Filed Pursuant to Rule 424(b)(3)

Registration No. 333-259484

PROSPECTUS SUPPLEMENT NO. 11

(To Prospectus Dated June 6, 2022)

(Prospectus Supplement No. 1 Dated June 30, 2022)

(Prospectus Supplement No. 2 Dated July 11, 2022)

(Prospectus Supplement No. 3 Dated August 2, 2022)

(Prospectus Supplement No. 4 Dated August 11, 2022)

(Prospectus Supplement No. 5 Dated August 22, 2022)

(Prospectus Supplement No. 6 Dated August 26, 2022)

(Prospectus Supplement No. 7 Dated September 30, 2022)

(Prospectus Supplement No. 8 Dated October 7, 2022)

(Prospectus Supplement No. 9 Dated November 7, 2022)

(Prospectus Supplement No. 10 Dated November 14, 2022)

Up to 13,426,181 Shares of Common Stock

This Prospectus Supplement No.

11 (this “Prospectus Supplement”) updates and supplements the prospectus dated June 6, 2022, as supplemented by Prospectus

Supplement No. 1 dated June 30, 2022 and as further supplemented by Prospectus Supplement No. 2 dated July 11, 2022; Prospectus Supplement

No. 3 dated August 2, 2022; Prospectus Supplement No. 4 dated August 11, 2022; Prospectus Supplement No. 5 dated August 22, 2022, Prospectus

Supplement No. 6 dated August 26, 2022; Prospectus Supplement No. 7 dated September 30, 2022; Prospectus Supplement No. 8 filed on October

7, 2022; Prospectus Supplement No. 9 filed on November 7, 2022; and Prospectus Supplement No. 10 dated November 14, 2022 (the “Prospectus”),

which forms a part of our Registration Statement on Form S-1, as amended by that Post-Effective Amendment No. 1 on Form S-1 (“Post-Effective

Amendment”), which Post-Effective Amendment was declared effective by the Securities and Exchange Commission on June 6, 2022 (Registration

No. 333-259484). This Prospectus Supplement is being filed to update and supplement the information in the Prospectus with the information

contained in our Current Reports on Form 8-Ks for November 21, 2022 and November 29, 2022 filed with the Securities and Exchange Commission

on November 25, 2022 and December 1, 2022, respectively (collectively the “Form 8-Ks”). Accordingly, we have attached the

Form 8-Ks to this Prospectus Supplement.

The Prospectus and this Prospectus

Supplement relate to the offer and sale from time to time by 3i, LP, a Delaware limited partnership (“3i, LP”), or their permitted

transferees that may be identified in the Prospectus by prospectus supplement (the “Selling Stockholders”) of up to 13,426,181

shares of Common Stock consisting of:

| |

● |

up to 2,180,497 shares of Common Stock issued upon conversion of 20,000 shares of our Series A Preferred Stock originally issued in a private placement to 3i, LP, based upon an initial conversion price of $9.906 and stated par value of $1,080 (which stated par value includes a one-time dividend equal to an 8% increase in the original stated par value of $1,000). See the section titled “Business - The Private Placement (PIPE Financing);” |

| |

● |

up to 2,018,958 shares of Common Stock issuable upon exercise of the PIPE Warrant based upon an exercise price of $9.906; and |

| |

● |

up to 9,226,726 additional shares of Common Stock that may be issuable upon conversion of our Preferred Stock using the Floor Price of $1.9812. See the section titled, “Description of Our Capital Stock — The Series A Preferred Stock.” This amount also includes 505,740 shares allocated to the exercise of the PIPE Warrant to comply with our obligation to register 125% of the number of shares of our Common Stock issuable upon the exercise of the PIPE Warrant. See the section titled, “Description of Our Capital Stock — PIPE Warrant.” |

The shares of Common Stock covered

by the Prospectus and this Prospectus Supplement were registered pursuant to the terms of a registration rights agreement between us and

3i, LP. We will not receive any proceeds from the sale of shares of Common Stock offered for resale by the Selling Stockholders, although

we may receive up to $20 million in gross proceeds if the Selling Stockholders exercise the PIPE Warrant in full.

We are an “emerging growth

company” and a “smaller reporting company” as defined under U.S. federal securities laws and, as such, have elected

to comply with reduced public company reporting requirements. The Prospectus, together with this Prospectus Supplement, complies with

the requirements that apply to an issuer that is an emerging growth company and a smaller reporting company. We are incorporated in Delaware.

This Prospectus Supplement should

be read in conjunction with the Prospectus. If there is any inconsistency between the information in the Prospectus and this Prospectus

Supplement, you should rely on the information in this Prospectus Supplement.

Our Common Stock is listed on

the NASDAQ Global Market under the symbol “ALLR.” On December 1, 2022, the last reported sale price of our Common Stock was

$0.46 per share. As of December 1, 2022, we had 10,260,157 shares of Common Stock issued and outstanding.

Since December 2021 pursuant to

a series of exercise of conversion by 3i, LP, we issued 2,184,333 shares of Common Stock to 3i, LP upon the conversion of 4,774 shares

of Series A Preferred Stock. As of December 1, 2022, we had 15,226 shares of Series A Preferred Stock issued and outstanding.

Investing in our securities

involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled “Risk

Factors” beginning on page 13 of the Prospectus, and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities and

Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the

accuracy or adequacy of this Prospectus Supplement and the Prospectus. Any representation to the contrary is a criminal offense.

Prospectus Supplement dated December 1, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November

21, 2022

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant as specified in our charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

22 School Street, 2nd Floor

Boston, MA |

|

02108 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone number, including area

code)

Not applicable

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On November

22, 2022, the Company entered into a Secured Note Purchase Agreement (“Purchase Agreement”) with 3i LP. Under the Purchase

Agreement, the Company has authorized the sale and issuance of three secured promissory notes, the first note in an aggregate principal

amount of $350,000 to be issued at closing; the second note in the principal amount of $1,666,640 to be issued at closing and which represents

the payment of $1,666,640 due to 3i, LP in Alternative Conversion Floor Amounts, as defined in the Certificate of Designations for the

Series A Preferred Stock, that began to accrue on July 14, 2022; and the third note in an aggregate principal amount of $650,000 with

respect to a new loan to be funded upon the Company filing a registration statement with Securities and Exchange Commission in connection

with a registered offering.

Each

note matures on January 1, 2024, carries an interest rate of at 5% per annum, and is secured by all of the Company’s assets pursuant

to a security agreement (the “Security Agreement”). In addition, 3i LP may exchange such promissory note for the Company’s

common stock at an exchange price equal to the lowest price per share of the equity security sold to other purchasers, rounded down to

the nearest whole share, if the Company concludes a future equity financing prior to the maturity date or other repayment of such promissory

note. In addition, each promissory note and interest earned thereon may be redeemed by the Company at its option or the holder may demand

redemption if the Company obtains gross proceeds of at least $5 million in a financing in an amount of up to 35% of the gross proceeds

of the financing.

The forgoing

descriptions of the Purchase Agreement, secured promissory note and Security Agreement are qualified in their entirety to the Purchase

Agreement, form of secured promissory note and Security Agreement filed hereto as Exhibits 10.1, 10.2, and 10.3.

Item 3.01 Notice of Delisting

or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

On November 21, 2022,

the Company received a written notice (the “Notice”) from the Nasdaq Listing Qualifications Department of The Nasdaq Stock

Market (“Nasdaq”) indicating that the Company is not in compliance with the minimum bid price requirement of 1.00 per share

under the Nasdaq Listing Rules (the “Listing Rules”). Based on the closing bid price of the Company’s listed securities

for the last 30 consecutive business days from October 10, 2022 to November 18, 2022, the Company no longer meets the minimum bid price

requirement set forth in Listing Rule 5550(a)(2). The Notice is only a notification of deficiency and has no current effect on the listing

or trading of the Company’s securities on the Nasdaq Global Market subject to previous disclosures on Form 8-K. (See Form 8-K filed

with the SEC on October 14, 2022.)

The Notice states that

under Listing Rule 5810(c)(3)(A), the Company is provided with a compliance period of 180 calendar days, or until May 22, 2023, to regain

compliance under the Listing Rules. To regain compliance under the Listing Rules, the Company’s common shares must be at least $1.00

for a minimum of ten consecutive business days. In the event the Company does not regain compliance by May 22, 2022, the Company may be

eligible for additional time to regain compliance or may face delisting.

The Company intends to

monitor the closing bid price of its common shares between now and May 22, 2023, and to evaluate its available options to regain compliance

within the compliance period.

Item 3.03. Material Modification to Rights

of Security Holders.

The disclosure set forth

in Item 5.03 below is hereby incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation

or Bylaws.

| A. |

Amendment to Series A Convertible Preferred Stock |

On November 22, 2022, the Company

amended Section 12 of the Certificate of Designation of Series A Convertible Preferred Stock to provide for voting rights. Subject to

a 9.99% beneficial ownership limitation, the holders of Series A preferred stock shall have the right to vote on all matters presented

to the stockholders for approval together with the shares of common stock, voting together as a single class, on an “as converted”

basis using the “Conversion Price” (initially $9.906 per share before any adjustment) (rounded down to the nearest whole number

and using the record date for determining the stockholders of the Company eligible to vote on such matters), except as required by law

(including without limitation, the DGCL) or as otherwise expressly provided in the Company’s Certificate of Incorporation or the

Certificate of Designations of Series A Convertible Preferred Stock. The voting rights described above shall expire on February 28, 2023,

and thereafter holders of preferred stock shall not have voting rights except as required by law (including without limitation, the DGCL).

The forgoing summary of the amendment

to the Series A Convertible Preferred Stock is qualified in its entirety to the Certificate of Amendment to Certificate of Designation

of Series A Convertible Preferred Stock filed as Exhibit 3.1.

| B. |

Establishment Series B Preferred Stock |

On November 22, 2022,

the Board established the Series B Preferred Stock, par value $0.0001 per share (“Series B Preferred Stock”). The following

is a summary of the terms of the Series B Preferred Stock.

1.

Designation, Amount and Par Value. The series of Preferred Stock created is designated as the Series B Preferred Stock (the

“Series B Preferred Stock”), and the number of shares so designated shall be 200,000. Each share of Series B Preferred

Stock shall have a par value of $0.0001 per share.

2.

Dividends. The holders of Series B Preferred Stock shall not be entitled to receive dividends of any kind.

3.

Voting Rights and Power. Except as otherwise provided by the Certificate of Incorporation or required by law, the holders

of shares of Series B Preferred Stock shall have the following voting rights and power:

| |

a. |

Each outstanding share of Series B Preferred Stock shall have 400 votes per share (and, for the avoidance of doubt, each fraction of a share of Series B Preferred Stock shall have a ratable number of votes). The outstanding shares of Series B Preferred Stock shall vote together with the outstanding shares of common stock, par value $0.0001 per share (the “Common Stock”), of the Company as a single class exclusively with respect to the Reverse Stock Split, the Share Increase Proposal and the Adjournment Proposal (all as defined below) and shall be included in the number of shares present in person or by proxy at the meeting for all matters coming before the meeting, but shall not be entitled to vote on any other matter except to the extent required under the DGCL. Notwithstanding the foregoing, and for the avoidance of doubt, each share of Series B Preferred Stock (or fraction thereof) redeemed pursuant to the Initial Redemption (as defined below) shall have no voting power with respect to, and the holder of each share of Series B Preferred Stock (or fraction thereof) redeemed pursuant to the Initial Redemption shall have no voting power with respect to any such share of Series B Preferred Stock (or fraction thereof) on, the Reverse Stock Split, the Share Increase Proposal, the Adjournment Proposal or any other matter brought before any meeting of stockholders held to vote on the Reverse Stock Split and the Share Increase Proposal. As used herein, (1) the term “Reverse Stock Split” means any proposal to adopt an amendment to the Certificate of Incorporation to reclassify the outstanding shares of Common Stock into a smaller number of shares of Common Stock at a ratio specified in or determined in accordance with the terms of such amendment, (2) the term “Share Increase Proposal” means any proposal to adopt an amendment to the Certificate of Incorporation to increase the number of authorized shares of the Company’s Common Stock and (3) “Adjournment Proposal” means any proposal to adjourn any meeting of stockholders called for the purpose of voting on Reverse Stock Split or the Share Increase Proposal. |

| |

b. |

Provided that the Board of Directors, or its authorized proxy, has elected to cast the votes created in this Section 3 in accordance with Section 3.c hereof, the vote of each share of Series B Preferred Stock (or fraction thereof) entitled to vote on the Reverse Stock Split, the Share Increase Proposal, the Adjournment Proposal or any other matter brought before any meeting of stockholders held to vote on the Reverse Stock Split, the Share Increase Proposal, and the Adjournment Proposal shall be cast in the same manner as the vote, if any, of the share of Common Stock (or fraction thereof) or Series A Preferred Stock in respect of which such share of Series B Preferred Stock (or fraction thereof) was issued as a dividend is cast on the Reverse Stock Split, the Share Increase Proposal, the Adjournment Proposal or such other matter, as applicable, and the proxy or ballot with respect to shares of Common Stock or Series A Preferred Stock held by any holder on whose behalf such proxy or ballot is submitted will be deemed to include all shares of Series B Preferred Stock (or fraction thereof) held by such holder. |

| |

c. |

The power to vote, or not to vote, the votes created by this Section 3 shall be vested solely and exclusively in the Board of Directors, or its authorized proxy. If the Board of Directors, or its authorized proxy, decides to vote any votes created by this Section 3, it must vote all votes created by this Section 3 in accordance with the provisions of Section 3.b. |

| |

a. |

The Series B Preferred Stock shall rank senior to the Common Stock, but junior to the Series A Preferred Stock, as to any distribution of assets upon a liquidation, dissolution or winding up of the Company, whether voluntarily or involuntarily (a “Dissolution”). |

| |

|

|

| |

b. |

Upon any Dissolution, each holder of outstanding shares of Series B Preferred Stock shall be entitled to be paid out of the assets of the Company available for distribution to stockholders, prior or in preference to any distribution to the holders of Common Stock, but junior to the holders of Series A Preferred Stock, an amount in cash equal to $0.01 per outstanding share of Series B Preferred Stock. |

| |

a. |

All shares of Series B Preferred Stock that are not present in person or by proxy through the presence of such holder’s shares of Common Stock or Series A Preferred Stock, in person or by proxy, at any meeting of stockholders held to vote on the Reverse Stock Split, the Share Increase Proposal and the Adjournment Proposal as of immediately prior to the opening of the polls at such meeting (the “Initial Redemption Time”) shall automatically be redeemed by the Company at the Initial Redemption Time without further action on the part of the Company or the holder thereof (the “Initial Redemption”). |

| |

|

|

| |

b. |

Any outstanding shares of Series B Preferred Stock that have not been redeemed pursuant to an Initial Redemption shall be redeemed in whole, but not in part, (i) if such redemption is ordered by the Board of Directors in its sole discretion, automatically and effective on such time and date specified by the Board of Directors in its sole discretion or (ii) automatically upon the approval by the Company’s stockholders of the Reverse Stock Split and the Share Increase Proposal at any meeting of stockholders held for the purpose of voting on such proposals (any such redemption pursuant to this Section 5.b, the “Subsequent Redemption” and, together with the Initial Redemption, the “Redemptions”). |

| |

|

|

| |

c. |

Each share of Series B Preferred Stock redeemed in any Redemption pursuant to this Section 5 shall be redeemed in consideration for the right to receive an amount equal to $0.10 in cash for each ten whole shares of Series B Preferred Stock that are “beneficially owned” by the “beneficial owner” (as such terms are defined below) thereof as of immediately prior to the applicable Redemption Time and redeemed pursuant to such Redemption, payable upon the applicable Redemption Time. |

| |

|

|

| |

d. |

From and after the time at which any shares of Series B Preferred Stock are called for redemption (whether automatically or otherwise) in accordance with Section 5.a or Section 5.b, such shares of Series B Preferred Stock shall cease to be outstanding, and the only right of the former holders of such shares of Series B Preferred Stock, as such, will be to receive the applicable redemption price, if any. |

| |

|

|

| |

6. |

Transfer. Shares of Series B Preferred Stock will be uncertificated

and represented in book-entry form. No shares of Series B Preferred Stock may be transferred by the holder thereof except in connection

with a transfer by such holder of any shares of Common Stock or Series A Preferred Stock held thereby, in which case a number of

0.016 of a share of Series B Preferred Stock equal to the number of shares of Common Stock to be transferred by such holder shall

be automatically transferred to the transferee of such shares of Common Stock and a number of 1.744 shares of Series B Preferred

Stock equal to the number of shares of Series A Preferred Stock to be transferred by such holder shall be automatically transferred

to the transferee of such shares of Series A Preferred Stock. Notice of the foregoing restrictions on transfer shall be given in

accordance with Section 151 of the DGCL. |

| |

|

|

| |

7. |

Fractional Shares. The Series B Preferred Stock may be issued in whole shares or in any fraction of a share that is one one-thousandth (1/1,000th) of a share or any integral multiple of such fraction, which fractions shall entitle the holder, in proportion to such holder’s fractional shares, to exercise voting rights, participate in distributions upon a Dissolution and have the benefit of any other rights of holders of Series B Preferred Stock. |

The foregoing summary of the terms

of the Series B Preferred Stock is qualified in its entirety to the Certificate of Designation of Series B Preferred Stock filed as Exhibit

3.2.

Item 5.08 Shareholder Director Nominations

The Board determined

that the Company’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”) will be held virtually online by means

of remote communication on or about January 16, 2023, or as otherwise set forth in the Company’s notice and proxy statement for

the Annual Meeting. Stockholders of record of the Company’s common stock at the close of business on December 6, 2022, will be entitled

to notice of, and to vote at, the Annual Meeting. The Company, however, reserves the right to change the record date prior to the Annual

Meeting.

Since the Company did not hold

an annual stockholders meeting the previous year, stockholders of the Company who wish to have a proposal considered for inclusion in

the Company’s proxy materials for the Annual Meeting pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or pursuant to the Amended and Restated Bylaws of Allarity Therapeutics, Inc. (the “Bylaws”),

must ensure that such proposal is delivered to or mailed to and received by the Company’s Secretary at Allarity Therapeutics, Inc.,

22 School Street, 2nd Floor, Boston, Massachusetts 02108 on or before the close of business on December 5, 2022, which pursuant

to Sections 2.12 and 2.13 of the Bylaws is ten (10) days after public disclosure of the date of the Company’s 2023 Annual Meeting.

The Company has determined such date to be reasonable under the Bylaws and the rules under the Exchange Act and is hereby providing notice

of the deadline for stockholder proposals.

In addition to complying

with the December 5, 2022 deadline, stockholder director nominations and stockholder proposals intended to be considered for inclusion

in the Company’s proxy materials for the Annual Meeting must also comply with all applicable Securities and Exchange Commission

rules, including Rule 14a-8, Delaware corporate law and the Bylaws in order to be eligible for inclusion in the proxy materials for the

Annual Meeting. Any director nominations and stockholder proposals received after the December 5, 2022 deadline will be considered untimely

and will not be considered for inclusion in the proxy materials for the Annual Meeting nor will it be considered at the Annual Meeting.

Item 8.01 Other Events

| A. |

Termination of 2022 Annual Meeting to be held December 2, 2022. |

As previously disclosed,

the Company scheduled its 2022 annual meeting of stockholders which was convened on November 4, 2022, and was subsequently adjourned without

any business being conducted. The 2022 annual meeting was adjourned until December 2, 2022. In light of new proposals which must be presented

to the Company’s stockholders, the Company’s Board of Directors have decided to terminate the 2022 annual meeting adjourned

until December 2, 2022.

| B. |

2023 Annual Meeting to be held January 16, 2023 |

On November 22, 2022,

the Company’s Board of Directors approved that the 2023 Annual Meeting of Stockholders will be virtually held on January 16, 2023.

Stockholders of record as of December 6, 2022, will be entitled to notice of and to vote at the Annual Meeting. A proxy statement regarding

the 2023 Annual Meeting of stockholders will be filed with the Securities and Exchange Commission and provided to the stockholders.

| C. |

Declaration of Dividend of Series B Preferred Stock |

On November 22, 2022, the Board

of Directors declared a dividend of Series B Preferred Stock to the stockholders of record of Common Stock and Series A Convertible Preferred

Stock as of December 5, 2022 (the “Record Date”). On the Record Date, each share of Common Stock outstanding will receive

0.016 of a share of Series B Preferred Stock and each share of Series A Convertible Preferred Stock outstanding will receive 1.744 shares

of Series B Preferred Stock.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Allarity Therapeutics, Inc. |

| |

|

| |

By: |

/s/ James G. Cullem |

| |

|

James G. Cullem

|

| |

|

Chief Executive Officer |

| |

|

|

| Dated: November 25, 2022 |

|

|

6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November

29, 2022

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant as specified in our charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

22 School Street, 2nd

Floor

Boston, MA |

|

02108 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone number, including area

code)

Not applicable

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

The

information included in Item 8.01 relating to the new meeting date for the 2023 Annual Meeting of Stockholders is incorporated herein

by reference. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

This

information is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section

18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section, unless we specifically incorporate

it by reference in a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934. By furnishing this information

on this Current Report on Form 8-K, we make no admission as to the materiality of any information in this report that is required to be

disclosed solely by reason of Regulation FD.

Item 8.01 Other Events

On November

29, 2022, the Company’s Board of Directors approved the change of the meeting date for the 2023 Annual Meeting of Stockholders from

January 16, 2023 to January 19, 2023. No change was made with respect to the record date. Accordingly, stockholders of record as of December

6, 2022, will continue to be entitled to notice of and to vote at the Annual Meeting in the manner described in the proxy statement. A

proxy statement regarding the 2023 Annual Meeting of stockholders will be filed with the Securities and Exchange Commission and provided

to the stockholders.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Allarity Therapeutics, Inc. |

| |

|

| |

By: |

/s/ James G. Cullem |

| |

|

James G. Cullem |

| |

|

Chief Executive Officer |

| |

|

|

| Dated: December 1, 2022 |

|

|

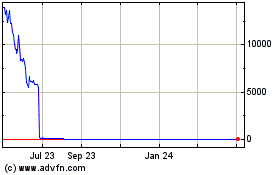

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

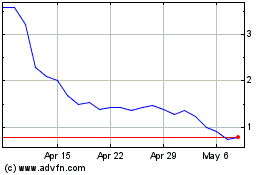

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Apr 2023 to Apr 2024