Align Technology Announces $200 Million Accelerated Stock Repurchase Agreement Under Its $1 Billion Repurchase Program

31 October 2022 - 11:51PM

Business Wire

CEO Joe Hogan intends to personally purchase

an additional $2.0 million of Align’s common stock following his

prior $2 million purchase in May 2022

Align Technology, Inc. (“Align”) (Nasdaq: ALGN), a leading

global medical device company that designs, manufactures, and sells

the Invisalign® system of clear aligners, iTero™ intraoral

scanners, and exocad™ CAD/CAM software for digital orthodontics and

restorative dentistry, today announced that it has entered into a

new accelerated stock repurchase agreement ("ASR") with Goldman

Sachs & Co. LLC, to repurchase $200 million of Align's common

stock under Align’s $1.0 billion stock repurchase program announced

on May 13, 2021. In addition to the ASR, Joe Hogan, president and

CEO, intends to personally purchase $2.0 million of Align’s common

stock, in addition to his $2.0 million purchase in May 2022.

Under the terms of the ASR, Align will receive an initial

delivery of approximately 849 thousand shares. The final number of

shares to be repurchased will be based on Align's volume-weighted

average stock price during the term of the ASR, less an agreed upon

discount. The ASR transaction will be funded with Align's cash on

hand and is expected to be completed by approximately February 1,

2023. As of September 30, 2022, Align had approximately 78.2

million shares outstanding and $1.1 billion in cash, cash

equivalents, and short-term and long-term marketable

securities.

As of September 30, 2022, Align has repurchased 1,321 thousand

shares of its common stock with an average price of $416.39 for a

total of approximately $550 million under its May 2021 $1.0 Billion

Repurchase Program. After this current ASR, there will be

approximately $250 million remaining available under the

Program.

“I am confident in the incredible under-penetrated market

opportunity for digital orthodontics and restorative dentistry and

the long-term value of Align,” said Joe Hogan, president and CEO.

“Regardless of the operating environment, we are committed to

balancing investments to drive growth and long-term strategic

priorities that will transform the practice of dentistry and

strengthen our business. We will continue to invest in digital

solutions and demand creation to help doctors and their patients,

while working through the global macroeconomic challenges

together.”

“We're pleased to announce a new $200 million accelerated stock

repurchase agreement that reflects our commitment to increasing

stockholder value and returning capital to our stockholders through

stock repurchase programs, while simultaneously investing in our

strategic growth drivers,” said John Morici, executive vice

president, finance and CFO. “We are well capitalized to continue

managing through these challenging market conditions with a strong

balance sheet including over $1 billion in cash and investments, a

healthy cash flow position, and zero long-term debt. We will

continue to focus on those matters that have been central to our

historically successful business strategies by managing those

things within our control. This includes maintaining fiscal

controls and focused delivery on our business model so that we are

positioned for success once this difficult operating environment

ultimately abates.”

About Align Technology,

Inc.

Align Technology designs and manufactures the Invisalign®

system, the most advanced clear aligner system in the world, iTero™

intraoral scanners and services, and exocad™ CAD/CAM software.

These technology building blocks enable enhanced digital

orthodontic and restorative workflows to improve patient outcomes

and practice efficiencies for over 234 thousand doctor customers

and is key to accessing Align’s 500 million consumer market

opportunity worldwide. Over the past 25 years, Align has helped

doctors treat 14 million patients with the Invisalign system and is

driving the evolution in digital dentistry through the Align

Digital Platform™, our integrated suite of unique, proprietary

technologies and services delivered as a seamless, end-to-end

solution for patients and consumers, orthodontists and GP dentists,

and lab/partners. Visit www.aligntech.com for more information.

For additional information about the Invisalign system or to

find an Invisalign trained doctor in your area, please visit

www.invisalign.com. For additional information about the iTero

digital scanning system, please visit www.itero.com. For additional

information about exocad dental CAD/CAM offerings and a list of

exocad reseller partners, please visit www.exocad.com.

Invisalign, iTero, exocad, Align, Align Digital Platform, Smile

Architect, Invisalign Go, and ClinCheck are trademarks of Align

Technology, Inc.

Forward-Looking

Statements

This news release contains forward-looking statements including

statements regarding the expected completion date of the ASR

transaction, the number of shares of common stock that will be

repurchased, Align's expectation that it will finance the ASR

transaction with cash on hand as well as other statements regarding

the ASR, the anticipated amount and timing of purchases of stock by

Align's President and CEO, management's beliefs regarding market

opportunities, current and future market conditions and Align's

value, and management's financial and strategic goals and Align's

ability to achieve to them. Forward-looking statements contained in

this news release relating to expectations about future events or

results are based upon information available to Align as of the

date hereof. Readers are cautioned that these forward-looking

statements are only predictions and are subject to risks,

uncertainties and assumptions that are difficult to predict. As a

result, actual results may differ materially and adversely from

those expressed in any forward-looking statement.

Factors that might cause such a difference include, but are not

limited to:

- macroeconomic conditions, including inflation, fluctuations in

currency exchange rates, rising interest rates, market volatility,

weakness in general economic conditions and recessions and the

impact of efforts by central banks and federal, state and local

governments to combat inflation and recession;

- customer and consumer purchasing behavior and changes in

consumer spending habits as a result of, among other things,

prevailing macroeconomic conditions, levels of employment, salaries

and wages, inflationary pressure, declining consumer confidence,

and the military conflict in Ukraine;

- the impact of the COVID-19 pandemic and its variants on the

health and safety of our employees, customers, patients, and our

suppliers, as well as the physical and economic impacts of the

various recommendations, orders, and protocols issued by local and

national governmental agencies in light of continual evolution of

the pandemic, including any periodic reimplementation of

preventative measures in various global locations;

- the economic and geopolitical ramifications of the military

conflict in Ukraine, including sanctions, retaliatory sanctions,

nationalism, supply chain disruptions and other consequences, any

of which may or will continue to adversely impact our operations

and research and development activities inside and outside of

Russia;

- the timing and availability and cost of raw materials,

components, products and other shipping and supply chain

constraints;

- unexpected or rapid changes in the growth or decline of our

domestic and/or international markets;

- competition from existing and new competitors;

- rapidly evolving and groundbreaking advances that fundamentally

alter the dental industry or the way new and existing customers

market and provide products and services to consumers;

- the ability to protect our intellectual property rights;

- continued compliance with regulatory requirements;

- declines in, or the slowing of the growth of, sales of our

clear aligners and intraoral scanners domestically and/or

internationally and the impact either would have on the adoption of

Invisalign products;

- the willingness and ability of our customers to maintain and/or

increase product utilization in sufficient numbers;

- the possibility that the development and release of new

products or enhancements to existing products do not proceed in

accordance with the anticipated timeline or may themselves contain

bugs, errors or defects in software or hardware requiring

remediation and that the market for the sale of these new or

enhanced products may not develop as expected;

- a tougher consumer demand environment in China generally,

especially for manufacturers and service providers whose

headquarters or primary operations are not based in China;

- the risks relating to our ability to sustain or increase

profitability or revenue growth in future periods (or minimize

declines) while controlling expenses;

- expansion of our business and products;

- the impact of excess or constrained capacity at our

manufacturing and treat operations facilities and pressure on our

internal systems and personnel; and

- the compromise of our systems or networks, including any

customer and/or patient data contained therein, for any

reason.

The foregoing and other risks are detailed from time to time in

our periodic reports filed with the Securities and Exchange

Commission, including, but not limited to, our Annual Report on

Form 10-K for the year ended December 31, 2021, which was filed

with the Securities and Exchange Commission on February 25, 2022

and our Quarterly Report on Form 10-Q for the quarter ended June

30, 2022, which was filed with the SEC on August 4, 2022. Align

undertakes no obligation to revise or update publicly any

forward-looking statements for any reason.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221030005062/en/

Align Technology Madelyn Valente

(909) 833-5839 mvalente@aligntech.com

Zeno Group Sarah Johnson (828)

551-4201 sarah.johnson@zenogroup.com

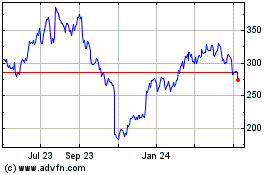

Align Technology (NASDAQ:ALGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

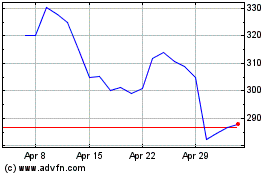

Align Technology (NASDAQ:ALGN)

Historical Stock Chart

From Apr 2023 to Apr 2024