Current Report Filing (8-k)

10 September 2021 - 6:55AM

Edgar (US Regulatory)

0000353184false00003531842021-09-022021-09-090000353184us-gaap:CommonStockMember2021-09-022021-09-090000353184airt:CumulativeCapitalSecuritiesMember2021-09-022021-09-09

______________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________________________________________________________________

FORM 8-K

______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 02, 2021

______________________________________________________________________________

AIR T, INC.

(Exact Name of Registrant as Specified in Charter)

______________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-35476

|

|

52-1206400

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

5930 Balsom Ridge Road

Denver, North Carolina 28037

(Address of Principal Executive Offices, and Zip Code)

________________(828) 464-8741__________________

Registrant’s Telephone Number, Including Area Code

Not applicable___

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

AIRT

|

NASDAQ Global Market

|

|

Alpha Income Preferred Securities (also referred to as 8% Cumulative Capital Securities) (“AIP”)

|

AIRTP

|

NASDAQ Global Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

|

|

☐

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Item 1.01 Entry into a Material Definitive Agreement

To the extent responsive, the information included in Item 2.03 is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

On September 2, 2021, Contrail Aviation Support, LLC (“Contrail”), a 79%-owned subsidiary of Air T, Inc. entered into a Fourth Amendment to Supplement #2 to Master Loan Agreement (the “Amendment”) and Third Amended and Restated Promissory Note Revolving Note with Old National Bank (the “Bank”). The principal revisions to Contrail’s existing credit facility with the Bank as contained in the Amendment and the Restated Promissory Note Revolving Note are summarized below:

a.The termination date of the facility was extended to September 5, 2023;

b.The Promissory Note Revolving Note principal amount was revised from $40,000,000 to $25,000,000;

c.The net worth covenant was amended and the definition of “net worth” was revised. The net worth covenant now requires that the borrower maintain a net worth of at least: (i) $8,000,000 at all times prior to March 31, 2023; (ii) $10,000,000 at all times during the period beginning March 31, 2023 and ending on March 30, 2024; and (iii) $12,000,000 at all times on or after March 31, 2024. The definition of “Tangible Net Worth” was revised to mean “a Borrower’s total assets excluding all intangible assets (i.e. goodwill, trademarks, patents, copyrights, organizational expenses, and other intangible assets) less Total Liabilities excluding any amounts owing to Kuhn pursuant to the earn out provision of the Asset Purchase Agreement dated July 18, 2016 by and between Contrail Aviation Support, Inc., as Seller and Contrail Aviation Support, LLC as Buyer. An equity investment or an investment in a beneficial interest in a trust prior to consummation of the investment shall be deemed intangible for purposes of this definition and not included in the determination of Tangible Net Worth.”

The foregoing summary of the terms of the Amendment and the Third Amended and Restated Promissory Note Revolving Note do not purport to be complete and are qualified in their entirety by reference to the documents which are filed as Exhibit 10.1 and 10.2 hereto, which are incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 9, 2021.

AIR T, INC.

By: /s/ Brian Ochocki

Brian Ochocki, Chief Financial Officer

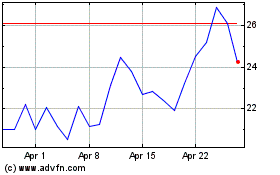

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

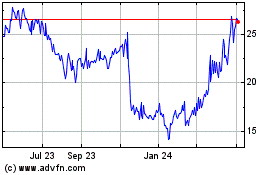

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Apr 2023 to Apr 2024