Current Report Filing (8-k)

25 January 2022 - 8:53AM

Edgar (US Regulatory)

0000353184false00003531842022-01-192022-01-250000353184us-gaap:CommonStockMember2022-01-192022-01-250000353184airt:CumulativeCapitalSecuritiesMember2022-01-192022-01-25

______________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________________________________________________________________

FORM 8-K

______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 19, 2022

______________________________________________________________________________

AIR T, INC.

(Exact Name of Registrant as Specified in Charter)

______________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-35476

|

|

52-1206400

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

5930 Balsom Ridge Road

Denver, North Carolina 28037

(Address of Principal Executive Offices, and Zip Code)

________________(828) 464-8741__________________

Registrant’s Telephone Number, Including Area Code

Not applicable___

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

AIRT

|

NASDAQ Global Market

|

|

Alpha Income Preferred Securities (also referred to as 8% Cumulative Capital Securities) (“AIP”)

|

AIRTP

|

NASDAQ Global Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

|

|

|

☐

|

Emerging growth company

|

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Item 1.01 Entry into a Material Definitive Agreement

On January 19, 2022, Contrail Aviation Support, LLC (“CAS”), a 79%-owned subsidiary of Air T, Inc. (the “Company”), entered into a purchase agreement to acquire eight (8) used CFM56-5B3/2P aircraft engines. Such engines are further described in the purchase agreement provided as Exhibit 10.1 to this report (the “Agreement”) and the transaction value, assuming all eight (8) engines are purchased would exceed $15,000,000. The seller of the engines is Finnair Aircraft Finance Oy and although closing of the transactions is currently anticipated to occur prior to March 31, 2022, the Agreement provides that the engines will be purchased in sets of two and in a particular sequence, with each purchase being conditioned on the prior transaction(s) being completed. The Agreement is subject to numerous closing conditions and other terms and conditions customary for such transactions and there is no assurance that such transactions will close on the dates anticipated or at all.

The purchase agreement also contains representations and warranties made by the parties thereto made to and solely for the benefit of each other, and such representation and warranties should not be relied upon by any other person. The assertions embodied in those representations and warranties were made solely for the purposes of the Agreement and are subject to important qualifications and limitations agreed to by and between the CAS and the other party thereto in connection with negotiating the Agreement. Accordingly, security holders should not rely on the representations and warranties as accurate or complete or characterizations of the actual state of facts as of any specified date because such representations and warranties are modified in important part by the underlying disclosure schedules, are subject to a contractual standard of materiality different from that generally applicable to security holders and were used only for the purposes of conducting certain limited due diligence inquiries and allocating risks and not for establishing all material facts with respect to the matters addressed.

The foregoing does not purport to be a complete summary of the terms of the Agreement and is qualified by reference to the full text of the Agreement, which is provided as Exhibit 10.1 to this report and is incorporated herein by reference as if fully set forth herein.

*Portions of the transaction documents have been omitted for confidential treatment.

Item 9.01 Financial Statements and Exhibits

* Portions of this exhibit have been omitted for confidential treatment.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 24, 2022.

AIR T, INC.

By: /s/ Brian Ochocki

Brian Ochocki, Chief Financial Officer

23135415v3

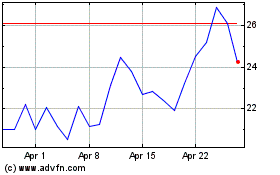

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

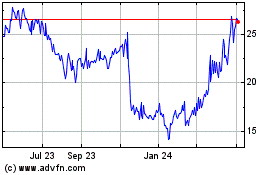

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Apr 2023 to Apr 2024