Current Report Filing (8-k)

12 December 2022 - 10:02PM

Edgar (US Regulatory)

0001860657

false

0001860657

2022-12-09

2022-12-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 9, 2022

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant as specified in our charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

22 School Street, 2nd Floor

Boston, MA |

|

02108 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone number, including

area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On December 9, 2022, the Company

and 3i, LP (“3i”), the holder of outstanding shares of Series A Convertible Preferred Stock (“Series A Preferred Stock”)

entered into a letter agreement which provided that pursuant to Section 8(g) of the Certificate of Designations for the Series A Preferred

Stock, the parties agreed that the Conversion Price (as defined in such Certificate of Designations”) was modified to mean the lower

of: (i) the Closing Sale Price (as defined in the Certificate of Designations) on the trading date immediately preceding the Conversion

Date (as defined in the Certificate of Designations and (ii) the average Closing Sale Price of the common stock for the five trading days

immediately preceding the Conversion Date, for the Trading Days (as defined in the Certificate of Designations) through and inclusive

of January 19, 2023.

The shares of Series A Preferred

Stock was acquired by 3i pursuant to the terms that certain Securities Purchase Agreement dated as of May 20, 2021 and the other related

transaction documents by and between the Company and 3i. In addition to the material relationship with 3i relating to the Series A Preferred

Stock, as previously disclosed, 3i is also a holder of a secured promissory note issued by the Company pursuant to a Secured Note Purchase

Agreement and a Security Agreement by and between the Company and 3i, each of which is dated as of November 22, 2022.

Item 3.03. Material Modification to

Rights of Security Holders.

As previously disclosed in

Item 1.01, upon the approval of the Board of Directors on December 9, 2022, the Company and 3i agreed that pursuant to Section 8(g) of

the Certificate of Designations for the Series A Preferred Stock the Conversion Price (as defined in such Certificate of Designations”)

the parties agreed to modify the term Conversion Price to mean the lower of: (i) the Closing Sale Price (as defined in the Certificate

of Designations) on the trading date immediately preceding the Conversion Date (as defined in the Certificate of Designations and (ii)

the average Closing Sale Price of the common stock for the five trading days immediately preceding the Conversion Date, for the Trading

Days (as defined in the Certificate of Designations) through and inclusive of January 19, 2023.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Allarity Therapeutics, Inc. |

| |

|

| |

By: |

/s/ James G. Cullem |

| |

|

James G. Cullem |

| |

|

Chief Executive Officer |

| |

|

|

| Dated: December 12, 2022 |

|

|

2

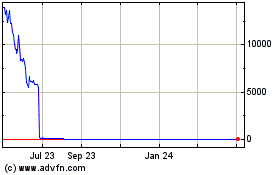

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

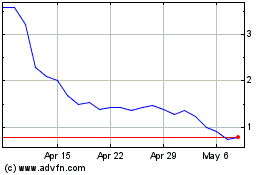

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Apr 2023 to Apr 2024