Current Report Filing (8-k)

28 March 2023 - 7:32AM

Edgar (US Regulatory)

0000353184false00003531842023-03-222023-03-270000353184us-gaap:CommonStockMember2023-03-222023-03-270000353184airt:CumulativeCapitalSecuritiesMember2023-03-222023-03-27

______________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________________________________________________________________

FORM 8-K

______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 22, 2023

______________________________________________________________________________

AIR T, INC.

(Exact Name of Registrant as Specified in Charter)

______________________________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-35476 | | 52-1206400 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

5930 Balsom Ridge Road

Denver, North Carolina 28037

(Address of Principal Executive Offices, and Zip Code)

________________(828) 464-8741__________________

Registrant’s Telephone Number, Including Area Code

Not applicable___

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | AIRT | NASDAQ Global Market |

| Alpha Income Preferred Securities (also referred to as 8% Cumulative Capital Securities) (“AIP”) | AIRTP | NASDAQ Global Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). |

| ☐ | Emerging growth company |

| ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Item 1.01 Entry into a Material Definitive Agreement

On March 22, 2023, Contrail Aviation Support, LLC and Contrail Aviation Leasing, LLC (collectively “Contrail”) entered into the First Amendment to Second Amendment to Master Loan Agreement and Third Amendment to Master Loan Agreement (the “Amendment”) with Old National Bank (“ONB”). The Amendment amends the Master Loan Agreement dated as of June 24, 2019, as amended.

The principal revisions made in the Amendment are: (i) Section 3 of the Second Amendment was revised so that exclusion of certain gains and losses from the definition of “net income” applies through September 30, 2023, not March 31, 2023; (ii) Section 5 of the Second Amendment relating to prepayment of Term Loan G was amended to eliminate the requirement that all asset sales during the period beginning with October 1, 2022 and ending on March 31, 2023 be applied as prepayments on Term Loan G; instead, the Amendment provision now reflects the agreement that voluntary payments totaling $20,000,000 would be made by the borrower on Term Loan G no later than September 30, 2023; and, (iii) a revolving note resting period covenant was added to the Amendment whereby the outstanding principal balance on the revolving note would be paid to zero (0) for at least thirty (30) consecutive days during each annual period ending on the anniversary date of the revolving note, provided the borrower has not achieved a debt service coverage ratio of 1.10:1.

The foregoing summary of the terms of the Amendment is qualified in its entirety by reference to the form of First Amendment to Second Amendment to Master Loan Agreement and Third Amendment to Master Loan Agreement filed as Exhibit 10.1 herewith, which is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

To the extent required by Item 2.03 of Form 8-K, the information contained in Item 1.01 is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits

| | | | | |

| 10.1 | |

| 104 | Cover Page Interactive Data File (embedded within Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 27, 2023

AIR T, INC.

By: /s/ Brian Ochocki

Brian Ochocki, Chief Financial Officer

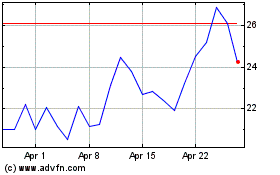

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

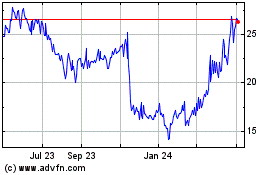

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Apr 2023 to Apr 2024