVID-19 pandemic.

Our business could be adversely affected by health epidemics wherever we have clinical trial sites or other business operations. In addition, health epidemics could cause significant disruption in the operations of third-party manufacturers, contract research organizations and other third parties upon whom we rely. For example, the COVID-19 pandemic has presented a substantial public health and economic challenge around the world and is affecting employees, patients, communities and business operations, as well as the U.S. economy and financial markets. Many geographic regions have imposed, or in the future may impose, “shelter-in-place” orders, quarantines or similar orders or restrictions to control the spread of COVID-19. These measures may negatively impact productivity, disrupt our business and delay our clinical programs and timelines, the magnitude of which will depend, in part, on the length and severity of the restrictions and other limitations on our ability to conduct our business in the ordinary course. These and similar, and perhaps more severe, disruptions in our operations could negatively impact our business, operating results and financial condition.

We are dependent on a worldwide supply chain for products to be used in our clinical trials and, if approved by the regulatory authorities, for commercialization. Quarantines, shelter-in-place and similar government orders, or the expectation that such orders, shutdowns or other restrictions could occur, whether related to COVID-19 or other infectious diseases, could impact personnel at third-party manufacturing facilities in the United States and other countries, or the availability or cost of materials, which could disrupt our supply chain. For example, any manufacturing supply interruption of any product candidate could adversely affect our ability to conduct ongoing and future clinical trials of such product candidate. In addition, closures of transportation carriers and modal hubs could materially impact our clinical development and any future commercialization timelines.

If our relationships with our suppliers or other vendors are terminated or scaled back as a result of the COVID-19 pandemic or other health epidemics, we may not be able to enter into arrangements with alternative suppliers or vendors or do so on commercially reasonable terms or in a timely manner. Switching or adding additional suppliers or vendors involves substantial cost and requires management time and focus. In addition, there is a natural transition period when a new supplier or vendor commences work. As a result, delays could generally occur, which could adversely impact our ability to meet our desired clinical development and any future commercialization timelines. See “Risks Related to Our Dependence on Third Parties.”

In addition, our clinical trials have been and may continue to be affected by the COVID-19 pandemic. Clinical site initiation and patient enrollment may be delayed due to prioritization of hospital resources toward the COVID-19 pandemic or concerns among patients about participating in clinical trials during a pandemic and public health measures imposed by the respective national governments of countries in which the clinical sites are located. Some patients may have difficulty following certain aspects of clinical trial protocols if quarantines impede patient movement or interrupt healthcare services. Similarly, our inability to successfully recruit and retain patients and principal investigators and site staff who, as healthcare providers, may have heightened exposure to COVID-19 or experience additional restrictions by their institutions, city or state governments could adversely impact our clinical trial operations.

We are continuing to monitor the potential impact of the pandemic, but we cannot be certain of the future impact on our business, financial condition, results of operations and prospects. Depending on developments relating to the pandemic, including the emergence of new variants, the pandemic may affect our ability to initiate and complete research studies, delay the initiation of our future research studies, disrupt regulatory activities or have other adverse effects on our business, results of operations, financial condition and prospects.

The global pandemic of COVID-19 continues to evolve rapidly. The ultimate impact of the COVID-19 pandemic or a similar health epidemic is highly uncertain and subject to change. We do not yet know the full extent of potential delays or impacts on our business, our clinical trials, healthcare systems or the global economy as a whole. However, these effects could have a material impact on our operations, and we will continue to monitor the COVID-19 situation closely.

We need to raise additional capital to operate our business. If we fail to obtain the capital necessary to fund our operations, we will be unable to continue or complete our product development.

We are a company primarily focused on product development and have generated little product revenues to date. Until, and if, we receive approval from the TFDA, FDA and other regulatory authorities for our product candidates, we cannot sell our products and will not have product revenues. We had cash and cash equivalents of approximately $1,871,349 as of March 31, 2022, and we will need to continue to seek capital from time to time to continue to capitalize the development and commercialization of our product candidates and to acquire and develop other product candidates. Our actual capital requirements will depend on many factors. For instance, our business or operations may change in a manner that would consume available funds more rapidly than anticipated and substantial additional funding may be required to maintain operations, fund expansion, develop new or enhanced products, acquire complementary products, business or technologies or otherwise respond to competitive pressures and opportunities, such as a change in the regulatory environment or a change in COVID-19 treatment modalities. If we experience unanticipated cash requirements, we may need to seek additional sources of financing, which may not be available on favorable terms, if at all.

However, we may not be able to secure funding when we need it or on favorable terms. If we cannot raise adequate funds to satisfy our capital requirements, we will have to delay, scale-back or eliminate our research and development activities, clinical studies or future operations, we may be unable to complete planned nonclinical studies and clinical trials or obtain approval of our product candidates from the TFDA, FDA and other regulatory authorities. In addition, we could be forced to discontinue product development, reduce or forego sales and marketing efforts and attractive business opportunities, reduce overhead, or discontinue operations. We may also be required to obtain funds through arrangements with collaborators, which arrangements may require us to relinquish rights to certain technologies or products that we otherwise would not consider relinquishing, including rights to future product candidates or certain major geographic markets. We may further have to license our technology to others. This could result in sharing revenues which we might otherwise retain for ourselves. Any of these actions may harm our business, financial condition and results of operations.

The amount of capital we may need depends on many factors, including the progress, timing and scope of our product development programs; the progress, timing and scope of our nonclinical studies and clinical trials; the time and cost necessary to obtain regulatory approvals; the time and cost necessary to further develop manufacturing processes and arrange for contract manufacturing; our ability to enter into and maintain collaborative, licensing and other commercial relationships; and our partners’ commitment of time and resources to the development and commercialization of our products.

We may be unable to access the capital markets and even if we can raise additional funding, we may be required to do so on terms that are dilutive to you.

The capital markets have been unpredictable in the recent past for unprofitable companies such as ours. The amount of capital that a company such as ours is able to raise often depends on variables that are beyond our control. As a result, we cannot assure you that we will be able to secure financing on terms attractive to us, or at all. If we are able to consummate a financing arrangement, the amount raised may not be sufficient to meet our future needs. If adequate funds are not available on acceptable terms, or at all, our business, results of operations, financial condition and our continued viability will be materially adversely affected.

Our operating results may fluctuate significantly, which will make our future results difficult to predict and could cause our results to fall below expectations.

Our quarterly and annual operating results may fluctuate significantly, which will make it difficult for us to predict our future results. These fluctuations may occur due to a variety of factors, many of which are outside of our control and may be difficult to predict, including:

| | · | the timing, cost of, and level of investment in, research, development and commercialization activities, which may change from time to time; |

| | · | the timing and status of enrollment for our clinical trials; |

| | · | the timing of regulatory approvals, if any, in the United States and internationally; |

| | · | the timing of expanding our operational, financial and management systems and personnel, including personnel to support our clinical development, quality control, manufacturing and commercialization efforts and our operations as a public company; |

| | · | the cost of manufacturing, as well as building out our supply chain, which may vary depending on the quantity produced, and the terms of any agreements we enter into with third-party suppliers; |

| | · | the timing and amount of any milestone, royalty or other payments due under any current or future collaboration or license agreement; |

| | · | coverage and reimbursement policies with respect to any future approved products, and potential future drugs that compete with our products; |

| | · | the timing and cost to establish a sales, marketing, medical affairs and distribution infrastructure to commercialize any products for which we may obtain marketing approval and intend to commercialize on our own or jointly with current or future collaborators; |

| | · | expenditures that we may incur to acquire, develop or commercialize additional products and technologies; |

| | · | the level of demand for any future approved products, which may vary significantly over time; |

| | · | future accounting pronouncements or changes in accounting principles or our accounting policies; and |

| | · | the timing and success or failure of nonclinical studies and clinical trials for our product candidates or competing product candidates, or any other change in the competitive landscape of our industry, including consolidation among our competitors or collaboration partners. |

The cumulative effects of these factors could result in large fluctuations and unpredictability in our quarterly and annual operating results. As a result, comparing our operating results on a period-to-period basis may not be meaningful. Investors should not rely on our past results as an indication of our future performance.

Risks related to product development and regulatory process

We are early in our development efforts of some of our product candidates, and our business is dependent on the successful development of our current and future product candidates. If we or our collaboration partner are unable to advance our current or future product candidates through clinical trials, obtain marketing approval and ultimately commercialize any product candidates we develop, or experience significant delays in doing so, our business will be materially harmed.

Our product candidates are in different stages of clinical development. Our current and future product candidates may never achieve expected levels of efficacy or an acceptable safety profile. Our use of clinically validated targets to pursue treatments does not guarantee efficacy or safety or necessarily reduce the risk that our current or future product candidates will not achieve expected levels of efficacy or an acceptable safety profile.

The success of our business, including our ability to finance our Company and generate revenue from products in the future will depend heavily on the successful development and eventual commercialization of our product candidates, which may never occur. Our current product candidates, and any future product candidates we develop, will require additional nonclinical and clinical development, management of clinical, nonclinical and manufacturing activities, marketing approval in the United States and other markets, obtaining sufficient manufacturing supply for both clinical development and commercial production, building of a commercial organization, and substantial investment and significant marketing efforts before we generate any revenues from product sales.

As a company, we have limited experience in preparing, submitting and prosecuting regulatory filings. In addition, we are reliant on TCNT to pursue and obtain regulatory approval for certain product candidates. If we do not receive regulatory approvals for current or future product candidates, or if TCNT chooses not to pursue or is unable to obtain regulatory approval for certain product candidates, we may not be able to continue our operations. Even if we, or TCNT, successfully obtain regulatory approval to market a product candidate, our revenue will depend, in part, upon the size of the markets in the territories for which we gain regulatory approval and have commercial rights, as well as the availability of competitive products, third-party reimbursement and adoption by physicians.

We, either individually or through TCNT, plan to seek regulatory approval to commercialize our product candidates both in the United States and in select foreign countries. While the scope of regulatory approval in other countries is generally similar to that in the United States, in order to obtain separate regulatory approval in other countries we must comply with numerous and varying regulatory requirements of such countries. We may be required to expend significant resources to obtain regulatory approval and to comply with ongoing regulations in these jurisdictions.

The success of our current and future product candidates will depend on many factors, which may include the following:

| | · | sufficiency of our financial and other resources to complete the necessary nonclinical studies and clinical trials, and our ability to raise any additional required capital on acceptable terms, or at all; |

| | · | the timely and successful completion of nonclinical studies and clinical trials for which the TFDA, FDA, or any comparable foreign regulatory authority, agree with the design, endpoints, or implementation ; |

| | · | receipt of regulatory approvals or authorizations to conduct future clinical trials or other studies beyond those planned to support approval of our product candidates; |

| | · | successful enrollment and completion of clinical trials; |

| | · | successful data from our clinical program that supports an acceptable risk-benefit profile of our product candidates in the intended populations; |

| | · | timely receipt and maintenance of marketing approvals from applicable regulatory authorities; |

| | · | establishing, scaling up and scaling out, either alone or with third-party manufacturers, cGMP compliant manufacturing capabilities of clinical supply for our clinical trials and commercial manufacturing (including licensure), if any of our product candidates are approved; |

| | · | entry into collaborations to further the development of our product candidates in select indications or geographies; |

| | · | obtaining and maintaining regulatory exclusivity for our product candidates as well as establishing competitive positioning amongst other therapies; and |

| | · | successfully launching commercial sales of our product candidates and obtaining and maintaining healthcare coverage and reimbursement from third party payors, if approved. |

If we are not successful with respect to one or more of these factors in a timely manner or at all, we could experience significant delays or an inability to successfully obtain regulatory approval of or commercialize the product candidates we develop, which would materially harm our business. If we do not receive marketing approvals for our current or future product candidates, we may not be able to continue our operations. Even if regulatory approvals are obtained, we may never be able to successfully commercialize any products. Accordingly, we cannot provide assurances that we will be able to generate sufficient revenue through the sale of products to continue our business.

If the FDA or other regulatory bodies do not approve TCNT’s Emergency Use Authorization (EUA) submissions or revoke or terminate the EUAs or other regulatory authorizations for Ainos COVID-19 test kits, we will be required to stop commercialization of COVID-19 test kits in those relevant markets unless we, or our manufacturing collaborators, can obtain 510(k) or other clearance or approval for our COVID-19 test and its currently authorized uses.

We understand Taiwan Carbon Nano Technology (“TCNT”), our product co-developer, manufacturing collaborator and affiliated company, intends to submit EUAs to the FDA for Ainos COVID-19 Antigen Rapid Test Kits. The terms of the TCNT Agreement do not contractually obligate TCNT to submit EUAs to the FDA, or to obtain marketing authorization from the FDA, or any other regulatory authority. If for any reason TCNT does not maintain or obtain marketing authorizations, our business, financial condition, results of operations and future prospects could be materially adversely affected. Moreover, we cannot predict if TCNT’s submission will be approved or, if approved, how long either of the EUAs will remain in effect, and TCNT may not receive advance notice from the TFDA or FDA regarding revocation of either or both of their EUAs. If the EUAs are terminated or TCNT’s submissions are not approved, we will be required to cease commercialization of Ainos COVID-19 Antigen Rapid Test Kits in the United States, unless and until TCNT has obtained marketing authorization from the FDA through another regulatory pathway, possibly requiring us to obtain a 510(k) or other marketing authorization from the FDA for the Ainos COVID-19 Antigen Rapid Test Kits. Changing policies and regulatory requirements could limit, delay or prevent further commercialization of Ainos COVID-19 Antigen Rapid Test Kits and could materially adversely impact our business, financial condition, results of operations and future prospects.

Clinical product development involves a lengthy and expensive process, with uncertain outcomes. We may experience delays in completing, or ultimately be unable to complete, the development and commercialization of our current and future product candidates, which could result in increased costs to us, delay or limit our ability to generate revenue and adversely affect our business, financial condition, results of operations and prospects.

To obtain the requisite regulatory approvals to commercialize any of our product candidates, we must demonstrate that our products are safe and effective in humans. Clinical trials are expensive and can take many years to complete, and their outcomes are inherently uncertain. We may experience delays in completing current and future clinical trials. We may also experience numerous unforeseen events prior to, during, or as a result of our nonclinical studies or clinical trials that could delay or prevent our ability to receive marketing approval or commercialize the product candidates we develop, including:

| | · | regulators, Institutional Review Boards (IRBs) or ethics committees may not authorize us to conduct the clinical study; |

| | · | we may experience delays due to challenges with third-party contractors and contract research organizations (CROs), including negotiating agreement terms, compliance with regulatory requirements, compliance with clinical trial protocols; |

| | · | it may be difficult to enroll a sufficient number of suitable patients, or enrollment may be slower than we anticipate or participants may drop out of these clinical trials or fail to return for post-treatment follow-up at a higher rate than we anticipate; |

| | · | the supply or quality of materials for product candidates we develop or other materials necessary to conduct clinical trials may be insufficient or inadequate; and |

| | · | we may experience disruptions by man-made or natural disasters or public health pandemics or epidemics or other business interruptions, including the current COVID-19 pandemic and future outbreaks of the disease. |

We could encounter delays if a current or future clinical trial is suspended or terminated by us, by TCNT, by the TFDA, FDA or other regulatory authorities and/or review boards. Such authorities may impose such a suspension or termination due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by the TFDA, FDA or other regulatory authorities resulting in the imposition of a clinical hold, unforeseen safety issues, failure to demonstrate a benefit from using a product, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical trial. Many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of marketing approval of our product candidates.

If termination or delays are experienced in the completion of any clinical trial of our product candidates, the commercial prospects of our product candidates will be harmed, and our ability to generate product revenues from any of these product candidates may be delayed. In addition, any delays in completing our clinical trials will likely increase our costs, slow down our product candidate development and approval process and impact our ability to commence product sales and generate revenues. Significant clinical trial delays could also allow our competitors to bring products to market before we do, shorten any periods during which we may have the exclusive right to commercialize our product candidates, impair our ability to commercialize our product candidates and harm our business and results of operations.

Any of these occurrences may harm our business, financial condition and prospects significantly. Delays in clinical product development present material uncertainty and risk with respect to our clinical trials, business, and financial condition.

We and our collaboration partners have conducted and intend to conduct clinical trials for selected product candidates at sites outside the United States, and for any of our product candidates for which we seek approval in the United States, the FDA may not accept data from trials conducted in such locations or may require additional U.S.-based trials.

We and our collaboration partners have conducted and plan to continue to conduct, clinical trials outside the United States, particularly in Taiwan. Although the FDA may accept data from clinical trials conducted outside the United States, acceptance of these data is subject to certain conditions imposed by the FDA. There can be no assurance that the FDA will accept data from trials conducted outside of the United States. If the FDA does not accept the data from any clinical trials that we or our collaboration partners conduct outside the United States, it would likely result in the need for additional clinical trials, which would be costly and time-consuming and delay or permanently halt our ability to develop and market these or other product candidates in the United States. In other jurisdictions, for instance, in Taiwan, there is a similar risk regarding the acceptability of clinical trial data conducted outside of that jurisdiction.

Our long-term prospects depend in part upon discovering, developing and commercializing additional products, including POCT testing devices, which may fail in development or suffer delays that adversely affect their commercial viability.