Securities Registration Statement (simplified Form) (s-3/a)

17 November 2022 - 10:01PM

Edgar (US Regulatory)

As filed with the Securities

and Exchange Commission on November 16, 2022

Registration No. 333-268214

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

AMENDMENT NO. 1 TO

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Akoya

Biosciences, Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

47-5586242 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

100 Campus Drive, 6th Floor

Marlborough, MA 01752

(855) 896-8401

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Brian McKelligon

Chief Executive Officer

Akoya Biosciences, Inc.

100 Campus Drive, 6th Floor

Marlborough, MA 01752

(855) 896-8401

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copy

to:

Patrick O’Malley, Esq.

DLA Piper LLP (US)

4365 Executive Drive, Suite 1100

San Diego, CA 92121

Tel: (858) 677-1400

Fax: (858) 677-1401

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box: ¨

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act

of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering: ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

| Non-accelerated filer |

|

x |

|

Smaller reporting company |

|

x |

| |

|

|

|

Emerging growth company |

|

x |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby

amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file

a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and

Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Akoya Biosciences, Inc. is filing this

Pre-Effective Amendment No. 1 (“Amendment No. 1”) to its Registration Statement on Form S-3 (333-268214), originally

filed on November 7, 2022 (the “Registration Statement”), as an exhibit-only filing solely to file an updated auditor

consent as Exhibit 23.1. This Amendment No. 1 consists only of the facing page, this explanatory note, Part II of the Registration

Statement, the signature page to the Registration Statement, the exhibit index and the exhibit being filed with this Amendment No. 1.

Part I of the Registration Statement is unchanged and has been omitted.

PART II

INFORMATION NOT REQUIRED

IN PROSPECTUS

| Item 14. |

Other Expenses of Issuance and Distribution |

The following table sets

forth the fees and expenses incurred or expected to be incurred by Akoya Biosciences, Inc. (the “Registrant”) in connection

with the issuance and distribution of the securities being registered hereby. All the amounts shown are estimates, except for the SEC

registration fee and Financial Industry Regulatory Authority, Inc. (FINRA) filing fee.

| SEC registration fee | |

$ | 16,530 | |

| Nasdaq listing fee | |

| 23,000 | |

| FINRA filing fees | |

| * | |

| Accounting fees and expenses | |

| * | |

| Legal fees and expenses | |

| * | |

| Transfer agent fees and expenses | |

| * | |

| Printing and miscellaneous expenses | |

| * | |

| Total | |

| * | |

| * |

These fees or expenses cannot be estimated at this time, as they are calculated based on the securities offered and the number of issuances. |

| Item 15. |

Indemnification of Directors and Officers |

Section 145 of the Delaware General Corporation

Law authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers in terms sufficiently

broad to permit such indemnification under certain circumstances for liabilities, including reimbursement for expenses incurred, arising

under the Securities Act. Our Certificate of Incorporation requires us to indemnify our directors and officers to the maximum extent permitted

by the Delaware General Corporation Law, our Bylaws provide that we will indemnify our directors and officers and permit us to indemnify

our employees and other agents, in each case to the maximum extent permitted by the Delaware General Corporation Law.

We have entered into indemnification agreements

with our directors and officers, whereby we have agreed to indemnify our directors and officers to the fullest extent permitted by law,

including indemnification against expenses and liabilities incurred in legal proceedings to which the director or officer was, or is threatened

to be made, a party by reason of the fact that such director or officer is or was a director, officer, employee or agent of the Registrant,

provided that such director or officer acted in good faith and in a manner that the director or officer reasonably believed to be in,

or not opposed to, our best interest. At present, there is no pending litigation or proceeding involving a director or officer regarding

which indemnification is sought, nor are we aware of any threatened litigation that may result in claims for indemnification.

We maintain insurance policies that indemnify

our directors and officers against various liabilities arising under the Securities Act and the Exchange Act that might be incurred by

any director or officer in his or her capacity as such.

Item 16. Exhibits and Financial Statement

Schedules.

(a) Exhibits

| * | To be filed by amendment or as exhibit(s) to a Current Report of the registrant on Form 8-K and incorporated herein by reference,

as applicable. |

| † | To be filed pursuant to Section 305(b)(2) of the Trust Indenture Act of 1939, as applicable. |

| (a) | The undersigned registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth

in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar

value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum

offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate,

the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement; and |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement; |

Provided, however, that

paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13

or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or

is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement;

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof; |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering; |

| (4) | That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| (A) | Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement

as of the date the filed prospectus was deemed part of and included in the registration statement; and |

| (B) | Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement

in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose

of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included

in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the

first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes

of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration

statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference

into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract

of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that

was part of the registration statement or made in any such document immediately prior to such effective date; and |

| (5) | That, for the purpose of determining liability of the Registrant under the Securities Act of 1933 to any purchaser in the initial

distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant

pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser: |

| (i) | Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; |

| (ii) | Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to

by the undersigned registrant; |

| (iii) | The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and |

| (iv) | Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| (b) | The undersigned registrant hereby undertakes that, for the purpose of determining liability under the Securities Act of 1933, each

filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange

Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of

the Securities Exchange Act of 1934) that is incorporated by reference into the registration statement shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. |

| (c) | Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the

Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred

or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue. |

| (d) | The undersigned registrant hereby undertakes that: |

| (1) | For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed

as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant pursuant

to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement

as of the time it was declared effective. |

| (2) | For the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form

of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (e) | The undersigned registrant hereby undertakes to file an application for the purpose of determining the eligibility of the trustee

to act under subsection (a) of Section 310 of the Trust Indenture Act in accordance with the rules and regulations prescribed

by the Commission under Section 305(b)(2) of the Act. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the

undersigned, thereunto duly authorized, in the City of Marlborough, State of Massachusetts on November 16, 2022.

| |

akoya biosciences, inc. |

| |

|

| |

By: |

/s/ Brian McKelligon |

| |

|

Brian McKelligon |

| |

|

President and Chief Executive

Officer |

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities

and on the dates indicated.

| Name |

|

Title |

|

Date |

| |

|

|

|

|

| * |

|

President, Chief Executive

Officer and Director |

|

November 16,

2022 |

| Brian McKelligon |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| * |

|

Chief Financial Officer

|

|

November 16,

2022 |

| Joseph Driscoll |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| * |

|

Chairman of the Board |

|

November 16,

2022 |

| Robert G. Shepler |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 16,

2022 |

| Garry Nolan, PhD |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 16,

2022 |

| Thomas Raffin, MD |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 16,

2022 |

| Thomas P. Schnettler |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 16,

2022 |

| Scott Mendel |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 16, 2022 |

| Matthew Winkler, PhD |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 16, 2022 |

| Myla Lai-Goldman, MD |

|

|

|

|

| *By |

/s/ Joseph Driscoll |

|

| Joseph Driscoll |

|

| Attorney-in-fact |

|

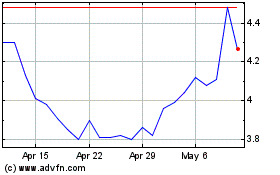

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

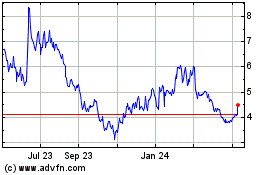

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

From Apr 2023 to Apr 2024