Filed Pursuant to Rule 424(b)(3)

Registration No. 333-259484

PROSPECTUS SUPPLEMENT NO. 9

(To Prospectus Dated June 6, 2022)

(Prospectus Supplement No. 1 Dated June 30, 2022)

(Prospectus Supplement No. 2 Dated July 11, 2022)

(Prospectus Supplement No. 3 Dated August 2, 2022)

(Prospectus Supplement No. 4 Dated August 11, 2022)

(Prospectus Supplement No. 5 Dated August 22, 2022)

(Prospectus Supplement No. 6 Dated August 26, 2022)

(Prospectus Supplement No. 7 Dated September 30, 2022)

(Prospectus Supplement No. 8 Dated October 7, 2022)

Up to 13,426,181 Shares of Common Stock

This Prospectus Supplement No.

9 (this “Prospectus Supplement”) updates and supplements the prospectus dated June 6, 2022, as supplemented by Prospectus

Supplement No. 1 dated June 30, 2022 and as further supplemented by Prospectus Supplement No. 2 dated July 11, 2022; Prospectus Supplement

No. 3 dated August 2, 2022; Prospectus Supplement No. 4 dated August 11, 2022; Prospectus Supplement No. 5 dated August 22, 2022, Prospectus

Supplement No. 6 dated August 26, 2022; Prospectus Supplement No. 7 dated September 30, 2022 and Prospectus Supplement No. 8 filed on

October 7, 2022 (the “Prospectus”), which forms a part of our Registration Statement on Form S-1, as amended by that Post-Effective

Amendment No. 1 on Form S-1 (“Post-Effective Amendment”), which Post-Effective Amendment was declared effective by the Securities

and Exchange Commission on June 6, 2022 (Registration No. 333-259484). This Prospectus Supplement is being filed to update and supplement

the information in the Prospectus with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange

Commission on November 7, 2022 (the “Form 8-K”). Accordingly, we have attached the Form 8-K to this Prospectus Supplement.

The Prospectus and this Prospectus

Supplement relate to the offer and sale from time to time by 3i, LP, a Delaware limited partnership (“3i, LP”), or their permitted

transferees that may be identified in the Prospectus by prospectus supplement (the “Selling Stockholders”) of up to 13,426,181

shares of Common Stock consisting of:

| |

● |

up to 2,180,497 shares of Common Stock issued upon conversion of 20,000 shares of our Series A Preferred Stock originally issued in a private placement to 3i, LP, based upon an initial conversion price of $9.906 and stated par value of $1,080 (which stated par value includes a one-time dividend equal to an 8% increase in the original stated par value of $1,000). See the section titled “Business - The Private Placement (PIPE Financing);” |

| |

● |

up to 2,018,958 shares of Common Stock issuable upon exercise of the PIPE Warrant based upon an exercise price of $9.906; and |

| |

● |

up to 9,226,726 additional shares of Common Stock that may be issuable upon conversion of our Preferred Stock using the Floor Price of $1.9812. See the section titled, “Description of Our Capital Stock — The Series A Preferred Stock.” This amount also includes 505,740 shares allocated to the exercise of the PIPE Warrant to comply with our obligation to register 125% of the number of shares of our Common Stock issuable upon the exercise of the PIPE Warrant. See the section titled, “Description of Our Capital Stock — PIPE Warrant.” |

The shares of Common Stock covered

by the Prospectus and this Prospectus Supplement were registered pursuant to the terms of a registration rights agreement between us and

3i, LP. We will not receive any proceeds from the sale of shares of Common Stock offered for resale by the Selling Stockholders, although

we may receive up to $20 million in gross proceeds if the Selling Stockholders exercise the PIPE Warrant in full.

We are an “emerging growth

company” and a “smaller reporting company” as defined under U.S. federal securities laws and, as such, have elected

to comply with reduced public company reporting requirements. The Prospectus, together with this Prospectus Supplement, complies with

the requirements that apply to an issuer that is an emerging growth company and a smaller reporting company. We are incorporated in Delaware.

This Prospectus Supplement should

be read in conjunction with the Prospectus. If there is any inconsistency between the information in the Prospectus and this Prospectus

Supplement, you should rely on the information in this Prospectus Supplement.

Our Common Stock is listed on

the NASDAQ Global Market under the symbol “ALLR.” On November 7, 2022, the last reported sale price of our Common Stock was

$0.5499 per share. As of November 7, 2022, we had 10,260,157 shares of Common Stock issued and outstanding.

Since December 2021 pursuant to

a series of exercise of conversion by 3i, LP, we issued 2,184,333 shares of Common Stock to 3i, LP upon the conversion of 4,774 shares

of Series A Preferred Stock. As of November 7, 2022, we had 15,226 shares of Series A Preferred Stock issued and outstanding.

Investing in our securities

involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled “Risk

Factors” beginning on page 13 of the Prospectus, and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities and

Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the

accuracy or adequacy of this Prospectus Supplement and the Prospectus. Any representation to the contrary is a criminal offense.

Prospectus Supplement dated November 7, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 4, 2022

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant as specified in our charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification

No.) |

|

210 Broadway, Suite 201

Cambridge, MA |

|

02139 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone number, including

area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission

of Matters to a Vote of Security Holders.

The information disclosed in

Item 8.01 below is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On November 4, 2022, Allarity

Therapeutics, Inc. (the “Company”) convened and adjourned its 2022 Annual Meeting of Stockholders (“Annual Meeting”)

without transacting any business due to lack of quorum. In addition, on November 7, 2022, the Company issued a press release announcing

the adjournment of its Annual Meeting until December 2, 2022 at 1:00 p.m. (Eastern Time), along with a corporate update on the Company’s

efforts to secure the necessary additional capital in order to continue as a going concern and execute its ongoing and anticipated clinical

trials. In addition, the Company announced its decision to delay the enrollment of patients in its previously announced anticipated Phase

1b/2 clinical trial of its therapeutic candidate PARP inhibitor, stenoparib, in combination with its therapeutic candidate pan-TKI, dovitinib,

for the second-line or later treatment of metastatic ovarian cancer until it has raised additional capital. The information disclosed

in Item 8.01 below is incorporated by reference. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form

8-K and is incorporated herein by reference.

This information is furnished pursuant to Item

7.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934

or otherwise subject to the liabilities of that Section, unless we specifically incorporate it by reference in a document filed under

the Securities Act of 1933 or the Securities Exchange Act of 1934. By furnishing this information on this Current Report on Form 8-K,

we make no admission as to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation

FD.

Item 8.01 Other Events

The

Company convened its Annual Meeting on Friday, November 4, 2022, at 1:00 p.m. (Eastern Time). At that time, there were not present virtually

or represented by proxy a sufficient number of shares of the Company’s common stock to constitute a quorum. Accordingly, the Annual

Meeting was adjourned without any business being conducted, in order to allow time to achieve quorum and to allow the Company’s

stockholders additional time to vote on the proposals set forth in the Company’s definitive proxy statement filed with the U.S.

Securities and Exchange Commission (the “SEC”) on September 19, 2022 (the “Proxy Statement”).

The

adjourned Annual Meeting will reconvene on December 2, 2022 at 1:00 p.m. (Eastern Time) virtually at https://meetnow.global/MRJXJMN. The

record date for the determination of stockholders of the Company entitled to vote at the reconvened Annual Meeting remains the close of

business on September 15, 2022.

Stockholders

who have already voted do not need to recast their votes unless they wish to change their vote. Proxies previously submitted in respect

of the Annual Meeting will be voted at the adjourned Annual Meeting unless properly revoked, and stockholders who have previously submitted

a proxy or otherwise voted need not take any action. During the period of adjournment, the Company will continue to solicit votes from

its stockholders with respect to the proposals set forth in the Proxy Statement.

No

changes have been made in the proposals to be voted on by stockholders at the Annual Meeting. Company encourages all stockholders as of

the record date on September 15, 2022 who have not yet voted to do so promptly.

The

Company’s Proxy Statement, Definitive Additional Materials and any other materials filed by the Company with the SEC can be obtained

free of charge at the SEC’s website at www.sec.gov.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Allarity Therapeutics, Inc. |

| |

|

| |

By: |

/s/ James G. Cullem |

| |

|

James G. Cullem

Chief Executive Officer |

| |

|

|

| Dated: November 7, 2022 |

|

|

Exhibit 99.1

Press release

Allarity Therapeutics Announces Adjournment of 2022

Annual Meeting

of Stockholders

Cambridge, MA U.S.A. (November 7, 2022) — Allarity

Therapeutics, Inc. (“Allarity” or the “Company”), a clinical-stage pharmaceutical company developing novel oncology

therapeutics together with drug-specific DRP® companion diagnostics for personalized cancer care today announced that the Company’s

2022 Annual Meeting of Stockholders (the “Meeting”), was convened on November 4, 2022, at 1:00 p.m. (Eastern Time) and was

adjourned without any business being conducted.

The Meeting was adjourned until 1:00 p.m. (Eastern

Time) on Friday, December 2, 2022, to allow additional time to achieve quorum and for stockholders to vote on the proposals set forth

in the Company’s definitive proxy statement filed with the U.S. Securities and Exchange Commission (SEC) on September 19, 2022 (the

“Proxy Statement”), including, but not limited to, a proposal to increase the number of authorized shares of common stock

in the Company’s certificate of incorporation from 30,000,000 to 150,000,000 shares. As previously disclosed in the Company’s

SEC reports, the Company must raise additional capital in order to continue as a going concern and execute its ongoing and anticipated

clinical trials. The Company is currently in discussions with the holder of its Series A Preferred Shares regarding a potential bridge

loan to extend the Company’s cash runway in order to provide the Company with more time to complete the process of amending its

certificate of incorporation increasing its authorized share capital in order to facilitate additional capital investments. No assurances

can be given that the discussions will be successful or that the Company will be able to raise additional capital on favorable terms,

or at all. The Company has decided to delay the enrollment of patients in its previously announced anticipated Phase

1b/2 clinical trial of its therapeutic candidate PARP inhibitor, stenoparib, in combination with its therapeutic candidate pan-TKI, dovitinib,

for the second-line or later treatment of metastatic ovarian cancer until it has raised additional capital.

The Meeting will reconvene on December 2, 2022, at

1:00 p.m. (Eastern Time) virtually at https://meetnow.global/MRJXJMN. The record date for the Annual Meeting remains the same, September

15, 2022. Stockholders of record may attend the virtual webcast meeting on Friday, December 2, 2022, 1:00 p.m. (Eastern Time) by logging

in through the same method. During this adjournment, the Company will continue to solicit votes from its stockholders regarding all proposals

set forth in the Proxy Statement. Stockholders who have already voted their shares on the proposals contained in the Proxy Statement do

not need to vote again. Proxies previously submitted in respect of the Meeting will be voted at the adjourned Meeting, and stockholders

who have previously submitted a proxy or otherwise voted need not take any action.

Stockholders who have not already voted are strongly

urged to promptly vote their shares in favor of all the proposals.

Stockholders may use the Proxy Card that they were

originally provided with or vote in the manner as set forth in the Proxy Statement. Stockholders who have questions or require any assistance

in voting their shares may contact the Company’s proxy solicitor, Georgeson LLC, toll-free at (866) 482-5026 or at +1 (781) 575-2137

for stockholders located outside the United States.

Allarity encourages all stockholders, as of the record

date on September 15, 2022, who have not yet voted to do so promptly.

Allarity

Therapeutics, Inc. I 210 Broadway, #201 I Cambridge, MA I U.S.A. I

NASDAQ: ALLR I www.allarity.com

Page

1 of 5

About Allarity Therapeutics

Allarity Therapeutics, Inc. (Nasdaq: ALLR) develops

drugs for personalized treatment of cancer guided by its proprietary and highly validated companion diagnostic technology, the DRP®

platform. The Company has a mature portfolio of three drug candidates: stenoparib, a PARP inhibitor in Phase 2 development for ovarian

cancer; dovitinib, a post-Phase 3 pan-tyrosine kinase inhibitor; and the European rights to IXEMPRA® (Ixabepilone), a microtubule

inhibitor approved in the U.S. and marketed by R-PHARM U.S. for the treatment of second-line metastatic breast cancer, currently in Phase

2 development in Europe for the same indication. Additionally, the Company has rights in two secondary assets: 2X-111, a liposomal formulation

of doxorubicin in Phase 2 development for metastatic breast cancer and/or glioblastoma multiforme (GBM), which is the subject of discussions

for a restructured out-license to Smerud Medical Research International AS; and LiPlaCis®, a liposomal formulation of cisplatin and

its accompanying DRP®, being developed via a partnership with Chosa ApS, an affiliate of Smerud Medical Research International, for

late-stage metastatic breast cancer. The Company is headquartered in the United States and maintains an R&D facility in Hoersholm,

Denmark. For more information, please visit the Company’s website at www.Allarity.com.

About the Drug Response Predictor – DRP®

Companion Diagnostic

Allarity uses its drug-specific DRP® to select

those patients who, by the genetic signature of their cancer, are found to have a high likelihood of responding to the specific drug.

By screening patients before treatment, and only treating those patients with a sufficiently high DRP® score, the therapeutic response

rate can be significantly increased. The DRP® method builds on the comparison of sensitive vs. resistant human cancer cell lines,

including transcriptomic information from cell lines combined with clinical tumor biology filters and prior clinical trial outcomes. DRP®

is based on messenger RNA from patient biopsies. The DRP® platform has proven its ability to provide a statistically significant prediction

of the clinical outcome from drug treatment in cancer patients in 37 out of 47 clinical studies that were examined (both retrospective

and prospective), including ongoing, prospective Phase 2 trials of Stenoparib and IXEMPRA®. The DRP® platform, which can be used

in all cancer types and is patented for more than 70 anti-cancer drugs, has been extensively published in peer reviewed literature.

Follow Allarity on Social Media

Facebook: https://www.facebook.com/AllarityTx/

LinkedIn: https://www.linkedin.com/company/allaritytx/

Twitter: https://twitter.com/allaritytx

Allarity

Therapeutics, Inc. I 210 Broadway, #201 I Cambridge, MA I U.S.A. I

NASDAQ: ALLR I www.allarity.com

Page

2 of 5

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide Allarity’s

current expectations or forecasts of future events. The words “anticipates,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,”

“possible,” “potential,” “predicts,” “project,” “should,” “would”

and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not

forward-looking. These forward-looking statements include, but are not limited to, statements related to raising additional capital and

the expectation of negotiating a bridge loan with its holder of Series A Preferred Shares, clinical and commercial potential due to the

Company advancing dovitinib in combination with another therapeutic candidate or other approved drug, any statements related to ongoing

clinical trials for stenoparib as a monotherapy or in combination with another therapeutic candidate for the treatment of advanced ovarian

cancer, or ongoing clinical trials (in Europe) for IXEMPRA® for the treatment of metastatic breast cancer, and statements relating

to the effectiveness of the Company’s DRP® companion diagnostics platform in predicting whether a particular patient is likely

to respond to a specific drug. Any forward-looking statements in this press release are based on management’s current expectations

of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely

from those set forth in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to,

the risk that results of a clinical study do not necessarily predict final results and that one or more of the clinical outcomes may materially

change following more comprehensive reviews of the data, and as more patient data become available, the risk that results of a clinical

study are subject to interpretation and additional analyses may be needed and/or may contradict such results, the receipt of regulatory

approval for dovitinib or any of our other therapeutic candidates or, if approved, the successful commercialization of such products,

the risk of cessation or delay of any of the ongoing or planned clinical trials and/or our development of our product candidates, the

risk that the results of previously conducted studies will not be repeated or observed in ongoing or future studies involving our therapeutic

candidates, and the risk that the current COVID-19 pandemic will impact the Company’s current and future clinical trials and the

timing of the Company’s preclinical studies and other operations. For a discussion of other risks and uncertainties, and other important

factors, any of which could cause our actual results to differ from those contained in the forward-looking statements, see the section

entitled “Risk Factors” in our Form S-1 registration statement on file with the Securities and Exchange Commission, available

at the Securities and Exchange Commission’s website at www.sec.gov, and as well as discussions of potential risks, uncertainties

and other important factors in the Company’s subsequent filings with the Securities and Exchange Commission. All information in

this press release is as of the date of the release, and the Company undertakes no duty to update this information unless required by

law.

###

Company Contact:

Thomas Jensen

Senior V.P. of Investor Relations

investorrelations@allarity.com

Investor Relations:

Chuck Padala

LifeSci Advisors

+1 (646) 627-8390

chuck@lifesciadvisors.com

U.S. Media Contact:

Mike Beyer

Sam Brown, Inc.

+1 (312) 961-2502

mikebeyer@sambrown.com

EU Media Contact:

Thomas Pedersen

Carrotize PR & Communications

+45 6062 9390

tsp@carrotize.com

Allarity

Therapeutics, Inc. I 210 Broadway, #201 I Cambridge, MA I U.S.A. I

NASDAQ: ALLR I www.allarity.com

Page

3 of 5

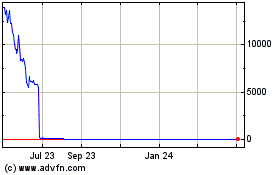

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

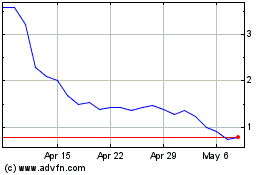

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Apr 2023 to Apr 2024