Current Report Filing (8-k)

27 December 2022 - 11:01PM

Edgar (US Regulatory)

falseMA000134123500013412352022-12-222022-12-22

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 27, 2022 (December 22, 2022)

ALDEYRA THERAPEUTICS, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

|

001-36332

|

|

20-1968197

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File No.)

|

|

(IRS Employer

Identification No.)

|

131 Hartwell Avenue, Suite 320

Lexington, MA 02421

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (781) 761-4904

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.001 par value per share

|

|

ALDX

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On December 22, 2022, Aldeyra Therapeutics, Inc. (“Aldeyra” or the “Company”) entered into the Second Amendment (the “Second Amendment”) to Loan and Security

Agreement, which is effective as of December 31, 2022 (the “Effective Date”) and amended that certain Loan and Security Agreement, dated as of March 25, 2019, by and among the Company, Helio Vision, LLC, the several banks and other financial

institutions or entities from time to time parties thereto (the “Lenders”) and Hercules Capital, Inc., in its capacity as administrative agent and collateral agent for itself and the Lenders (the “Original Loan Agreement” and as previously amended

and as amended by the Second Amendment, the “Loan Agreement”).

The Second Amendment makes certain changes to the Loan Agreement, including, among other things, (i) extending the expiration of the period in which

interest-only payments on borrowings under the Loan Agreement are made from May 1, 2023 to May 1, 2024; (ii) extending the Term Loan Maturity Date (as defined in the Loan Agreement) from October 1, 2023 to October 1, 2024; (iii) extending the

availability of the fourth term loan tranche commitment of $20 million from May 1, 2023 to May 1, 2024; and (iv) amending the Prepayment Charge (as defined in the Loan Agreement) to equal 0.75% of the amount prepaid during the 12-month period

following the Effective Date, and 0% thereafter. In addition, a supplemental end of term charge of $292,500 shall be due on the earlier of (A) Term Loan Maturity Date, as amended, or (B) repayment of the outstanding Advances. The existing end of

term charge of $1,042,500 remains due on the earlier of (A) October 1, 2023 or (B) repayment of the outstanding Advances. The ability to draw the fourth term loan tranche commitment remains conditioned on approval by the Lenders’ investment

committee.

The foregoing summary of the Original Loan Agreement and the Second Amendment does not purport to be complete and is qualified in its entirety by the complete

text of the Original Loan Agreement and the Second Amendment, which are filed as Exhibit 10.1 and 10.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information provided in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Based on its current operating plans, as a result of the Second Amendment disclosed in Item 1.01 above, Aldeyra believes that its existing cash, cash

equivalents, and marketable securities will now be sufficient to fund the Company into the second half of 2024. The current operating plan and use of funds includes initial commercialization and launch plans for reproxalap and ADX-2191, if

approved; and continued early and late-stage development of the Aldeyra’s product candidates in ocular and systemic immune-mediated diseases.

Various statements contained in this Current Report on Form 8-K are “forward-looking statements” under the securities laws, including, but not limited to, statements regarding Aldeyra’s operating plans

and expectations regarding the sufficiency and uses of its existing cash, cash equivalents, and marketable securities . In some cases, you can identify forward looking statements

by terms such as, but not limited to, “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “anticipate,” “project,” “on track,” “scheduled,” “target,” “design,” “estimate,” “predict,” “potential,”

“aim,” “plan” or the negative of these terms, and similar expressions intended to identify forward-looking statements. Such forward-looking statements are based upon current expectations that involve risks, changes in circumstances, assumptions, and uncertainties.

Important factors that could cause actual results to differ materially from those reflected in Aldeyra's forward-looking statements include, among others, the timing of enrollment, commencement and completion of Aldeyra's clinical trials, the timing and success of preclinical studies and clinical trials conducted by

Aldeyra and its development partners; delay in or failure to obtain regulatory approval of Aldeyra's product candidates, including as a result of the FDA not accepting Aldeyra’s regulatory filings, requiring additional clinical trials or data prior

to review or approval of such filings; the ability to maintain regulatory approval of Aldeyra's product candidates, and the labeling for any approved products; the risk that prior results, such as signals of safety, activity, or durability of

effect, observed from preclinical or clinical trials, will not be replicated or will not continue in ongoing or future studies or clinical trials involving Aldeyra's product candidates; the scope, progress, expansion, and costs of developing and

commercializing Aldeyra's product candidates; the current and potential future impact of the COVID-19 pandemic on Aldeyra’s business, results of operations, and financial position; uncertainty as to Aldeyra’s ability to commercialize (alone or with

others) and obtain reimbursement for Aldeyra's product candidates following regulatory approval, if any; the size and growth of the potential markets and pricing for Aldeyra's product candidates and the ability to serve those markets; Aldeyra's

expectations regarding Aldeyra's expenses and revenue, the sufficiency or use of Aldeyra's cash resources and needs for additional financing; the rate and degree of market acceptance of any of Aldeyra's product candidates; Aldeyra's expectations

regarding competition; Aldeyra's anticipated growth strategies; Aldeyra's ability to attract or retain key personnel; Aldeyra’s limited sales and marketing infrastructure; Aldeyra's ability to establish and maintain development partnerships;

Aldeyra’s ability to successfully integrate acquisitions into its business; Aldeyra's expectations regarding federal, state, and foreign regulatory requirements; political, economic, legal, social, and health risks, including the COVID-19 pandemic

and subsequent public health measures, and war or other military actions, that may affect Aldeyra’s business or the global economy; regulatory developments in the United States and foreign countries; Aldeyra's ability to obtain and maintain

intellectual property protection for its product candidates; the anticipated trends and challenges in Aldeyra's business and the market in which it operates; and other factors that are described in the "Risk Factors" and "Management's Discussion

and Analysis of Financial Condition and Results of Operations" sections of Aldeyra's Annual Report on Form 10-K for the year ended December 31, 2021, and Aldeyra’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2022, which are on

file with the Securities and Exchange Commission (SEC) and available on the SEC's website at https://www.sec.gov/. In addition to the risks described above and in Aldeyra’s other filings with the SEC, other unknown or unpredictable factors also

could affect Aldeyra’s results. No forward-looking statements can be guaranteed and actual results may differ materially from such statements. The information

conveyed this Current Report on Form 8-K is provided only as of the date hereof, and Aldeyra undertakes no obligation to update any forward-looking statements

included herein on account of new information, future events, or otherwise, except as required by law.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit

|

|

Description

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

ALDEYRA THERAPEUTICS, INC.

|

ALDEYRA THERAPEUTICS, INC.

|

| |

|

|

|

By:

|

|

| |

|

Name: Todd C. Brady M.D., Ph.D.

|

| |

|

Title: Chief Executive Officer

|

Dated December 27, 2022

Aldeyra Therapeutics (NASDAQ:ALDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

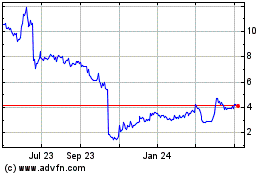

Aldeyra Therapeutics (NASDAQ:ALDX)

Historical Stock Chart

From Apr 2023 to Apr 2024