Q4 total revenues of $901.5 million and 2022

total revenues of $3.7 billion

Board of Directors has authorized a new $1

billion stock repurchase program, to succeed the current $1 billion

program that is expected to be completed in Q2 2023

- 2022 total revenues of $3.7 billion, Clear Aligner revenues of

$3.1 billion and Systems and Services revenues of $662.1

million

- 2022 revenues were unfavorably impacted by foreign exchange of

approximately $193.8 million(1) compared to 2021

- 2022 operating margin of 17.2%, non-GAAP operating margin of

21.5%, and diluted net income per share of $4.61, non-GAAP diluted

net income per share of $7.76(3)

- 2022 operating margin was unfavorably impacted by foreign

exchange of approximately 2.8 points compared to 2021(1)

- Repurchased $475 million of common stock in 2022(2) with plans

to repurchase $250 million more starting in Q1 2023 and expect to

entirely complete our 2021 $1 Billion Stock Repurchase Program in

Q2 2023

- Q4 total revenues of $901.5 million, and diluted net income per

share of $0.54, non-GAAP diluted net income per share of

$1.73(3)

- Q4 revenues were unfavorably impacted by foreign exchange of

approximately $16.0 million sequentially and approximately $67.6

million year over year(1)

Align Technology, Inc. (Nasdaq: ALGN), a leading global medical

device company that designs, manufactures, and sells the

Invisalign® system of clear aligners, iTero™ intraoral scanners,

and exocad™ CAD/CAM software for digital orthodontics and

restorative dentistry, today reported financial results for the

fourth quarter ("Q4'22") and year ended December 31, 2022 ("2022").

Q4'22 total revenues were $901.5 million, up 1.3% sequentially and

down 12.6% year-over-year. Q4'22 Clear Aligner revenues were $731.7

million, flat sequentially and down 10.3% year-over-year. Q4'22

Clear Aligner volume was up 1.1% sequentially and down 7.5%

year-over-year. Q4'22 Imaging Systems and CAD/CAM Services revenues

were $169.9 million, up 7.8% sequentially and down 21.3%

year-over-year. Q4’22 Clear Aligner revenues were unfavorably

impacted by foreign exchange of approximately $13.4 million or 1.8%

sequentially and approximately $56.4 million or 7.2% year over

year.(1) Q4'22 Imaging Systems and CAD/CAM Services revenues were

unfavorably impacted by foreign exchange of approximately $2.7

million or 1.5% sequentially and approximately $11.2 million or

6.2% year over year.(1) Q4'22 operating income was $112.7 million

resulting in an operating margin of 12.5%. Q4'22 operating margin

was unfavorably impacted by foreign exchange of approximately 0.9

points sequentially and approximately 4.2 points year over year.(1)

Q4'22 net income was $41.8 million, or $0.54 per diluted share. On

a non-GAAP basis, Q4'22 net income was $134.2 million, or $1.73 per

diluted share. (3)

During Q4’22, we incurred a total of $14.3 million of

restructuring and other charges, of which $2.9 million was included

in cost of net revenues and $11.5 million included in operating

expenses. Restructuring and other charges included $8.7 million of

severance related costs and $5.6 million of certain lease

terminations costs and asset impairments.

2022 Clear Aligner revenues of $3.1 billion were unfavorably

impacted by foreign exchange of approximately $160.8 million or

5.0% compared to 2021.(1) 2022 Imaging Systems and CAD/CAM Services

revenues of $662.1 million were unfavorably impacted by foreign

exchange of approximately $33.0 million or 4.7% compared to

2021.(1)

In Q4’22, we changed to a long-term projected tax rate in our

computation of the non-GAAP income tax provision to provide better

consistency across reporting periods. Our previous methodology for

calculating our non-GAAP effective tax rate included certain

non-recurring and period-specific items, that produced fluctuating

effective tax rates that management does not believe are reflective

of the Company's long-term effective tax rate. We have recast all

prior periods in 2022 to reflect this change. We did not make any

changes to the results reported for 2021 as reflecting the change

in methodology for the computation of the non-GAAP effective tax

rate was immaterial to our 2021 results. Refer to the section

titled "Recast of Financial Measures for Prior Periods in 2022 for

Tax Rate Change" under Unaudited GAAP to Non-GAAP Reconciliation

for further information.

Commenting on Align's Q4'22 and 2022 results, Align Technology

President and CEO Joe Hogan said, “Overall, I’m pleased to report

fourth quarter results that reflect a more stable environment for

doctors and their patients than recent quarters, especially in the

Americas and EMEA regions, as well as most APAC markets outside of

China. Throughout Q4, trends in consumer interest for orthodontic

treatment, patient traffic in doctor’s practices, and iTero™

scanner demos continued to improve. However, the unfavorable effect

of foreign exchange on our fourth quarter and full year 2022

results was unprecedented and reduced our revenues and margins

significantly. Despite the impact of unfavorable foreign exchange,

Q4 revenues of $901.5 million increased sequentially from Q3,

reflecting growth in systems and services as well as a slight

increase in clear aligner shipments. This is the first quarter in a

year that our total revenues and volumes for both scanners and

clear aligners increased sequentially. As we move through 2023, I

am cautiously optimistic that we will see continued stability and

an improving operating environment, but also recognize that the

macroeconomic situation is fragile. Regardless, we remain confident

in our large, untapped market opportunity for digital orthodontics

and restorative dentistry. We anticipate that 2023 will be a very

exciting year for Align innovations as we begin to commercialize

one of the largest new product and technology cycles in our 25-year

history.”

(1) Non-GAAP measure (2) The contract was open as of Dec 31,

2022. (3) In Q4'22, we changed our methodology for the computation

of the non-GAAP effective tax rate to a long-term projected tax

rate and have given effect to the new methodology from January 1,

2022, and recast the previously reported quarterly periods in 2022.

We did not make any changes to the results reported for 2021 as

reflecting the change in methodology for the computation of the

non-GAAP effective tax rate was immaterial to our 2021 results.

Please see section captioned "Recast of Financial Measures for

Prior Periods In 2022 For Tax Rate Change" under "Unaudited GAAP to

Non-GAAP Reconciliation" for further information.

Financial Summary - Fourth Quarter

Fiscal 2022

Q4'22

Q3'22

Q4'21

Q/Q Change

Y/Y Change

Invisalign Case Shipments

583,655

577,170

631,145

+1.1

%

(7.5

)%

GAAP

Net Revenues

$

901.5M

$

890.3M

$

1,031.1M

+1.3

%

(12.6

)%

Clear Aligner

$

731.7M

$

732.8M

$

815.3M

(0.2

)%

(10.3

)%

Imaging Systems and CAD/CAM Services

$

169.9M

$

157.5M

$

215.8M

+7.8

%

(21.3

)%

Net Income

$

41.8M

$

72.7M

$

191.0M

(42.5

)%

(78.1

)%

Diluted EPS

$

0.54

$

0.93

$

2.40

($

0.39

)

($

1.86

)

Non-GAAP

Net Income(3)

$

134.2M

$

127.2M

$

224.5M

+5.5

%

(40.2

)%

Diluted EPS(3)

$

1.73

$

1.63

$

2.83

+$0.10

($

1.10

)

Financial Summary - Fiscal

2022

2022

2021

Y/Y Change

Invisalign Case Shipments

2,358,645

2,547,685

(7.4

)%

GAAP

Net Revenues

$

3,734.6M

$

3,952.6M

(5.5

)%

Clear Aligner

$

3,072.6M

$

3,247.1M

(5.4

)%

Imaging Systems and CAD/CAM Services

$

662.1M

$

705.5M

(6.2

)%

Net Income

$

361.6M

$

772.0M

(53.2

)%

Diluted EPS

$

4.61

$

9.69

($

5.08

)

Non-GAAP

Net Income(3)

$

608.2M

$

893.5M

(31.9

)%

Diluted EPS(3)

$

7.76

$

11.22

($

3.46

)

(3) In Q4'22, we changed our methodology

for the computation of the non-GAAP effective tax rate to a

long-term projected tax rate and have given effect to the new

methodology from January 1, 2022, and recast the previously

reported quarterly periods in 2022. We did not make any changes to

the results reported for 2021 as reflecting the change in

methodology for the computation of the non-GAAP effective tax rate

was immaterial to our 2021 results. Please see section captioned

"Recast of Financial Measures for Prior Periods In 2022 For Tax

Rate Change" under "Unaudited GAAP to Non-GAAP Reconciliation" for

further information.

As of December 31, 2022, we had over $1.0 billion in cash, cash

equivalents and short-term and long-term marketable securities

compared to over $1.1 billion as of September 30, 2022. As of

December 31, 2022, we had $300.0 million available under a

revolving line of credit which was amended during Q4'22 to extend

the term through 2027. In October 2022, we purchased approximately

848 thousand shares of our common stock at an average price of

$188.62 per share through a $200.0 million Accelerated Share

Repurchase under our May 13, 2021 $1.0 billion Stock Repurchase

Program. We have $250.0 million remaining available for repurchase

under this program and we plan to repurchase this remaining amount

starting in Q1 2023 through either, or a combination of, open

market repurchases or an accelerated stock repurchase agreement,

and entirely completing this $1.0 Billion Stock Repurchase Program

in Q2 2023.

Commenting on Align's 2022 results, Align Technology CFO and EVP

Global Finance, John Morici said, “We remain focused on expanding

our technology and industry leadership, while making disciplined

investments in our strategic growth drivers. We exited fiscal year

2022 with a strong balance sheet, including $1 billion in cash and

investments, a healthy cash flow position and no long-term debt. We

are pleased to announce that our Board of Directors has authorized

a new $1 billion stock repurchase program to succeed the current $1

billion program. This new $1 billion program reflects the strength

of our balance sheet and cash flow generation, as well as

management’s and our Board's continued confidence in our ability to

capitalize on large market opportunities in our target markets and

trajectory for growth while concurrently returning capital to our

stockholders.”

Q4'22 Announcement

Highlights

- On October 3, 2022, we announced the latest release of the

iTero-exocad Connector™, which integrates iTero™ intraoral camera

and Near-infrared imaging ("NIRI") images within exocad DentalCAD

3.1 Rijeka software. This new integration, introduced at the exocad

Insights 2022 event in Mallorca, Spain, is designed to support the

goal of a seamless, end-to-end workflow for doctors and lab

technicians. It optimizes design and fabrication of highly esthetic

restorations by providing the ability for dental professionals to

visualize the internal and external structure of teeth.

- On October 31, 2022, we announced that we entered into a new

accelerated stock repurchase agreement with Goldman Sachs & Co.

LLC, to repurchase $200 million of our common stock under our May

13, 2021, $1.0 billion Stock Repurchase Program.

- On November 3, 2022, we announced a strategic collaboration to

supply iTero Element™ Flex intraoral scanners to Desktop Labs

allowing it to connect general dentist locations with its growing

network of premium full-service labs. We noted that the iTero

Element Flex intraoral scanner will be the exclusive restorative

scanner for Desktop Labs, one of the largest lab networks in the

United States.

- On November 7, 2022, we announced the opening of Align's 2023

Research Award Program to support clinical and scientific dental

research in universities across the globe. In 2023, up to $300,000

will be awarded to university faculty for scientific and

technological research initiatives to advance patient care in the

fields of orthodontics and dentistry. Align Technology’s Research

Award Program has funded approximately $2.7 million in research

since the program’s inception in 2010.

Fiscal 2023 Business

Outlook

For 2023, Align provides the following business outlook:

- We are pleased with our Q4 results and what appears to be a

more stable operating environment in North America, EMEA. We are

cautiously optimistic for continued stability and improving trends

as we move through the year. However, the macroeconomic environment

remains fragile and given continued global challenges and

uncertainty, we are not providing full year revenue guidance. We

would like to see improvements in the operating environment and

consumer demand signals, including stability in China before

revisiting our approach.

- At the same time, we are confident in our large, untapped

market opportunity for digital orthodontics and restorative

dentistry and our ability to make progress toward our strategic

initiatives. We intend to focus on the things we can control and

influence which includes strategic investments in sales, marketing,

technology and innovation.

- For full year 2023, assuming no additional material disruptions

or circumstances beyond our control, we anticipate 2023 GAAP

operating margin to be slightly above 16% and expect our 2023

non-GAAP operating margin to be slightly above 20%.

- With this backdrop, for Q1 2023, we anticipate clear aligner

volumes to be down sequentially primarily due to weakness in China

from COVID, partially offset by some stability from our Americas

and EMEA regions. We anticipate clear aligner ASPs to be up from

Q4’22 primarily due to higher pricing and favorable foreign

exchange rates. We anticipate iTero scanner and services revenue to

be down sequentially as the business follows a more typical capital

equipment cycle.

- Taken in total, we expect Q1’23 revenues to be about flat to

Q4’22. We expect our Q1’23 GAAP operating margin to be up

approximately 1% point from Q4’22 GAAP operating margin and expect

our Q1’23 non-GAAP operating margin to be consistent with Q4’22

non-GAAP operating margin, as we continue to make investments in

R&D and go-to-market activities.

- For 2023, we expect our investments in capital expenditures to

exceed $200 million. Capital expenditures primarily relate to

building construction and improvements as well as additional

manufacturing capacity to support our international expansion.

Align Web Cast and Conference

Call

We will host a conference call today, February 1, 2023, at 4:30

p.m. ET, 1:30 p.m. PT, to review our fourth quarter and full year

2022 results, discuss future operating trends, and our business

outlook. The conference call will also be webcast live via the

Internet. To access the webcast, go to the "Events &

Presentations" section under Company Information on Align's

Investor Relations website at http://investor.aligntech.com. To

access the conference call, please dial 844-200-6205 with access

code 659082. An archived audio webcast will be available beginning

approximately one hour after the call's conclusion and will remain

available for approximately one month. Additionally, a telephonic

replay of the call can be accessed by dialing 866-813-9403 with

access code 328900. For international callers, please dial

929-458-6194 and use the same access code referenced above. The

telephonic replay will be available through 5:30 p.m. ET on

February 15, 2023.

About Non-GAAP Financial

Measures

To supplement our condensed consolidated financial statements,

which are prepared and presented in accordance with generally

accepted accounting principles in the United States ("GAAP"), we

may provide investors with certain non-GAAP financial measures

which may include constant currency net revenues, constant currency

gross profit, constant currency gross margin, constant currency

income from operations, constant currency operating margin, gross

profit, gross margin, operating expenses, income from operations,

operating margin, interest income and other income (expense), net,

net income before provision for income taxes, provision for income

taxes, effective tax rate, net income and/or diluted net income per

share, which excludes certain items that may not be indicative of

our fundamental operating performance including, foreign currency

exchange rate impacts and discrete cash and non-cash charges or

gains that are included in the most directly comparable GAAP

measure. In Q4'22, we changed to a long-term non-GAAP effective tax

rate in our computation of the non-GAAP income tax provision to

provide better consistency across reporting periods. Our previous

methodology for calculating our non-GAAP effective tax rate

included certain non-recurring and period-specific items, that

produced fluctuating effective tax rates that management does not

believe are reflective of the Company's long-term effective tax

rate. We have given effect to this new methodology effective

January 1, 2022 and recast prior periods in 2022. No changes have

been made to 2021, as reflecting the change in methodology for the

computation of the non-GAAP effective tax rate was immaterial to

our 2021 results. Unless otherwise indicated, when we refer to

non-GAAP financial measures they will exclude the effects of

stock-based compensation, amortization of certain acquired

intangibles, restructuring and other charges, acquisition-related

costs, and arbitration award gain, and associated tax impacts.

Our management believes that the use of certain non-GAAP

financial measures provides meaningful supplemental information

regarding our recurring core operating performance. We believe that

both management and investors benefit from referring to these

non-GAAP financial measures in assessing our performance and when

planning, forecasting, and analyzing future periods. We believe

these non-GAAP financial measures are useful to investors both

because (1) they allow for greater transparency with respect to key

metrics used by management in its financial and operational

decision-making and (2) they are used by our institutional

investors and the analyst community to help them analyze the

performance of our business.

There are limitations to using non-GAAP financial measures as

they are not prepared in accordance with GAAP and may be different

from non-GAAP financial measures used by other companies. The

non-GAAP financial measures are limited in value because they

exclude certain items that may have a material impact upon our

reported financial results. In addition, they are subject to

inherent limitations as they reflect the exercise of judgments by

management about which charges are excluded from the non-GAAP

financial measures. We compensate for these limitations by

analyzing current and future results on a GAAP as well as a

non-GAAP basis and also by providing GAAP measures in our public

disclosures. The presentation of non-GAAP financial information is

meant to be considered in addition to, not as a substitute for or

in isolation from, the directly comparable financial measures

prepared in accordance with GAAP. We urge investors to review the

reconciliation of our GAAP financial measures to the comparable

non-GAAP financial measures included herein and not to rely on any

single financial measure to evaluate our business. For more

information on these non-GAAP financial measures, please see the

tables captioned "Unaudited GAAP to Non-GAAP Reconciliation."

About Align Technology,

Inc.

Align Technology designs and manufactures the Invisalign®

system, the most advanced clear aligner system in the world, iTero™

intraoral scanners and services, and exocad™ CAD/CAM software.

These technology building blocks enable enhanced digital

orthodontic and restorative workflows to improve patient outcomes

and practice efficiencies for over 239 thousand doctor customers

and are key to accessing Align’s 500 million consumer market

opportunity worldwide. Over the past 25 years, Align has helped

doctors treat over 14.5 million patients with the Invisalign system

and is driving the evolution in digital dentistry through the Align

Digital Platform™, our integrated suite of unique, proprietary

technologies and services delivered as a seamless, end-to-end

solution for patients and consumers, orthodontists and GP dentists,

and lab/partners. Visit www.aligntech.com for more information.

For additional information about the Invisalign system or to

find an Invisalign doctor in your area, please visit

www.invisalign.com. For additional information about the iTero

digital scanning system, please visit www.itero.com. For additional

information about exocad dental CAD/CAM offerings and a list of

exocad reseller partners, please visit www.exocad.com.

Invisalign, iTero, exocad, Align, Align Digital Platform, iTero

Element and iTero-exocad Connector are trademarks of Align

Technology, Inc.

Forward-Looking

Statements

This news release, including the tables below, contains

forward-looking statements, including statements of beliefs and

expectations regarding anticipated capital expenditures,

anticipated clear aligner volumes, clear aligner ASPs, iTero

scanner and services revenue, total revenues and operating margin,

customer and consumer demand trends and market opportunities, our

ability to successfully control our business and operations and

pursue our strategic growth drivers, our expectations regarding the

timing and impact of new products and technologies, our beliefs for

the impacts of our stock repurchase programs and our ability to

generate cash flow, and our beliefs regarding the trajectory of our

business. Forward-looking statements contained in this news release

relating to expectations about future events or results are based

upon information available to Align as of the date hereof. Readers

are cautioned that these forward-looking statements reflect our

best judgments based on currently known facts and circumstances and

are subject to risks, uncertainties, and assumptions that are

difficult to predict. As a result, actual results may differ

materially and adversely from those expressed in any

forward-looking statement.

Factors that might cause such a difference include, but are not

limited to:

- macroeconomic conditions, including inflation, fluctuations in

currency exchange rates, rising interest rates, market volatility,

weakness in general economic conditions and recessions and the

impact of efforts by central banks and federal, state and local

governments to combat inflation and recession;

- customer and consumer purchasing behavior and changes in

consumer spending habits as a result of, among other things,

prevailing macro-economic conditions, levels of employment,

salaries and wages, debt obligations, discretionary income,

inflationary pressure, declining consumer confidence, and the

military conflict in Ukraine;

- the impact of the COVID-19 pandemic and its variants on the

health and safety of our employees, customers, patients, and our

suppliers, as well as the physical and economic impacts of the

various recommendations, orders, and protocols issued by local and

national governmental agencies in light of continual evolution of

the pandemic, including any periodic reimplementation of

preventative measures in various global locations;

- the economic and geopolitical ramifications of the military

conflict in Ukraine, including sanctions, retaliatory sanctions,

nationalism, supply chain disruptions and other consequences, any

of which may or will continue to adversely impact our operations

and research and development activities inside and outside of

Russia;

- variations in our product mix and selling prices regionally and

globally;

- the timing and availability and cost of raw materials,

components, products and other shipping and supply chain

constraints;

- unexpected or rapid changes in the growth or decline of our

domestic and/or international markets;

- competition from existing and new competitors;

- rapidly evolving and groundbreaking advances that fundamentally

alter the dental industry or the way new and existing customers

market and provide products and services to consumers;

- the ability to protect our intellectual property rights;

- continued compliance with regulatory requirements;

- declines in, or the slowing of the growth of, sales of our

clear aligners and intraoral scanners domestically and/or

internationally and the impact either would have on the adoption of

Invisalign products;

- the willingness and ability of our customers to maintain and/or

increase product utilization in sufficient numbers;

- the possibility that the development and release of new

products or enhancements to existing products do not proceed in

accordance with the anticipated timeline or may themselves contain

bugs, errors or defects in software or hardware requiring

remediation and that the market for the sale of these new or

enhanced products may not develop as expected;

- a tougher consumer demand environment in China generally,

especially for manufacturers and service providers whose

headquarters or primary operations are not based in China;

- the risks relating to our ability to sustain or increase

profitability or revenue growth in future periods (or minimize

declines) while controlling expenses;

- expansion of our business and products;

- the impact of excess or constrained capacity at our

manufacturing and treat operations facilities and pressure on our

internal systems and personnel;

- the compromise of our systems or networks, including any

customer and/or patient data contained therein, for any

reason;

- the timing of case submissions from our doctor customers within

a quarter as well as an increased manufacturing costs per

case;

- foreign operational, political, military and other risks

relating to our operations; and

- the loss of key personnel, labor shortages or work stoppages

for us or our suppliers.

The foregoing and other risks are detailed from time to time in

our periodic reports filed with the Securities and Exchange

Commission, including, but not limited to, our Annual Report on

Form 10-K for the year ended December 31, 2021, which was filed

with the Securities and Exchange Commission ("SEC") on February 25,

2022 and our latest Quarterly Report on Form 10-Q for the quarter

ended September 30, 2022, which was filed with the SEC on November

4, 2022. Align undertakes no obligation to revise or update

publicly any forward-looking statements for any reason.

ALIGN TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per share data)

Three Months Ended December

31,

Year Ended

December 31,

2022

2021

2022

2021

Net revenues

$

901,515

$

1,031,099

$

3,734,635

$

3,952,584

Cost of net revenues

283,814

286,536

1,100,860

1,017,229

Gross profit

617,701

744,563

2,633,775

2,935,355

Operating expenses:

Selling, general and administrative

410,067

451,195

1,674,469

1,708,640

Research and development

83,520

72,476

305,258

250,315

Restructuring and other charges

11,453

—

11,453

—

Total operating expenses

505,040

523,671

1,991,180

1,958,955

Income from operations

112,661

220,892

642,595

976,400

Interest income and other income

(expense), net:

Interest income

2,760

676

5,367

3,103

Other income (expense), net

(100

)

(1,556

)

(48,905

)

32,920

Total interest income and other income

(expense), net

2,660

(880

)

(43,538

)

36,023

Net income before provision for income

taxes

115,321

220,012

599,057

1,012,423

Provision for income taxes

73,546

29,051

237,484

240,403

Net income

$

41,775

$

190,961

$

361,573

$

772,020

Net income per share:

Basic

$

0.54

$

2.42

$

4.62

$

9.78

Diluted

$

0.54

$

2.40

$

4.61

$

9.69

Shares used in computing net income per

share:

Basic

77,541

78,759

78,190

78,917

Diluted

77,683

79,431

78,420

79,670

ALIGN TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

December 31,

2022

December 31,

2021

ASSETS

Current assets:

Cash and cash equivalents

$

942,050

$

1,099,370

Marketable securities, short-term

57,534

71,972

Accounts receivable, net

859,685

897,198

Inventories

338,752

230,230

Prepaid expenses and other current

assets

226,370

195,305

Total current assets

2,424,391

2,494,075

Marketable securities, long-term

41,978

125,320

Property, plant and equipment, net

1,231,855

1,081,926

Operating lease right-of-use assets,

net

118,880

121,257

Goodwill

407,551

418,547

Intangible assets, net

95,720

109,709

Deferred tax assets

1,571,746

1,533,767

Other assets

55,826

57,509

Total assets

$

5,947,947

$

5,942,110

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

127,870

$

163,886

Accrued liabilities

454,374

607,315

Deferred revenues

1,343,643

1,152,870

Total current liabilities

1,925,887

1,924,071

Income tax payable

124,393

118,072

Operating lease liabilities

100,334

102,656

Other long-term liabilities

195,975

174,597

Total liabilities

2,346,589

2,319,396

Total stockholders’ equity

3,601,358

3,622,714

Total liabilities and stockholders’

equity

$

5,947,947

$

5,942,110

ALIGN TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

Year Ended December

31,

2022

2021

CASH FLOWS FROM OPERATING

ACTIVITIES

Net cash provided by operating

activities

$

568,732

$

1,172,544

CASH FLOWS FROM INVESTING

ACTIVITIES

Net cash used in investing activities

(213,316

)

(563,430

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Net cash used in financing activities

(501,686

)

(458,332

)

Effect of foreign exchange rate changes on

cash, cash equivalents, and restricted cash

(11,514

)

(12,117

)

Net (decrease) increase in cash, cash

equivalents, and restricted cash

(157,784

)

138,665

Cash, cash equivalents, and restricted

cash at beginning of the period

1,100,139

961,474

Cash, cash equivalents, and restricted

cash at end of the period

$

942,355

$

1,100,139

ALIGN TECHNOLOGY, INC.

INVISALIGN BUSINESS METRICS

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

2021

2021

2021

2021

2022

2022

2022

2022

Invisalign Average Selling Price

(ASP)

$

1,195

$

1,185

$

1,195

$

1,200

$

1,250

$

1,220

$

1,150

$

1,140

Number of Invisalign Trained Doctors

Cases Were Shipped To

78,605

83,465

85,500

83,540

82,440

82,275

84,410

82,865

Invisalign Trained Doctor Utilization

Rates*:

North America

9.1

9.9

9.8

9.3

9.2

9.3

8.9

8.8

North American Orthodontists

26.8

29.4

29.7

26.9

26.8

26.8

25.9

24.8

North American GP Dentists

4.8

5.3

5.0

5.1

5.0

5.1

4.8

5.0

International

6.8

7.1

6.5

6.8

6.4

6.4

6.0

6.5

Total Utilization Rates**

7.6

8.0

7.7

7.6

7.3

7.3

6.8

7.0

Clear Aligner Revenue Per Case

Shipment***:

$

1,265

$

1,265

$

1,280

$

1,290

$

1,350

$

1,335

$

1,270

1,255

* # of cases shipped / # of doctors to

whom cases were shipped

** LATAM utilization rate is not

separately disclosed but included in the total utilization

rates

*** Clear Aligner revenues / Case

shipments

ALIGN TECHNOLOGY, INC.

STOCK-BASED COMPENSATION

(in thousands)

Q1

Q2

Q3

Q4

Fiscal

Q1

Q2

Q3

Q4

Fiscal

2021

2021

2021

2021

2021

2022

2022

2022

2022

2022

Stock-based Compensation (SBC):

SBC included in Gross Profit

$

1,306

$

1,418

$

1,451

$

1,458

$

5,633

$

1,514

$

1,614

$

1,651

$

1,659

$

6,438

SBC included in Operating Expenses

25,935

27,437

26,951

28,380

108,703

30,107

32,526

31,267

33,029

$

126,929

Total SBC

$

27,241

$

28,855

$

28,402

$

29,838

$

114,336

$

31,621

$

34,140

$

32,918

$

34,688

$

133,367

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP

RECONCILIATION

CONSTANT CURRENCY NET REVENUES

(in thousands, except percentages)

Sequential constant currency analysis:

Three Months Ended

December 31, 2022

September 30,

2022

Impact % of Revenue

GAAP net revenues

$

901,515

$

890,348

Constant currency impact (1)

16,023

1.7

%

Constant currency net revenues

(1)

$

917,538

GAAP Clear Aligner net revenues

$

731,654

$

732,837

Clear Aligner constant currency impact

(1)

13,362

1.8

%

Clear Aligner constant currency net

revenues (1)

$

745,016

GAAP Imaging Systems and CAD/CAM

Services net revenues

$

169,861

$

157,511

Imaging Systems and CAD/CAM Services

constant currency impact (1)

2,661

1.5

%

Imaging Systems and CAD/CAM Services

constant currency net revenues (1)

$

172,522

Year-over-year constant currency

analysis:

Three Months Ended

December 31,

2022

2021

Impact % of

Revenue

GAAP net revenues

$

901,515

$

1,031,099

Constant currency impact (1)

67,588

7.0

%

Constant currency net revenues

(1)

$

969,103

GAAP Clear Aligner net revenues

$

731,654

$

815,259

Clear Aligner constant currency impact

(1)

56,387

7.2

%

Clear Aligner constant currency net

revenues (1)

$

788,041

GAAP Imaging Systems and CAD/CAM

Services net revenues

$

169,861

$

215,840

Imaging Systems and CAD/CAM Services

constant currency impact (1)

11,201

6.2

%

Imaging Systems and CAD/CAM Services

constant currency net revenues (1)

$

181,062

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED

CONSTANT CURRENCY NET REVENUES

CONTINUED

(in thousands, except percentages)

Current year versus prior year constant

currency analysis:

Year Ended December

31,

2022

2021

Impact % of Revenue

GAAP net revenues

$

3,734,635

$

3,952,584

Constant currency impact (1)

193,797

4.9

%

Constant currency net revenues

(1)

$

3,928,432

GAAP Clear Aligner net revenues

$

3,072,585

$

3,247,080

Clear Aligner constant currency impact

(1)

160,804

5.0

%

Clear Aligner constant currency net

revenues (1)

$

3,233,389

GAAP Imaging Systems and CAD/CAM

Services net revenues

$

662,050

$

705,504

Imaging Systems and CAD/CAM Services

constant currency impact (1)

32,993

4.7

%

Imaging Systems and CAD/CAM Services

constant currency net revenues (1)

$

695,043

Note:

(1)

We define constant currency net revenues

as total net revenues excluding the effect of foreign exchange rate

movements and use it to determine the percentage for the constant

currency impact on net revenues on a sequential, year-over-year and

current year versus prior year basis. Constant currency impact in

dollars is calculated by translating the current period GAAP net

revenues using the foreign currency exchange rates that were in

effect during the previous comparable period and subtracting it by

the current period GAAP net revenues. The percentage for the

constant currency impact on net revenues is calculated by dividing

the constant currency impact in dollars (numerator) by constant

currency net revenues in dollars (denominator). Refer to "About

Non-GAAP Financial Measures" section of press release.

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED

CONSTANT CURRENCY GROSS PROFIT AND GROSS

MARGIN

(in thousands, except percentages)

Sequential constant currency analysis:

Three Months Ended

December 31, 2022

September 30,

2022

GAAP gross profit

$

617,701

$

619,169

Constant currency impact on net

revenues

16,023

Constant currency gross profit

$

633,724

Three Months Ended

December 31, 2022

September 30,

2022

GAAP gross margin

68.5

%

69.5

%

Gross margin constant currency impact

(1)

0.6

Constant currency gross margin

(1)

69.1

%

Year-over-year constant currency

analysis:

Three Months Ended

December 31,

2022

2021

GAAP gross profit

$

617,701

$

744,563

Constant currency impact on net

revenues

67,588

Constant currency gross profit

$

685,289

Three Months Ended

December 30,

2022

2021

GAAP gross margin

68.5

%

72.2

%

Gross margin constant currency impact

(1)

2.2

Constant currency gross margin

(1)

70.7

%

Note:

(1)

We define constant currency gross margin

as constant currency gross profit as a percentage of constant

currency net revenues. Gross margin constant currency impact is the

increase or decrease in constant currency gross margin compared to

the GAAP gross margin.

Refer to "About Non-GAAP Financial

Measures" section of press release.

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED

CONSTANT CURRENCY INCOME FROM OPERATIONS

AND OPERATING MARGIN

(in thousands, except percentages)

Sequential constant currency analysis:

Three Months Ended

December 31, 2022

September 30,

2022

GAAP income from operations

$

112,661

$

143,656

Income from operations constant currency

impact (1)

10,698

Constant currency income from

operations (1)

$

123,359

Three Months Ended

December 31, 2022

September 30,

2022

GAAP operating margin

12.5

%

16.1

%

Operating margin constant currency impact

(2)

0.9

Constant currency operating margin

(2)

13.4

%

Year-over-year constant currency

analysis:

Three Months Ended

December 31,

2022

2021

GAAP income from operations

$

112,661

$

220,892

Income from operations constant currency

impact (1)

49,320

Constant currency income from

operations (1)

$

161,981

Three Months Ended

December 31,

2022

2021

GAAP operating margin

12.5

%

21.4

%

Operating margin constant currency impact

(2)

4.2

Constant currency operating margin

(2)

16.7

%

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED

CONSTANT CURRENCY INCOME FROM OPERATIONS

AND OPERATING MARGIN CONTINUED

(in thousands, except percentages)

Current year versus prior year constant

currency analysis:

Year Ended December

31,

2022

2021

GAAP income from operations

$

642,595

$

976,400

Income from operations constant currency

impact (1)

144,079

Constant currency income from

operations (1)

$

786,674

Year Ended December

31,

2022

2021

GAAP operating margin

17.2

%

24.7

%

Operating margin constant currency impact

(2)

2.8

Constant currency operating margin

(2)

20.0

%

Notes:

(1)

We define constant currency income from

operations as GAAP income from operations excluding the effect of

foreign exchange rate movements for GAAP net revenues and operating

expenses on a sequential, year-over-year and current year versus

prior year basis. Constant currency impact in dollars is calculated

by translating the current period GAAP net revenues and operating

expenses using the foreign currency exchange rates that were in

effect during the previous comparable period and subtracting it by

the current period GAAP net revenues and operating expenses.

(2)

We define constant currency operating

margin as constant currency income from operations as a percentage

of constant currency net revenues. Operating margin constant

currency impact is the increase or decrease in constant currency

operating margin compared to the GAAP operating margin.

Refer to "About Non-GAAP Financial

Measures" section of press release.

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED

FINANCIAL MEASURES OTHER THAN CONSTANT

CURRENCY

(in thousands, except per share data)

Three Months Ended December

31,

Year Ended

December 31,

2022

2021

2022

2021

GAAP gross profit

$

617,701

$

744,563

$

2,633,775

$

2,935,355

Stock-based compensation

1,659

1,458

6,438

5,633

Amortization of intangibles (1)

2,610

2,798

10,134

9,502

Restructuring charges (2)

2,866

—

2,866

—

Non-GAAP gross profit

$

624,836

$

748,819

$

2,653,213

$

2,950,490

GAAP gross margin

68.5

%

72.2

%

70.5

%

74.3

%

Non-GAAP gross margin

69.3

%

72.6

%

71.0

%

74.6

%

GAAP total operating expenses

$

505,040

$

523,671

$

1,991,180

$

1,958,955

Stock-based compensation

(33,029

)

(28,380

)

(126,929

)

(108,703

)

Amortization of intangibles (1)

(810

)

(933

)

(3,417

)

(3,668

)

Restructuring and other charges (3)

(11,453

)

—

(11,453

)

—

Acquisition-related costs (4)

—

—

—

(104

)

Non-GAAP total operating

expenses

$

459,748

$

494,358

$

1,849,381

$

1,846,480

GAAP income from operations

$

112,661

$

220,892

$

642,595

$

976,400

Stock-based compensation

34,688

29,838

133,367

114,336

Amortization of intangibles (1)

3,420

3,731

13,551

13,170

Restructuring and other charges

(2),(3)

14,319

—

14,319

—

Acquisition-related costs (4)

—

—

—

104

Non-GAAP income from operations

$

165,088

$

254,461

$

803,832

$

1,104,010

GAAP operating margin

12.5

%

21.4

%

17.2

%

24.7

%

Non-GAAP operating margin

18.3

%

24.7

%

21.5

%

27.9

%

GAAP total interest income and other

income (expense), net

$

2,660

$

(880

)

$

(43,538

)

$

36,023

Arbitration award gain (5)

—

—

—

(43,403

)

Non-GAAP total interest income and

other income (expense), net

$

2,660

$

(880

)

$

(43,538

)

$

(7,380

)

GAAP net income before provision for

income taxes

$

115,321

$

220,012

$

599,057

$

1,012,423

Stock-based compensation

34,688

29,838

133,367

114,336

Amortization of intangibles (1)

3,420

3,731

13,551

13,170

Restructuring and other charges

(2),(3)

14,319

—

14,319

—

Acquisition-related costs (4)

—

—

—

104

Arbitration award gain (5)

—

—

—

(43,403

)

Non-GAAP net income before provision

for income taxes

$

167,748

$

253,581

$

760,294

$

1,096,630

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED

FINANCIAL MEASURES OTHER THAN CONSTANT

CURRENCY CONTINUED

(in thousands, except per share data)

Three Months Ended December

31,

Year Ended

December 31,

2022

2021

2022

2021

GAAP provision for income taxes

$

73,546

$

29,051

$

237,484

$

240,403

Tax impact on non-GAAP adjustments (6)

(39,997

)

49

(85,426

)

(37,312

)

Non-GAAP provision for income taxes

(6)

$

33,549

$

29,100

$

152,058

$

203,091

GAAP effective tax rate

63.8

%

13.2

%

39.6

%

23.7

%

Non-GAAP effective tax rate (6)

20.0

%

11.5

%

20.0

%

18.5

%

GAAP net income

$

41,775

$

190,961

$

361,573

$

772,020

Stock-based compensation

34,688

29,838

133,367

114,336

Amortization of intangibles (1)

3,420

3,731

13,551

13,170

Restructuring and other charges

(2),(3)

14,319

—

14,319

—

Acquisition-related costs (4)

—

—

—

104

Arbitration award gain (5)

—

—

—

(43,403

)

Tax impact on non-GAAP adjustments (6)

39,997

(49

)

85,426

37,312

Non-GAAP net income (6)

$

134,199

$

224,481

$

608,236

$

893,539

GAAP diluted net income per

share

$

0.54

$

2.40

$

4.61

$

9.69

Non-GAAP diluted net income per share

(6)

$

1.73

$

2.83

$

7.76

$

11.22

Shares used in computing diluted net

income per share

77,683

79,431

78,420

79,670

Notes:

(1)

Amortization of intangible assets related

to certain acquisitions

(2)

During the fourth quarter of 2022, we

initiated a restructuring plan to increase efficiencies across the

organization and lower the overall cost structure. Restructuring

charges recorded to Cost of net revenues relate primarily to

severance costs and impairment charges.

(3)

Restructuring and other charges recorded

to Operating expenses primarily relate to severance costs, lease

termination charges and asset impairments.

(4)

Acquisition-related costs for professional

fees related to our 2020 exocad acquisition

(5)

Gain from the SDC arbitration award

regarding the value of Align's capital account balance

(6)

In Q4'22, we changed our methodology for

the computation of the non-GAAP effective tax rate to a long-term

projected tax rate and have given effect to the new methodology

from January 1, 2022, and recast previously reported quarterly

periods in 2022. We did not make any changes to the results

reported for 2021 as reflecting the change in methodology for the

computation of the non-GAAP effective tax rate was immaterial to

our 2021 results. Please see section captioned "Recast of Financial

Measures for Prior Periods In 2022 For Tax Rate Change" under

"Unaudited GAAP to Non-GAAP Reconciliation" for further

information.

Refer to "About Non-GAAP Financial Measures" section of press

release.

ALIGN TECHNOLOGY, INC. UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED RECAST OF FINANCIAL MEASURES FOR PRIOR PERIODS IN 2022

FOR TAX RATE CHANGE (in thousands, except per share data)

In Q4'22, we changed our methodology for the computation of the

non-GAAP effective tax rate to a long-term projected tax rate as

our management believes shifting to a long-term projected tax rate

provides better consistency across reporting periods. Our previous

methodology for calculating non-GAAP effective tax rate included

certain non-recurring and period-specific items that produced,

between periods, results management does not believe are reflective

of the Company's long-term effective tax rate. We have given effect

to the new methodology effective January 1, 2022, and recast the

previously reported quarterly periods in 2022 relating to the

Non-GAAP provision for income taxes, Non-GAAP effective tax rate,

Non-GAAP net income and Non-GAAP diluted net income per share. We

used a projected non-GAAP effective tax rate of 20% for 2022, and

expect to use the same rate for 2023. The non-GAAP effective tax

rate could be subject to change for a variety of reasons, including

the evolving global tax environment, significant changes to our

geographic earnings mix, or other changes to our strategy or

business operations. We will re-evaluate the long-term projected

tax rate as appropriate. No changes were made to the results

reported for 2021, as reflecting the change in methodology for the

computation of the non-GAAP effective tax rate would have been

immaterial to our 2021 results.

For the convenience of the reader, we have presented the

relevant sections of the GAAP to non-GAAP reconciliation, for all

the quarterly periods in 2022, both before and after the non-GAAP

effective tax rate methodology change described above.

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED

RECAST OF FINANCIAL MEASURES FOR PRIOR

PERIODS IN 2022 FOR TAX RATE CHANGE CONTINUED

(in thousands, except per share data)

Table below shows the information

before the tax rate change:

Three Months Ended

Three Months Ended

Six Months

Ended

Three Months Ended

Nine Months Ended

Three Months Ended

Year Ended

March 31, 2022

June 30, 2022

September 30, 2022

December 31, 2022

GAAP provision for income taxes

$

53,188

$

60,809

$

113,997

$

49,941

$

163,938

$

73,546

$

237,484

Tax impact on non-GAAP adjustments

10,788

4,317

15,105

3,300

18,405

22,531

40,936

Tax related non-GAAP items

(10,169

)

(11,065

)

(21,234

)

(682

)

(21,916

)

(18,568

)

(40,484

)

Non-GAAP provision for income

taxes

$

53,807

$

54,061

$

107,868

$

52,559

$

160,427

$

77,509

$

237,936

GAAP effective tax rate

28.4

%

35.0

%

31.6

%

40.7

%

33.9

%

63.8

%

39.6

%

Non-GAAP effective tax rate

24.2

%

25.6

%

24.9

%

33.1

%

27.1

%

46.2

%

31.3

%

GAAP net income

$

134,298

$

112,800

$

247,098

$

72,700

$

319,798

$

41,775

$

361,573

Stock-based compensation

31,621

34,140

65,761

32,918

98,679

34,688

133,367

Amortization of intangibles

3,397

3,265

6,662

3,469

10,131

3,420

13,551

Restructuring and other charges

—

—

—

—

—

14,319

14,319

Tax impact on non-GAAP adjustments

(10,788

)

(4,317

)

(15,105

)

(3,300

)

(18,405

)

(22,531

)

(40,936

)

Tax related non-GAAP items

10,169

11,065

21,234

682

21,916

18,568

40,484

Non-GAAP net income

$

168,697

$

156,953

$

325,650

$

106,469

$

432,119

$

90,239

$

522,358

GAAP diluted net income per

share

$

1.70

$

1.44

$

3.13

$

0.93

$

4.07

$

0.54

$

4.61

Non-GAAP diluted net income per

share

$

2.13

$

2.00

$

4.13

$

1.36

$

5.49

$

1.16

$

6.66

Shares used in computing diluted net

income per share

79,193

78,545

78,840

78,237

78,652

77,683

78,420

Refer to "About Non-GAAP Financial Measures" section of press

release.

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED

RECAST OF FINANCIAL MEASURES FOR PRIOR

PERIODS IN 2022 FOR TAX RATE CHANGE CONTINUED

(in thousands, except per share data)

Table below shows the information after

the tax rate change:

Three Months Ended

Three Months Ended

Six Months

Ended

Three Months Ended

Nine Months Ended

Three Months Ended

Year Ended

March 31, 2022

June 30, 2022

September 30, 2022

December 31, 2022

GAAP provision for income taxes

$

53,188

$

60,809

$

113,997

$

49,941

$

163,938

$

73,546

237,484

Tax impact on non-GAAP adjustments

(8,687

)

(18,606

)

(27,293

)

(18,136

)

(45,429

)

(39,997

)

(85,426

)

Non-GAAP provision for income

taxes

$

44,501

$

42,203

$

86,704

$

31,805

$

118,509

$

33,549

$

152,058

GAAP effective tax rate

28.4

%

35.0

%

31.6

%

40.7

%

33.9

%

63.8

%

39.6

%

Non-GAAP effective tax rate

20.0

%

20.0

%

20.0

%

20.0

%

20.0

%

20.0

%

20.0

%

GAAP net income

$

134,298

$

112,800

$

247,098

$

72,700

$

319,798

$

41,775

$

361,573

Stock-based compensation

31,621

34,140

65,761

32,918

98,679

34,688

133,367

Amortization of intangibles

3,397

3,265

6,662

3,469

10,131

3,420

13,551

Restructuring and other charges

—

—

—

—

—

14,319

14,319

Tax impact on non-GAAP adjustments

8,687

18,606

27,293

18,136

45,429

39,997

85,426

Non-GAAP net income

$

178,003

$

168,811

$

346,814

$

127,223

$

474,037

$

134,199

$

608,236

GAAP diluted net income per

share

$

1.70

$

1.44

$

3.13

$

0.93

$

4.07

$

0.54

$

4.61

Non-GAAP diluted net income per

share

$

2.25

$

2.15

$

4.40

$

1.63

$

6.03

$

1.73

$

7.76

Shares used in computing diluted net

income per share

79,193

78,545

78,840

78,237

78,652

77,683

78,420

Refer to "About Non-GAAP Financial Measures" section of press

release.

ALIGN TECHNOLOGY, INC.

Q1 2023 - GAAP TO NON-GAAP

RECONCILIATION

Three Months Ended

Year Ended

March 31, 2023

December 31, 2023

GAAP Operating Margin

~13.5%

slightly above 16%

Stock-based compensation

~4.0%

~4.0%

Amortization of intangibles (1)

~0.4%

~0.4%

Non-GAAP Operating Margin

~18.0%

slightly above 20%

(1) Amortization of intangible assets

related to certain acquisitions

Refer to "About Non-GAAP Financial Measures" section of press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230201005433/en/

Align Technology Madelyn Valente

(909) 833-5839 mvalente@aligntech.com

Zeno Group Sarah Johnson (828)

551-4201 sarah.johnson@zenogroup.com

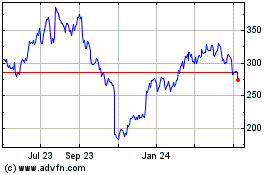

Align Technology (NASDAQ:ALGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

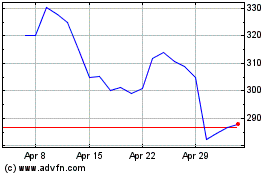

Align Technology (NASDAQ:ALGN)

Historical Stock Chart

From Apr 2023 to Apr 2024