SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE

13G/A

(Rule 13d-102)

INFORMATION TO BE INCLUDED IN STATEMENTS

FILED PURSUANT TO RULES 13d-1(b), (c), AND (d)

AND AMENDMENTS THERETO FILED PURSUANT TO RULE 13d-2

(Amendment No. 16)

Align

Technology, Inc.

(Name of Issuer)

Common Stock, $0.0001 par value per share

(Title of Class of Securities)

016255101

(CUSIP Number)

December 31, 2022

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to

designate the rule pursuant to which this Schedule is filed:

☐ Rule 13d-1(b)

☒ Rule 13d-1(c)

☐ Rule 13d-1(d)

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. |

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

| CUSIP NO. 016255101 |

|

13G/A |

|

Page

2

of 14 Pages |

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSONS Grant Gund, as trustee for the Gordon Gund – Grant Gund #2

Trust, the Grant Gund 1999 Trust, the Gordon Gund - Grant Gund GST Article III Trust, the Gordon Gund - Grant Gund GST Article III-A Trust, the Llura Blair Gund Gift Trust, the Grant Owen Gund Gift Trust, the

Kelsey Laidlaw Gund Gift Trust and the 2011 Grant Gund Descendants’ Trust and as sole manager of OLK Investments LLC and OLK Brookfield LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☒

|

| 3 |

|

SEC USE

ONLY |

| 4 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

|

|

|

|

|

NUMBER OF SHARES

BENEFICIALLY OWNED BY

EACH REPORTING

PERSON WITH |

|

5 |

|

SOLE VOTING POWER

902,738 |

| |

6 |

|

SHARED VOTING

POWER 171,000 |

| |

7 |

|

SOLE DISPOSITIVE

POWER 902,738 |

| |

8 |

|

SHARED DISPOSITIVE

POWER 171,000 |

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON 1,073,738 |

| 10 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 11 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9) 1.4% |

| 12 |

|

TYPE OF

REPORTING PERSON IN |

|

|

|

|

|

| CUSIP NO. 016255101 |

|

13G/A |

|

Page

3

of 14 Pages |

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSONS G. Zachary Gund, as trustee for the Gordon Gund – G. Zachary

Gund #2 Trust, the Z Coppermine Trust, the Gordon Gund - G. Zachary Gund GST Article III Trust, the Gordon Gund - G. Zachary Gund GST Article III-A Trust, the G. Zachary Gund Descendants’ Trust, the

Georgia Swift Gund Gift Trust and the Grant Gund 2017 Remainder Trust and as sole manager of GCG Investments LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☒

|

| 3 |

|

SEC USE

ONLY |

| 4 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

|

|

|

|

|

NUMBER OF SHARES

BENEFICIALLY OWNED BY

EACH REPORTING

PERSON WITH |

|

5 |

|

SOLE VOTING POWER

1,284,279 |

| |

6 |

|

SHARED VOTING

POWER 3,000 |

| |

7 |

|

SOLE DISPOSITIVE

POWER 1,284,279 |

| |

8 |

|

SHARED DISPOSITIVE

POWER 3,000 |

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON 1,287,279 |

| 10 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 11 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9) 1.6% |

| 12 |

|

TYPE OF

REPORTING PERSON IN |

|

|

|

|

|

| CUSIP NO. 016255101 |

|

13G/A |

|

Page

4

of 14 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSONS

Gordon Gund, as the sole manager of Gund CLAT Investments, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☒

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States of

America |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

850,647 |

| |

6 |

|

SHARED VOTING POWER

0 |

| |

7 |

|

SOLE DISPOSITIVE POWER

850,647 |

| |

8 |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

850,647 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (9) 1.1% |

| 12 |

|

TYPE OF REPORTING

PERSON IN |

|

|

|

|

|

| CUSIP NO. 016255101 |

|

13G/A |

|

Page

5

of 14 Pages |

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSONS Alison I. Glover, as trustee for the Llura Blair Gund Gift Trust,

the Grant Owen Gund Gift Trust, the Kelsey Laidlaw Gund Gift Trust and the Georgia Swift Gund Gift Trust |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☒

|

| 3 |

|

SEC USE

ONLY |

| 4 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

|

|

|

|

|

NUMBER OF SHARES

BENEFICIALLY OWNED BY

EACH REPORTING

PERSON WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING

POWER 174,000 |

| |

7 |

|

SOLE DISPOSITIVE

POWER 0 |

| |

8 |

|

SHARED DISPOSITIVE

POWER 174,000 |

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON 174,000 |

| 10 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 11 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9) 0.2% |

| 12 |

|

TYPE OF

REPORTING PERSON IN |

|

|

|

|

|

| CUSIP NO. 016255101 |

|

13G/A |

|

Page

6

of 14 Pages |

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSONS Dionis Trust |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☒

|

| 3 |

|

SEC USE

ONLY |

| 4 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Ohio |

|

|

|

|

|

|

NUMBER OF SHARES

BENEFICIALLY OWNED BY

EACH REPORTING

PERSON WITH |

|

5 |

|

SOLE VOTING POWER

-0- |

| |

6 |

|

SHARED VOTING

POWER 197,700 |

| |

7 |

|

SOLE DISPOSITIVE

POWER -0- |

| |

8 |

|

SHARED DISPOSITIVE

POWER 197,700 |

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON 197,700 |

| 10 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 11 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9) 0.3% |

| 12 |

|

TYPE OF

REPORTING PERSON OO |

|

|

|

|

|

| CUSIP NO. 016255101 |

|

13G/A |

|

Page

7

of 14 Pages |

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSONS Valentine Trust |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☒

|

| 3 |

|

SEC USE

ONLY |

| 4 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Ohio |

|

|

|

|

|

|

NUMBER OF SHARES

BENEFICIALLY OWNED BY

EACH REPORTING

PERSON WITH |

|

5 |

|

SOLE VOTING POWER

-0- |

| |

6 |

|

SHARED VOTING

POWER 574,550 |

| |

7 |

|

SOLE DISPOSITIVE

POWER -0- |

| |

8 |

|

SHARED DISPOSITIVE

POWER 574,550 |

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON 574,550 |

| 10 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 11 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9) 0.7% |

| 12 |

|

TYPE OF

REPORTING PERSON IN |

|

|

|

|

|

| CUSIP NO. 016255101 |

|

13G/A |

|

Page

8

of 14 Pages |

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSONS Gordon & Llura Gund Foundation |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☒

|

| 3 |

|

SEC USE

ONLY |

| 4 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

New Jersey |

|

|

|

|

|

|

NUMBER OF SHARES

BENEFICIALLY OWNED BY

EACH REPORTING

PERSON WITH |

|

5 |

|

SOLE VOTING POWER

-0- |

| |

6 |

|

SHARED VOTING

POWER 428,745 |

| |

7 |

|

SOLE DISPOSITIVE

POWER -0- |

| |

8 |

|

SHARED DISPOSITIVE

POWER 428,745 |

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON 428,745 |

| 10 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 11 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9) 0.5% |

| 12 |

|

TYPE OF

REPORTING PERSON IN |

|

|

|

|

|

| CUSIP NO. 016255101 |

|

13G/A |

|

Page

9

of 14 Pages |

This Amendment No. 16 (“Amendment No. 16”) amends and supplements the

Schedule 13G as originally filed by Llura L. Gund, Grant Gund, G. Zachary Gund, Gordon Gund, Richard T. Watson, Rebecca H. Dent, George Gund III and Gail Barrows on September 25, 2002, the Amendment No. 1 filed on November 25, 2002,

the Amendment No. 2 filed on February 17, 2004, the Amendment No. 3 filed on February 14, 2005, the Amendment No. 4 filed on February 7, 2006, the Amendment No. 5 filed on February 14, 2007, the Amendment

No. 6 filed on February 13, 2009, the Amendment No. 7 filed on February 13, 2013, the Amendment No. 8 filed on February 14, 2014, the Amendment No. 9 filed on February 9, 2016, the Amendment No. 10 filed

on February 9, 2017, the Amendment No. 11 filed on February 8, 2018, the Amendment No. 12 filed on February 11, 2019, the Amendment No. 13 filed on February 7, 2020, the Amendment No. 14 filed on

February 11, 2021 and the Amendment No. 15 filed on February 7, 2022 (as so amended, the “Schedule 13G”). Capitalized terms used but not defined in this Amendment No. 16 have the respective meaning ascribed to them in

the Schedule 13G.

Item 2 (a) of the Schedule 13G, “Identity and Background,” is hereby amended by deleting the last

paragraph thereof and inserting the following:

The Reporting Persons, in the aggregate, beneficially own 4,412,659 shares of Common

Stock or 5.6% of the outstanding Common Stock of the Issuer based on 78,112,351 shares outstanding as of October 28, 2022 as reported in the Quarterly Report on Form 10-Q of the Issuer for the period

ended September 30, 2022. Neither the fact of this filing nor anything contained herein shall be deemed to be an admission by any of the Reporting Persons that a group exists within the meaning of the Exchange Act.

Item 4 of the Schedule 13G, “Ownership” is hereby amended and restated in its entirety as follows:

Pursuant to the Exchange Act and regulations thereunder, the Reporting Persons may be deemed as a group to have acquired beneficial ownership

of 4,412,659 shares of Common Stock, which represents 5.6% of the outstanding Common Stock of the Issuer.

Grant Gund may be deemed

to have beneficial ownership in the aggregate of 1,073,738 shares of Common Stock, which constitutes 1.4% of the outstanding Common Stock of the Issuer. Of these shares, Grant Gund has sole power to vote and sole power to dispose of an aggregate of

902,738 shares of Common Stock by virtue of his position as the sole manager or trustee or investment trustee of certain entities listed below and may be deemed to have shared power to vote and shared power to dispose of 171,000 shares of Common

Stock by virtue of his position as co-trustee of certain trusts as listed below:

|

|

|

|

|

| Gordon Gund – Grant Gund #2 Trust (Mr. Grant Gund serves as investment trustee) |

|

|

275,379 |

|

| Grant Gund 1999 Trust (Mr. Grant Gund serves as sole trustee) |

|

|

98,455 |

|

| OLK Investments LLC (Mr. Grant Gund serves as sole manager) |

|

|

80,516 |

|

| OLK Brookfield LLC (Mr. Grant Gund serves as sole manager) |

|

|

8,532 |

|

| Gordon Gund - Grant Gund GST Article III Trust (Mr. Grant Gund serves as investment

trustee) |

|

|

285,349 |

|

| Gordon Gund - Grant Gund GST Article III-A Trust

(Mr. Grant Gund serves as investment trustee) |

|

|

107,000 |

|

| 2011 Grant Gund Descendants’ Trust (Mr. Grant Gund serves as investment

trustee) |

|

|

47,507 |

|

| Llura Blair Gund Gift Trust (Mr. Grant Gund serves as

co-trustee with Alison I. Glover) |

|

|

50,165 |

|

| Grant Owen Gund Gift Trust (Mr. Grant Gund serves as

co-trustee with Alison I. Glover) |

|

|

50,165 |

|

| Kelsey Laidlaw Gund Gift Trust (Mr. Grant Gund serves as

co-trustee with Alison I. Glover) |

|

|

70,670 |

|

|

|

|

|

|

| CUSIP NO. 016255101 |

|

13G/A |

|

Page

10

of 14 Pages |

G. Zachary Gund may be deemed to have beneficial ownership in the aggregate of

1,287,279 shares of Common Stock, which constitutes 1.6% of the outstanding Common Stock of the Issuer. Of these shares, G. Zachary Gund has sole power to vote and sole power to dispose of 1,284,279 shares of Common Stock by virtue of his position

as the sole manager or trustee or investment trustee of certain entities listed below and may be deemed to have shared power to vote and shared power to dispose of 3,000 shares by virtue of his position as

co-trustee for certain trusts as indicated below:

|

|

|

|

|

| Gordon Gund – G. Zachary Gund #2 Trust (Mr. G. Zachary Gund serves as investment

trustee) |

|

|

328,887 |

|

| Z Coppermine Trust (Mr. G. Zachary Gund serves as sole trustee) |

|

|

121,069 |

|

| GCG Investments LLC (Mr. G. Zachary Gund serves as sole manager) |

|

|

14,875 |

|

| Gordon Gund – G. Zachary Gund GST Article III Trust (Mr. G. Zachary Gund serves as

investment trustee) |

|

|

322,998 |

|

| Grant Gund 2017 Remainder Trust (Mr. G. Zachary Gund serves as trustee) |

|

|

11,450 |

|

| Gordon Gund – G. Zachary Gund GST Article III-A Trust

(Mr. G. Zachary Gund serves as investment trustee) |

|

|

107,000 |

|

| G. Zachary Gund Descendants’ Trust (Mr. G. Zachary Gund serves as investment

trustee) |

|

|

378,000 |

|

| Georgia Swift Gund Gift Trust (Mr. G. Zachary Gund serves as

co-trustee with Alison I. Glover) |

|

|

3,000 |

|

Gordon Gund may be deemed to have beneficial ownership of 850,647 shares of Common Stock, which

constitutes 1.1% of the outstanding Common Stock of the Issuer. Gordon Gund, as sole manager of Gund CLAT Investments, LLC has sole power to vote and sole power to dispose of 850,647 shares of Common Stock.

Alison I. Glover may be deemed to have beneficial ownership in the aggregate of 174,000 shares of Common Stock, which constitutes 0.2%

of the outstanding Common Stock of the Issuer. Of these shares, Alison I. Glover may be deemed to have shared power to vote and shared power to dispose of an aggregate of 174,000 shares of Common Stock by virtue of her position as co-trustee for certain trusts as indicated below:

|

|

|

|

|

| Llura Blair Gund Gift Trust (Ms. Glover serves as

co-trustee with Grant Gund) |

|

|

50,165 |

|

| Grant Owen Gund Gift Trust (Ms. Glover serves as

co-trustee with Grant Gund) |

|

|

50,165 |

|

| Kelsey Laidlaw Gund Gift Trust (Ms. Glover serves as

co-trustee with Grand Gund) |

|

|

70,670 |

|

| Georgia Swift Gund Gift Trust (Ms. Glover serves as

co-trustee with G. Zachary Gund) |

|

|

3,000 |

|

The Dionis Trust may be deemed to have beneficial ownership of 197,700 shares of Common Stock, which

constitutes 0.3% of the outstanding Common Stock of the Issuer. The Dionis Trust has shared power to vote and shared power to dispose of 197,700 shares of Common Stock.

|

|

|

|

|

| CUSIP NO. 016255101 |

|

13G/A |

|

Page

11

of 14 Pages |

The Valentine Trust may be deemed to have beneficial ownership of 574,550 shares of

Common Stock, which constitutes 0.7% of the outstanding Common Stock of the Issuer. The Valentine Trust has shared power to vote and shared power to dispose of 574,550 shares of Common Stock.

The Gordon & Llura Gund Foundation may be deemed to have beneficial ownership of 428,745 shares of Common Stock,

which constitutes 0.5% of the outstanding Common Stock of the Issuer. The Gordon & Llura Gund Foundation has shared power to vote and shared power to dispose of 428,745 shares of Common Stock.

Item 6 of the Schedule 13G, “Ownership of More Than Five Percent on Behalf of Another Person” is hereby amended and restated

in its entirety as follows:

Other persons are known to have the right to receive or the power to direct the receipt of dividends from,

or the proceeds from the sale of, these securities.

Item 10. Certifications. (See Instructions)

By signing below I certify that, to the best of my knowledge and belief, the securities referred to above were not acquired and are not held

for the purpose of or with the effect of changing or influencing the control of the issuer of the securities and were not acquired and are not held in connection with or as a participant in any transaction having that purpose or effect.

|

|

|

|

|

| CUSIP NO. 016255101 |

|

13G/A |

|

Page

12

of 14 Pages |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated: February 1, 2023

|

|

|

|

|

| By: |

|

/s/ Catherine Bird |

|

|

Name: |

|

Catherine Bird |

|

|

For herself and as Attorney-in-Fact for the |

|

|

Reporting Persons |

| * |

The Power of Attorney authorizing Catherine Bird to act on behalf of the Reporting Persons is attached hereto

as Exhibit A. |

Attention: Intentional misstatements or omissions of fact constitute Federal criminal violations (See 18 U.S.C. 1001).

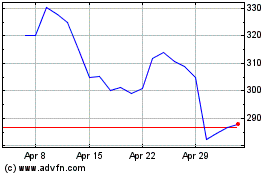

Align Technology (NASDAQ:ALGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

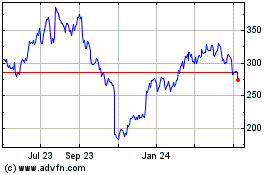

Align Technology (NASDAQ:ALGN)

Historical Stock Chart

From Apr 2023 to Apr 2024