Current Report Filing (8-k)

04 January 2022 - 8:19AM

Edgar (US Regulatory)

false 0001653087 0001653087 2021-12-31 2021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 31, 2021

Alector, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38792

|

|

82-2933343

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

131 Oyster Point Blvd.

Suite 600

|

|

|

|

South San Francisco,

California

|

|

94080

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (415) 231-5660

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock

|

|

ALEC

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On December 31, 2021, Alector, LLC, a subsidiary of Alector, Inc. (collectively, the “Company”) entered into an agreement (the “Separation Agreement”) with Shehnaaz Suliman, the Company’s President and Chief Operating Officer, completing the terms of Dr. Suliman’s previously announced voluntary separation from the Company. Pursuant to the Separation Agreement, Dr. Suliman’s last day of employment was December 31, 2021 (the “Separation Date”). In addition, under the terms of the Separation Agreement, Dr. Suliman will receive a lump sum severance payment equal to $375,000 and a lump sum severance bonus of $337,500. The Company will also pay the premiums for continued health insurance coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”) for a period of nine months, starting January 1, 2022 and ending on September 30, 2022, provided that Dr. Suliman meets all of COBRA’s continuation requirements. Further, under the terms of the Separation Agreement, the Company will cause all incentive stock options and non-qualified stock options subject to the certain specified grants, as defined in the Separation Agreement, that would have otherwise vested in accordance with the terms of the Company’s 2019 Equity Incentive Plan and the award agreements, absent a termination of employment, during the nine month period immediately following the Separation Date to become fully vested and exercisable as of the Separation Date; however, none of Dr. Suliman’s outstanding performance stock units will be accelerated, and as a result, will be cancelled as unvested on the separation date. In consideration for the compensation noted above, Dr. Suliman will agree to a customary general release of claims for the benefit of the Company.

The foregoing description of the Separation Agreement is only a summary and is qualified by reference to the Separation Agreement, a copy of which is attached as Exhibit 10.1 hereto, which is incorporated by reference into this Item 5.02.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ALECTOR, INC.

|

|

|

|

|

|

|

Date: January 3, 2022

|

|

|

|

By:

|

|

/s/ Arnon Rosenthal

|

|

|

|

|

|

|

|

Arnon Rosenthal, Ph.D.

Co-founder and Chief Executive Officer

|

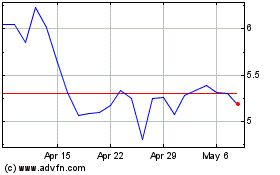

Alector (NASDAQ:ALEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alector (NASDAQ:ALEC)

Historical Stock Chart

From Apr 2023 to Apr 2024