Current Report Filing (8-k)

04 January 2023 - 11:03PM

Edgar (US Regulatory)

0001584754

false

0001584754

2023-01-01

2023-01-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): January

1, 2023

AKOUSTIS

TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38029 |

|

33-1229046 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

9805 Northcross Center Court, Suite A

Huntersville, NC 28078

(Address of principal executive offices, including

zip code)

704-997-5735

(Registrant’s telephone number, including area

code)

Not Applicable

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

☐ Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of Each Class: |

|

Trading Symbol: |

|

Name of each exchange on which registered: |

| Common Stock, $0.001 par value |

|

AKTS |

|

The Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.b-2 of this chapter)

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On January 1, 2023 (the “Closing Date”),

Akoustis Technologies, Inc. (the “Company”) and its wholly-owned subsidiary, Akoustis, Inc. (the “Purchaser”),

entered into a Stock Purchase Agreement (the “Purchase Agreement”) with Grinding & Dicing Services, Inc. (“GDSI”)

and the stockholders of GDSI (the “Sellers”). Pursuant to the Purchase Agreement, the Purchaser acquired all of the outstanding

capital stock of GDSI (such acquisition, the “Transaction”).

The total consideration paid to the Sellers at

closing of the Transaction consisted of $14.0 million in cash, approximately $2.0 million unregistered shares (the “Closing

Shares”) of the Company’s common stock, par value $0.001 per share (“Common Stock”), and a secured

promissory note in the original principal amount of $4.0 million issued by the Purchaser to the Sellers’ representative (the

“Note”). The Note does not bear interest, is subject to partial prepayment (reduction of the outstanding principal

amount down to $1.3 million) on the second anniversary of the Closing Date, and is payable in full on the third anniversary of the

Closing Date. The Purchaser can reduce the principal amount of the Note (i) to satisfy certain post-closing adjustments to the

Transaction purchase price, (ii) to satisfy the Sellers’ indemnification obligations under the Purchase Agreement, and (iii)

if GDSI’s President is terminated for cause or due to disability or resigns without good reason prior to maturity. The Note is

secured by certain of the Purchaser’s and GDSI’s assets. In the event of certain events of default, including failure to

pay amounts due under the Note and certain bankruptcy events, the outstanding principal amount of the Note will become immediately

due.

The Purchaser, GDSI and the Sellers have each made certain

customary representations, warranties, covenants and agreements in the Purchase Agreement. Additionally, the Purchaser and the Sellers agreed

to customary indemnification for breaches of representations, warranties, covenants and agreements, subject to certain limitations set

forth in the Purchase Agreement. The Sellers have also agreed to enter into customary non-compete and non-solicitation covenants in connection

with the Transaction.

The foregoing description of the Purchase Agreement

and the Note does not purport to be complete and is qualified in its entirety by reference to each of the Purchase Agreement and the Note,

which the Company will file as exhibits to its Quarterly Report on Form 10-Q for the quarter ended March 31, 2023.

Item 2.03 Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure relating to the Note set forth in Item

1.01 above is incorporated into this Item 2.03 by reference.

Item 3.02 Unregistered Sales of Equity Securities.

On the Closing Date, the Company entered into an

employment agreement with Joseph Collins to continue as President of GDSI (the “Employment Agreement”). Pursuant to the

Employment Agreement, the Company will issue up to $2.0 million in unregistered shares of Common Stock (the “Employment

Shares”) to Mr. Collins. A total of 242,235 Employment Shares were issued on or about the Closing Date and an aggregate of up

to 363,353 Employment Shares are issuable during the term of the Employment Agreement.

As described in Item 1.01 above, an aggregate

of 605,589 Closing Shares were issued to the Sellers on or about the Closing Date pursuant to the Purchase Agreement.

The issuance of the Closing Shares and the Employment

Shares is exempt from the registration requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof

as a transaction by an issuer not involving any public offering.

Item 7.01 Regulation FD Disclosure.

A copy of the press release issued by the Company

announcing the Transaction is included herewith as Exhibit 99.1 and is incorporated herein by reference.

In connection with the announcement of the Transaction,

the Company will host a call on January 4, 2023 at 8:00 a.m. Eastern time. Call details are contained in the press release referenced

above.

This information is intended to be furnished under

Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Akoustis Technologies, Inc. |

| |

|

| Date: January 4, 2023 |

By: |

/s/ Kenneth E. Boller |

| |

Name: |

Kenneth E. Boller |

| |

Title: |

Chief Financial Officer |

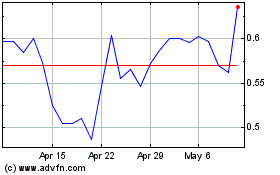

Akoustis Technologies (NASDAQ:AKTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

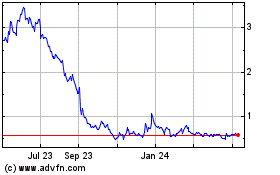

Akoustis Technologies (NASDAQ:AKTS)

Historical Stock Chart

From Apr 2023 to Apr 2024